Mortgage Rates Just Hit a 3-Year Low. Does It Matter in 2026?

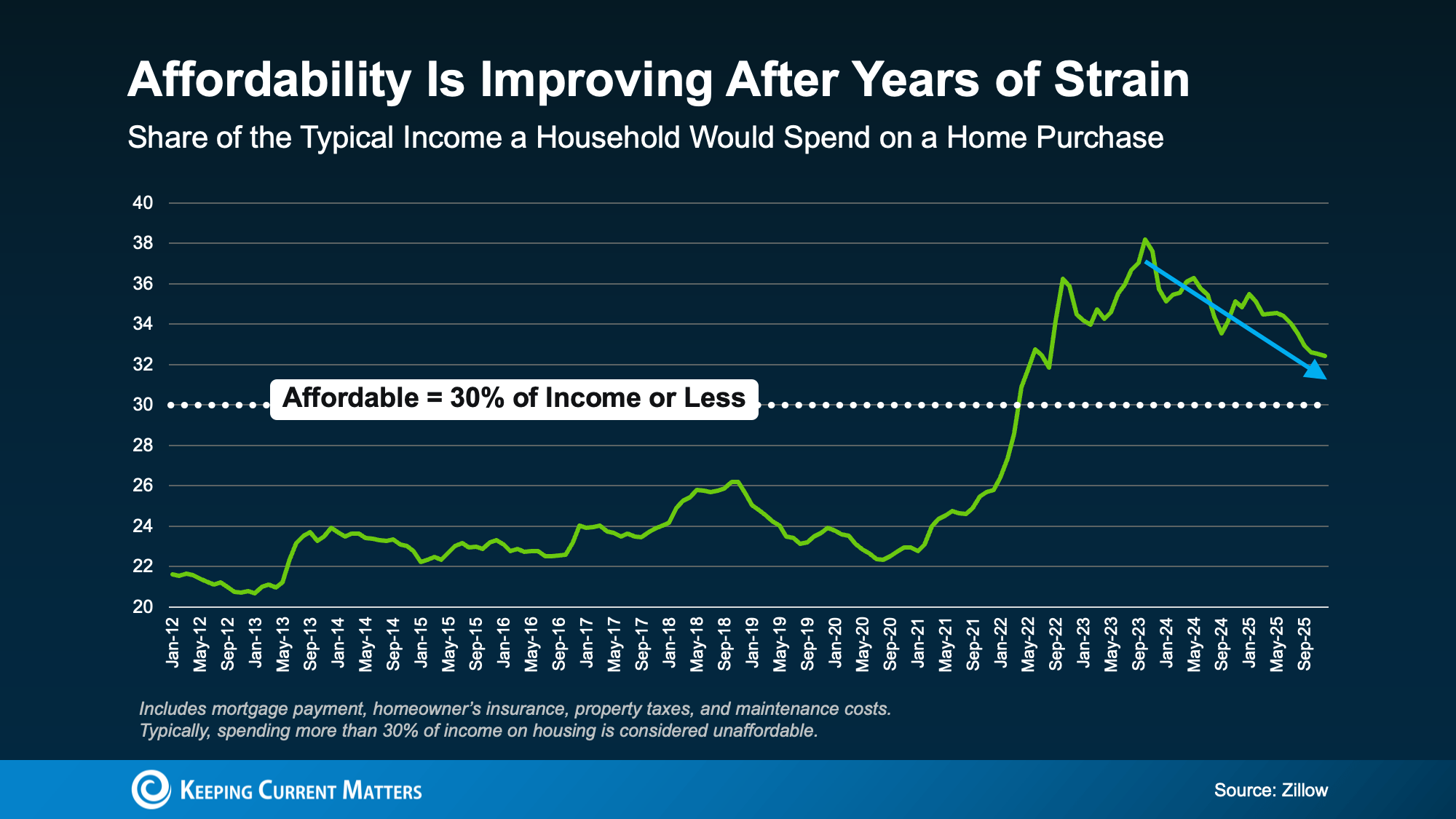

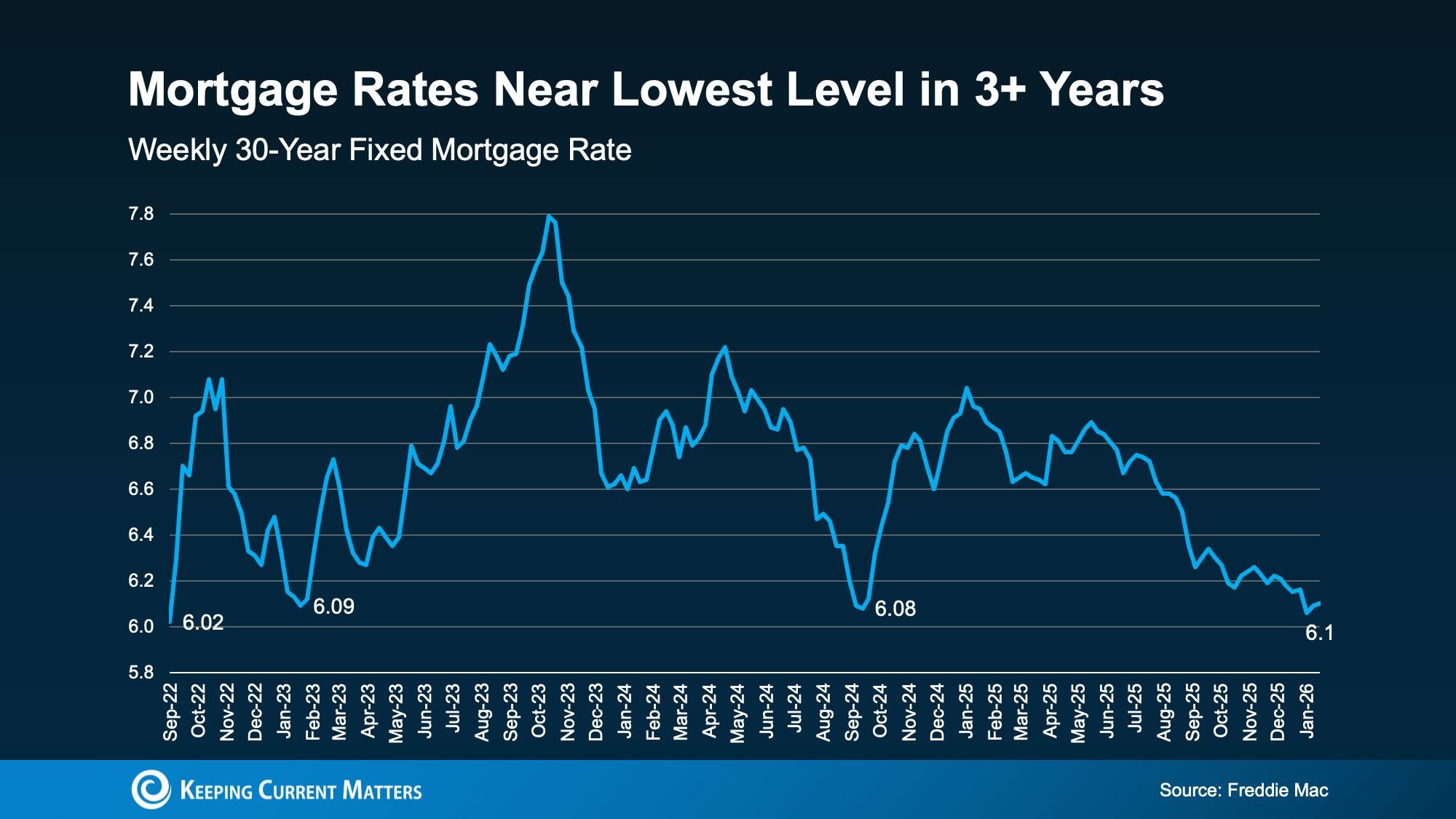

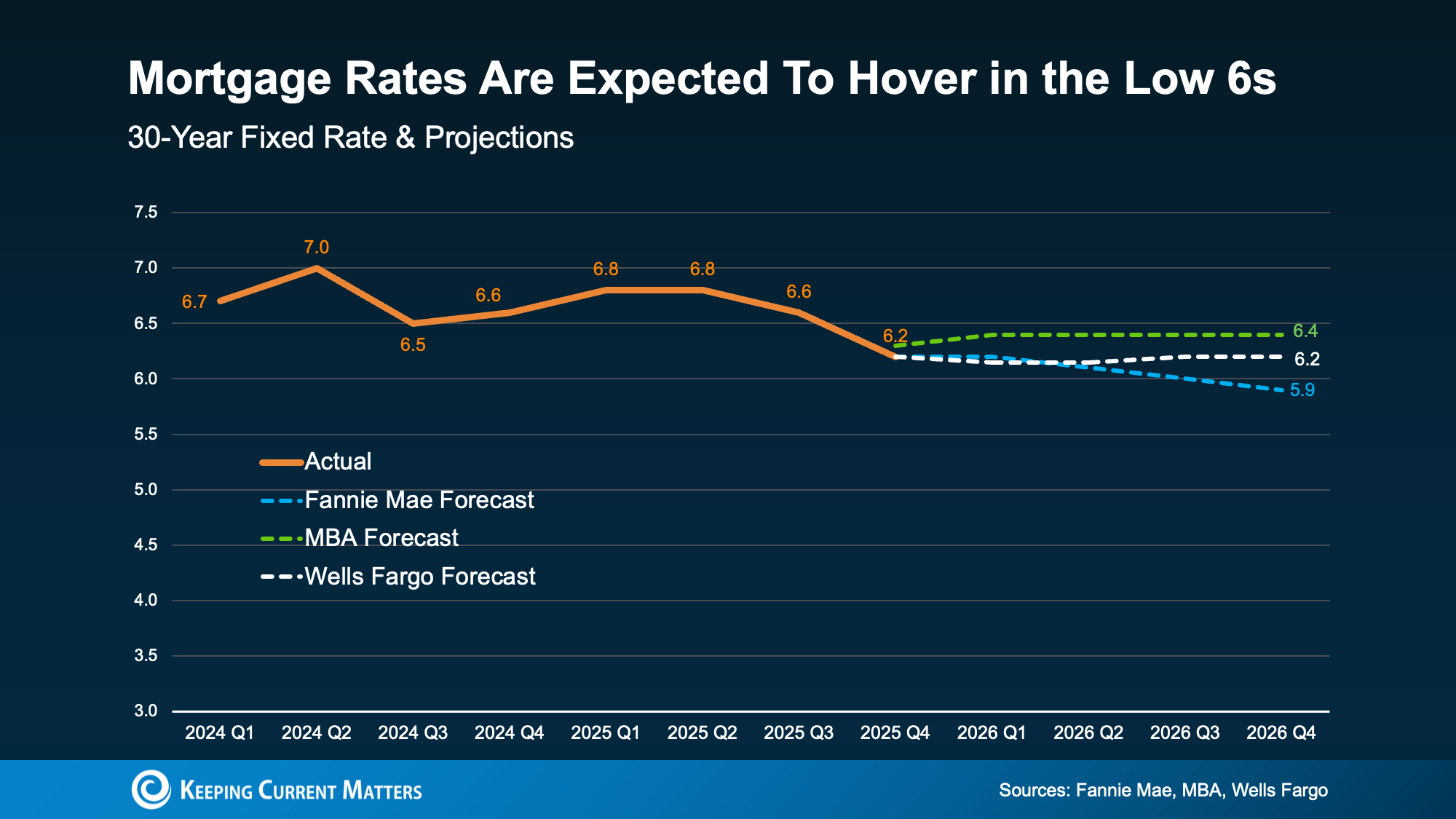

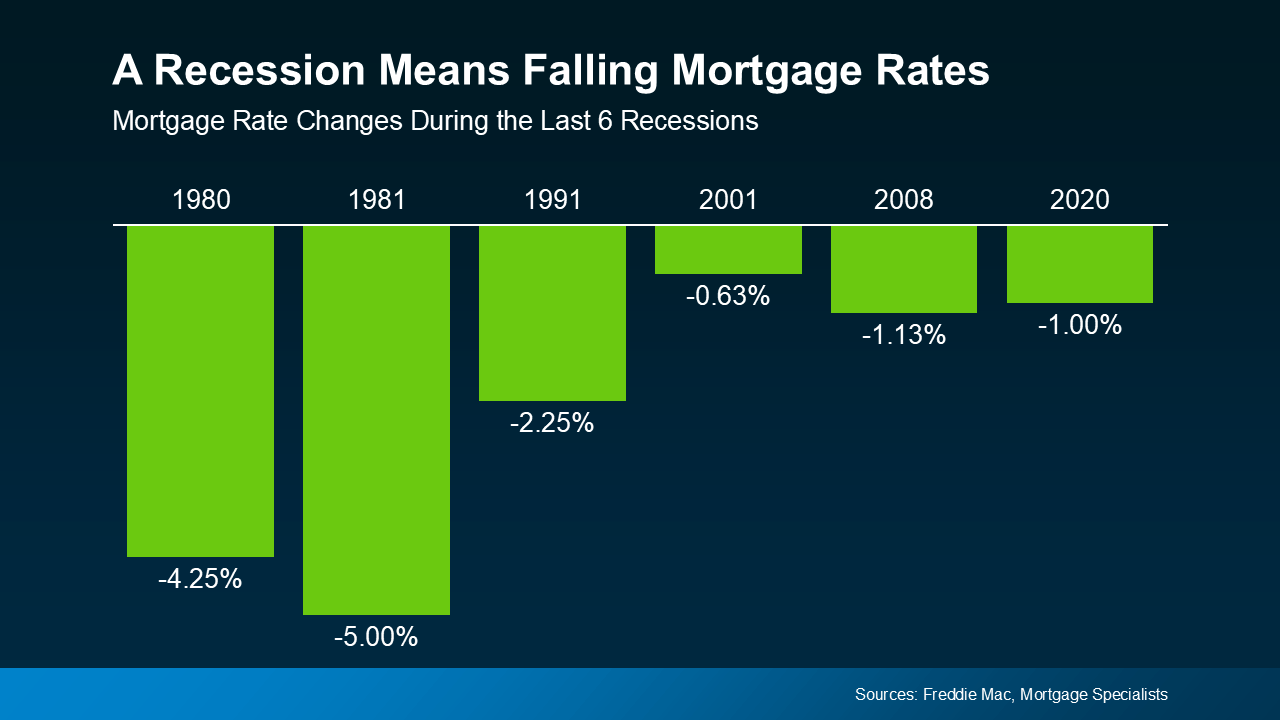

If you’ve been watching mortgage rates and waiting for a “better time” to buy, here’s your chance. Rates just dipped below 6% for the first time in more than three years. Even modest rate movement can change what you can afford, how competitive you can be, and whether buying feels realistic again, especially if last year’s higher rates pushed you to the sidelines.

