Like many homebuyers, you may be waiting for rates to drop before you finally buy a home this year. The latest expert reports predict that rates will continue to fall, but not as low as many hope. While this may be discouraging, the good news is that there are still ways you can buy a home in 2025 without waiting for lower rates.

Will Rates Keep Dropping?

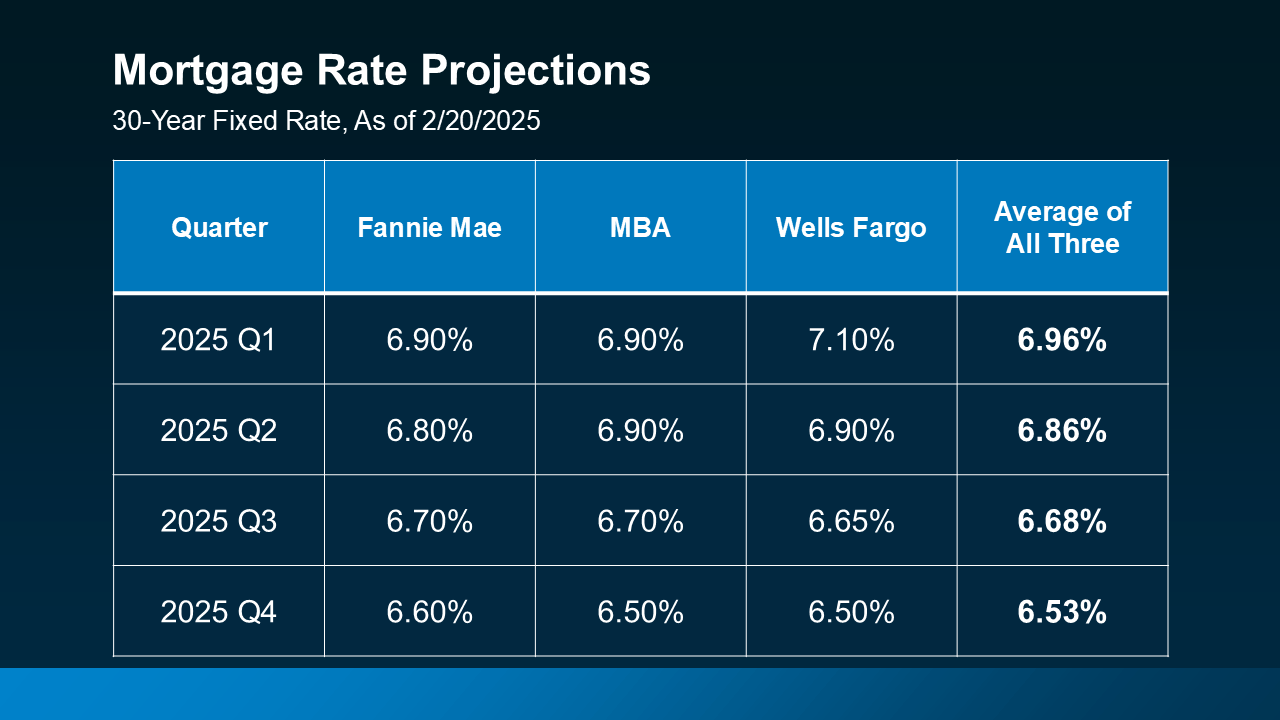

Near the end of 2024, experts were predicting that mortgage rates could dip below 6% by the end of 2025. More recent projections are suggesting that rates will continue to fall but hover somewhere above 6%.

Recent projections from Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo now predict that mortgage rates will stabilize around 6.5% by the end of the year.

If you’re holding out for mortgage rates to drop below 6% before buying, you may need to keep waiting into next year at least. But what if you’re a buyer who can’t wait to move because of a major life event, like a new job, a new baby, or a marriage? Don’t panic—you’ll still be able to move this year, but you may need to take advantage of some alternative financing options.

How to Finance a Home in Today’s Market

With rates predicted to hold more stubbornly than expected this year, it’s worth researching different financing options, especially if your move is a non-negotiable one. Here are three unique financing strategies that may be helpful to you depending on your situation. If you’ve already chosen a lender, discuss each of these options with them to decide if any are a good fit. It may make all the difference you need to buy a house in 2025.

1. Mortgage Buydowns

A mortgage buydown allows you to pay an upfront fee—sometimes called “discount points”— to lower your mortgage rate temporarily or sometimes permanently. This can be an especially helpful option if you want or need a lower monthly mortgage payment early on. Of course, the obvious downside is a higher upfront cost.

A recent survey by HomeLight found that 27% of real estate agents day first-time homebuyers are increasingly requesting mortgage buydowns from sellers. This is a new program called RateReduce Sell that allows sellers to pay an upfront cost to lock in a lower mortgage rate for buyers. However, a real estate agent can help negotiate this with a seller, so be sure to mention it if you’re actively looking to buy a house.

2. Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) are loans that combine a fixed-rate period with an adjustable-rate period. ARMs typically start with a lower rate than a traditional 30-year fixed mortgage then fluctuate with the market once the fixed-rate period ends. This can make them an attractive option if you expect rates to drop in the future, or plan to refinance your home later.

If you remember the 2008 housing crash, it may be reassuring to know that today’s ARMs aren’t like the volatile loans from back then. Lance Lambert, Co-Founder of ResiClub, describes modern ARMs this way:

“. . . ARM products today are different from many of the products issued in the mid-2000s. Before 2008, lenders often approved ARMs based on borrowers ability to pay the initial lower interest rates. And sometimes they didn’t even check that (remember Ninja loans). Today, adjustable-rate borrowers qualify based on their ability to cover a higher monthly payment, not just the initial lower payment.”

Before 2008, banks used to give loans without checking to see if buyers could realistically afford them. These days, lenders verify income, assets, and employment, reducing the risks previously associated with loans like ARMs.

3. Assumable Mortgages

An assumable mortgage allows you to take over a seller’s existing loan, usually including its lower mortgage rate, repayment period, and remaining balance. This can be a great option if the seller was locked into a low mortgage rate, but few are willing to offer it by default. According to U.S. News, more than 11 million homes qualify for an assumable mortgage, so it’s always worth bringing up with your agent or seller.

Conclusion

With mortgage rates looking unlikely to fall below 6% in this year, waiting for a drop may not work out if you’re eager to buy a house in 2025. Consider options like mortgage buydowns, ARMs, or assumable mortgages depending on what makes the most sense for you. Connect with a local lender or expert agent today to explore your options and get the help you need.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link