Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Renting vs. Buying: What The Numbers Say

Renting often feels like the simpler move these days. There’s no down payment to save up for, no surprise repair bills, and no long-term commitment if life changes.

But then your lease renews and the rent jumps. Then it happens again. Eventually, what felt flexible suddenly starts to feel expensive, especially when you realize every monthly payment is going to your landlord, not building wealth for you.

A big reason this stings is because there’s been so much talk about how homeownership is “out of reach.” And in some markets, it absolutely can be. But here’s the part that doesn’t get said enough: when you compare the numbers side by side, buying can cost less per month than renting in more places than most people expect.

Buying Can Be More Affordable Than Renting in Many Areas

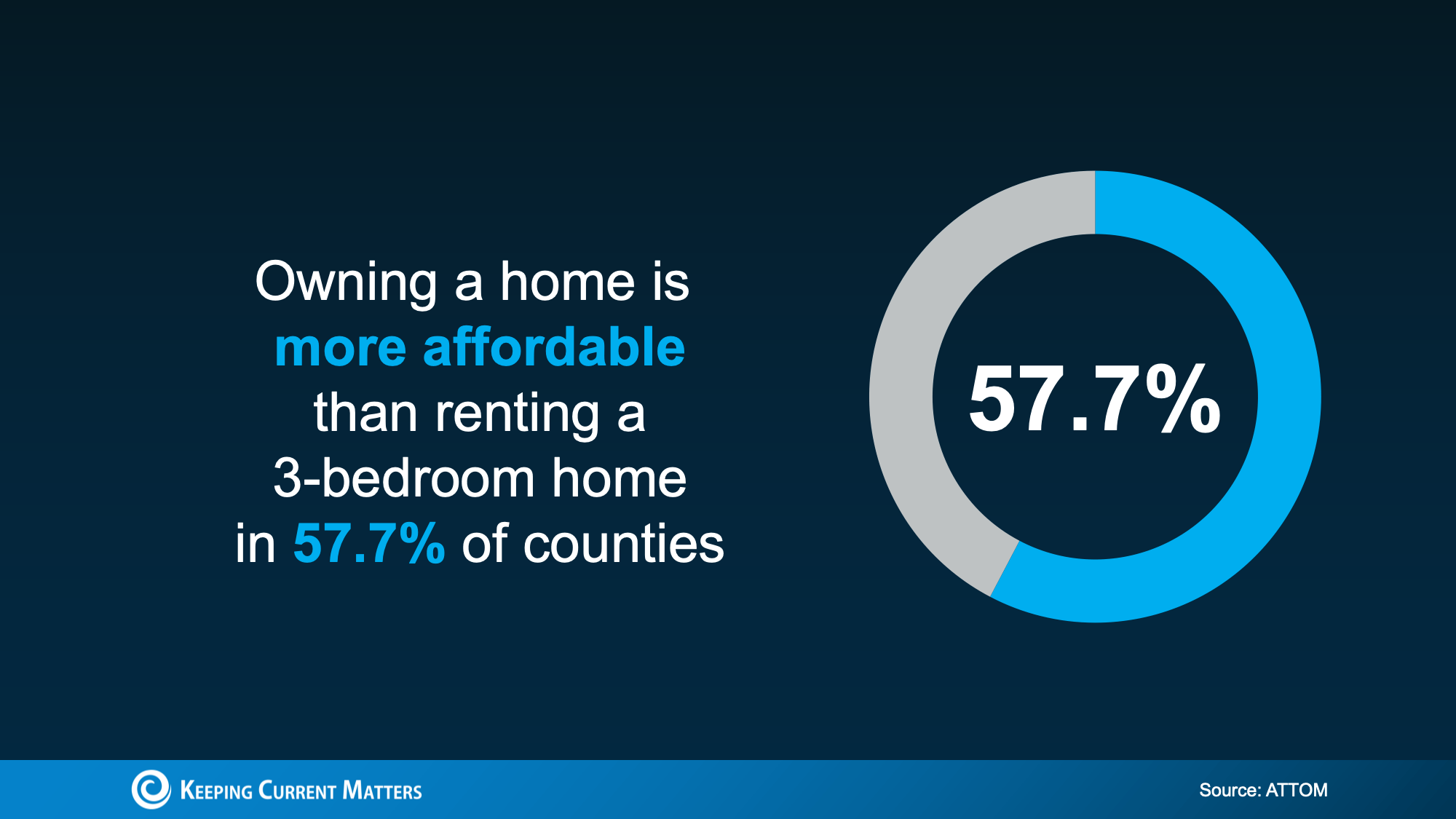

In a lot of markets today, owning a home may actually have a lower monthly cost than renting a 3-bedroom home. New data from ATTOM suggest this is true in nearly 58% of counties across the United States.

And this comparison isn’t just a mortgage payment versus rent. It also takes into account common ownership costs like insurance and regular maintenance.

So if you’ve assumed buying automatically means a higher monthly bill, it may be worth a second look. Recent changes in home price growth, housing inventory, and mortgage rates have been shaking certain markets. Depending on where you live, buying might be finally in your favor.

Affordability Depends on Where You Live

Even though the national picture has shifted, it doesn’t mean buying is cheaper everywhere, or that every renter will have the same experience.

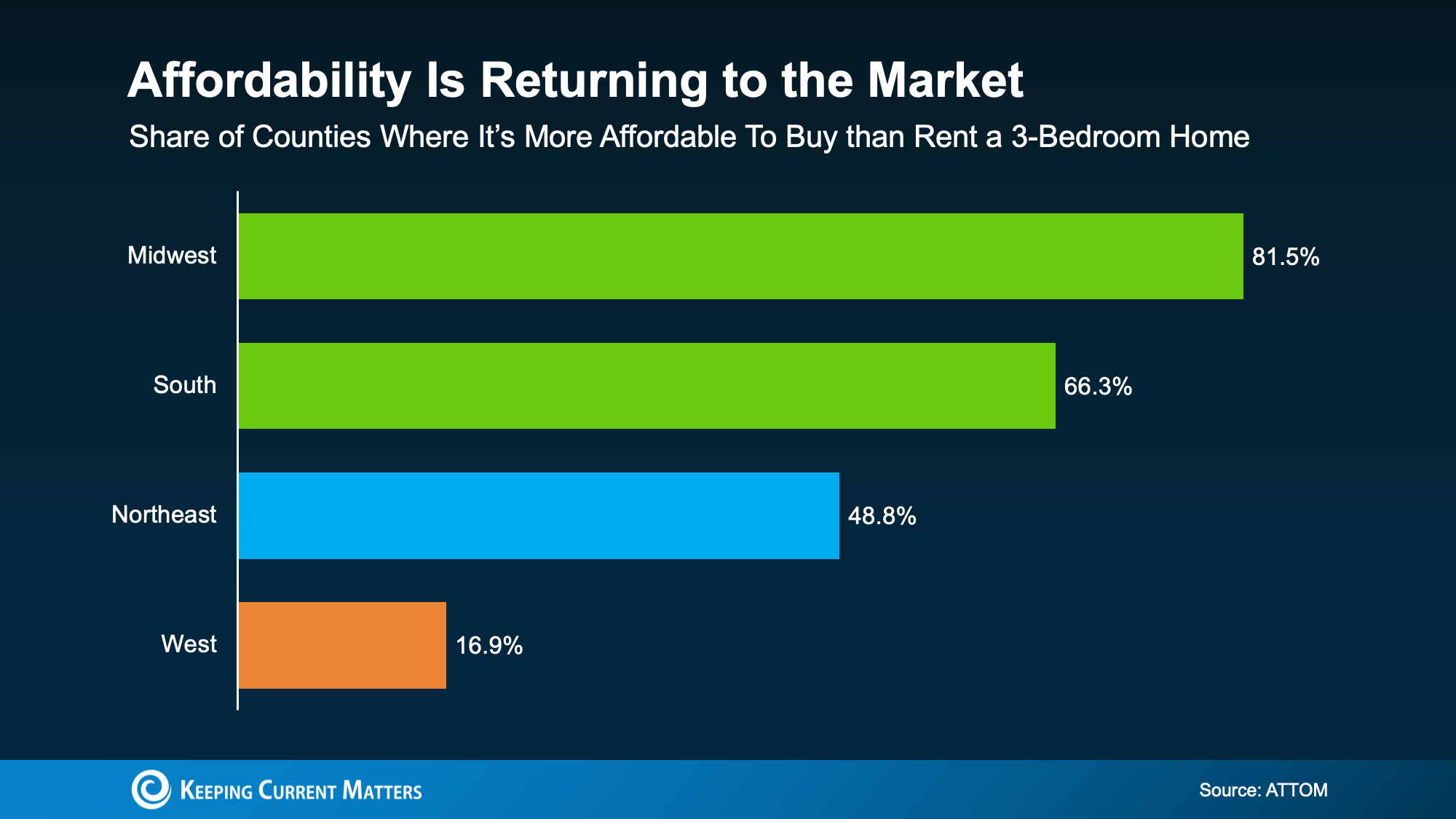

That “nearly 58%” figure looks very different depending on the region. The biggest improvement is happening in the Midwest and South, while the West can still feel tight for many households.

The key takeaway is simple: real estate is local. A national headline can’t tell you what the rent-versus-buy equation looks like in your zip code. The only way to know is to run the numbers based on your local prices, rents, taxes, and insurance.

What’s Still Holding Buyers Back?

If you’re thinking, “Even if the monthly payment works, I can’t afford the upfront costs,” you’re not alone.

For many renters, the biggest hurdle isn’t the monthly payment. It’s the down payment (and often closing costs) that feels like a wall.

Here’s the good news: there are thousands of down payment assistance programs across the country, and many buyers qualify without realizing it. The average benefit is around $18,000, which can help cover part of your down payment or closing costs.

Support like this can make buying feel a lot more realistic, because it reduces how much cash you need to get in the door.

How to Figure Out What’s Right for You

If you want clarity instead of guesswork, focus on a simple comparison:

- Your current rent (and how often it’s rising).

- An estimated monthly ownership cost (mortgage, taxes, insurance, HOA if applicable).

- A realistic maintenance cushion.

- Upfront costs (and any down payment assistance you may qualify for).

When you combine potential assistance with monthly costs that may be closer than expected, the gap between renting and buying can shrink quickly, or even flip in favor of buying.

Conclusion

The bottom line isn’t that everyone should buy a home as soon as possible.

The idea is that renting isn’t always the cheaper option people assume it is, and buying may be more realistic than it feels once you look at the full picture.

If you’re renting and feel stuck saying “someday”, consider a quick conversation with a local real estate agent or lender. Not a commitment, just a way to see what’s possible and whether it makes sense for you.

Why Did Home Sales Fall in January?

If you saw headlines saying home sales fell sharply in January, it’s understandable to feel uneasy, especially if you’re thinking about selling. But one month of data rarely tells the whole story.

Yes, January home sales declined. In most years, that’s normal. And this particular drop has a lot more to do with seasonality and winter weather than a sudden collapse in buyer demand.