With rates finally easing up into 2026, here’s a fresh take on why lower mortgage rates are still a big deal, plus what to do next if you’re thinking about making a move.

Why Mortgage Rates Impact More Than Just Interest

A mortgage rate isn’t just a number on a lender’s website. It shapes the entire homebuying experience because it affects:

- Your monthly payment

- How much home you can qualify for

- Your comfort level with your budget

- How competitive your offer can be

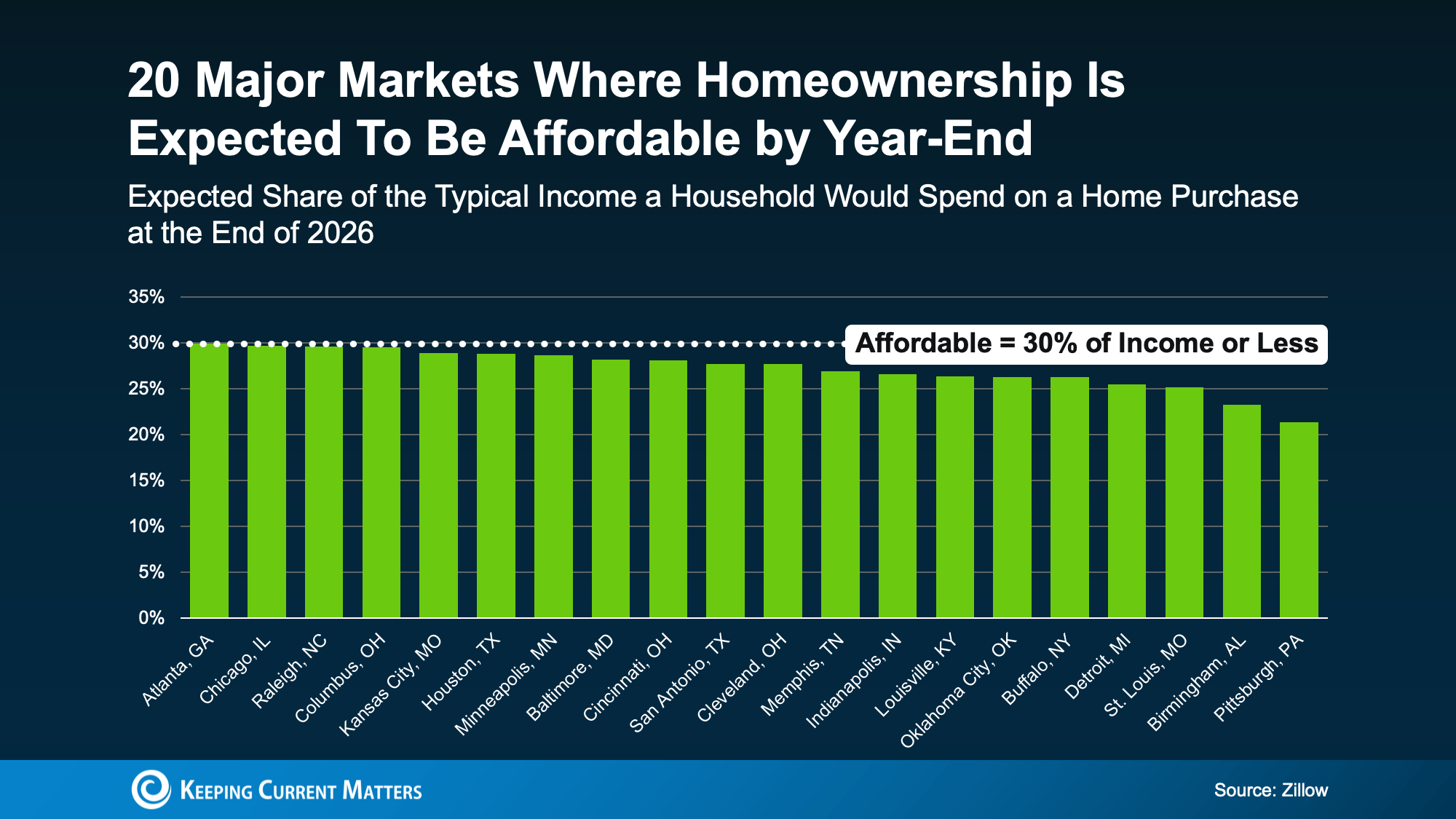

When rates jump, affordability tightens fast. That’s why many buyers (especially first-time homebuyers) feel the pinch first. When rates ease, the reverse happens: budgets get a little more breathing room, and choices open up.

The “One-Point” Difference That Changes the Math

One of the easiest ways to understand why rate declines matter is to look at a simple example.

When rates are closer to 7%, monthly payments rise sharply. When rates move closer to 6% (or below), payments can drop meaningfully. On a typical loan amount, that can translate into hundreds of dollars per month in savings compared to the higher-rate environment.

That difference can help you:

-

Stretch your budget without stretching your lifestyle

-

Consider more homes in a neighborhood you actually want

-

Keep cash available for repairs, furnishing, or future goals

In practical terms, the change isn’t just “cheaper interest.” It can be the difference between compromising on your wish list and finding a home that fits.

What Lower Rates Can Unlock for Buyers

When borrowing costs come down, three things usually happen for homebuyers:

1) Lower monthly payments

A lower rate can reduce the monthly principal-and-interest payment, which helps many buyers feel more confident about moving forward.

2) More buying power

When the payment drops, you may qualify for more home at the same monthly budget. That can mean a better location, an extra bedroom, or a property that needs fewer updates.

3) Stronger offers without overextending

More budget flexibility can help you compete without taking on a payment that makes you uncomfortable. That matters in markets where inventory is still tight and desirable homes move quickly.

Why This Can Bring More Buyers Off the Sidelines

Rate changes don’t only affect you. They affect everyone who has been waiting, too.

