If you’ve been holding off on buying a home for a lower mortgage rate, take another look at the market. Mortgage rates are trending downward, and they just hit their lowest point of the year so far.

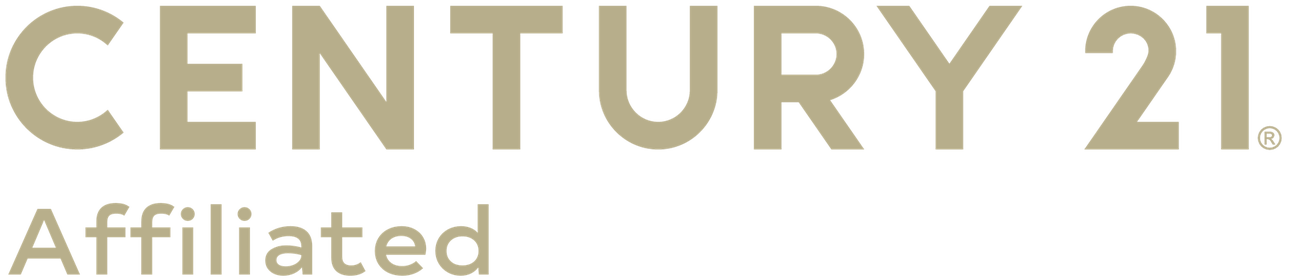

According to a report from Freddie Mac, mortgage rates have been falling for seven straight weeks. The average weekly rate for a 30-year-fixed mortgage is now at the lowest level its been in 2025.

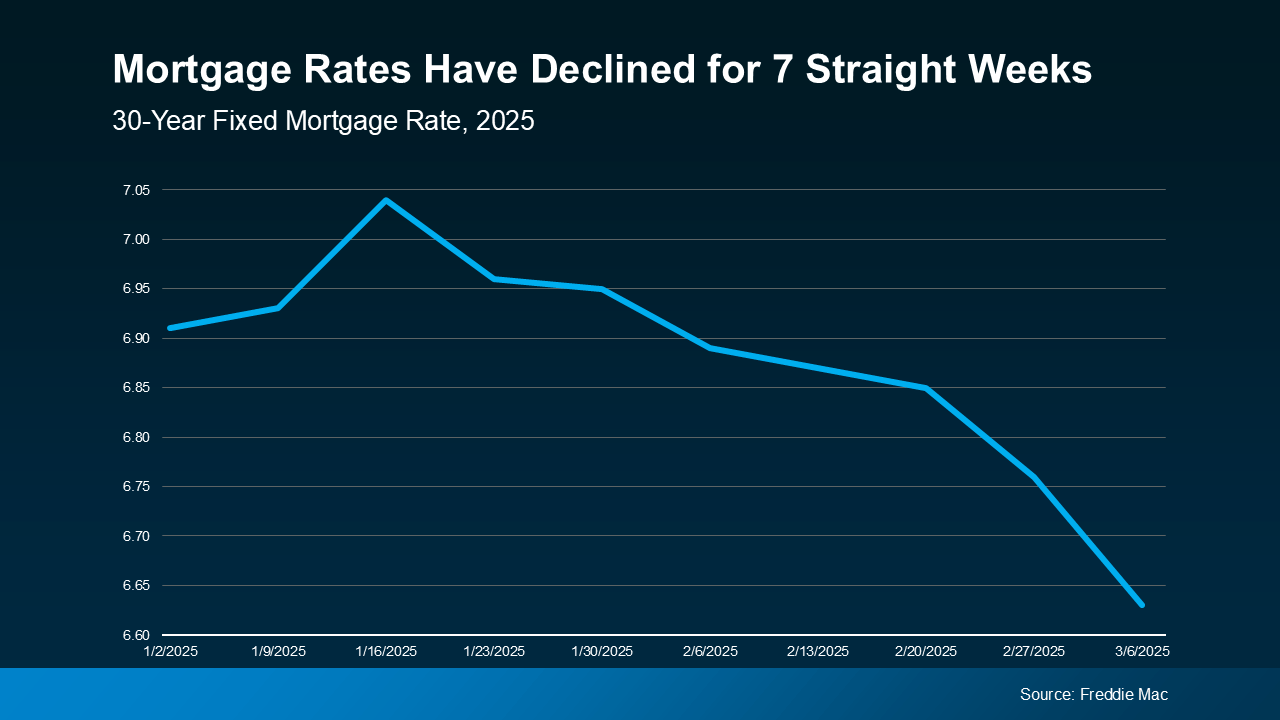

This may not sound significant on its own, but it outlines a remarkable trend. A drop in rates from over 7% to the mid-6’s can make all the difference when buying a home. What’s most significant is that experts previously predicted that rates wouldn’t fall this low until Q3 of this year.