What’s Really Behind the “Home Sales Fell” Headlines

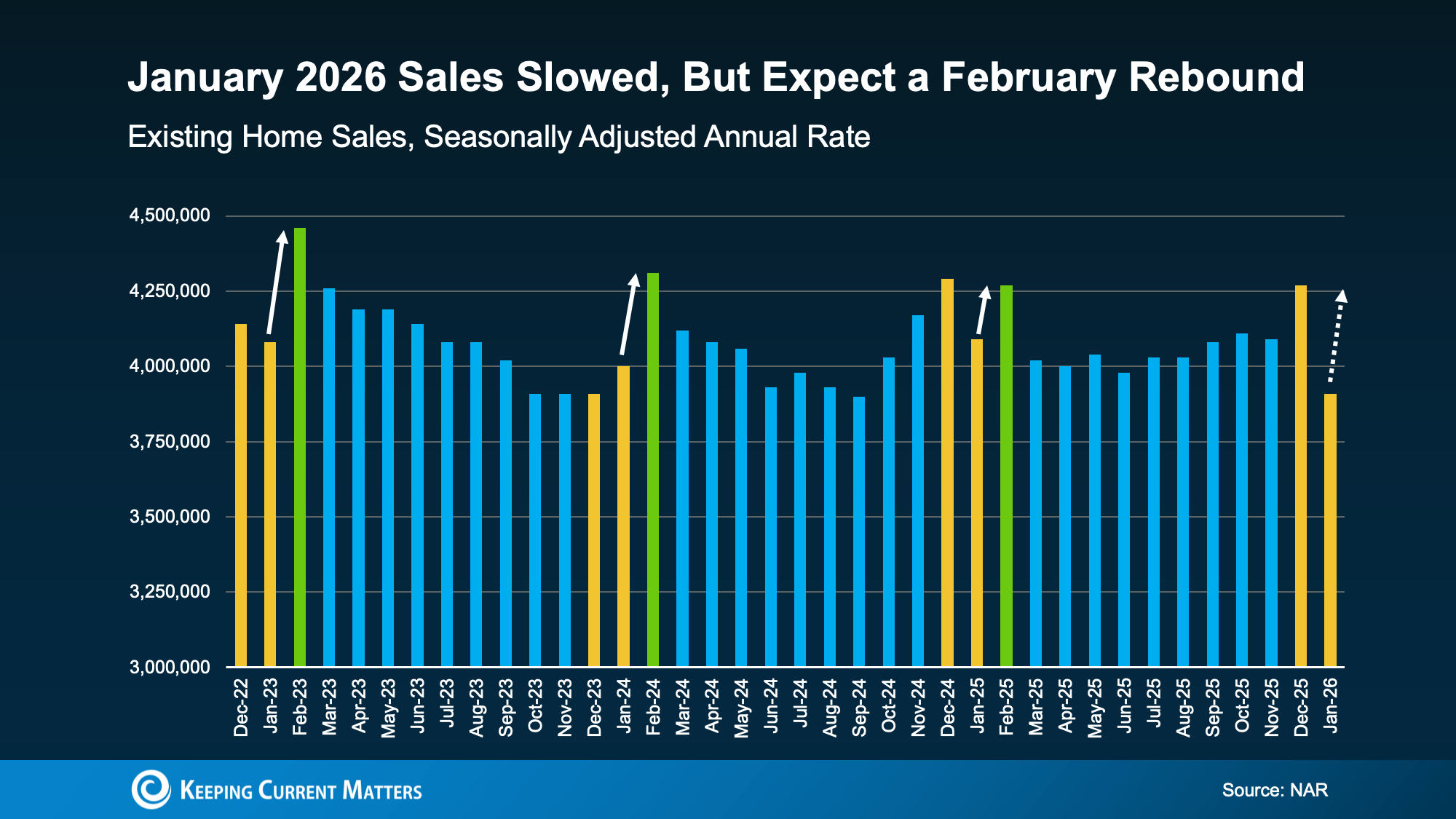

Recent reports from the National Association of Realtors (NAR) show existing home sales dropped about 8.4% month over month. That’s the number making the rounds, and it’s an accurate one.

The key is understanding why it happened:

- January is historically slow for real estate in general

- Fewer people list and tour during the coldest weeks of the year

- Holidays, travel, and weather disruptions often push closings into the next month

So while the percentage sounds dramatic, it doesn’t necessarily signal a weakening market.

Why January Is Often a Slower Month for Home Sales

Seasonality is a consistent pattern in U.S. real estate. In many markets:

- Winter brings fewer new listings

- Buyers move more cautiously due to schedules and weather

- Fewer transactions close, even when demand is still there

Over the past several years, sales have commonly dipped in January and then picked up again in February as the market begins ramping up for spring. In other words, a January slowdown is often a pause, not a trend. You can see this in the graph below, particularly in the green bars showing February sales rebounds:

Home sales often slow in January and rebound quickly in February.

The Bigger Drop This Year: Weather, Not Demand

This year’s decline was steeper than the usual January dip, even with lower mortgage rates. But the likely explanation is simple: disruptive winter weather.

As Realtor.com explains:

“Winter storm Fern, which dumped snow and ice across large swaths of the country, likely disrupted some closings, weighing on the data and making it difficult to pick out the housing market momentum trend from the weather noise.”

According to the original post, 40 states experienced widespread winter weather. In real estate, that matters because bad weather can delay the final steps needed to close, including:

- Inspections

- Appraisals

- Final walk-throughs

- Lender or title timelines

Why “Fewer Sales” Can Really Mean “Later Closings”

One important detail most headlines skip: existing home sales track closings, not contracts.

That means a storm doesn’t have to “kill” a deal to show up in the data. If weather slows the process, many transactions simply move from January into February (or later).

So January’s missing sales are more likely postponed, not lost.

Will Home Sales Pick Back Up?

Despite a slower January, the data still point toward the market gaining traction as spring approaches.

Here are two encouraging points to consider:

- Affordability has improved for seven straight months (according to NAR)

- Buyers in many areas are regaining some negotiating power

That combo can support more activity as the weather improves and the traditional spring season begins.

What If You’re Thinking About Selling?

If you’re a homeowner watching the market, here’s the practical takeaway:

- Don’t overreact to one weather-impacted month

- Expect activity to improve as schedules normalize and temperatures rise

- Focus on what’s happening locally, because conditions vary by city and even neighborhood

A strong strategy right now is to talk with a local agent about:

- Pricing based on current comps

- Likely spring demand in your area

- How quickly homes are moving in your price range

Conclusion

Don’t confuse a winter slowdown with a market wide red flag. January’s decline appears tied to seasonality and storm-related delays, not disappearing demand. As affordability improves and spring approaches, activity can thaw quickly.

Housing Inventory Is Improving in 2026: What That Means for Buyers

After a long stretch of buyers competing for too few homes, housing inventory is finally improving. Over the past year, more listings have come to market, and depending on where you live, that shift can open up your options in a meaningful way.

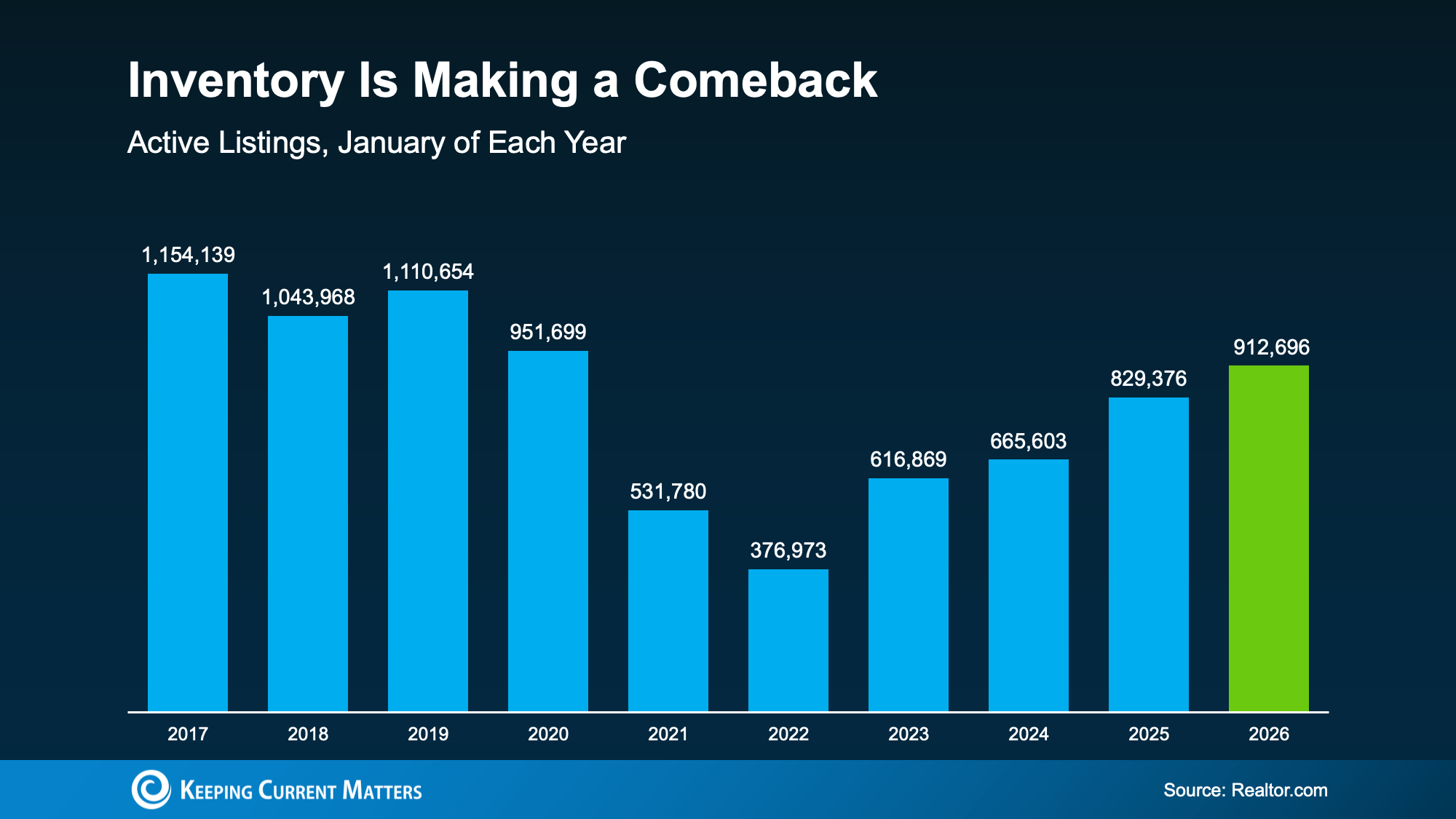

According to Realtor.com, the number of homes available for sale in January 2026 was the highest it’s been since 2020. That matters because getting closer to pre-pandemic levels signals a gradual return to a more typical market, where buyers aren’t forced to make rushed decisions with limited choices.

That said, inventory is not back to normal everywhere. And even with growth, more listings alone won’t “fix” affordability or fully rebalance the market overnight. But the changes we’ve seen recently can still have a real impact on how competitive it feels to buy.

When Supply Rises, Buyers Gain Breathing Room

In a low-inventory market, the pressure ramps up fast. Buyers often feel like they have to move immediately, waive protections, or offer well above asking just to stay in the running.

More inventory can reduce that intensity. When there are more homes for sale, buyers typically gain:

- More time to tour homes and think through a decision

- More options across neighborhoods, home styles, and price points

- More leverage to negotiate on price, repairs, closing costs, or timelines

In other words, more listings can shift the experience from stressful to manageable, even if the market still leans competitive in certain areas.

A Growing Share of the Country Is Getting Back to Typical Inventory

Inventory growth is not uniform nationwide. Some markets are seeing a stronger rebound, while others are still tight.

According to Lance Lambert, Co-Founder of ResiClub, in January 2025, just a little over one year ago, only 41 of the 200 largest metros were back to normal inventory-wise.

By around the end of the year, almost half (90) of the largest 200 metro areas were back at or above typical levels. That is a big improvement in roughly a year, and the trend is still moving forward.

Why This Matters for Your Local Home Search

If your area is one of the metros where inventory has returned to typical levels, you may notice:

- More new listings each week

- Fewer “must-bid-now” situations

- More realistic negotiations, especially on homes that sit longer

If your market is still below normal, you may still see multiple offers on well-priced homes. The difference is that, nationally, the direction is improving, and more markets are joining that list over time.