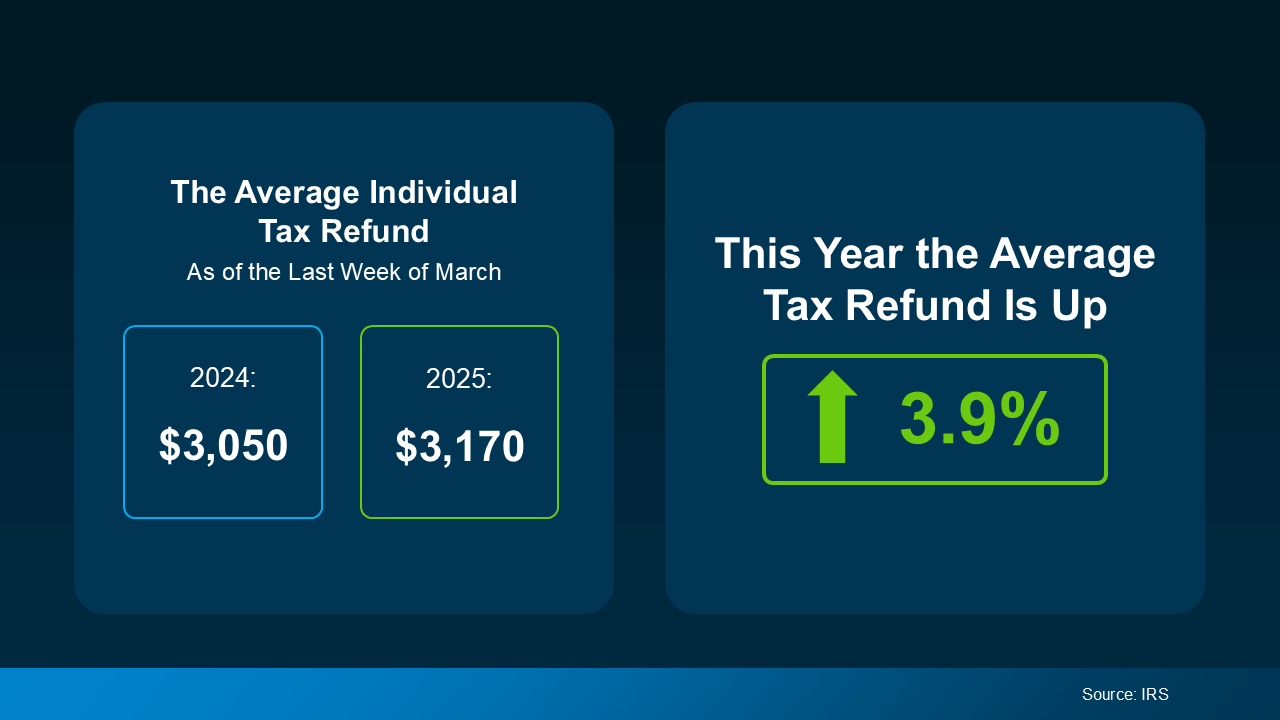

Industry research suggests that when rates sit around certain thresholds, millions more households can afford a median-priced home. In fact, research from the National Association of Realtors (NAR) points to 5.5 million additional households being able to afford the median-priced home when rates are at 6% or below, and it estimates roughly 550,000 of those households could buy within the next 12 to 18 months.

That matters because it signals something important: pent-up demand can return quickly when affordability improves.

If you’re home-searching now (or preparing to), you may be able to act before competition fully ramps back up.

A Quick Reality Check: Rates Aren’t the Only Factor

Lower rates help, but they don’t magically make every home affordable. Your true monthly cost depends on several moving pieces, including:

-

Home price

-

Local inventory and competition

-

Property taxes

-

Homeowners insurance (which can vary widely by state and ZIP code)

-

HOA dues

-

Your down payment and credit profile

That’s why the smartest next step isn’t guessing. It’s running real numbers to figure out what “affordable” looks like for you.

What To Do Next If You’re Considering Buying

If you’ve been waiting for rates to improve, here’s a simple, practical plan:

-

Get pre-approved (not just pre-qualified).

Pre-approval gives you a clearer budget and shows sellers you’re serious. -

Calculate your comfortable payment range.

Decide what fits your life, not just what a lender says you can qualify for. -

Compare scenarios with your lender.

Ask for payment examples at different price points, down payments, and rate options. -

Watch inventory in your target neighborhoods.

The best “deal” is the home that works for your needs and your budget.

Conclusion

Mortgage rates easing from last year’s highs isn’t just an attractive headline. For many buyers, it can be the shift that turns “maybe someday” into “this could actually work.”

If you paused your search when rates were higher, it’s worth revisiting your numbers now. A quick conversation with a trusted lender can show what today’s rate environment means for your payment, your buying power, and your options.

If you’re thinking of buying, or need help finding a lender, reach out to us today. We can connect you with local agents and lenders to make your journey as simple as possible.

Many Fear a Housing Market Crash in 2025 – Will It Happen?

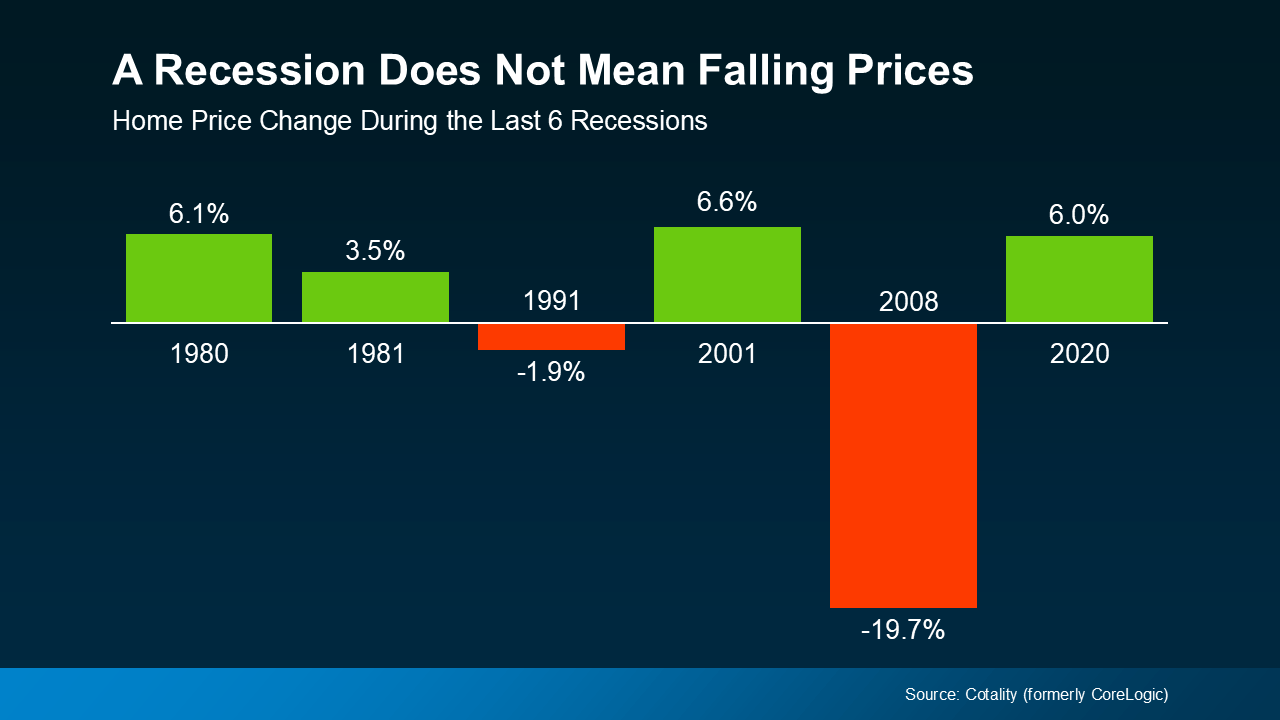

Between every economic uncertainty underpinning this year so far, Americans are understandably trepid about the future. Amid market lows and rising prices, many are asking if we’re heading for a housing market crash in 2025.

