Between stubborn mortgage rates and rising home prices, you’ve probably mulled over renting vs. buying a home. In market conditions like these, renting and waiting to buy can feel like your only realistic option. This can be the truth in many cases, and buying before you’re ready can be a costly mistake.

But the short-term savings of renting can sometimes trap you in a cycle, preventing you from making wealth-building investments. Over time, this can actually end up costing you more than buying a home early and slowly building equity. Unsurprisingly, a recent survey from Bank of America found that 70% of prospective homebuyers feel renting could hinder their financial future.

Ultimately, the pros and cons of renting and buying come down to your own short-term and long-term financial goals. If you’re feeling torn over whether you should nest or invest, take these major differences into account to decide.

Homeownership Builds Your Wealth Over Time

Apart from giving you your own place to live, homeownership grants the important bonus of building your wealth over time. This is because home prices usually rise as time goes on, meaning waiting longer to buy costs you more. This isn’t always true of every housing market, but the general national trend tends to speak for itself.

The average home sale price has more than tripled in the past 30 years.

Even better, your home equity also grows over time when you’re a homeowner. Equity is the difference between what your home is worth and what you still owe on your mortgage. Your equity grows with each mortgage payment you make, and this builds your net worth over time.

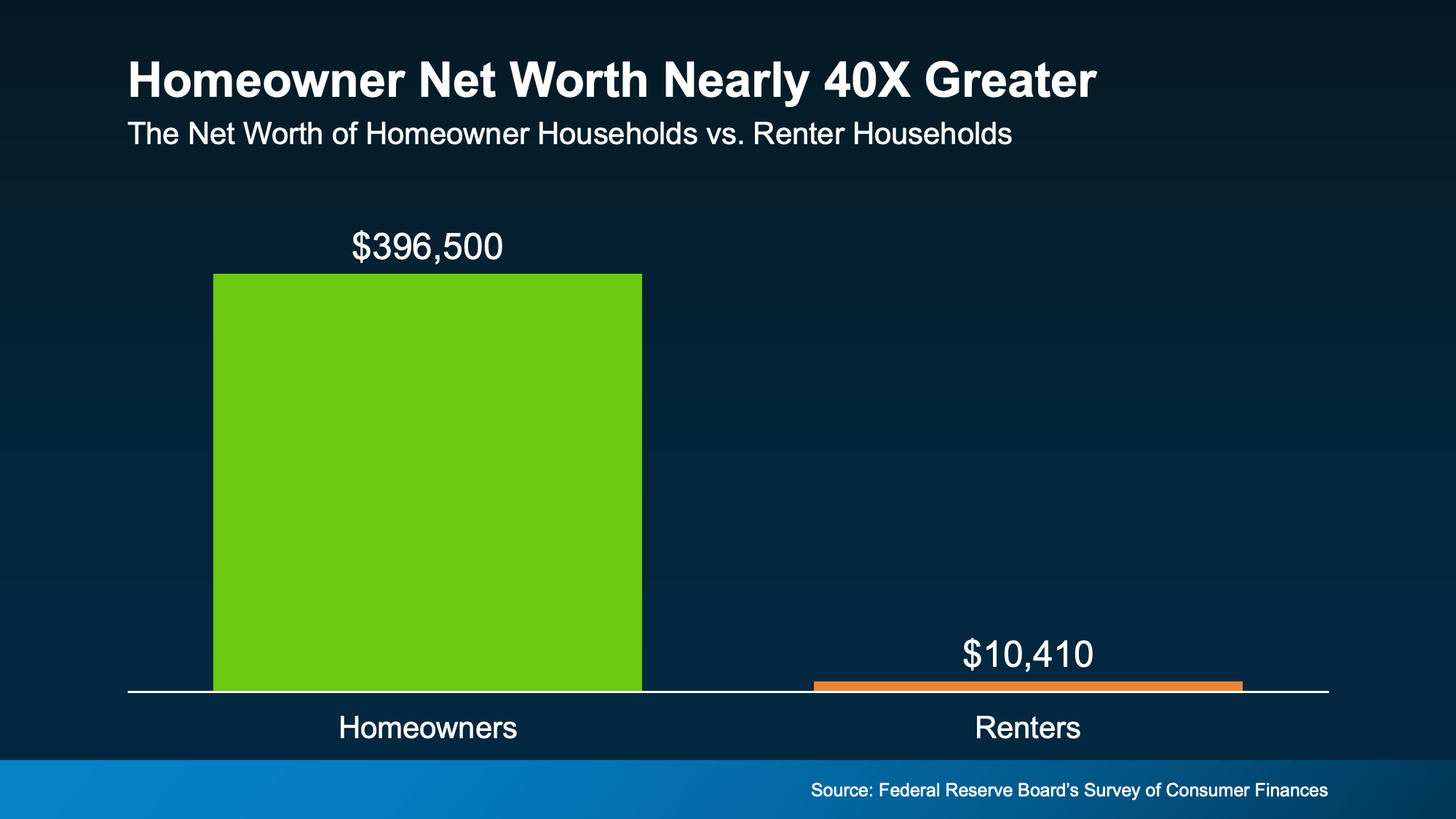

According to the Federal Reserve, the average homeowner’s net worth is nearly 40 times greater than that of a renter. That’s a life-changing difference, and seeing it represented visually really drives the point home.

The average net worth of a homeowner household is almost 40X greater than that of a renter household.

This massive difference in personal wealth is just one of the reasons that Forbes says:

“While renting might seem like [the] less stressful option . . . owning a home is still a cornerstone of the American dream and a proven strategy for building long-term wealth.”

Renting Helps You Save in the Short Term

Compared to homeownership, renting offers lower monthly payments and the freedoms of relatively negligible commitment and responsibility. This often makes renting feel like the safer option, and it usually is, at least in the short term. But in the long term, renting can land you in a trap that prevents you from building real wealth.