Inventory Is Expected to Keep Growing in 2026

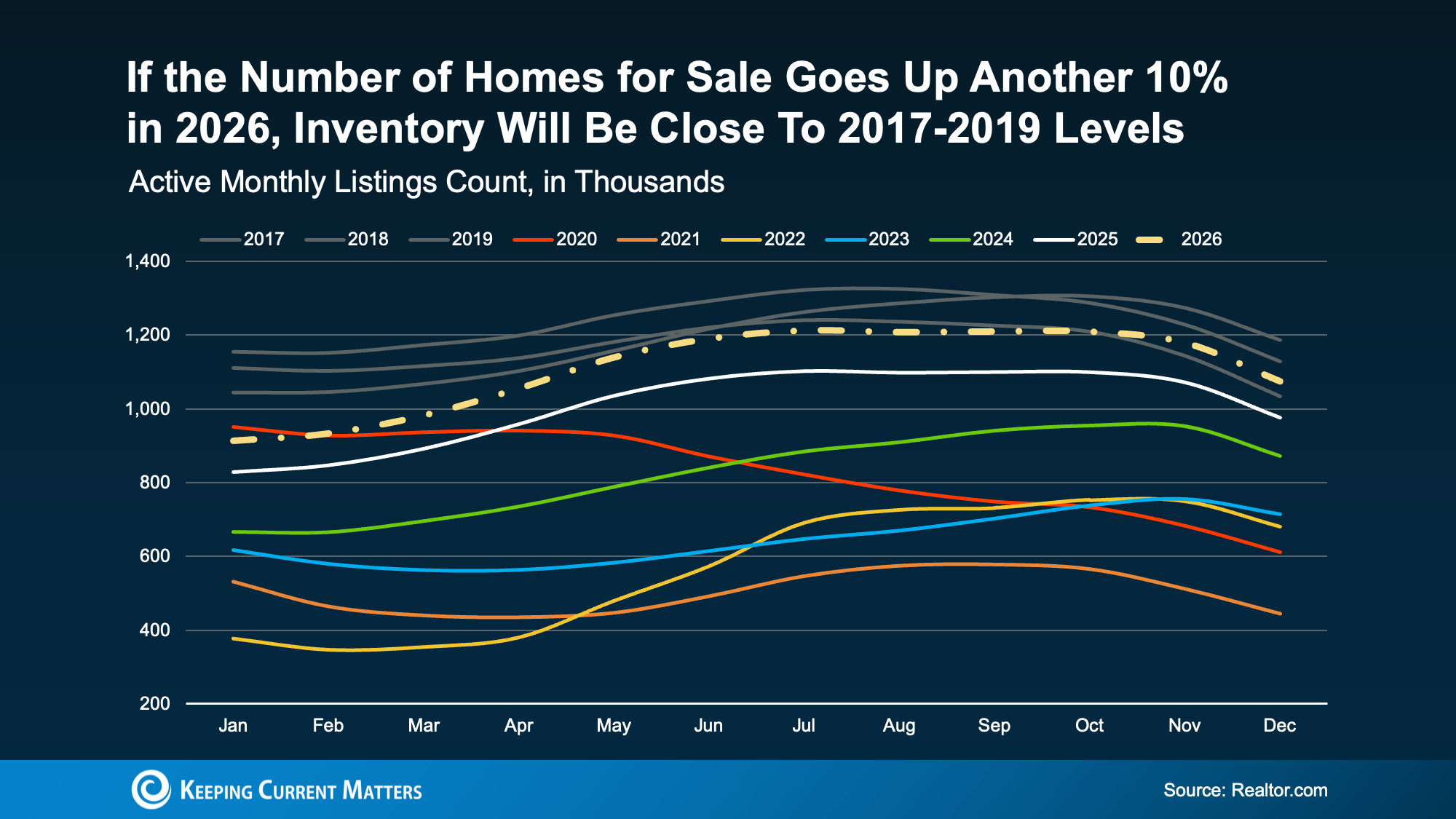

Looking ahead, forecasts suggest the number of homes for sale could rise another 10% this year. If that happens, even more markets should move closer to balanced conditions.

That potential growth could push inventory closer to the levels we saw in 2017–2019 by roughly this fall, which would be a huge milestone for buyers. Of course, reaching something closer to “normal” nationally wouldn’t mean every market feels the same. But, it would increase the odds that more buyers in more markets can find a home without feeling boxed in by a lack of choices.

As Hannah Jones, Senior Economic Research Analyst at Realtor.com, says:

“. . . housing market conditions are gradually rebalancing after several years of extreme seller advantage. Buyers are beginning to see more options and modest negotiating power as inventory improves . . .”

That is the key takeaway: the market is starting to work with buyers again, not against them.

Conclusion

Inventory may not be fully back to normal everywhere, but it’s moving in the right direction. And some markets, it’s already there.

If you have been waiting for a moment when you have more options and a little breathing room, 2026 is shaping up to be the strongest setup buyers have seen in years.

If you want the latest on inventory in your local market, talk to an agent who can break down inventory trends, pricing, and what that means for your next move. And if you’re not sure where to start, you can always reach out to us at CENTURY 21 Affiliated.

The Top Ten 2026 Housing Markets for Buyers and Sellers

Whether you’re buying or selling this year and need to know the top housing markets, you’re in luck. Here are two lists for the 2026 housing market, one for sellers and one for buyers. But before you scroll to the lists, keep this in mind:

If you’re planning a move for 2026, the most important takeaway is this: there are many housing markets to look at this year.

Experts agree 2026 is shaping up to be one of the most geographically split housing markets in years. Some areas are leaning toward sellers, while others are finally opening real doors for buyers. Who has the advantage depends almost entirely on where you live. Selma Hepp, Chief Economist at Cotality, explains it this way:

“Looking ahead to 2026, regional differences will remain pronounced, with demand favoring areas that offer both economic opportunity and relative affordability.”

To show just how divided the landscape is, here’s a look at where sellers may have the upper hand and where first-time buyers may find their opening.

Where Sellers Stand To Win Big in 2026

Zillow identified the following metros as some of the strongest seller markets for 2026, based on buyer demand, pricing momentum, and how quickly homes are expected to sell:

- Hartford, CT

- Buffalo, NY

- New York, NY

- Providence, RI

- San Jose, CA

- Philadelphia, PA

- Boston, MA

- Los Angeles, CA

- Richmond, VA

- Milwaukee, WI

In markets like these, buyers are likely to compete for limited inventory, which can give sellers more leverage.

What sellers can expect in these markets

If you’re a homeowner in a seller-friendly metro, you may see:

- Stronger buyer interest

- Shorter time on market

- Better odds of selling close to (or above) asking price

That doesn’t mean every listing is guaranteed to fly off the shelf. But it does mean sellers who price strategically, prep their home well, and follow a good agent’s guidance can be in a strong position in 2026.

Markets Where There’s More Opportunity for First-Time Buyers

On the other hand, some metros are giving buyers more breathing room, especially first-time buyers who have had the toughest time getting in lately. Realtor.com points to 10 top metros where first-time buyers are expected to enjoy advantages in 2026:

- Rochester, NY

- Harrisburg, PA

- Granite City, IL

- Birmingham, AL

- North Little Rock, AR

- Syracuse, NY

- Baltimore, MD

- St. Louis Park, MN

- Pittsburgh, PA

- Garfield Heights, OH

These housing markets are top contenders thanks to a mix of:

- More affordable home prices

- Better housing availability

- Strong local amenities and economic health

For first-time buyers, that combination matters. It’s often the difference between wishful thinking and a real path to homeownership.

What buyers can expect in these markets

In more buyer-friendly areas, first-time buyers may find:

- Less intense competition

- More room to negotiate

- A clearer path to getting an offer accepted

What Matters More Than Any Top 10 List

Not seeing your city on either list? Don’t worry. This is a snapshot at the national level, not a definitive statement on your local market. These lists simply show how different conditions can be from one metro area to the next.

And remember: you can buy or sell no matter which side your local market favors. All you need is the right strategy for your market’s unique conditions.

Here’s what that can look like:

- Sellers in a more buyer-friendly metro may need to price competitively and focus on strong prep (repairs, staging, and marketing).

- Buyers in a seller-leaning area may still need to come prepared with a clean, compelling offer and a smart plan for competing.

To find out where your market falls and what you should expect, a local expert can help you interpret the trends and build a game plan.

Conclusion

The housing market in 2026 isn’t one-size-fits-all. Local conditions matter more than ever, and knowing whether you’re in a buyer-friendly or seller-friendly area can shape everything from pricing to negotiations.

Whether you’re buying, selling, or just exploring your options, the right strategy (and the right agent) can put you in a strong position this year. If you’re a buyer or seller ready for the next step, search the top housing markets now, or reach out to us for help today.

Good News for Buyers: Home Affordability Improving in 2026

If you’ve felt priced out of the market or stuck waiting on the sidelines, there’s finally some encouraging news:

Buying a home is finally becoming more affordable.

Monthly payments have started to come down thanks lower interest rates, and buyers are starting to feel pricing pressures ease. That doesn’t mean homeownership is suddenly easy for everyone, but after a tough stretch, small improvements are meaningful.

Home Affordability Is Finally Improving

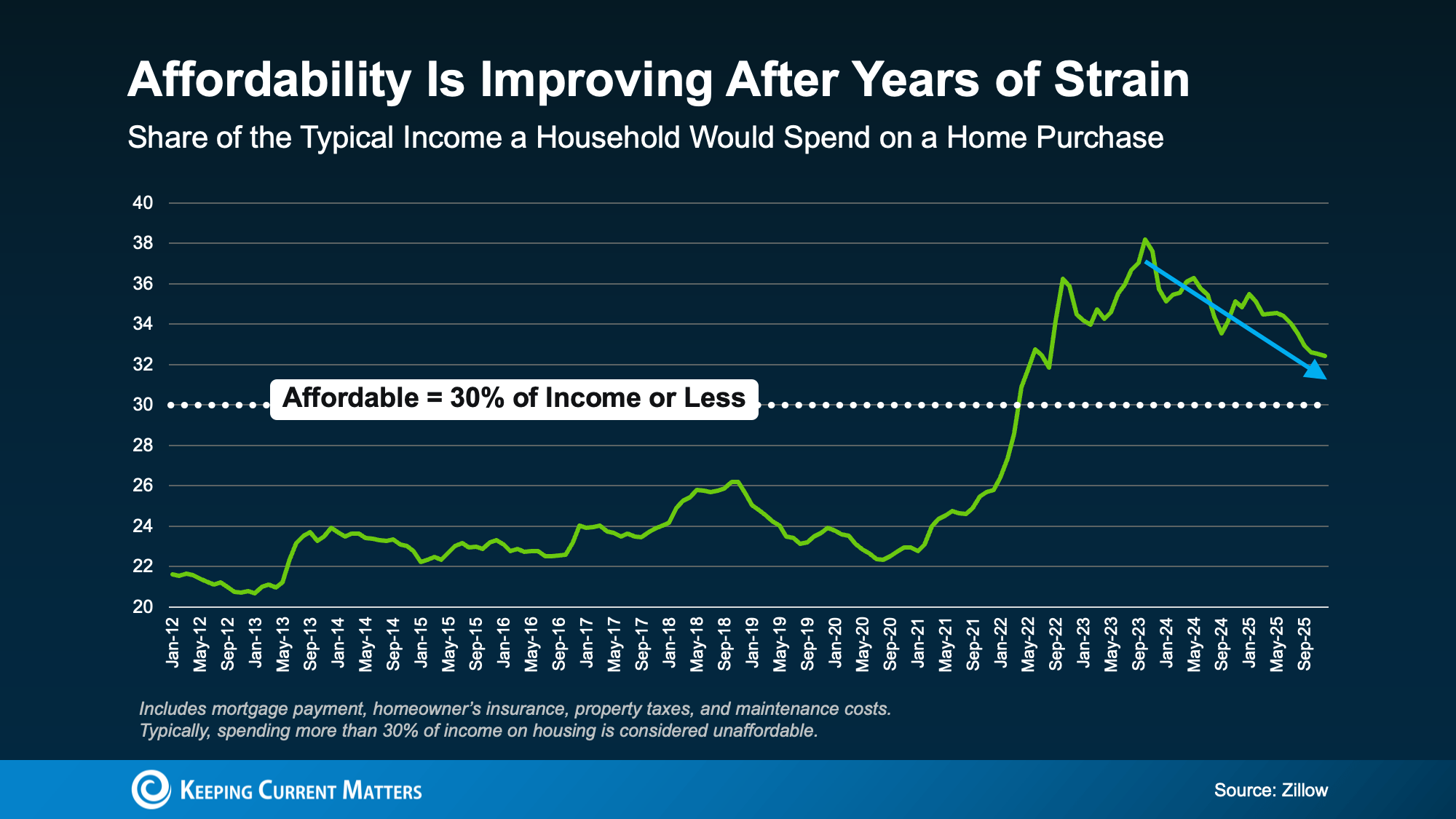

One of the clearest ways to track this change is to look at how much of a household’s income goes toward owning a home.

