You’re probably familiar with the saying “The best time to plant a tree was yesterday, but the next best time is today.” It’s a valuable lesson about future planning and investment that, surprisingly, applies to the decision to buy a home too.

Even though buying a home is a major financial expense, it’s also a major investment that grows over time. As the price of your home increases over time, the value of the equity you’ve built grows with it. And while waiting for prices to drop may be an attractive option, trying to time the market rarely works.

But here’s something to consider: the longer you wait to buy a home, the more your patience could cost you. Let’s explain why.

Home Prices Are Expected To Continue Climbing

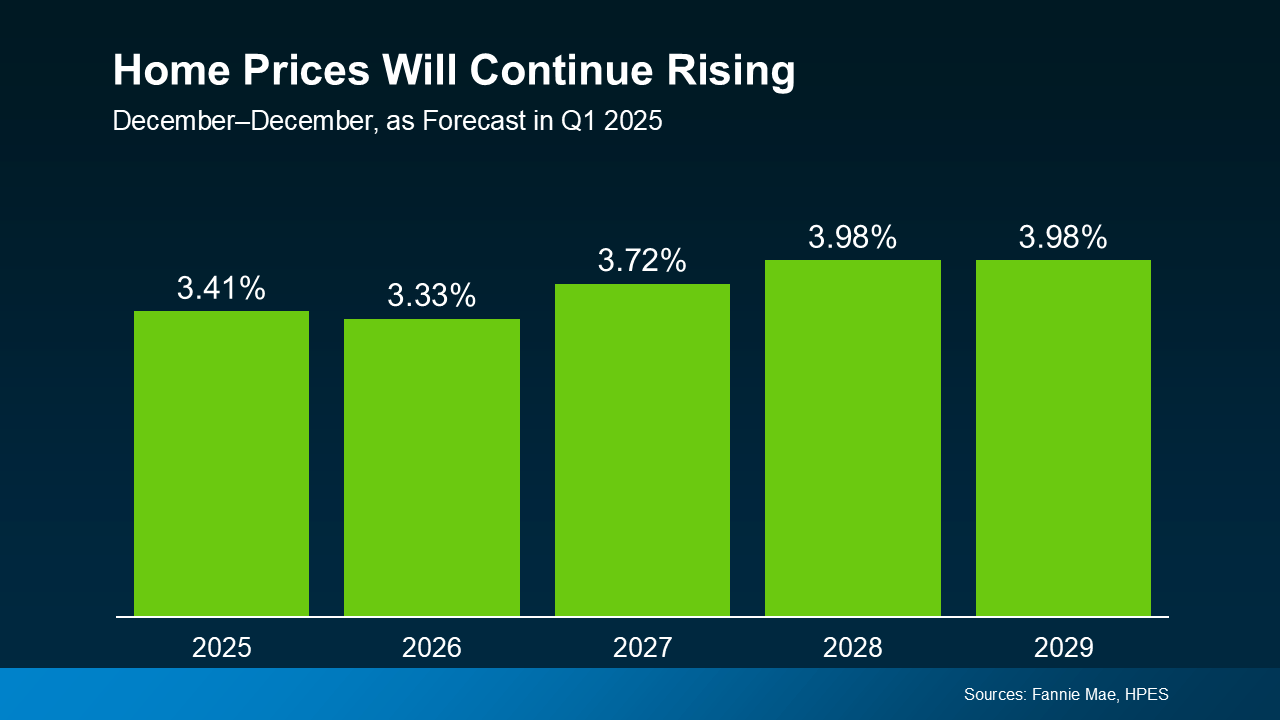

Each quarter, over 100 housing market experts respond to Fannie Mae‘s Home Price Expectations Survey (HPES). Consistently, the survey results show experts agreeing that home prices will continue to rise through 2029 or even longer.

Sharp price increases may be behind us, but experts predict steadier, healthier increases of 3-4% per year moving forward. This rate of increase will vary by market from year to year, but it’s much closer to normal. Reliable growth is a promising sign for hopeful buyers, and the housing market at large, as the graph below demonstrates.

Even in markets experiencing slower price growth or short-term decreases, the steady gains of homeownership eventually win in time. After all, a growing, long-term financial investment will always beat a one-time discount.

Here are the main points to remember:

- Home prices will be higher next year. Experts don’t expect home prices to fall any time soon, at least at the national level.

- Waiting for a perfect mortgage rate or price drops is a gamble. With only slight dips in mortgage rates expected in the near future, price increase could outpace any potential mortgage savings. Unless home price growth is slow or mortgage rates are low in your area, waiting will likely be more expensive.

