Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

From Dan’s Desk: June 3, 2025

As spring winds down and June approaches, we typically anticipate a familiar surge in housing market activity across the United States. This seasonal trend is especially pronounced in regions like the Midwest, where warmer weather traditionally brings buyers and sellers out in force. But this year, something feels different. The energy we expect to accompany spring’s closing weeks has been muted. The 2025 spring market, it seems, is stalling.

So, What’s Different This Time Around?

There are a number of likely culprits behind this pause. Mortgage interest rates, while slightly lower than last year, are still hovering in the high 6% range—making monthly payments a challenge for many would-be buyers. Combined with lingering concerns over global trade tensions and general market conditions, both buyers and sellers appear to be proceeding with caution.

Let’s Talk Stats:

This caution is reflected in national data. According to the National Association of REALTORS® (NAR), existing-home sales dropped by 0.5% in April, totaling a seasonally adjusted annual rate of 4 million homes—a 2.0% decline compared to April 2024. While these figures aren’t catastrophic, they do suggest a cooling from the more aggressive pace we saw last spring.

Regionally, the story is mixed. In the Midwest, sales actually rose slightly by 2.1% month-over-month, though they’re still down 1.0% compared to last year. The median home price in this region climbed to $313,300—a 3.6% increase, suggesting that demand hasn’t vanished, but is perhaps more measured. In contrast, sales in the West declined 3.9% from March.

Yet, within this slowdown, there are glimmers of opportunity. Inventory is growing—a crucial signal for future momentum. The number of unsold existing homes jumped 9.0% from March to April, now sitting at 1.45 million units. More listings mean more choices, and more choices may nudge hesitant buyers off the fence.

Consumer attitudes are also evolving. We’re seeing increased willingness among sellers to embrace strategic price reductions. Buyers, in turn, are responding to those reductions and showing renewed interest in properties they might have previously dismissed. First-time homebuyers are stepping back into the market as well, accounting for 34% of April’s purchases—an encouraging uptick from earlier this year.

Optimism is bubbling in some corners of the industry. There’s talk that the second half of 2025 could bring a notable rebound, especially if mortgage rates stabilize or even soften. NAR projects total existing-home sales to reach 4.5 million by year’s end, with the national median price expected to hover around $410,700.

Of course, time will tell. But whether that optimism materializes into a midyear boom or not, one thing remains clear: preparation matters. In today’s uncertain environment, the professionals who stay engaged—those who nurture their networks, prospect consistently, and understand the shifting behaviors of both buyers and sellers—will be best positioned for success.

So, while this spring may not be delivering the surge we expected, it’s far from a lost season. It’s a moment of reset—a chance to watch the signals, adjust strategies, and get ready for what’s next.

That’s all for now,

Dan

How Could a Recession in 2025 Affect the Housing Market?

As talk about economic slowdowns runs wild, worries about a potential recession in 2025 are on the rise. Naturally, many homeowners are wondering what a recession could do to the value of their home, and their buying power.

Using historical data from recessions of decades past, let’s see how a recession might affect the housing market in 2025.