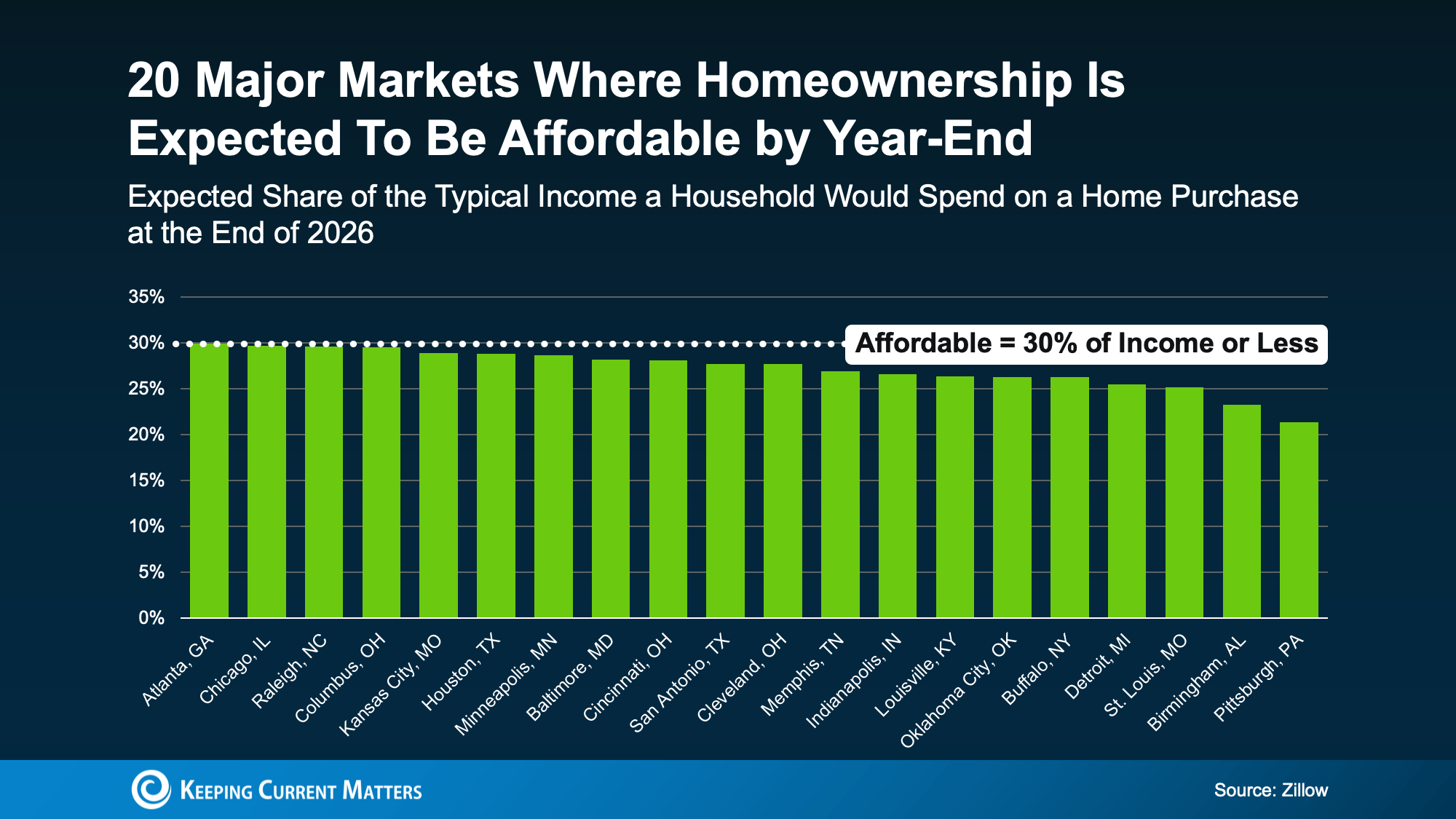

According to Zillow, housing is typically considered affordable when total housing costs take 30% or less of your monthly income. That includes your mortgage payment, property taxes, insurance, and basic maintenance.

For the past few years, many buyers were well above that mark, which pushed homeownership out of reach for a lot of households. But that’s starting to shift. Zillow research shows it’s taking less of a typical household’s income to buy a home than it did just a few years ago (see graph below):

We’re not all the way back to Zillow’s 30% threshold yet, so affordability is still tight in many markets. But the trend is improving, and that’s a big change from what buyers have been up against.

Why Homebuying Is Becoming More Affordable

Mortgage rates get most of the attention, and yes, rate movement plays a major role in monthly payment size. But it’s not the only reason affordability is improving. Three key trends are working in buyers’ favor right now:

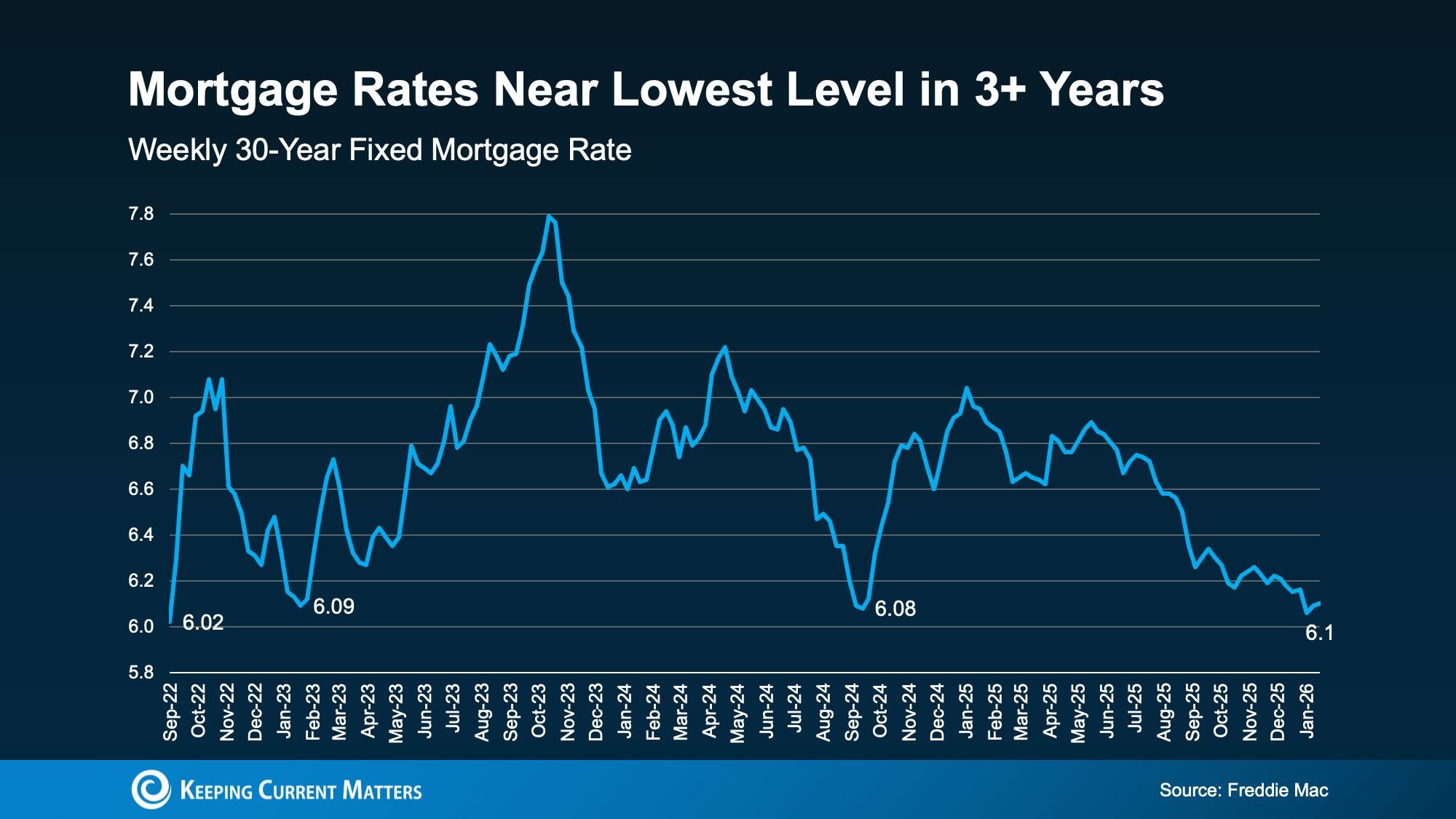

1) Mortgage rates have eased

Rates are near their lowest level in more than three years, which can reduce monthly payments and expand buying power (see graph below):

2) Home price growth has cooled

Home prices aren’t falling nationally, but they’re rising more slowly than they were a few years ago. That matters because slower price growth helps keep purchase prices from jumping as sharply, which can make payments feel more manageable and the overall buying process more predictable.

3) Wages are growing faster than home prices

This is a major factor that often gets overlooked. When incomes rise faster than home prices, buyers can start catching up. Mark Fleming, Chief Economist at First American, explains:

“When income growth exceeds house price growth, house-buying power improves—even if mortgage rates don’t decline meaningfully.”

None of this makes homes “cheap,” but it does help explain why the math is starting to work a bit better than it did even a year ago. In short, some of the forces that curbed affordability are finally easing. As Fleming again explains:

“Affordability remains challenging, but for the first time in several years, the underlying forces are finally aligned toward gradual improvement. Mortgage rates may drift down only slowly, but income growth exceeding house price appreciation will provide a boost to house-buying power — even in a higher-rate world. Affordability won’t snap back overnight, but like a ship finally catching a steady tailwind, it’s now sailing in the right direction.”

Because of these combined shifts, many economists expect affordability to continue improving in 2026.

Where Are Homes Becoming Affordable First?

So how much will affordability improve, and where will it show up first? In some places, the difference could be noticeable. Zillow says some markets are expected to fall back under their affordability threshold (30% of income or less) by the end of the year (see graph below):

But you don’t have to live in one of those specific markets, and you may not have to wait until year-end to see improvement. Many areas are already trending in a better direction.

That’s why your next best step is local: talk to a real estate agent who understands what’s happening in your market. The national headlines don’t always reflect what’s going on neighborhood by neighborhood, and you might be closer to buying than you think.

Conclusion

For the first time in a while, home affordability is easing, and that’s an important shift for buyers.

And because the pace of improvement varies by location, understanding what’s changing locally can make all the difference. If you want to see how these trends are playing out where you live, connect with a local real estate agent to talk through your options.

Expert Forecasts Point to Home Affordability Improving in 2026

If the last few years have felt like a constant tug-of-war between home prices, mortgage rates, and “Can we actually afford this?”, you’re not alone. Affordability has been the biggest obstacle for buyers (and a major source of hesitation for sellers), but the outlook for 2026 is more encouraging than what we’ve seen in a while.

In fact, affordability improved meaningfully in 2025, and many industry forecasts expect that progress to continue through 2026. The reason comes down to three forces shaping the market: mortgage rates, housing inventory, and home price growth.