- Buying early means building more equity. When you invest in homeownership early, your equity and appreciating home value reward you in the long run.

The Costs of Waiting To Buy

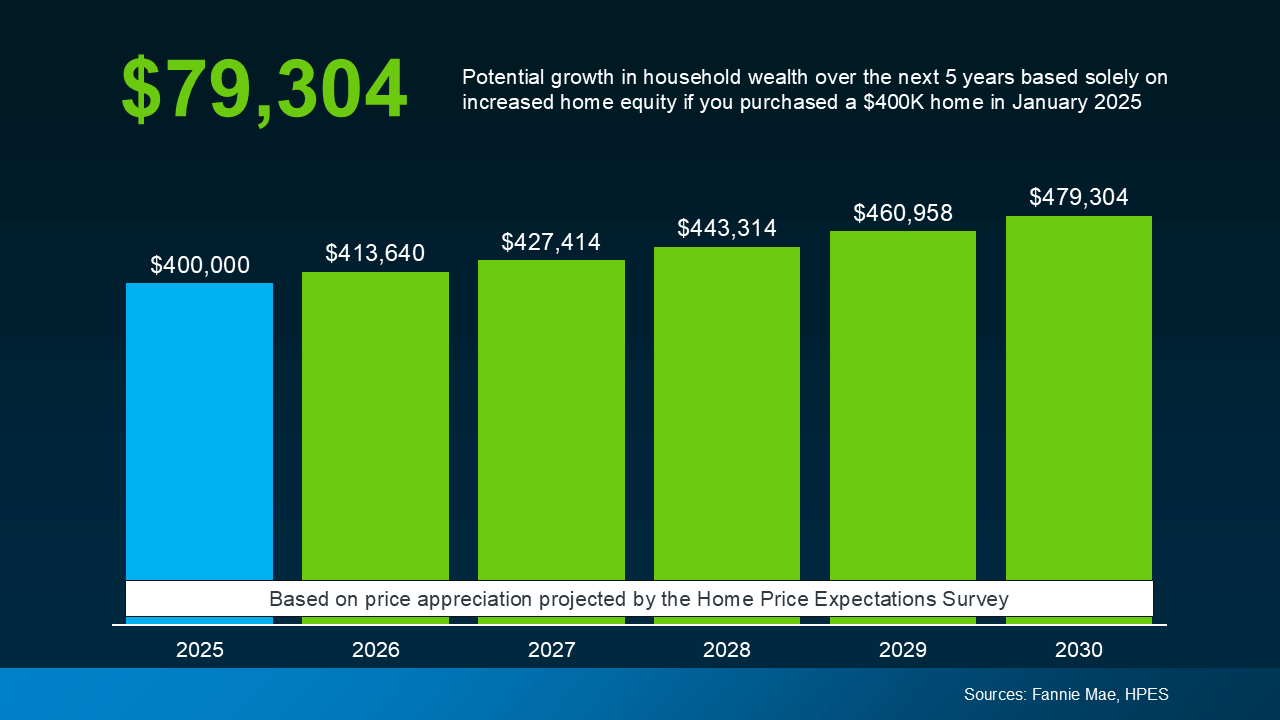

To demonstrate how these theories play out in real-world numbers, here’s a typical example. If you were to buy a $400,000 house in 2025, it could gain almost $80,000 in value by 2030. The graph below demonstrates how this value appreciates year by year based on the expert data we mentioned earlier.

This can be a considerable difference in your future wealth and why buyers who invest early are often glad they did. When it comes to building wealth through long-term investment, time in the market matters.

The question to consider isn’t “Should I wait to buy?” It’s really “Can I afford to buy now?” Just like planting a tree, making short-term sacrifices to buy a home will eventually pay off in the long-term.

Between rising prices and stubborn mortgage rates, today’s housing market is challenging, but achieving homeownership is far from impossible. Exploring different neighborhoods, seeking alternative financing options, or applying for down payment assistance programs can all make a critical difference.

What’s most important is acting decisively when you’re able to, instead of waiting for a perfect opportunity that never comes.

Conclusion

If you’re interested in buying but still undecided, take the time you need to make the right choice. But, remember that realizing an investment takes time, and the sooner you make one, the sooner you’ll be rewarded.

If you’re curious about what’s happening with prices in our local area, then reach out to us. Even if you’re not ready to buy, an expert local agent can fill you in with the info you need.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link