If talk of tariffs and mercurial markets are giving you pause about your plans, you’re not alone. In fact, new data from Clever Real Estate has found that 70% of Americans are worried about a housing crash in 2025. But how likely is this, and what does the latest data say?

Low Inventory Prevents a Crash in Prices

Before you put your plans to buy or a sell a home on hold, let’s look at the facts. The reality is that the trends in the housing market we’re seeing aren’t signs of crashing, only of shifting. As Chief Economist at First American Mark Fleming explains:

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

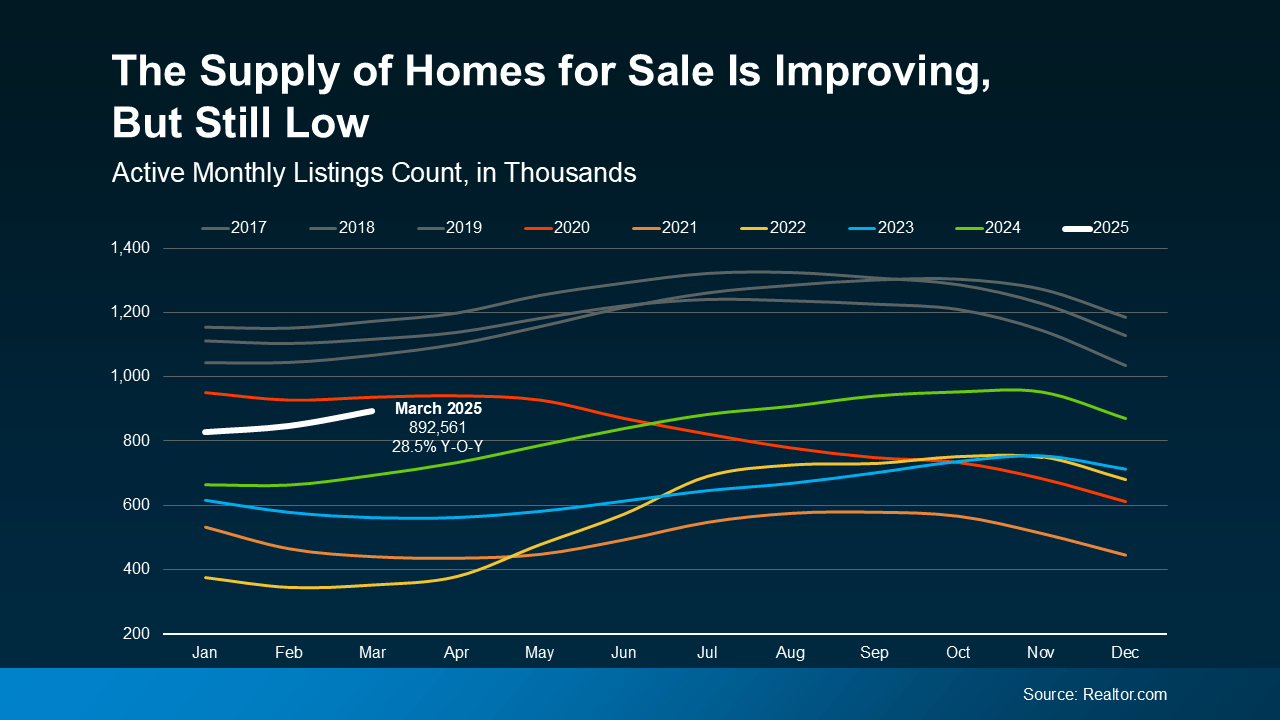

Consider the basic laws of supply and demand. If the supply of something is low, its prices are bound to go up, and homes are no exception. And even though housing inventory is up in 2025, high demand from buyers is still driving home prices higher.

According to recent data from Realtor.com, the number of homes for sale in 2025 is climbing, but still below normal levels. Even still, home supply is at its highest since pre-pandemic levels, showing a positive trend in the right direction.

That ongoing low supply is what’s stopping home prices from dropping at the national level. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“… if there’s a shortage, prices simply cannot crash.”