A Recession Won’t Lower Home Prices

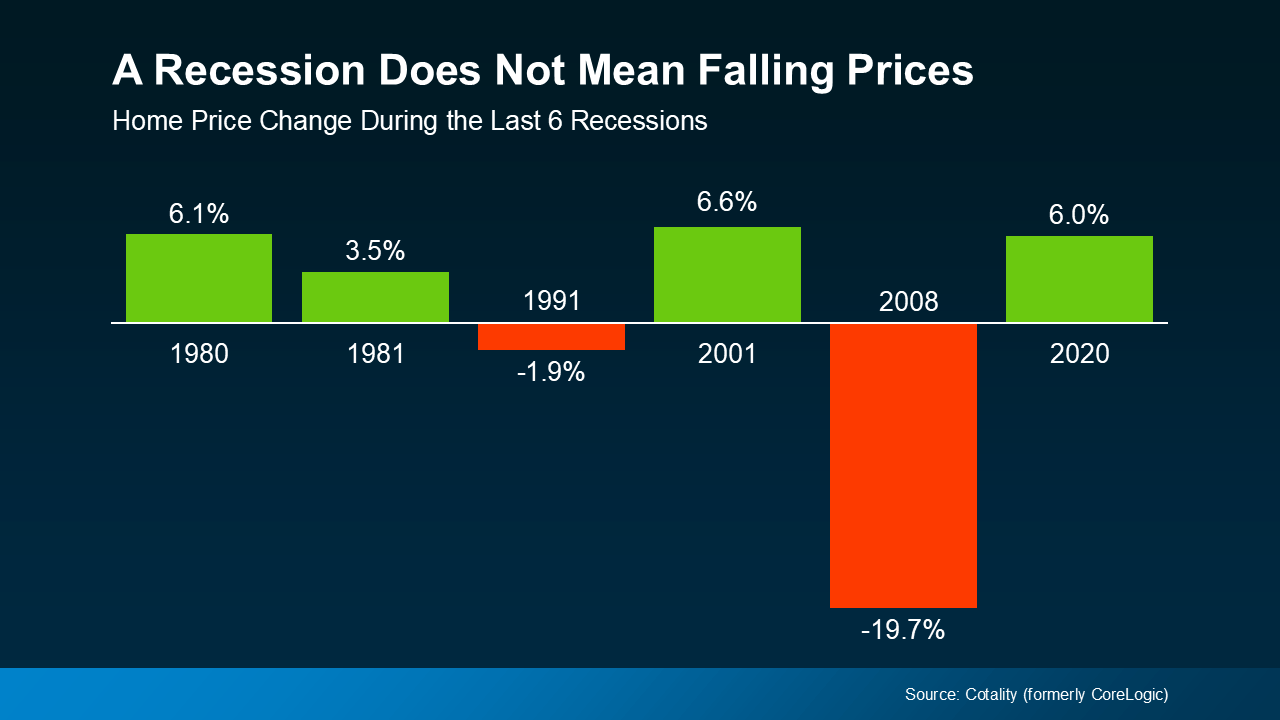

It’s a common misconception that a recession will cause home prices to crash, like they did in 2008. In reality, 2008 was the only time the housing market saw such an extreme, dramatic drop in prices. Overflowing home inventory caused that price crash, and conversely, low inventory has prevented a similar crash in the years since.

Even in markets where housing inventory is up, it’s still far below the listing oversupply that caused the 2008 crash. Indeed, according to data from Cotality, home prices actually increased during four of the last six major recessions.

As the graph shows, a recession doesn’t necessarily mean that home prices will crash, or even drop. In reality, historical data shows that home prices usually continue along their current trajectory when a recession hits. And at the moment, home prices are still rising nationally, but at a more normalized rate. So, as the market stands now, a recession in 2025 would most likely drive prices even higher.

Mortgage Rates Typically Decline During Recessions

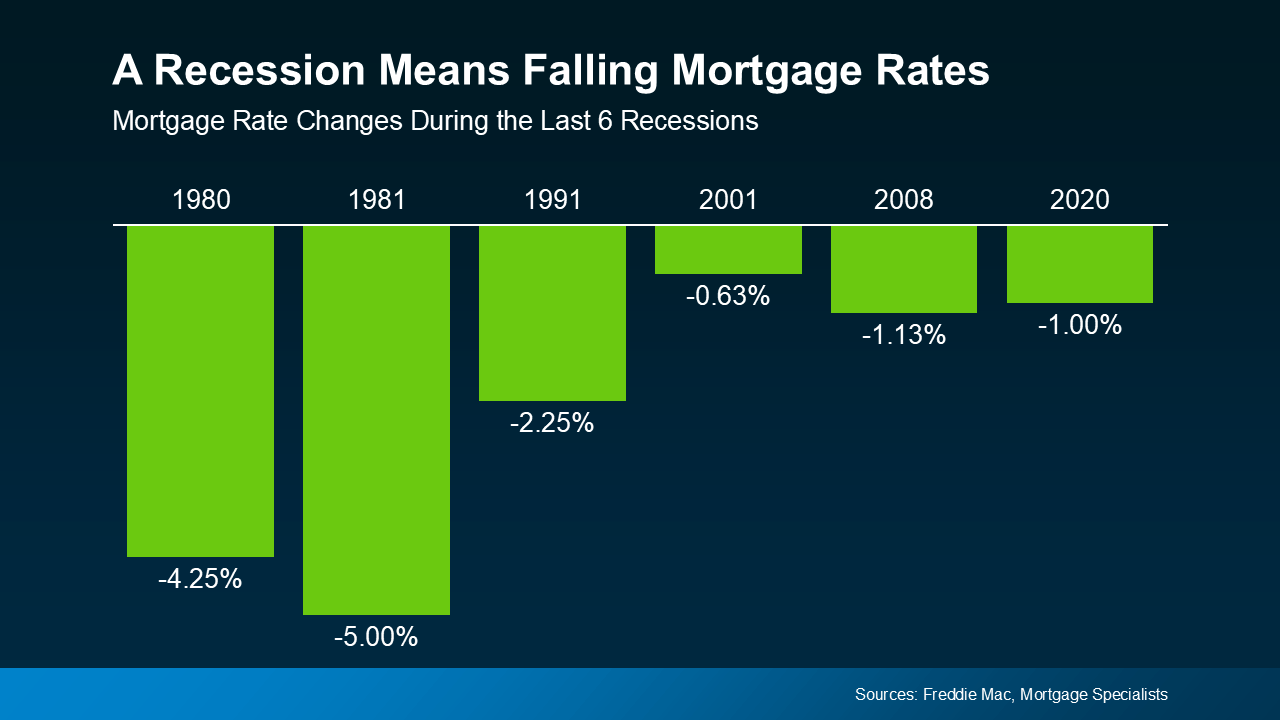

Home prices may stay their path during economic slowdowns, but mortgage rates actually tend to drop. Looking again at historical data from the last six recessions, this time from Freddie Mac, mortgage rates fell each time.

Historically speaking, a recession could mean that mortgage rates may even decline this year. However, the last time a recession dramatically lowered mortgage rates was over three decades ago in 1991. So with that said, even if a recession does happen, don’t expect a game-changing drop in mortgage rates.