Why Are Mortgage Rates Dropping?

According to Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA), ongoing economic uncertainty is a driving force in pushing rates lower:

“Mortgage rates declined last week on souring consumer sentiment regarding the economy and increasing uncertainty over the impact of new tariffs levied on imported goods into the U.S. Those factors resulted in the largest weekly decline in the 30-year fixed rate since November 2024.”

The timing of this rate drop is great for buyers moving into the Spring 2025 market. But remember that mortgage rates can change quickly, and always expect some volatility in markets driven by uncertainty. With that said, this small window of rates dropping into prime buying season might be exactly wait you’ve waited for.

What Falling Mortgage Rates Mean for Your Buying Power

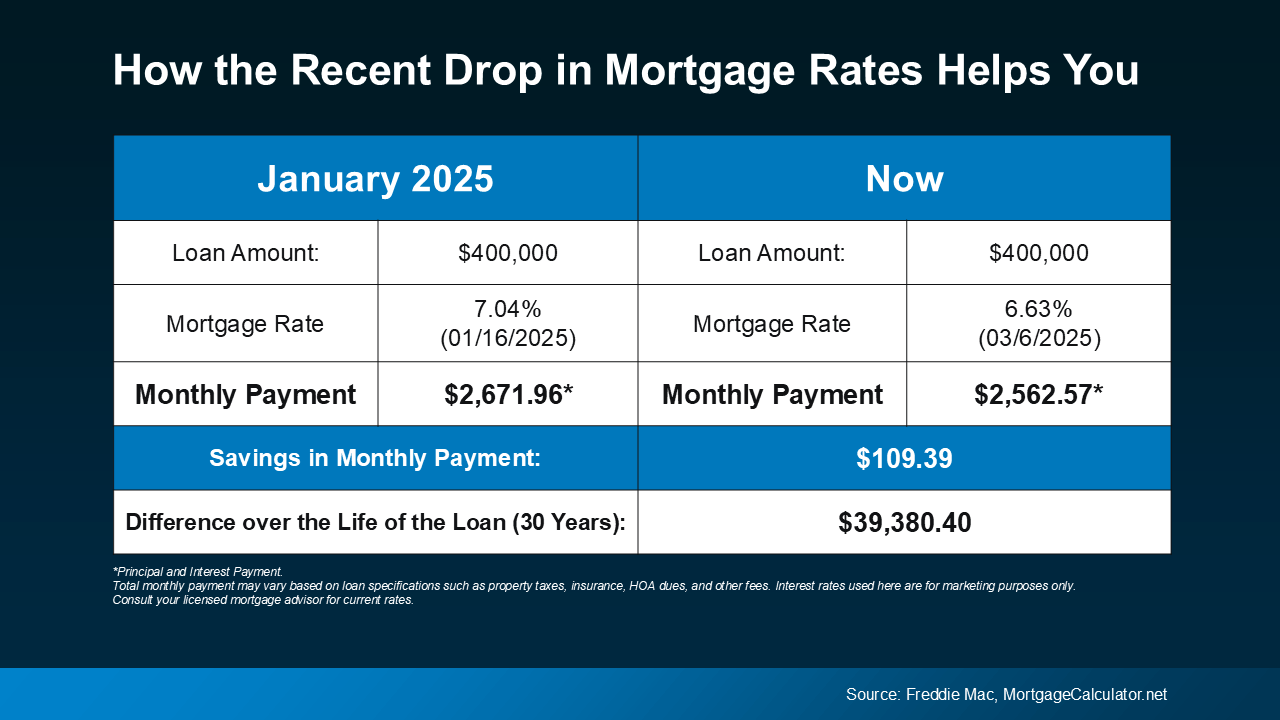

Even a small reduction in your mortgage rate can make a huge difference in your monthly housing payment. The chart below shows what a monthly payment (principal and interest) would look like on a $400K home loan if you purchased a house when rates were 7.04% back in mid-January (this year’s mortgage rate high). The right side shows what it could look like if you buy a home now at current rates.

In just the past few weeks, the expected payment on a $400K loan has come down by over $100 per month. That’s a significant savings that can make a world of difference when deciding to buy a house.

Recent economic shifts have driven rates down faster than expected, and that’s great news. But remember that this could change at any time in the coming days and months for better or worse. So if you’re waiting for rates to fall further before you buy, think hard about the current window of opportunity before making a decision.

Conclusion

Mortgage rates have dipped to their lowest point in 2025 so far. This grants buyers a great position moving into the spring buying season, especially for those who have been waiting. The unpredictability of the market and larger economy mean volatility, so get expert advice and consider before making a decision.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link