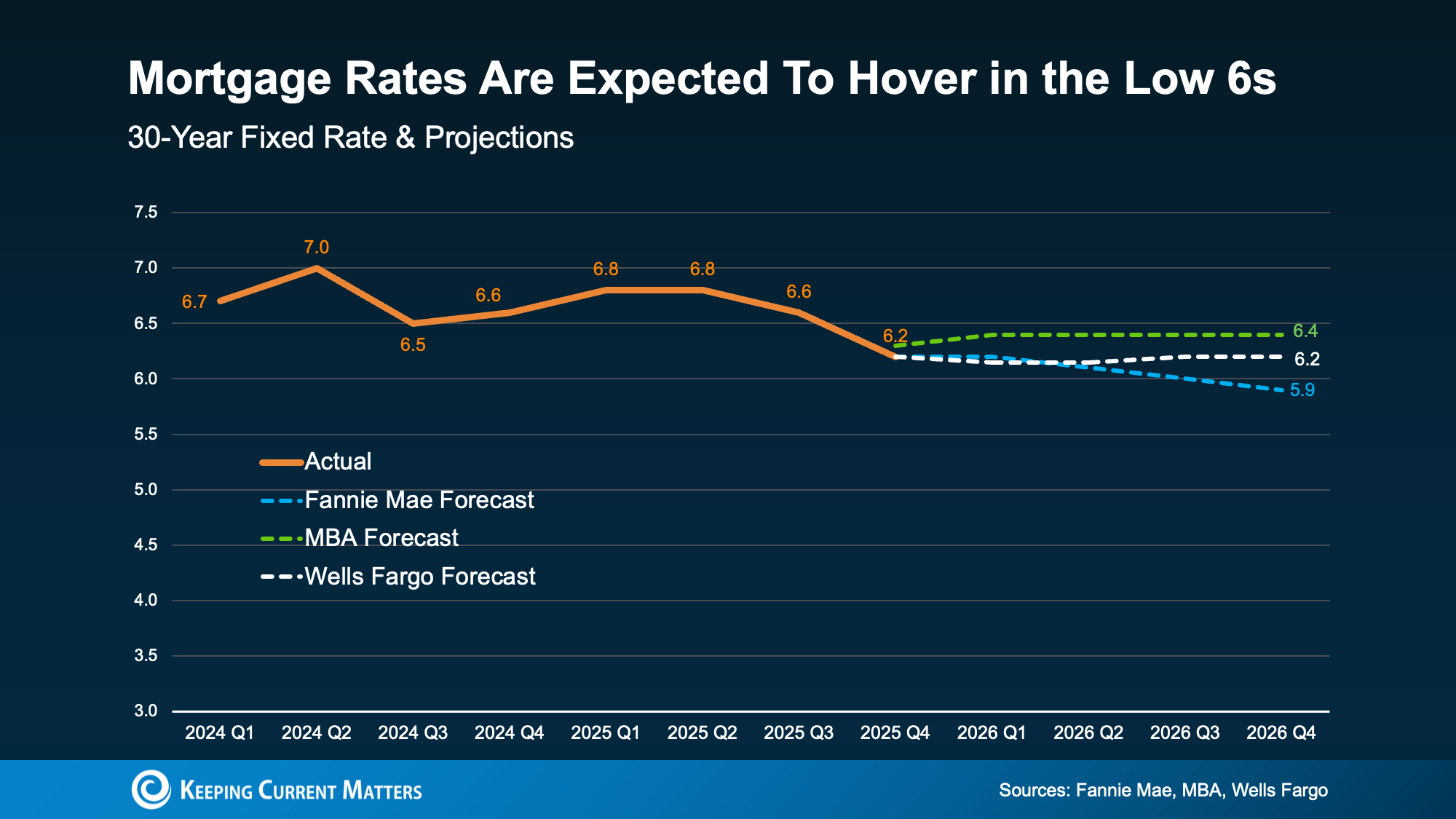

1) Mortgage Rates: Lower Than the Peak, Likely Steadier in 2026

Mortgage rates have already eased from recent highs by nearly a full percentage point over the past year in some measures, and that matters more than most people realize. Even small rate shifts can change monthly payments, buying power, and which homes feel like realistic options.

What experts expect

Forecasts suggest rates may hover in the low 6% range through 2026, though the exact path depends on the broader economy, the job market, and Federal Reserve policy decisions. The key takeaway: rates are already lower than they were a year ago, which helps restore some breathing room for people planning a move in 2026.

What this means for buyers

- Lower rates can reduce monthly payments

- Improved buying power can make more listings qualify as “within reach”

- You may have more flexibility to negotiate when combined with rising inventory

What this means for sellers

- The market is adjusting to the idea that “rates in the 6s” may be the new normal

- If you need to move, it may be more feasible than it looks, especially if you’re sitting on substantial equity

Experts expect mortgage rates to hover in the low 6s or drop even lower as the economy changes in 2026.

2) Housing Inventory: More Homes for Sale, More Leverage for Buyers

One of the biggest changes in 2025 was inventory finally moving in the right direction. With more homes available, buyers got something they haven’t had in years: options—plus more time to compare those options and negotiate.

Inventory is still expected to grow

After a meaningful rise of about 15% in 2025, forecasts call for continued growth in the supply of homes for sale in 2026 (though likely at a slower pace than the last big jump). Realtor.com economists, for example, project additional gains of about 8.9% in active listings this year.

What this means for buyers

- More choices (and fewer “take it or leave it” situations)

- Greater negotiating power—especially on homes that are priced too aggressively or need updates

What this means for sellers

- Pricing strategy becomes critical. In a market with more options, buyers compare everything.

- Strong presentation (clean, staged, repaired) matters more when competition increases

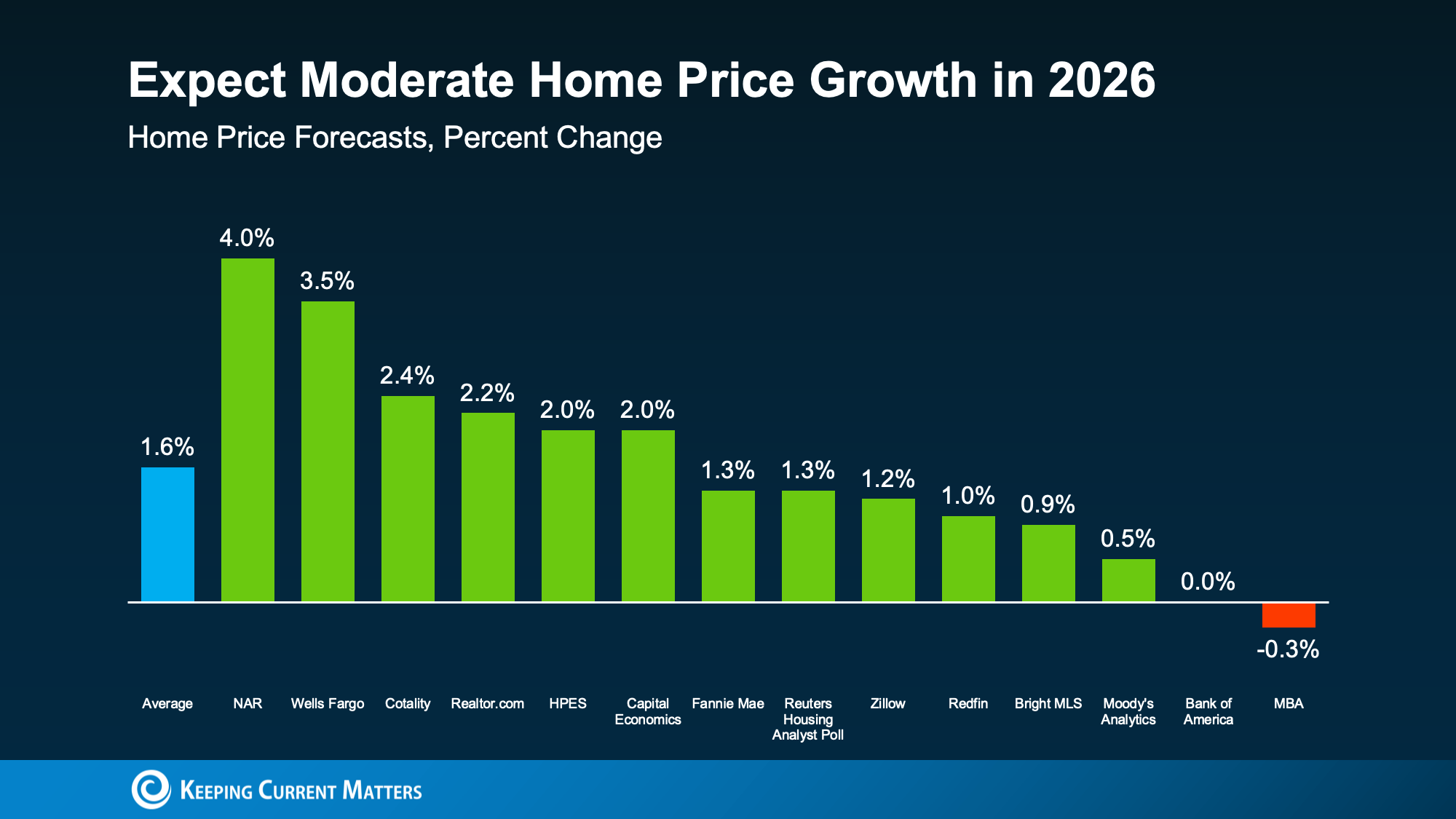

3) Home Prices: Still Rising Nationally, But at a More Sustainable Pace

Here’s what many headlines miss: increasing inventory tends to reduce upward pressure on prices, but it doesn’t automatically mean prices crash. Most national forecasts expect home prices to keep rising in 2026, just more slowly than the rapid spikes of the recent past. On average, experts predict home price growth of about 1.6% in 2026.

Why slower growth can be good news

More moderate appreciation helps buyers plan and budget with fewer surprises, while still supporting overall market stability.

But location is everything. Some areas may outperform the national average, while others could see flat or slightly declining prices depending on local supply, demand, and employment conditions. If you’re serious about a move, a local real estate agent can help you interpret what’s happening in your neighborhood, not just what’s happening nationally.

Home prices are expected to continue rising in 2026, though at a more moderate rate.