Conclusion

Nobody ever truly knows what the economy will do, but the odds of a recession in 2025 have increased. Still, a recession doesn’t mean you need to worry about the housing market or the value of your home. The historical data tells us that a recession may even drive home prices higher and mortgage rates lower.

Wondering how an economic slowdown could impact your local market? Connect with us to get the info you need to plan ahead.

Foreclosures Rose in Q1 2025 – Is It a Warning Sign?

With everyday costs seemingly rising across the board, the state of the housing market is a natural concern. When basic living expenses rise, even critical financial responsibilities like mortgage payments start to slip, leading to increased foreclosures. Unsurprisingly, new data shows filings for foreclosures rose in Q1 2025, stirring worries about another housing crash like in 2008.

But as it turns out, there’s less cause for worry than you might think. When contextualized correctly, it’s clear these new number don’t point to a repeat of the last big housing crash.

The 2008 Market Versus 2025

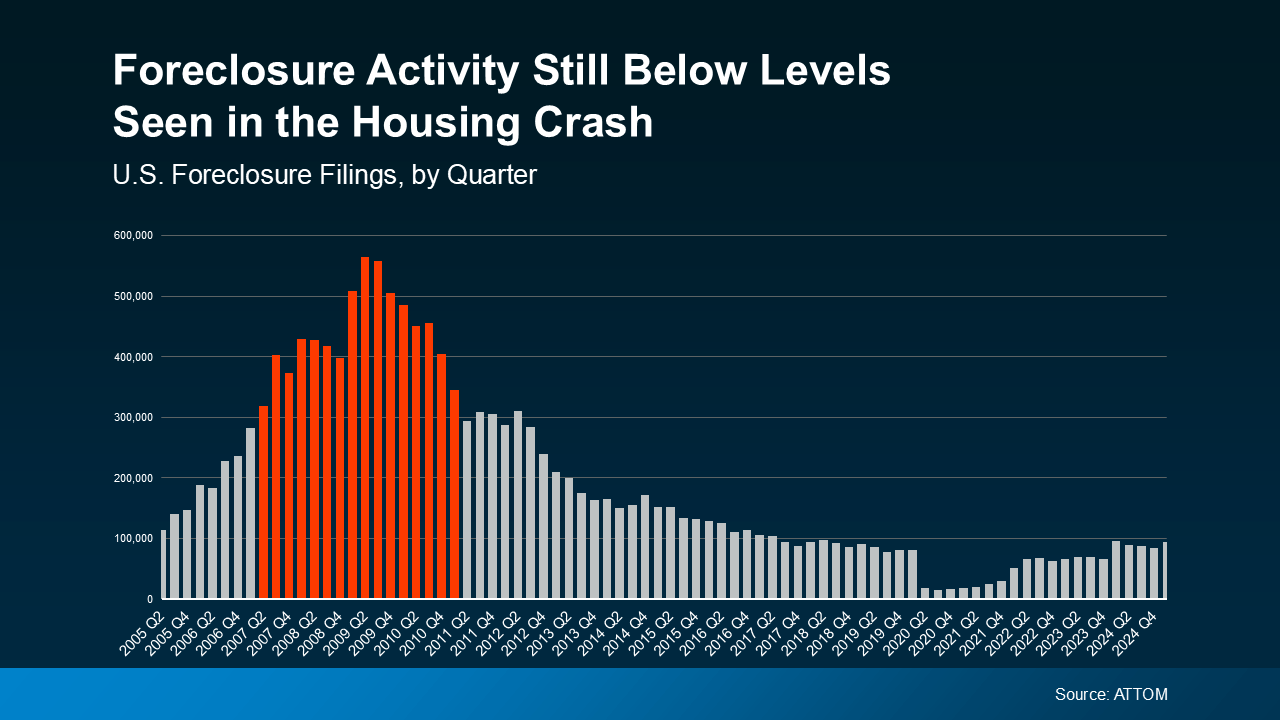

The latest quarterly report from ATTOM shows that foreclosures did rise in Q1 2025, which is concerning at first glance. However, foreclosure filings were still lower than the normal historical average, and far below the levels seen in 2008. When plotted visually, it’s easy to see the huge difference between 2008 and 2025.

Compare the foreclosure filings in Q1 2025 to the years surrounding the 2008 crash on the graph below. Even in the years preceding and following the 2008 crash, foreclosures were dramatically higher than what we’re seeing now.

Back in 2008, lenders were approving loans using much riskier practices, saddling many homeowners with mortgages they couldn’t afford. This flooded the market with distressed properties, surplus housing inventory, and free-falling home prices that collectively caused the crash.

In the years that followed, lending standards became much stricter and stronger to prevent such a crash from happening again. Today, most homeowners are in a much better financial position, and foreclosures have stabilized as a result.

The graph may appear to show foreclosures ramping up since the lows of 2020 and 2021, but this is deceiving. Foreclosures during those years were unusually low thanks to a moratorium designed to help millions of homeowners through the pandemic. That moratorium has since ended, which has caused foreclosure filings to return to the more normal levels we see now.

Compared to pre-pandemic years like 2017-2019, foreclosures overall are actually relatively down from what’s considered normal. So while foreclosures rose in Q1 2025, this doesn’t point to a troubling surge in the market.

