If you’re in the market for a house, you’re probably not encouraged by today’s mortgage rates. Elevated rates and rising home prices have many homebuyers starting to explore other financing options that make more sense. One type of loan gaining popularity is adjustable-rate mortgages (ARMs).

If you remember the 2008 market crash, you may be wary of new types of loans. It’s wise to be cautious, but there’s no need to worry. Today’s ARMs much safer and stricter than the ones you may remember from 2008.

During that time, some buyers held loans they couldn’t afford once their rate adjusted. Today, lenders are more careful, and determine whether you can afford an increased rate before the loan is ever offered. This time, ARMs are returning thanks to creative buyers looking for affordable ways to buy a home..

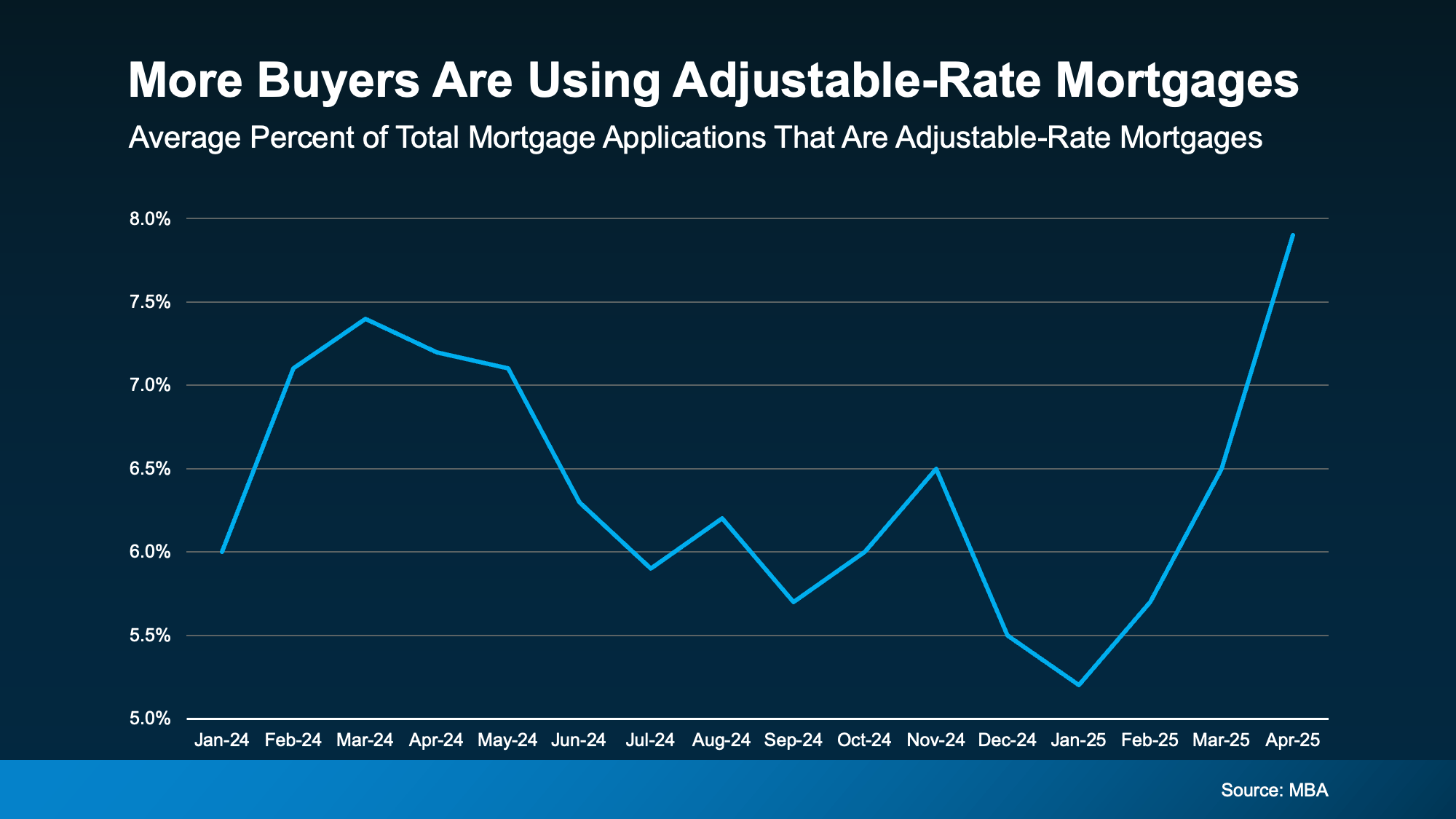

According to recent data from the Mortgage Bankers Association (MBA), more buyers are using ARMs to buy this year.

How Does an Adjustable-Rate Mortgage Work?

If you’ve never heard of ARMs before, you may be wondering what they are, and if they’re right for you. Here’s how Business Insider explains the main difference between a traditional fixed-rate mortgage and an adjustable-rate mortgage:

“With a fixed-rate mortgage, your interest rate remains the same for the entire time you have the loan. This keeps your monthly payment the same for years . . . adjustable-rate mortgages work differently. You’ll start off with the same rate for a few years, but after that, your rate can change periodically. This means that if average rates have gone up, your mortgage payment will increase. If they’ve gone down, your payment will decrease.”

Taxes or homeowner’s insurance can still influence a fixed-rate loan, but your baseline mortgage payment typically changes very little. Meanwhile, adjustable-rate mortgages can potentially change drastically in either direction after your initial payment period ends. Depending on your situation and anticipated market trends, this could either work for you, or be far too risky.

Pros and Cons of Adjustable-Rate Mortgages

With ARMs on the rise in 2025, it’s clear that more buyers are finding them appealing. Under the right conditions, they may offer attractive upsides, like a lower initial rate. According to Business Insider again:

“Because ARM rates are typically lower than fixed mortgage rates, they can help buyers find affordability when rates are high. With a lower ARM rate, you can get a smaller monthly payment or afford more house than you could with a fixed-rate loan.”

Remember that if you have an ARM, your rate will change over time. As Barron’s explains, they can potentially cost you more in the long run:

“Adjustable-rate loans offer a lower initial rate, but recalculate after a period. That is a plus for borrowers if rates come down in the future, or if a borrower sells before the fixed period ends, but can lead to higher costs if they hold on to their home and rates go up.”

While the upfront savings can be helpful now, consider what could happen if your initial rate ends before you move. Even though rates are projected to ease a bit over the next couple years, nothing is ever guaranteed. Before you choose an ARM, talk with your lender and financial advisor about all your options, and the potential risks.

Conclusion

For certain buyers, adjustable-rate mortgages can offer some big advantages, but this won’t be true for everyone. Understand how they work and whether their pros and cons make sense for you financially. Always talk to a trusted lender and a financial advisor before making entering into a new mortgage.

Need help connecting with a trustworthy lender in your area? Reach out to us for help today.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link