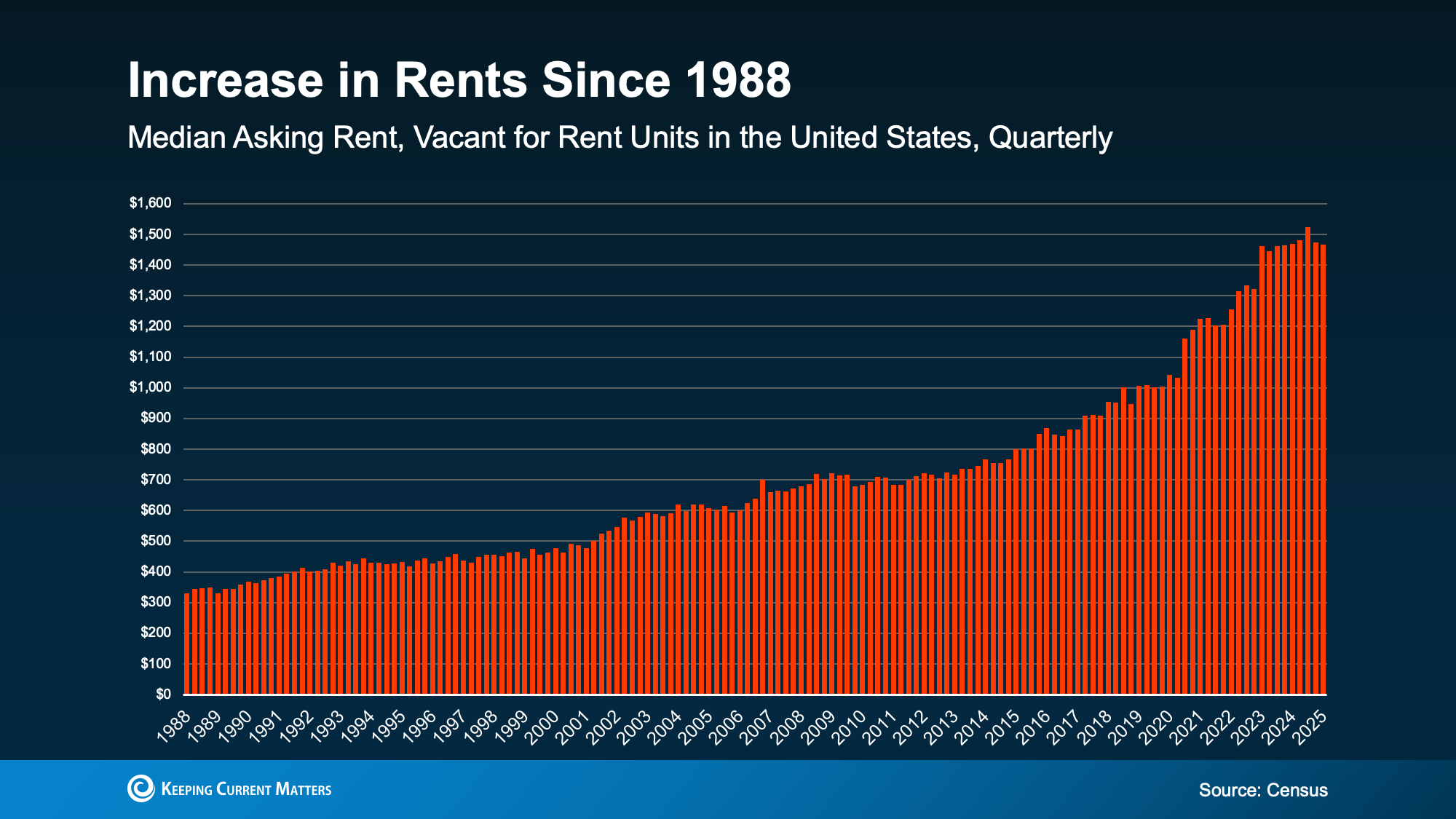

Rent tends to rise along with home prices, and this has been true for decades. Rental costs have been somewhat stable recently, but they almost never trend downward. This trap of paying increasing rent without building wealth can make buying a home feel impossible.

Like home prices, rental costs have risen dramatically in the past several years.

Financial uncertainty like this can have a real, lasting impact on any of your financial decisions. In the same Bank of America survey, 72% of potential buyers said they worry rising rent could affect their current and long-term finances.

Rent money doesn’t come back to you, and that means it doesn’t grow your wealth. The only mortgage it’s paying is your landlord’s.

So, whether you’re renting or owning, you’re paying off a mortgage. The question is: whose mortgage do you want to pay?

Renting vs. Buying: What Really Matters

Here’s another way to look at renting vs. buying. Rent money is gone once you pay it. Payments toward your own house build equity, like a savings account you can live in. Obviously, buying comes with higher upfront costs and more long-term responsibility. But the reward is a stable investment that grows over time. And while buying a home often feels out of reach, a solid plan can get you there.

As Realtor.com Senior Economist Joel Berner explains:

“Households working on their budget will find it much easier to continue to rent than to go through the expenses of homeownership. However, they need to consider the equity and generational wealth they can build up by owning a home that they can’t by renting it. In the long run, buying a home may be a better investment even if the short-run costs seem prohibitive.”

Conclusion

Renting may be cheaper in the short term, but it can cost you more over time without building your wealth. If you’re weighing the pros and cons of renting vs. buying, consider your long-term financial goals. Short-term saving can trap you in an endless cycle of renting, but buying without planning can be financially overwhelming.

If you’re ready to make the leap from renting into buying a home, contact us today. We’d be happy to connect you with a local agent who can make your dreams a reality.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link