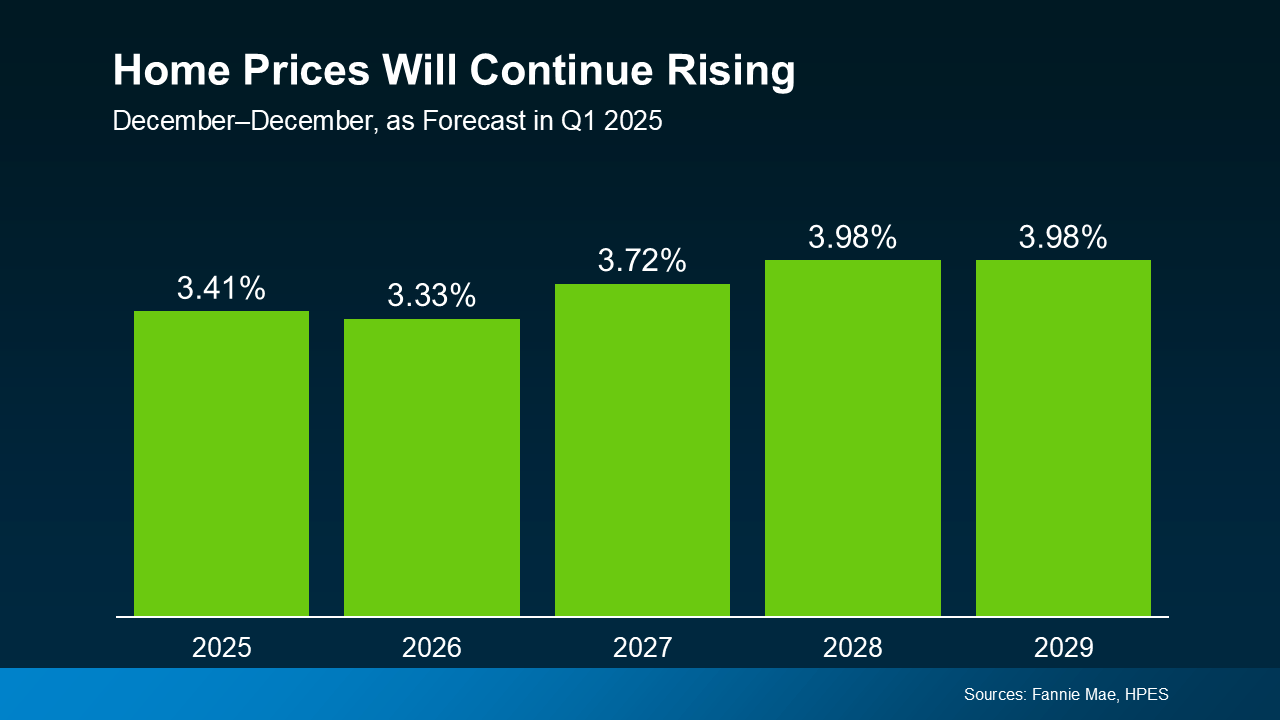

Home Prices Normalize as Inventory Increases

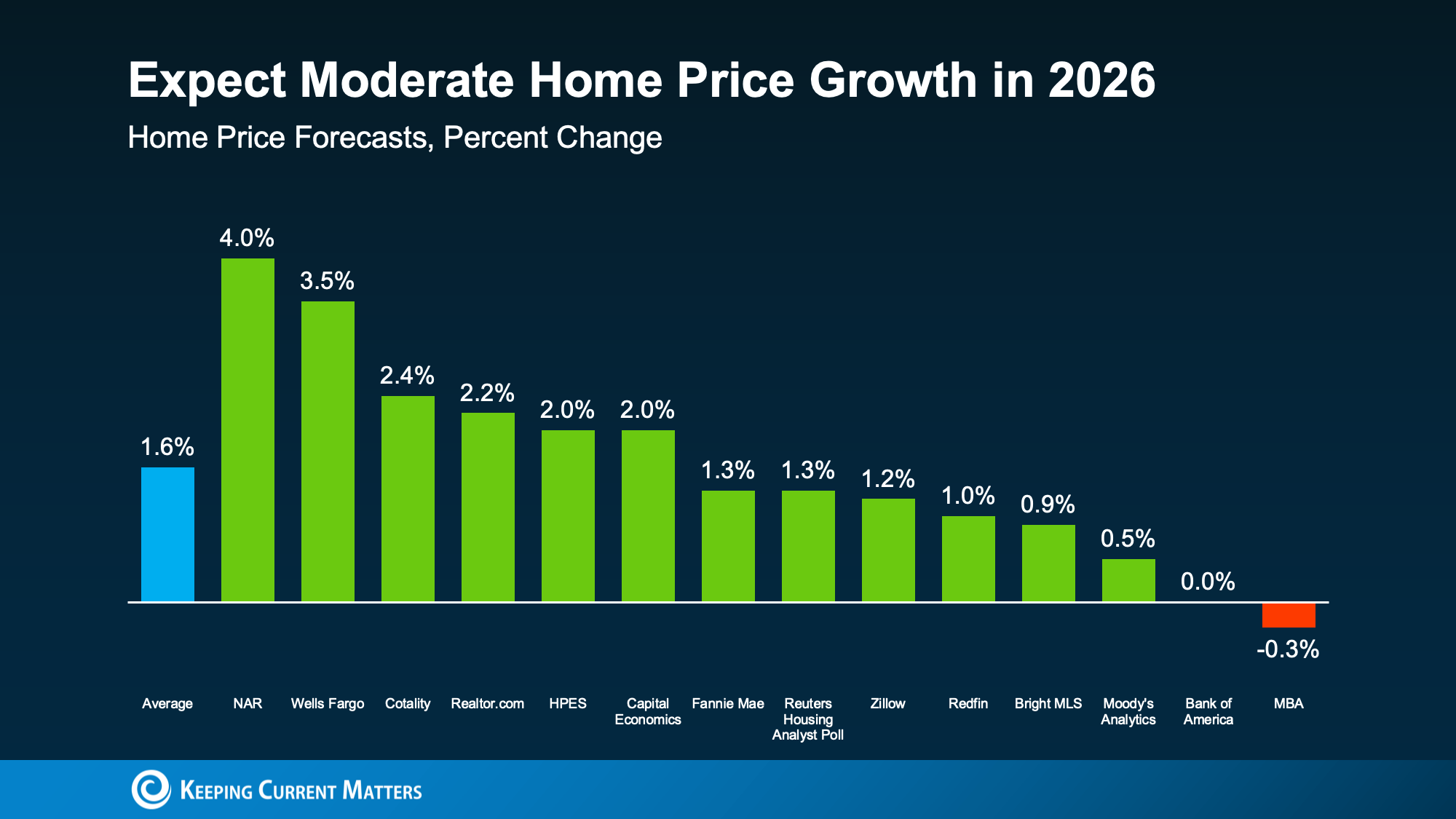

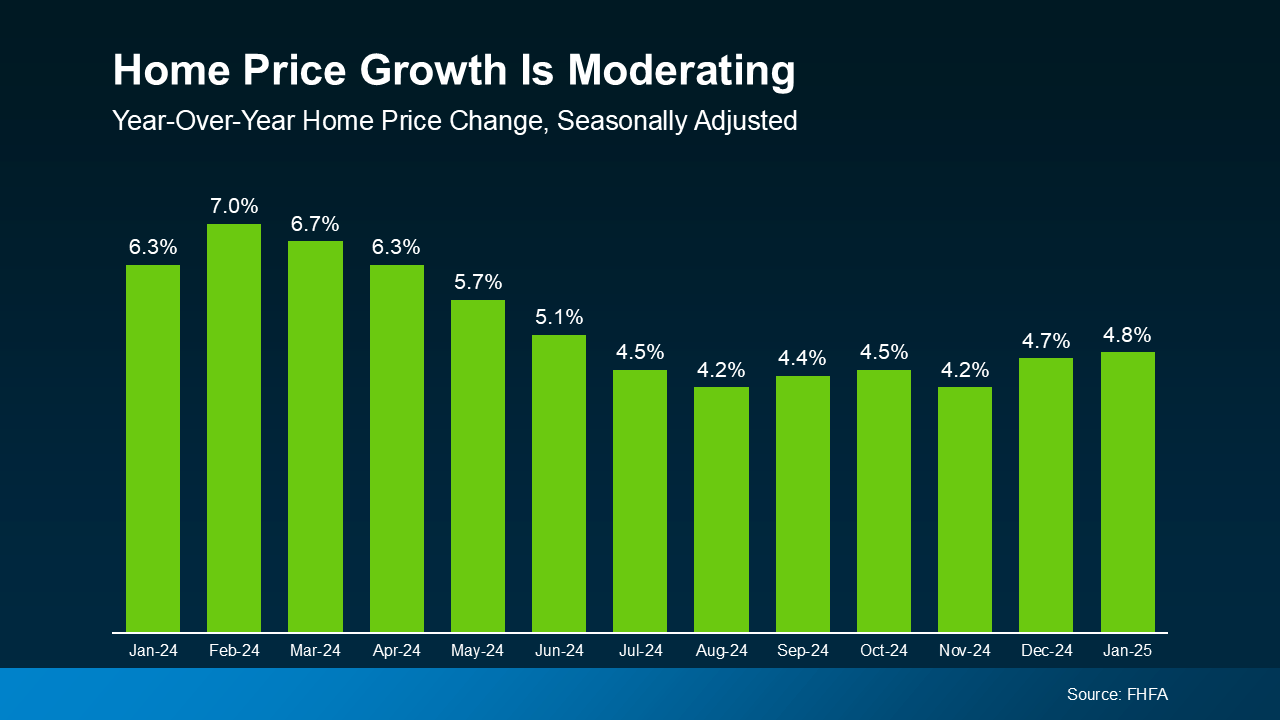

As more homes are listed on the market, upward pressure on home price growth normalizes. Prices may not be falling, but they’re rising at a rate closer to what we’d consider normal for the market.

Even though prices aren’t declining nationally, increased inventory means they’re rising more slowly than they were. The trend we’re currently seeing is what’s considered price moderation.

The good news for buyers is that this price moderation is expected to continue throughout the rest of the year, according to a January report from Freddie Mac:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

This means that home prices will continue rising in most markets, but not as quickly as they did in 2024. This is great news for anyone who’s been priced out of the market thanks to rapid price appreciation these past few years.

These numbers represent national trends, so the true story will vary in individual markets. A local real estate agent can give you the latest details on the market trends in your your own unique area.

