Spring is in full swing, and the spring 2025 housing market is swinging along with it. Wondering whether now is the right time to finally buy a house or sell your home? Here are four trends you can expect in the market this year, and what they mean for you.

1. More Homes on the Market

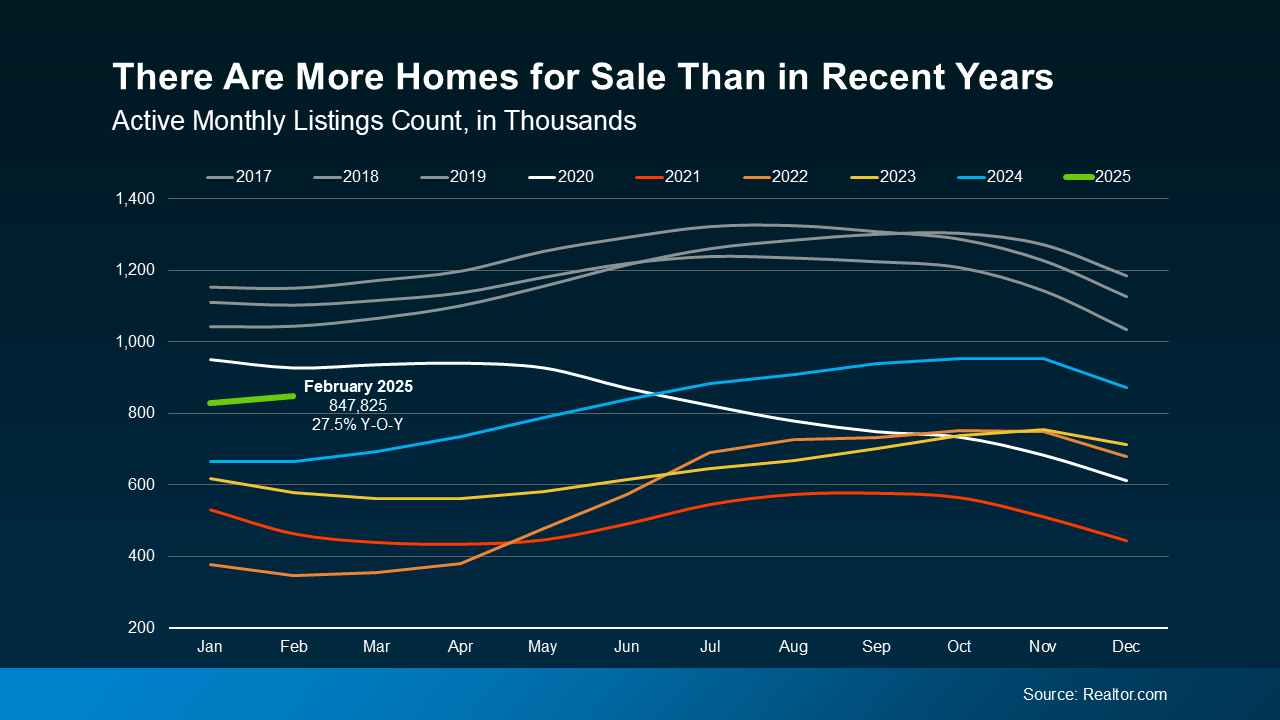

After years of housing shortages nationwide, the number of homes for sale is finally improving. According to recent national data from Realtor.com, active home listings are up 27.5% compared to this time last year. Housing inventory took a tremendous dive in 2020, but at long last, it’s close to reaching pre-pandemic levels this spring.

The graph below shows monthly active listing count for each year dating back to 2017. As you can see, even though inventory levels still haven’t quite returned to pre-pandemic norms, they’ve improved over last year. In fact, they’re almost at 2020 levels, and will likely exceed them this summer if their upward trend continues.

For Buyers: More housing inventory means you have more options and choices. Having options means you can be more selective, and that sellers may be more willing to negotiate with you.

For Sellers: With more homes available, you’re more likely to find the right house to move into. With inventory still below normal levels, your current home will stay in higher demand, at least until home supply normalizes.

2. Home Price Growth Is Slowing

As inventory increases, the rate of home price growth is slowing down as prices respond to buyer demand. This will continue through the spring 2025 housing market and beyond into 2026 if the current trend holds steady. With more homes for sale, eager buyers are less pressured to compete for limited inventory. Price growth will continue to slow as supply rises and buyers enjoy more options, but it will generally remain positive. A recent projection from Freddie Mac says:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

Every housing market is different, so while home prices are rising nationally, this may not be true everywhere. Some markets are actually seeing stronger price growth, while others are slowing or even seeing home prices decline.

For Buyers: Slower home price growth means prices aren’t rising as quickly as before. Still, any home you buy now is likely to appreciate in value over time, helping you build equity.

For Sellers: Home prices are still rising, but you may need to temper your expectations in terms of pricing your home. Pricing too high in a more competitive market could mean your house takes longer to sell. Listing at a price point competitive with your local market is going to become a key factor as prices normalize.