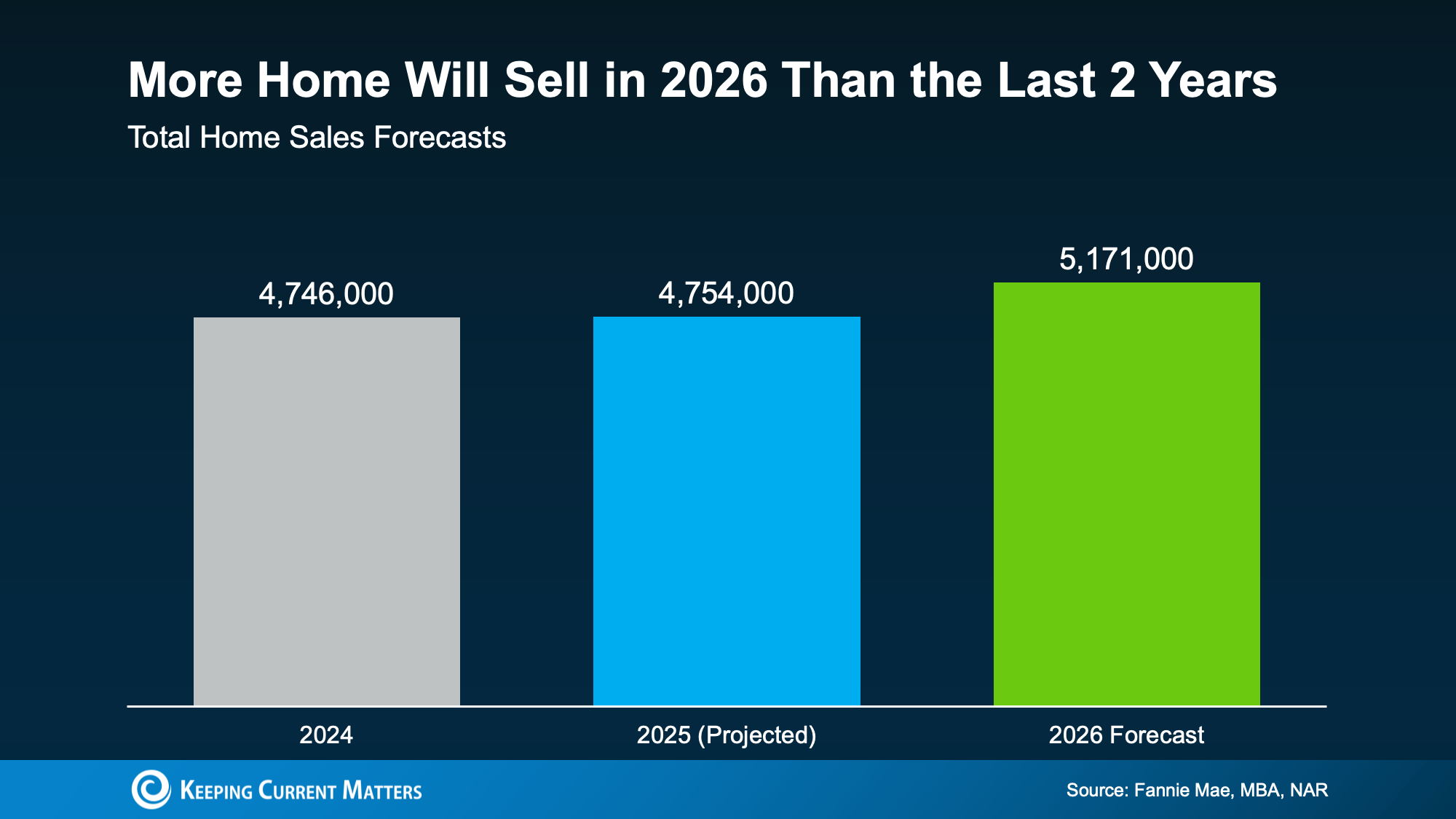

Will More Homes Sell in 2026?

When rates are lower than recent peaks, inventory is improving, and price growth is calmer, you get a healthier affordability equation. That’s why many experts expect more home sales in 2026, as both buyers and sellers find conditions easier to navigate.

As Zillow’s Chief Economist Mischa Fisher notes:

“Buyers are benefiting from more inventory and improved affordability, while sellers are seeing price stability and more consistent demand. Each group should have a bit more breathing room in 2026.”

Increased affordability in 2026 has experts predicting higher home sales over the past two years.

2026 Could Feel More Balanced Than You’ve Seen in Years

Affordability won’t change overnight. But if current forecasts hold, 2026 is shaping up to be a year with:

- More balance between buyers and sellers

- More predictability in pricing

- More flexibility in negotiations

- More opportunity for people who’ve been waiting on the sidelines

If you’re thinking about buying or selling in 2026, the smartest next step is to get hyper-local: understand neighborhood pricing trends, inventory levels, and what buyers are actually paying (and negotiating) right now.

Ready to start but aren’t sure how? Reach out to us today to connect with an expert agent for all the latest info on your local market.

Renting vs. Buying: Which Home Option Is Right for You?

Between stubborn mortgage rates and rising home prices, you’ve probably mulled over renting vs. buying a home. In market conditions like these, renting and waiting to buy can feel like your only realistic option. This can be the truth in many cases, and buying before you’re ready can be a costly mistake.

But the short-term savings of renting can sometimes trap you in a cycle, preventing you from making wealth-building investments. Over time, this can actually end up costing you more than buying a home early and slowly building equity. Unsurprisingly, a recent survey from Bank of America found that 70% of prospective homebuyers feel renting could hinder their financial future.

Ultimately, the pros and cons of renting and buying come down to your own short-term and long-term financial goals. If you’re feeling torn over whether you should nest or invest, take these major differences into account to decide.

Homeownership Builds Your Wealth Over Time

Apart from giving you your own place to live, homeownership grants the important bonus of building your wealth over time. This is because home prices usually rise as time goes on, meaning waiting longer to buy costs you more. This isn’t always true of every housing market, but the general national trend tends to speak for itself.

The average home sale price has more than tripled in the past 30 years.

Even better, your home equity also grows over time when you’re a homeowner. Equity is the difference between what your home is worth and what you still owe on your mortgage. Your equity grows with each mortgage payment you make, and this builds your net worth over time.

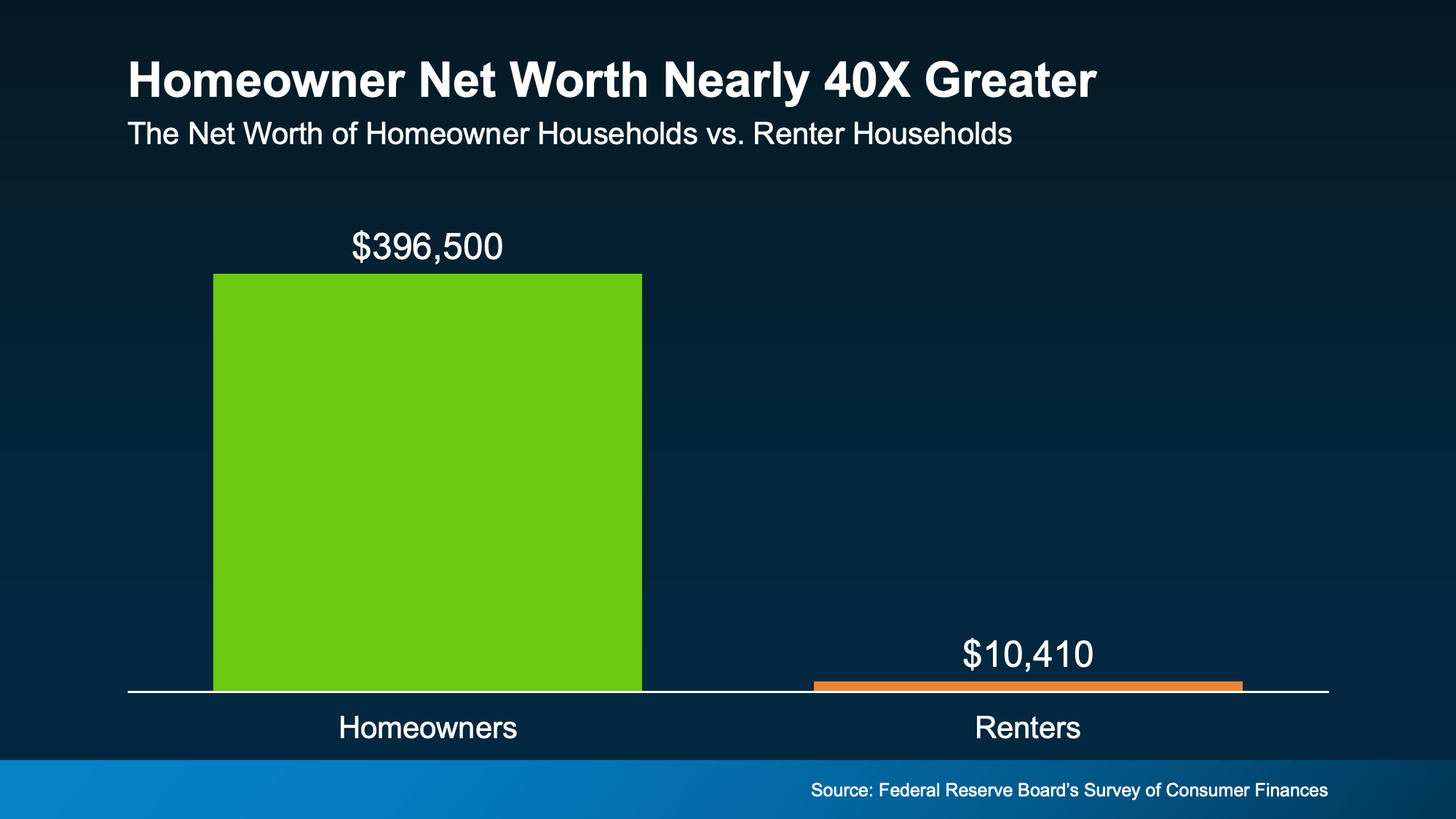

According to the Federal Reserve, the average homeowner’s net worth is nearly 40 times greater than that of a renter. That’s a life-changing difference, and seeing it represented visually really drives the point home.

The average net worth of a homeowner household is almost 40X greater than that of a renter household.

This massive difference in personal wealth is just one of the reasons that Forbes says:

“While renting might seem like [the] less stressful option . . . owning a home is still a cornerstone of the American dream and a proven strategy for building long-term wealth.”

Renting Helps You Save in the Short Term

Compared to homeownership, renting offers lower monthly payments and the freedoms of relatively negligible commitment and responsibility. This often makes renting feel like the safer option, and it usually is, at least in the short term. But in the long term, renting can land you in a trap that prevents you from building real wealth.

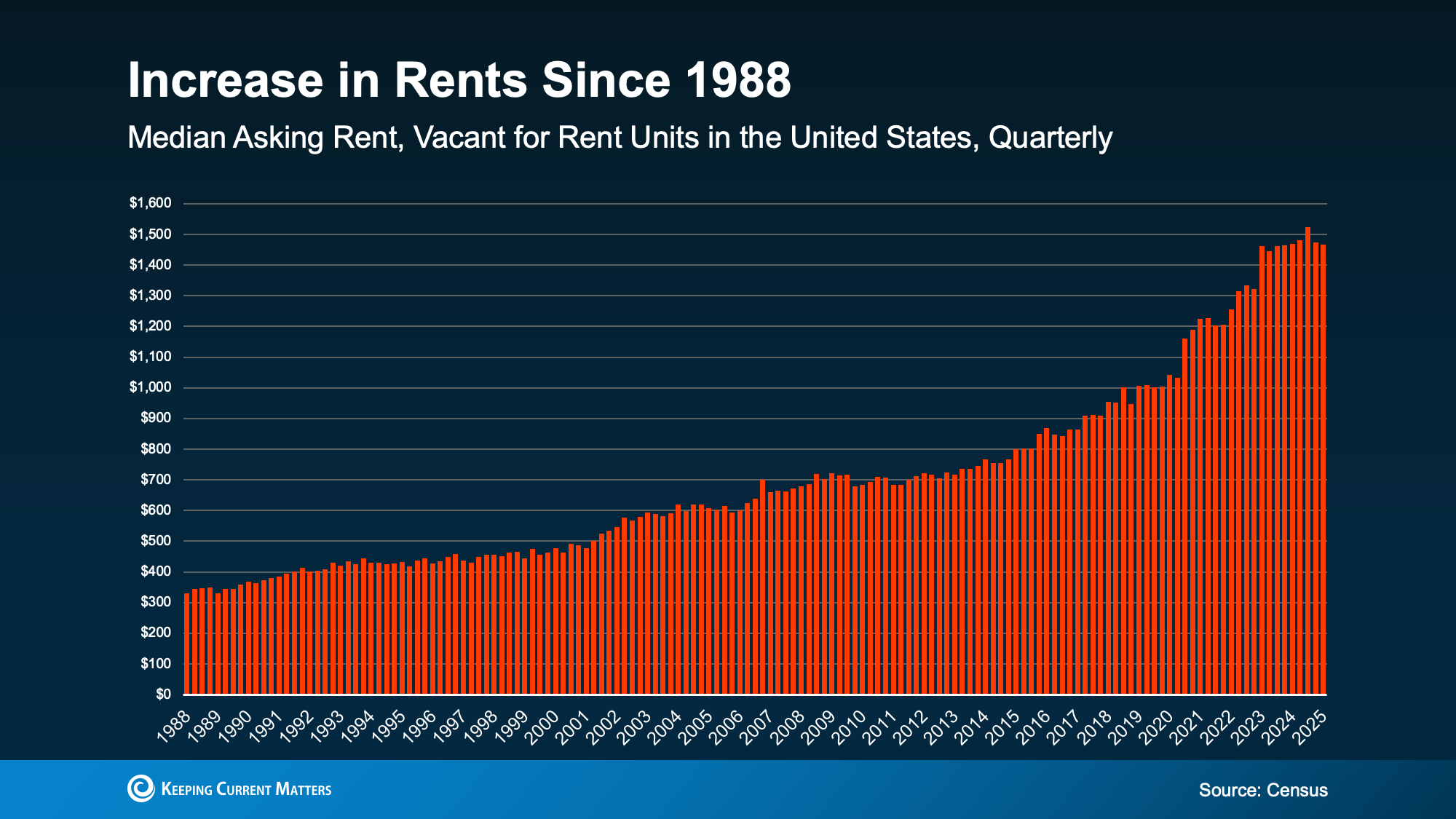

Rent tends to rise along with home prices, and this has been true for decades. Rental costs have been somewhat stable recently, but they almost never trend downward. This trap of paying increasing rent without building wealth can make buying a home feel impossible.