Why Foreclosures Haven’t Surged in 2025

Another reassuring difference in today’s real estate market is the power of increased homeowner equity. As home prices have exploded over these past few years, homeowners have enjoyed a welcome boost to their wealth. According to Rob Barber, CEO at ATTOM:

“While levels remain below historical averages, the quarterly growth suggests that some homeowners may be starting to feel the pressure of ongoing economic challenges. However, strong home equity positions in many markets continue to help buffer against a more significant spike . . .”

In short, if a homeowner can’t make their mortgage payments, they may be able to sell their home to avoid foreclosure. During 2008, many people owed more than their homes were worth and had no choice but to foreclose. Today, most homeowners have much stronger equity that protects them from being forced into foreclosing. As Rick Sharga, Founder and CEO of CJ Patrick Company, recently explained in a Forbes article:

“ . . . a significant factor contributing to today’s comparatively low levels of foreclosure activity is that homeowners—including those in foreclosure—possess an unprecedented amount of home equity.”

Conclusion

It’s true that foreclosures rose in Q1 2025, but they’re nowhere near the levels seen during the 2008 crash. Even as home prices continue rising, strong equity is protecting existing homeowners and bolstering their wealth. This doesn’t discount the struggles some homeowners are facing, but it’s a reassuring fact for the market at large.

If you’re a homeowner facing foreclosure, ask your mortgage provider about what options are available to you. Are you a first time buyer eager to build your equity? Contact us today for the info you need to get started.

From Dan’s Desk: May 5, 2025

As we continue navigating a rapidly evolving real estate landscape, I wanted to take a moment each quarter to connect directly with you—our agents, staff, and leadership team—to share what I’m seeing in the market, what it means for our business, and how we can continue moving forward together.

This new quarterly message is meant to offer perspective, spark conversation, and keep us aligned on the bigger picture. Whether you’re helping clients buy and sell every day, or supporting our operations behind the scenes, we’re all part of what makes this company strong, and what makes this company continue to succeed.

Let’s take a look at where things stand today and where I believe we’re headed next.

Where Is the Residential Real Estate Market Going?

This is the major question everyone in the industry is asking. With January and February sales numbers coming in weaker than expected—per the latest NAR data—and no significant movement in interest rates, many are beginning to second-guess 2025’s ability to rebound after two consecutive years of significantly low home sales in the U.S.

While I don’t have a crystal ball, we are beginning to see encouraging signs in many local markets. Our internal data shows March’s open business was up year-over-year, and listing inventory is starting to grow. As a company, we remain bullish that the summer of 2025 could be one of the stronger selling seasons we’ve experienced in recent years.

That being said, it may be a long time before we return to the 6 million-plus annual home sales we saw during the boom years of 2020 and 2021. Companies need to continue reinventing themselves in markets like this. The real challenge lies in this: how do we provide outstanding service to consumers and best-in-class support to our agents, all while maintaining an expense structure that allows organizations to thrive?

This is the question we all need to be asking to stay ahead of market trends. Personally, I don’t believe these types of markets are to be feared—but rather embraced. They push us to innovate, to adopt new technologies, and to develop new services that will make our businesses more resilient and better equipped to serve our clients in the long run.

That’s all for now,

Dan

Are You Waiting To Buy? This Spring May Be Your Time To Move

Between low inventory, high home prices, and unpredictable mortgage rates, 2024 was a rocky year for real estate. It should come as no surprise then that 70% of buyers stopped their home search last year. If you were one of them and are still waiting to buy in 2025, this spring could be your time.

The Drive of Housing Inventory

Many homeowners who put their move on pause last year are reentering the market this year. This means higher, stronger listing inventory, and with builders finishing more homes, new construction inventory is growing as well. Together, this creates more options for buyers like you, and better chances of finding the home you’ve waited for.

But that’s only part of the story. When you’re selling, you want to feel confident that you’ll find a home you’ll be thrilled to move into. At the same time, you don’t want housing inventory so high that your current house sits on the market. Fortunately, the spring 2025 market is striking a balance between supply and demand that many have waited for.