3. Mortgage Rates Are Falling and Stabilizing

One of the biggest obstacles for buyers – especially new ones – since the pandemic has been higher, less predictable mortgage rates. Fortunately, rates have been slowly stabilizing so far in Q1 of 2025, and have even dropped faster than experts anticipated. These aren’t the 3% rates of 2020, but less volatile rates give buyers more reason to buy with confidence. As Chief Economist at CoreLogic Selma Hepp says:

“With the spring homebuying season upon us, the recent improvements in mortgage rates may help invite homebuyers back into the market.”

For Buyers: When mortgage rates are stable, planning ahead is easier because your future payments are likely to be more predictable. But keep in mind that even though mortgage rates are stabilizing, they’re still far from being completely static. When buying, consult your agent and lender to stay current with rates and how they might affect your plans.

For Sellers: Lower rates starting to stabilize means more buyers are becoming active – especially those who have been patiently waiting. This means increases in housing demand and more potential interested buyers for your house.

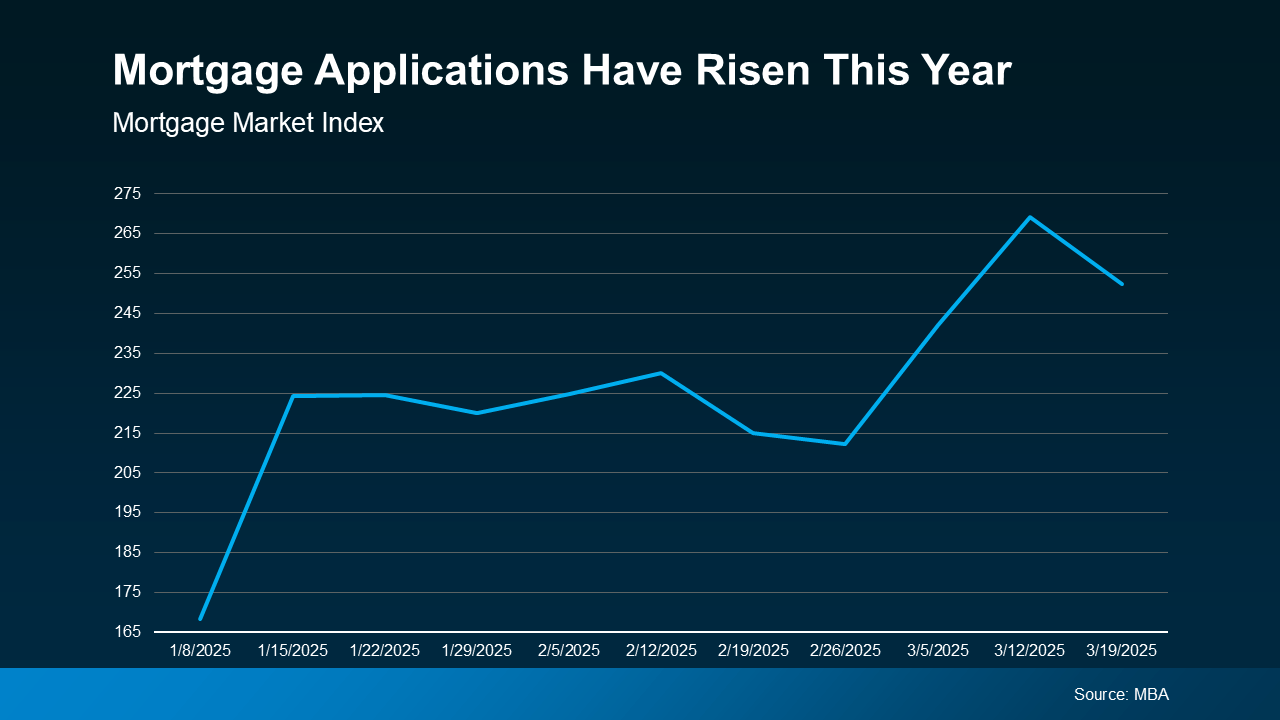

4. More Buyers Are Entering the Market

With more inventory, slowing price growth, and stabilizing mortgage rates, buyers are gaining confidence and finally reentering the market. Demand is increasing, and recent data from the Mortgage Bankers Association (MBA) shows an uptick in mortgage applications compared to the start of the year.

For Buyers: The spring 2025 housing market buying season is quickly heating up. Making your move now and getting a leg up on your competition could be a wise strategy this spring.

For Sellers: Eager buyers wanting to buy a home in the spring or summer are entering the market quickly. Naturally, this is great news for you: more buyers means a better chance of selling your home fast.

Conclusion

Between more homes for sale, slowing price growth, and stabilizing mortgage rates, there’s plenty reason to be positive this spring. Buyers can expect higher housing inventory at more reasonable rates, while sellers can count on a busier market with more activated homebuyers. If you’re wondering how this spring’s trends might affect you, contact us today to get started with an expert agent in your area.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link