Conclusion

Fears of a housing market crash in 2025 abound, but don’t let this worry you. While a little caution is healthy, experts are confident that a housing market crash is unlikely in 2025. As a recent report from Business Insider says:

“. . . economists who study housing market conditions generally do not expect a crash in 2025 or beyond unless the economic outlook changes.”

In reality, this year’s housing market is stabilizing thanks to decreasing price growth and increasing home supply. If you’re curious about the market trends in your local area, contact us today to connect with an agent who can reassure you with the facts.

Selling Your Home? Avoid This Mistake When Setting Your Asking Price

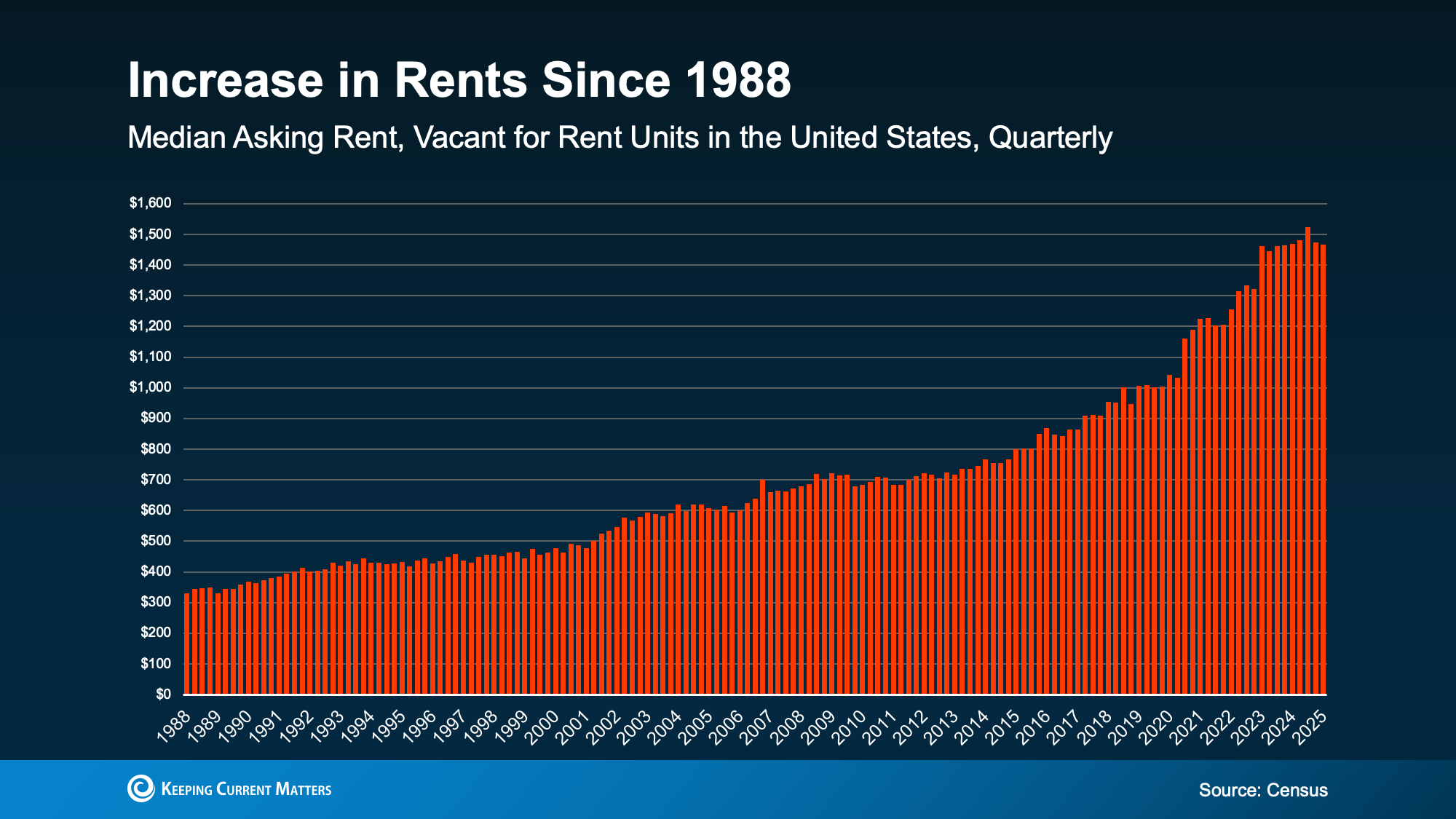

When selling your house, the typical goal is to sell quickly at the best price possible. Naturally, ever since home prices took off around 5 years ago, most sellers have been aiming high. But housing inventory is making a comeback, and some sellers haven’t considered what this shift means for their asking price. As a result, buyers are becoming choosier, and price cuts on overpriced listings are increasing alongside home supply.

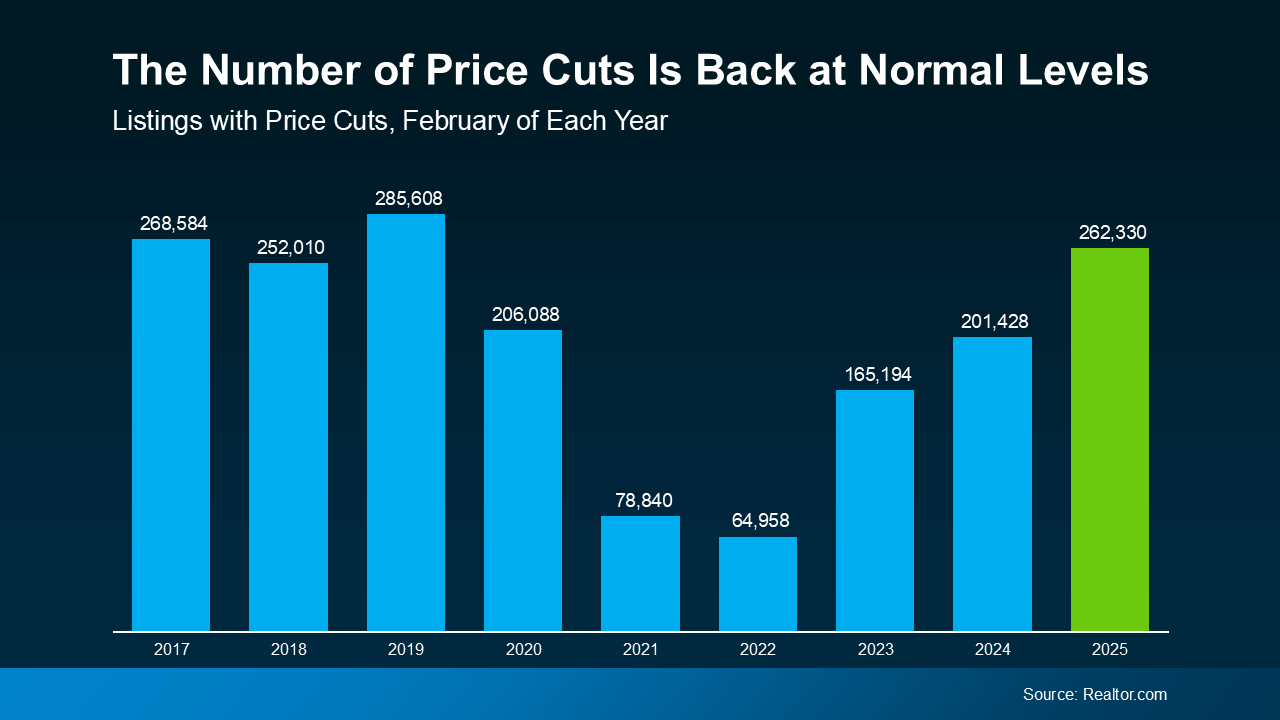

According to February 2025 data from Realtor.com, home price cuts this February reached their highest number since 2019. That’s the highest number of price cuts in 6 years, and a real return to pre-pandemic market levels.