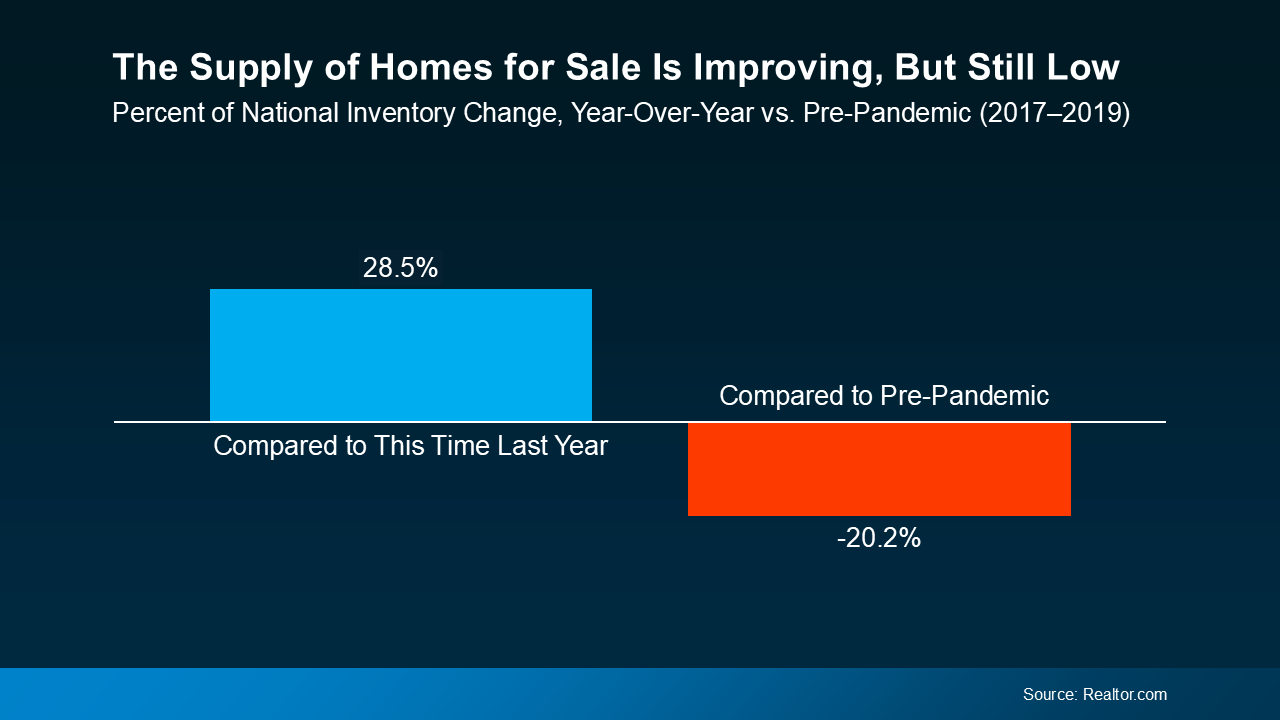

According to research from Realtor.com, housing inventory has jumped 28.5% year-over-year, making March the 17th straight month of inventory growth. This is still below pre-pandemic levels in most markets, but it’s a sweet spot for anyone waiting to buy.

For patient buyers, this means you’ll have more options when moving, but not so many that your current house won’t sell. As long as there’s a healthy demand for homes in your area, your house should still sell relatively quickly. Especially if you work with a local agent to make sure it’s priced right and fixed up to maximize value.

The Sweet Spot: More Options and Steady Demand

Here’s another promising point to think about. As we said, Realtor.com‘s March 2025 data shows that housing inventory has been rising for 17 consecutive months. What’s better, industry experts agree that listing inventory is likely to continue climbing through 2025. According to Lance Lambert, the Co-Founder of ResiClub:

“The fact that inventory is rising year-over-year . . . strongly suggests that national active housing inventory for sale is likely to end the year higher.”

If this prediction proves correct, this spring may be a better time to sell than you think. Listing now could help your house may stand out more than it would later in the year as inventory grows. With more homeowners reentering the market, waiting too long could make it all the more difficult to stand out.

Conclusion

If you’re one of the many who have been waiting to buy a house this past year, here’s your chance. Housing supply is growing but hasn’t caught up to demand yet, meaning new listings are still getting extra buyer attention. Meanwhile, increasing inventory is giving current homeowners more opportunities to scale up, further driving supply and activating buyers.

For both first time buyers and homeowners waiting to sell, this spring’s market is trending toward an ideal sweet spot. If you have questions keeping you from making your move, reach out to us for answers today. We can get you the info you need, or connect you with an agent to navigate your unique local market.

Get Ready: The Best Time to List Your House This Year Is Coming Soon

If you’re waiting for the best time to list your house this year, then wait no longer. Experts have looked at the data, and the best week to list your house in 2025 is almost here.

A recent study from Realtor.com analyzed years of housing market trends and found that April 13–19 is expected to be the best week this year to list your house:

“. . . we’ve identified April 13-19 as the best week to list for sellers . . . a seller listing a well-priced, move-in ready home is likely to find success. Because spring is generally the high season for real estate activity and buyers are more plentiful earlier rather than later in the year, listing earlier in the spring raises a seller’s odds of a successful sale.”

Why Is This the Best Time?

Spring is typically a strong season for sellers and when the housing starts to really take off every year. But according to Realtor.com, this window could be particularly advantageous in 2025 thanks to a few key factors. Here are the biggest influences that make April 13-19 the ideal week for new listings:

- More potential buyers are looking at your home since demand is usually highest in the spring and summer every year.

- A faster, easier sale since many serious, committed buyers are eager to move before summer.

- Higher chances of getting the best offer. According to Realtor.com, you could get $4,800 more on average this week, and $27,000 more than earlier in the year.

Want Your House Listed at the Best Time? Start Now

Only a couple weeks are left before the year’s prime listing week, but you can still make the deadline. If you’ve been planning to list for a while, a smart plan and quick action can make it happen. This is where working with a great local real estate agent can make all the difference between selling and not. An expert agent can help you:

- Figure out exactly what you need to do to get your home ready to list and, eventually, sold.

- Prioritize the tasks to make the biggest impact on your listing and chances of selling in the shortest time.

- Identify any quick fixes or easy upgrades to help you attract as many potential buyers as possible.