Like home prices, rental costs have risen dramatically in the past several years.

Financial uncertainty like this can have a real, lasting impact on any of your financial decisions. In the same Bank of America survey, 72% of potential buyers said they worry rising rent could affect their current and long-term finances.

Rent money doesn’t come back to you, and that means it doesn’t grow your wealth. The only mortgage it’s paying is your landlord’s.

So, whether you’re renting or owning, you’re paying off a mortgage. The question is: whose mortgage do you want to pay?

Renting vs. Buying: What Really Matters

Here’s another way to look at renting vs. buying. Rent money is gone once you pay it. Payments toward your own house build equity, like a savings account you can live in. Obviously, buying comes with higher upfront costs and more long-term responsibility. But the reward is a stable investment that grows over time. And while buying a home often feels out of reach, a solid plan can get you there.

As Realtor.com Senior Economist Joel Berner explains:

“Households working on their budget will find it much easier to continue to rent than to go through the expenses of homeownership. However, they need to consider the equity and generational wealth they can build up by owning a home that they can’t by renting it. In the long run, buying a home may be a better investment even if the short-run costs seem prohibitive.”

Conclusion

Renting may be cheaper in the short term, but it can cost you more over time without building your wealth. If you’re weighing the pros and cons of renting vs. buying, consider your long-term financial goals. Short-term saving can trap you in an endless cycle of renting, but buying without planning can be financially overwhelming.

If you’re ready to make the leap from renting into buying a home, contact us today. We’d be happy to connect you with a local agent who can make your dreams a reality.

Adjustable-Rate Mortgages on the Rise: Should You Jump In?

If you’re in the market for a house, you’re probably not encouraged by today’s mortgage rates. Elevated rates and rising home prices have many homebuyers starting to explore other financing options that make more sense. One type of loan gaining popularity is adjustable-rate mortgages (ARMs).

If you remember the 2008 market crash, you may be wary of new types of loans. It’s wise to be cautious, but there’s no need to worry. Today’s ARMs much safer and stricter than the ones you may remember from 2008.

During that time, some buyers held loans they couldn’t afford once their rate adjusted. Today, lenders are more careful, and determine whether you can afford an increased rate before the loan is ever offered. This time, ARMs are returning thanks to creative buyers looking for affordable ways to buy a home..

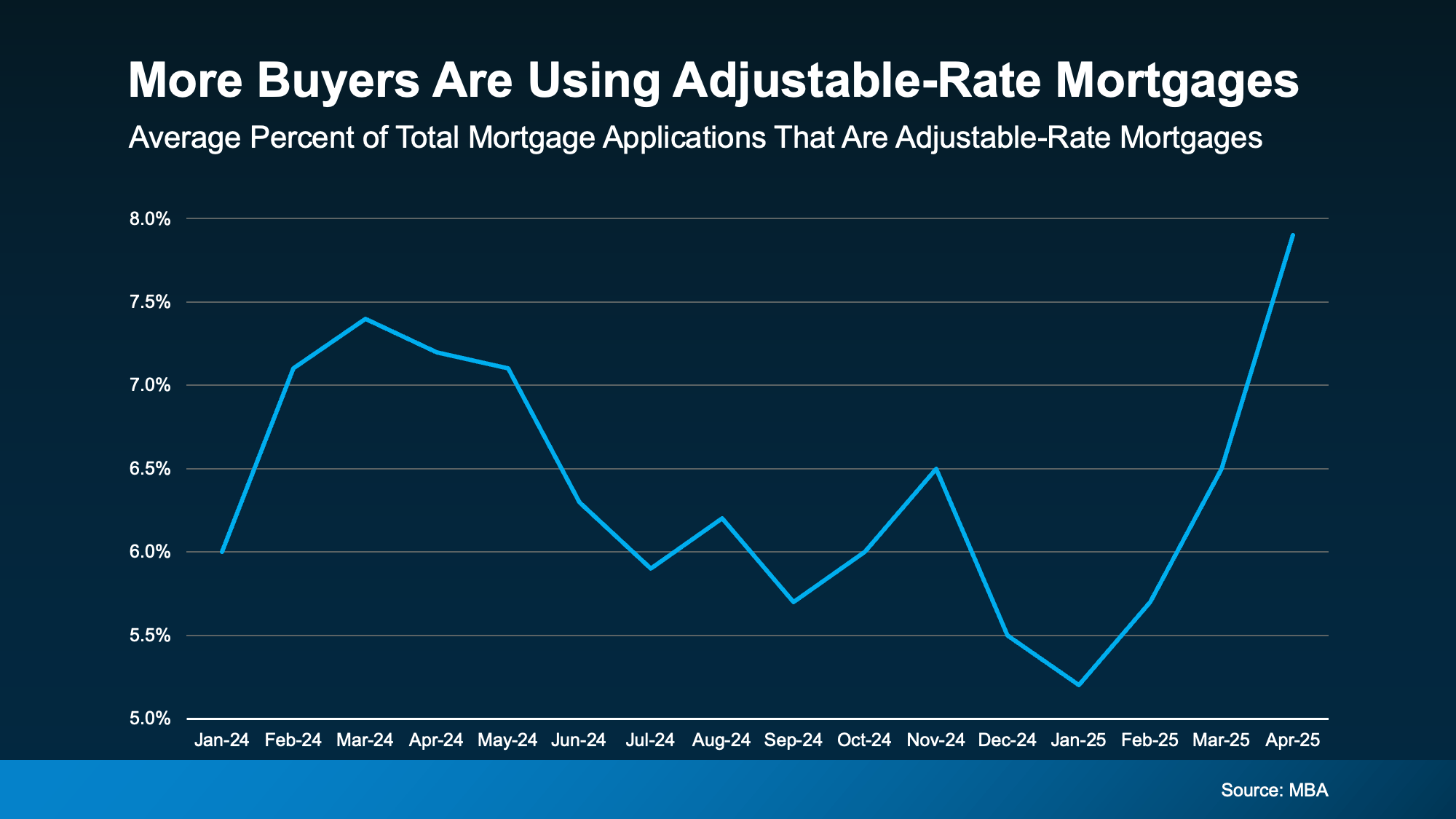

According to recent data from the Mortgage Bankers Association (MBA), more buyers are using ARMs to buy this year.

How Does an Adjustable-Rate Mortgage Work?

If you’ve never heard of ARMs before, you may be wondering what they are, and if they’re right for you. Here’s how Business Insider explains the main difference between a traditional fixed-rate mortgage and an adjustable-rate mortgage:

“With a fixed-rate mortgage, your interest rate remains the same for the entire time you have the loan. This keeps your monthly payment the same for years . . . adjustable-rate mortgages work differently. You’ll start off with the same rate for a few years, but after that, your rate can change periodically. This means that if average rates have gone up, your mortgage payment will increase. If they’ve gone down, your payment will decrease.”

Taxes or homeowner’s insurance can still influence a fixed-rate loan, but your baseline mortgage payment typically changes very little. Meanwhile, adjustable-rate mortgages can potentially change drastically in either direction after your initial payment period ends. Depending on your situation and anticipated market trends, this could either work for you, or be far too risky.

Pros and Cons of Adjustable-Rate Mortgages

With ARMs on the rise in 2025, it’s clear that more buyers are finding them appealing. Under the right conditions, they may offer attractive upsides, like a lower initial rate. According to Business Insider again:

“Because ARM rates are typically lower than fixed mortgage rates, they can help buyers find affordability when rates are high. With a lower ARM rate, you can get a smaller monthly payment or afford more house than you could with a fixed-rate loan.”

Remember that if you have an ARM, your rate will change over time. As Barron’s explains, they can potentially cost you more in the long run:

“Adjustable-rate loans offer a lower initial rate, but recalculate after a period. That is a plus for borrowers if rates come down in the future, or if a borrower sells before the fixed period ends, but can lead to higher costs if they hold on to their home and rates go up.”

While the upfront savings can be helpful now, consider what could happen if your initial rate ends before you move. Even though rates are projected to ease a bit over the next couple years, nothing is ever guaranteed. Before you choose an ARM, talk with your lender and financial advisor about all your options, and the potential risks.

Conclusion

For certain buyers, adjustable-rate mortgages can offer some big advantages, but this won’t be true for everyone. Understand how they work and whether their pros and cons make sense for you financially. Always talk to a trusted lender and a financial advisor before making entering into a new mortgage.

Need help connecting with a trustworthy lender in your area? Reach out to us for help today.

Are You Waiting To Buy? This Spring May Be Your Time To Move

Between low inventory, high home prices, and unpredictable mortgage rates, 2024 was a rocky year for real estate. It should come as no surprise then that 70% of buyers stopped their home search last year. If you were one of them and are still waiting to buy in 2025, this spring could be your time.

The Drive of Housing Inventory

Many homeowners who put their move on pause last year are reentering the market this year. This means higher, stronger listing inventory, and with builders finishing more homes, new construction inventory is growing as well. Together, this creates more options for buyers like you, and better chances of finding the home you’ve waited for.

But that’s only part of the story. When you’re selling, you want to feel confident that you’ll find a home you’ll be thrilled to move into. At the same time, you don’t want housing inventory so high that your current house sits on the market. Fortunately, the spring 2025 market is striking a balance between supply and demand that many have waited for.