If your house is already in good repair and condition, your focus should be on quick, value-adding updates. The idea is to eliminate any potential dealbreakers for interested buyers, as Investopedia says:

“You won’t have time for any major renovations, so focus on quick repairs to address things that could deter potential buyers.”

With the April 13-19 window fast approaching, the quicker you can finish these projects, the better. Here are some small projects recommended by Redfin you can do that can make a big difference to interested buyers:

What if You’re Not Ready to List?

If you don’t think you’ll be ready to list before this windows passes, then don’t worry. Even though Realtor.com expects April 13–19 to be the best time to list, it’s not the only good time to sell. What’s most important is getting your home ready to maximize its attractiveness to buyers when you do decide to list. Even if you list a bit late, there’s still plenty of opportunity before prime homebuying season is over.

Conclusion

If you’ve been waiting for just the right moment to sell, April 13-19 could be the perfect time. Realtor.com projects this as the best time to list your house this year, but there’s a bit more to consider. Making sure your home is fully prepped and priced competitively for your local market can make the difference.

Ready to list but need a real estate agent’s advice and expertise first? Reach out today and we’ll connect you with a local expert who can help you list and sell your home fast.

The Spring 2025 Housing Market: 4 Things To Expect

Spring is in full swing, and the spring 2025 housing market is swinging along with it. Wondering whether now is the right time to finally buy a house or sell your home? Here are four trends you can expect in the market this year, and what they mean for you.

1. More Homes on the Market

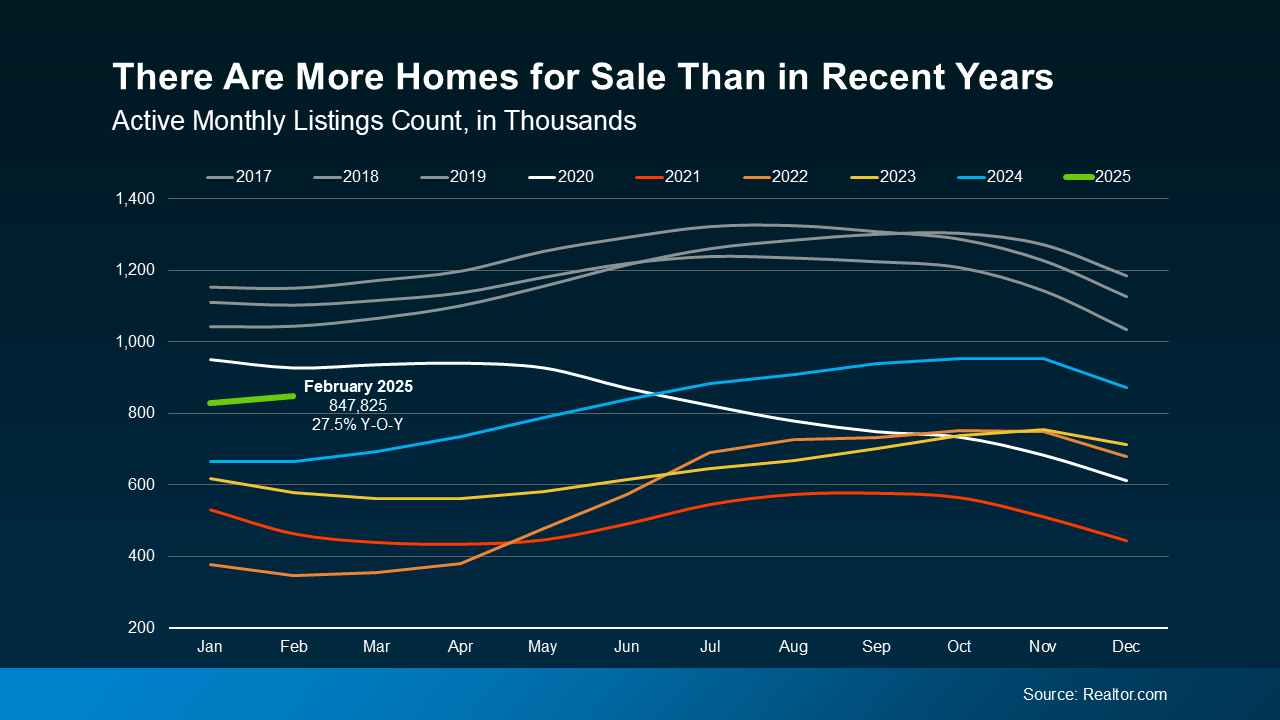

After years of housing shortages nationwide, the number of homes for sale is finally improving. According to recent national data from Realtor.com, active home listings are up 27.5% compared to this time last year. Housing inventory took a tremendous dive in 2020, but at long last, it’s close to reaching pre-pandemic levels this spring.

The graph below shows monthly active listing count for each year dating back to 2017. As you can see, even though inventory levels still haven’t quite returned to pre-pandemic norms, they’ve improved over last year. In fact, they’re almost at 2020 levels, and will likely exceed them this summer if their upward trend continues.

For Buyers: More housing inventory means you have more options and choices. Having options means you can be more selective, and that sellers may be more willing to negotiate with you.

For Sellers: With more homes available, you’re more likely to find the right house to move into. With inventory still below normal levels, your current home will stay in higher demand, at least until home supply normalizes.

2. Home Price Growth Is Slowing

As inventory increases, the rate of home price growth is slowing down as prices respond to buyer demand. This will continue through the spring 2025 housing market and beyond into 2026 if the current trend holds steady. With more homes for sale, eager buyers are less pressured to compete for limited inventory. Price growth will continue to slow as supply rises and buyers enjoy more options, but it will generally remain positive. A recent projection from Freddie Mac says:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

Every housing market is different, so while home prices are rising nationally, this may not be true everywhere. Some markets are actually seeing stronger price growth, while others are slowing or even seeing home prices decline.

For Buyers: Slower home price growth means prices aren’t rising as quickly as before. Still, any home you buy now is likely to appreciate in value over time, helping you build equity.

For Sellers: Home prices are still rising, but you may need to temper your expectations in terms of pricing your home. Pricing too high in a more competitive market could mean your house takes longer to sell. Listing at a price point competitive with your local market is going to become a key factor as prices normalize.

3. Mortgage Rates Are Falling and Stabilizing

One of the biggest obstacles for buyers – especially new ones – since the pandemic has been higher, less predictable mortgage rates. Fortunately, rates have been slowly stabilizing so far in Q1 of 2025, and have even dropped faster than experts anticipated. These aren’t the 3% rates of 2020, but less volatile rates give buyers more reason to buy with confidence. As Chief Economist at CoreLogic Selma Hepp says:

“With the spring homebuying season upon us, the recent improvements in mortgage rates may help invite homebuyers back into the market.”

For Buyers: When mortgage rates are stable, planning ahead is easier because your future payments are likely to be more predictable. But keep in mind that even though mortgage rates are stabilizing, they’re still far from being completely static. When buying, consult your agent and lender to stay current with rates and how they might affect your plans.

For Sellers: Lower rates starting to stabilize means more buyers are becoming active – especially those who have been patiently waiting. This means increases in housing demand and more potential interested buyers for your house.

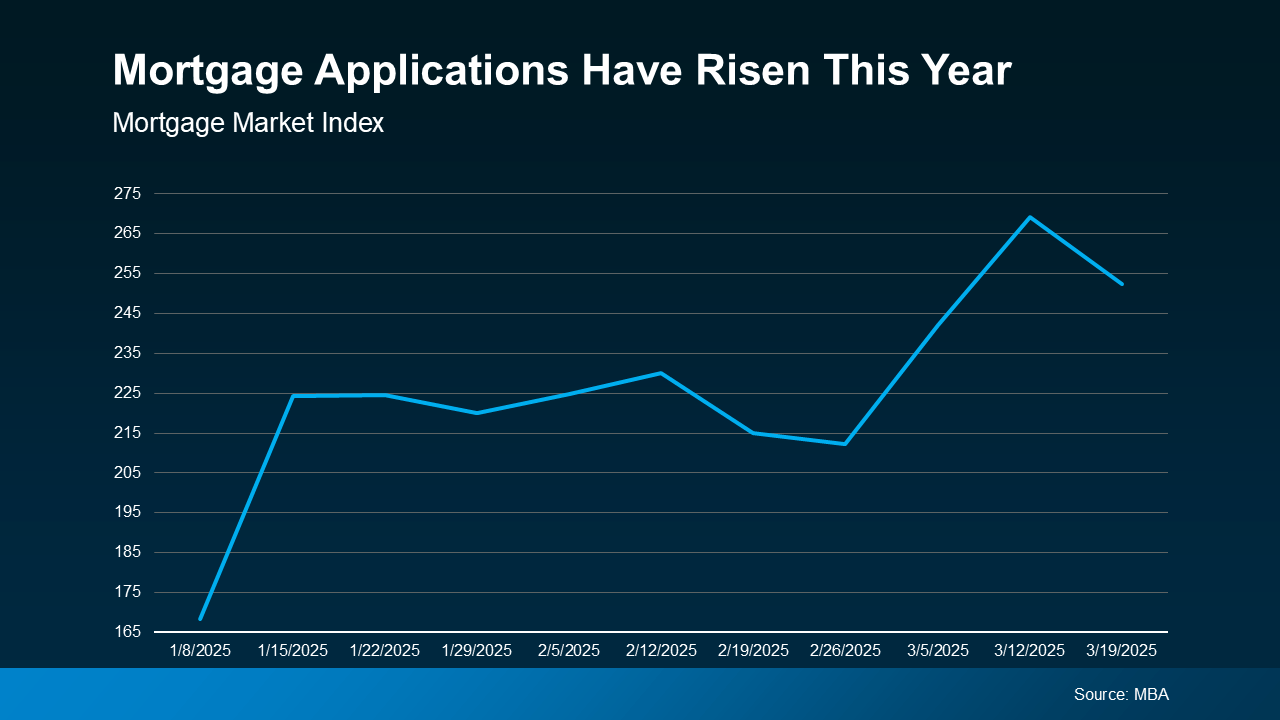

4. More Buyers Are Entering the Market

With more inventory, slowing price growth, and stabilizing mortgage rates, buyers are gaining confidence and finally reentering the market. Demand is increasing, and recent data from the Mortgage Bankers Association (MBA) shows an uptick in mortgage applications compared to the start of the year.