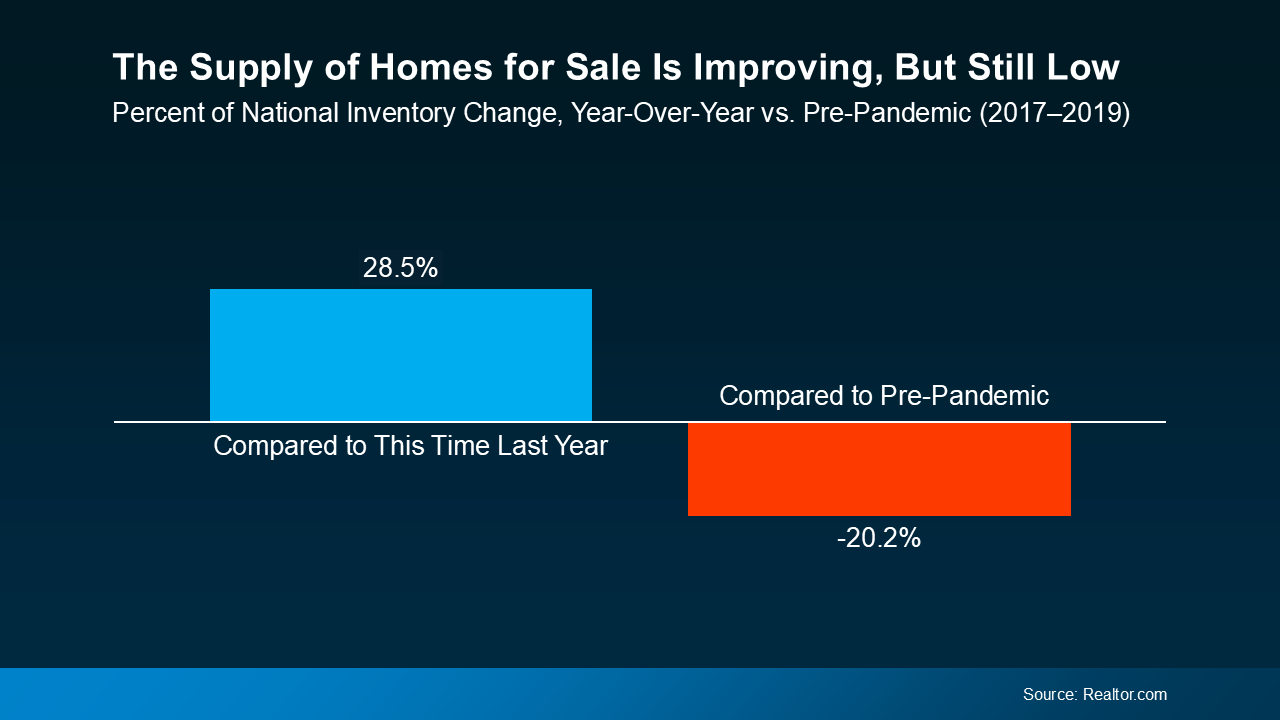

According to research from Realtor.com, housing inventory has jumped 28.5% year-over-year, making March the 17th straight month of inventory growth. This is still below pre-pandemic levels in most markets, but it’s a sweet spot for anyone waiting to buy.

For patient buyers, this means you’ll have more options when moving, but not so many that your current house won’t sell. As long as there’s a healthy demand for homes in your area, your house should still sell relatively quickly. Especially if you work with a local agent to make sure it’s priced right and fixed up to maximize value.

The Sweet Spot: More Options and Steady Demand

Here’s another promising point to think about. As we said, Realtor.com‘s March 2025 data shows that housing inventory has been rising for 17 consecutive months. What’s better, industry experts agree that listing inventory is likely to continue climbing through 2025. According to Lance Lambert, the Co-Founder of ResiClub:

“The fact that inventory is rising year-over-year . . . strongly suggests that national active housing inventory for sale is likely to end the year higher.”

If this prediction proves correct, this spring may be a better time to sell than you think. Listing now could help your house may stand out more than it would later in the year as inventory grows. With more homeowners reentering the market, waiting too long could make it all the more difficult to stand out.

Conclusion

If you’re one of the many who have been waiting to buy a house this past year, here’s your chance. Housing supply is growing but hasn’t caught up to demand yet, meaning new listings are still getting extra buyer attention. Meanwhile, increasing inventory is giving current homeowners more opportunities to scale up, further driving supply and activating buyers.

For both first time buyers and homeowners waiting to sell, this spring’s market is trending toward an ideal sweet spot. If you have questions keeping you from making your move, reach out to us for answers today. We can get you the info you need, or connect you with an agent to navigate your unique local market.

Should You Buy a Home This Spring or Wait for Lower Prices?

You’re probably familiar with the saying “The best time to plant a tree was yesterday, but the next best time is today.” It’s a valuable lesson about future planning and investment that, surprisingly, applies to the decision to buy a home too.

Even though buying a home is a major financial expense, it’s also a major investment that grows over time. As the price of your home increases over time, the value of the equity you’ve built grows with it. And while waiting for prices to drop may be an attractive option, trying to time the market rarely works.

But here’s something to consider: the longer you wait to buy a home, the more your patience could cost you. Let’s explain why.

Home Prices Are Expected To Continue Climbing

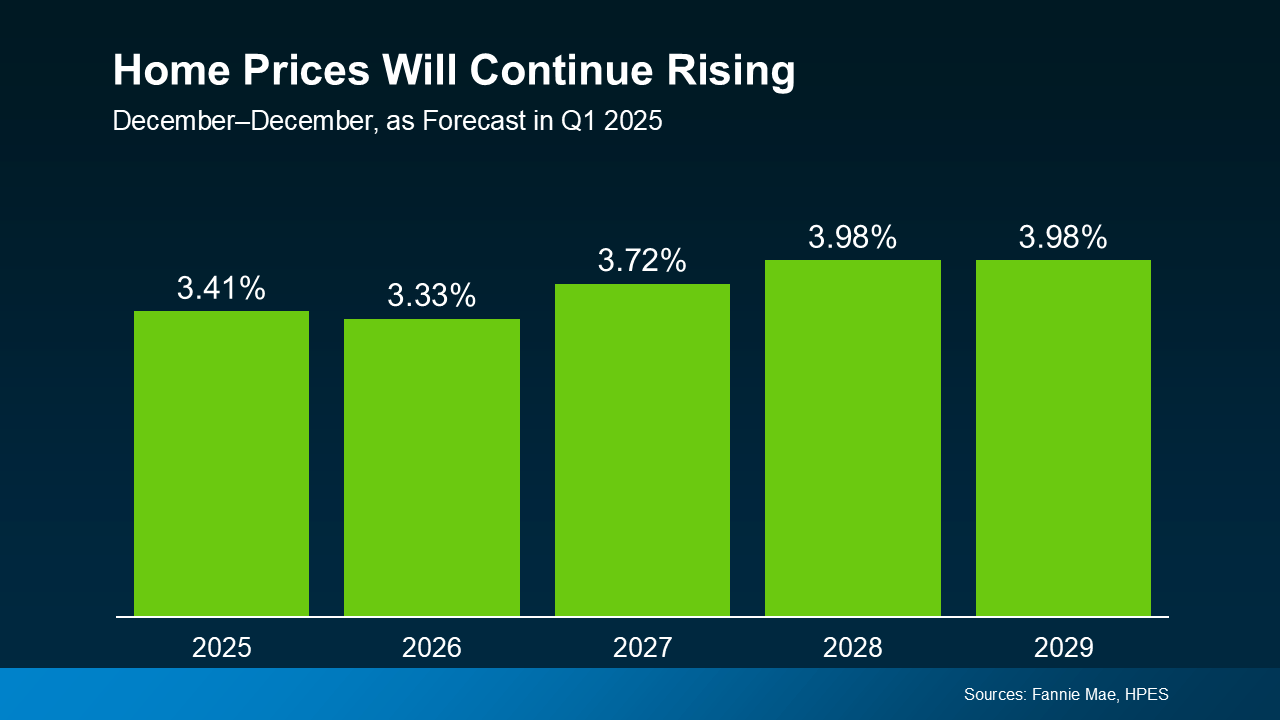

Each quarter, over 100 housing market experts respond to Fannie Mae‘s Home Price Expectations Survey (HPES). Consistently, the survey results show experts agreeing that home prices will continue to rise through 2029 or even longer.

Sharp price increases may be behind us, but experts predict steadier, healthier increases of 3-4% per year moving forward. This rate of increase will vary by market from year to year, but it’s much closer to normal. Reliable growth is a promising sign for hopeful buyers, and the housing market at large, as the graph below demonstrates.

Even in markets experiencing slower price growth or short-term decreases, the steady gains of homeownership eventually win in time. After all, a growing, long-term financial investment will always beat a one-time discount.

Here are the main points to remember:

- Home prices will be higher next year. Experts don’t expect home prices to fall any time soon, at least at the national level.

- Waiting for a perfect mortgage rate or price drops is a gamble. With only slight dips in mortgage rates expected in the near future, price increase could outpace any potential mortgage savings. Unless home price growth is slow or mortgage rates are low in your area, waiting will likely be more expensive.

- Buying early means building more equity. When you invest in homeownership early, your equity and appreciating home value reward you in the long run.

The Costs of Waiting To Buy

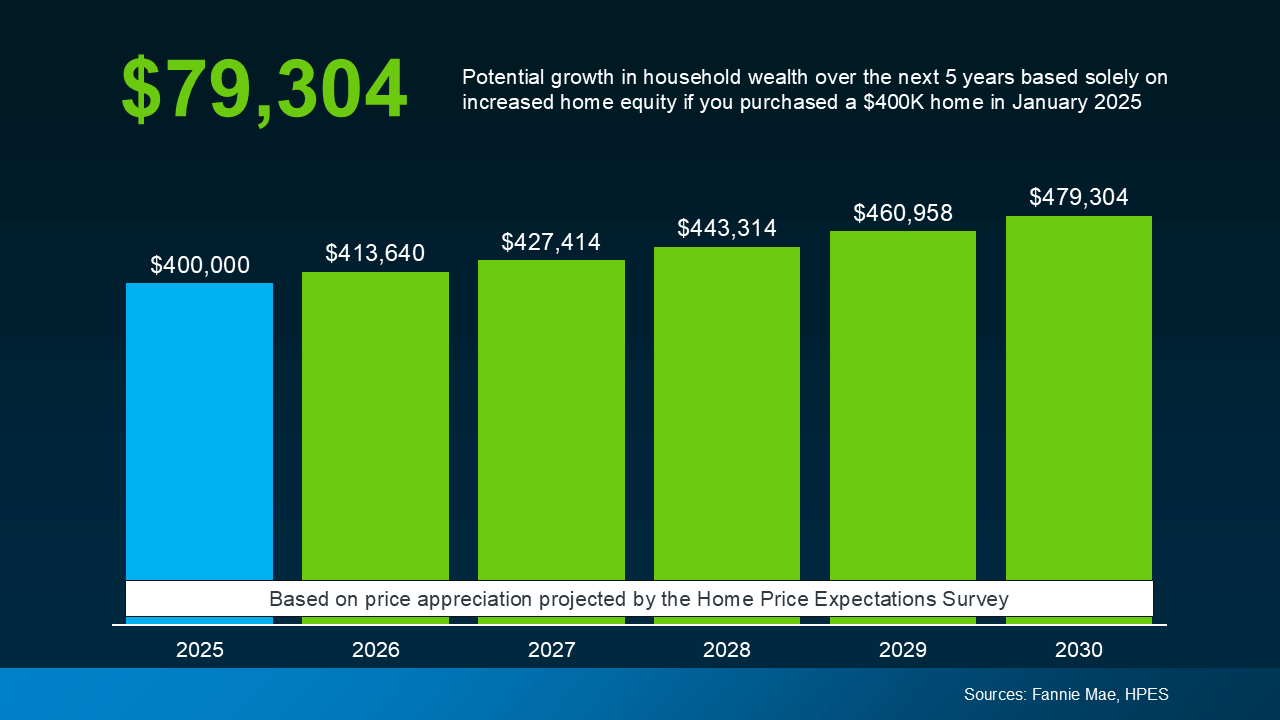

To demonstrate how these theories play out in real-world numbers, here’s a typical example. If you were to buy a $400,000 house in 2025, it could gain almost $80,000 in value by 2030. The graph below demonstrates how this value appreciates year by year based on the expert data we mentioned earlier.

This can be a considerable difference in your future wealth and why buyers who invest early are often glad they did. When it comes to building wealth through long-term investment, time in the market matters.

The question to consider isn’t “Should I wait to buy?” It’s really “Can I afford to buy now?” Just like planting a tree, making short-term sacrifices to buy a home will eventually pay off in the long-term.

Between rising prices and stubborn mortgage rates, today’s housing market is challenging, but achieving homeownership is far from impossible. Exploring different neighborhoods, seeking alternative financing options, or applying for down payment assistance programs can all make a critical difference.

What’s most important is acting decisively when you’re able to, instead of waiting for a perfect opportunity that never comes.

Conclusion

If you’re interested in buying but still undecided, take the time you need to make the right choice. But, remember that realizing an investment takes time, and the sooner you make one, the sooner you’ll be rewarded.

If you’re curious about what’s happening with prices in our local area, then reach out to us. Even if you’re not ready to buy, an expert local agent can fill you in with the info you need.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link