For Buyers: The spring 2025 housing market buying season is quickly heating up. Making your move now and getting a leg up on your competition could be a wise strategy this spring.

For Sellers: Eager buyers wanting to buy a home in the spring or summer are entering the market quickly. Naturally, this is great news for you: more buyers means a better chance of selling your home fast.

Conclusion

Between more homes for sale, slowing price growth, and stabilizing mortgage rates, there’s plenty reason to be positive this spring. Buyers can expect higher housing inventory at more reasonable rates, while sellers can count on a busier market with more activated homebuyers. If you’re wondering how this spring’s trends might affect you, contact us today to get started with an expert agent in your area.

3 Reasons To Buy a Home Before Spring

Buying a home before spring

Let’s face it — buying a home can feel like a challenge with today’s mortgage rates. You might even be thinking, “Should I just wait until spring when more homes hit the market and rates might be lower?”

But here’s the thing, no one knows for sure where mortgage rates will go from here, and waiting could mean facing more competition, higher prices, and a lot more stress.

What if Buying a home before spring might actually give you the upper hand? Here are three reasons why that just might be the case.

1. Less Competition from Other Buyers

The winter months tend to be quieter in the real estate market. Fewer people are actively looking for homes, which means you’ll likely face less competition when you make an offer. This makes the process feel less rushed and less stressful.

According to the National Association of Realtors (NAR), homes sit on the market longer in winter compared to spring and summer (see graph below):

Fewer buyers in the market means you’ll likely have more time to make thoughtful decisions. It also means you may have more negotiating power. According to the Alabama Association of Realtors:

“A significant benefit of buying a home in winter is the reduced competition. Because of the perceived benefits of spring, many buyers delay the start of their house hunt. As a result, you will find fewer people competing for the same properties during winter. Less demand can translate into more negotiating power as sellers may be more willing to entertain offers or agree to concessions to get a deal closed quickly.”

2. More Negotiating Power

With homes staying on the market longer, sellers may be more willing to negotiate. This can lead to better deals for you as a buyer, whether that means a lower price or added incentives, like sellers covering closing costs or making repairs. As Chen Zhao, an Economist at Redfin, points out:

“. . . buying during the off season means less competition from other buyers. That means potentially negotiating a better deal.”

Plus, when demand is lower, sellers often feel more pressure to work with serious buyers. This could give you an edge to negotiate terms that work best for your situation.

3. Lock in Today’s Prices Before They Rise

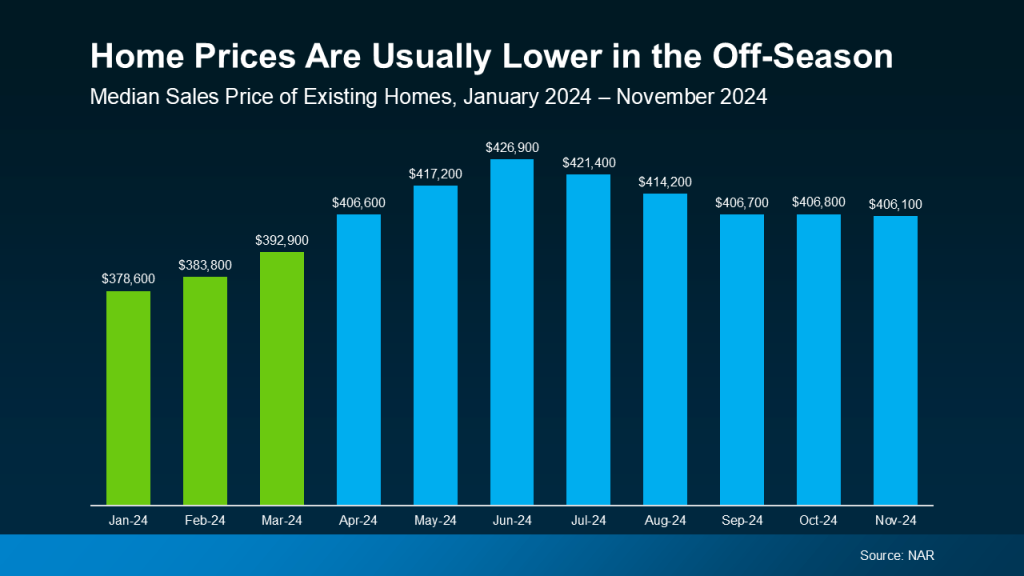

Historically, home prices tend to be at their lowest point in the winter months, too. According to data from NAR, home prices last year were at their lowest in January, February, and March — right before the spring buying season kicked in (see graph below):

This trend isn’t new — Bright MLS shows between 2010 and 2024, home prices in January and February were, on average, 15% lower than during the month of peak home prices (typically June). Buying in the off-season means you’re more likely to avoid paying the premium prices that come with the high demand of spring.

On top of that, home prices generally appreciate over time, meaning they tend to go up year after year. That means if you’re ready to buy and you can make it happen, you’re not only taking advantage of what might be the lowest prices of the year, but you’re also locking in today’s price before it increases in the future.

Bottom Line

While spring may seem like the obvious time to buy, moving before the peak season can give you significant advantages, like less competition, more negotiation power, and lower prices.

Start your home buying journey by visiting our Property Search page.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link