Given that 2019 is considered the housing market’s last normal year, this demonstrates a major, substantial shift. The market is finally starting to normalize, and may quickly break out of the post-pandemic slump it’s been stuck in.

However, this is a distinctly different trend from the hot seller’s market of 2021 and should be treated differently. You may not sell your house for top dollar like you would have at the pandemic’s peak, but that’s okay. By setting a smart asking price and tempering your expectations, you can still sell quickly, and at a great price.

You may be planning to price your listing high and cut it later if necessary, but this has its drawbacks. Pricing too high and lowering later means you may actually end up with lower offers in the end. Pricing right the first time is the best way to avoid this, and a local agent can make the difference.

How a Local Agent Can Find Your Perfect Asking Price

A true expert real estate agent doesn’t set an asking price without good reason. These agents consider real data and trends unique to your market, setting a price specific to your home. This way, you set a realistic price based on your home’s true value to attract as many buyers as possible.

Depending on your local market and your agent’s analysis, they may even recommend strategically pricing slightly below market value. While this may sound counterintuitive, it can be a strategic move to attract more attention to your listing, earning you more competitive offers. Here are a few ways a local agent will determine the best price for your listing:

- Researching recent home sales. What price did homes similar to yours finally sell for? Were these homes initially listed higher before dropping in price to sell?

- Analyzing local market trends. The true value of your home isn’t based on the price you’d like to sell it at. It’s the price that potential buyers are willing to pay. A local agent will have a strong idea of this number based on experience.

- Strategizing to sell. A great agent will price your home to attract attention, creating a sense of urgency among buyers and increasing demand.

How Overpricing Your Home Can Backfire

Unfortunately, some sellers still ignore their agent’s advice and prefer to start high just to see what happens. The hope being maybe they get their full asking price, or they at least have more wiggle room for negotiation. But pricing high usually ends up costing you, and here’s why:

- Buyers may ignore it. The market’s past few years – and the direction it’s headed – have made buyers more budget-conscious than ever. If a home listing looks overpriced, buyers are more likely to ignore it and move on than consider negotiating.

- It could stay on the market too long. The longer your home sits on the market without selling, the more buyers will assume something is wrong with it. This can make it harder and harder to sell as time goes on, and makes a price cut almost inevitable.

- You may sell for less in the end. Price cuts often lower a listing’s final selling price below its best, most realistic market value. Listing at the right price to begin with gives sellers the best chance of selling quickly at a great price.

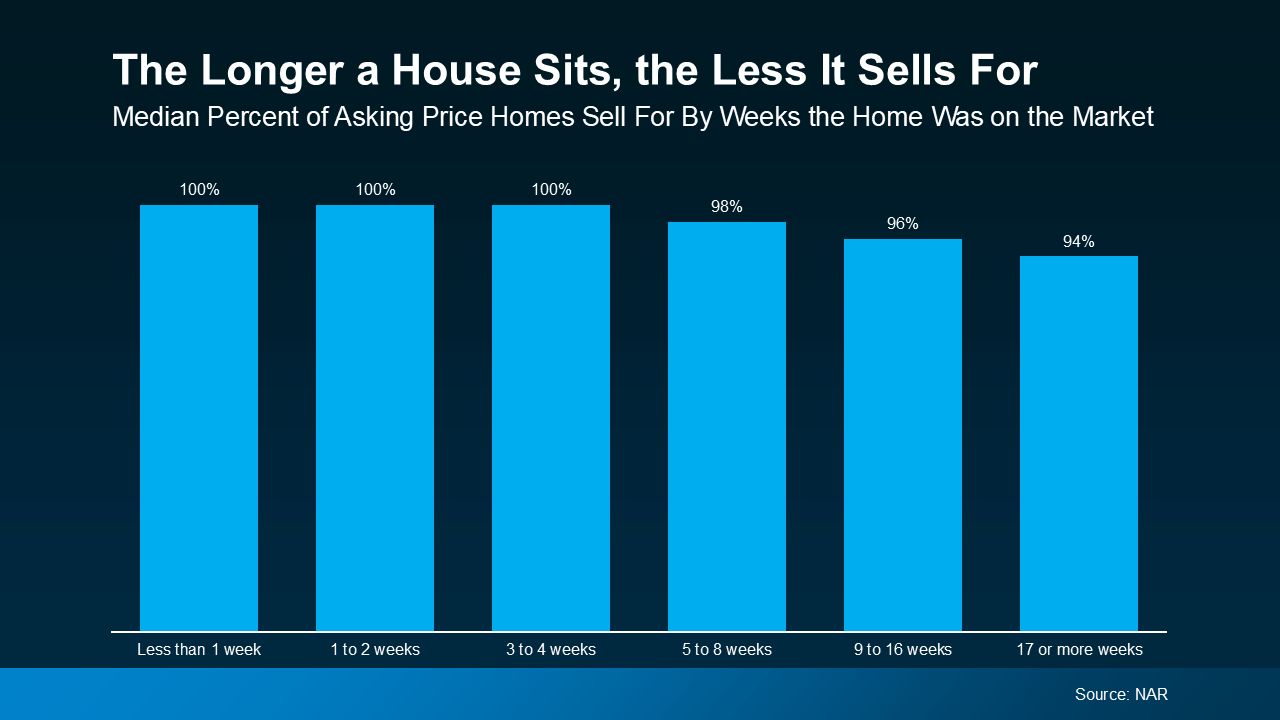

The graph below demonstrates how these factors play out in the market. Using data from the National Association of Realtors (NAR), it shows how time on the market lowers final selling price.

According to the data, if a house sells within its first 4 weeks after listing, it usually sells for full price. Homes that are priced at or just below current market value typically sell quickly in this same window. When a home is priced right, it attracts truly interested buyers who are willing to buy at your asking price. In a hot market, buyers may even compete with other buyers, or even make an offer above your listing price.

On the other hand, a home that’s overpriced will take longer to sell, if it sells at all. As the graph demonstrates, after that first 4 weeks on the market, final selling price starts to drop. And as buyer interest declines over time, the more likely a seller will accept a low offer, or cut their price.

Conclusion

The housing market is normalizing thanks to increasing housing inventory, causing price cuts to rise with increasing buyer power. For sellers, setting the right asking price is more important than ever, and overpricing could make your listing sit on the market. Advice from a local agent can help you avoid this mistake and sell quickly without having to lower your price.

Interested in selling but need help pricing your home for your local market? Get in touch with us today. We can connect you with a local agent who can sell your home at the best price possible.

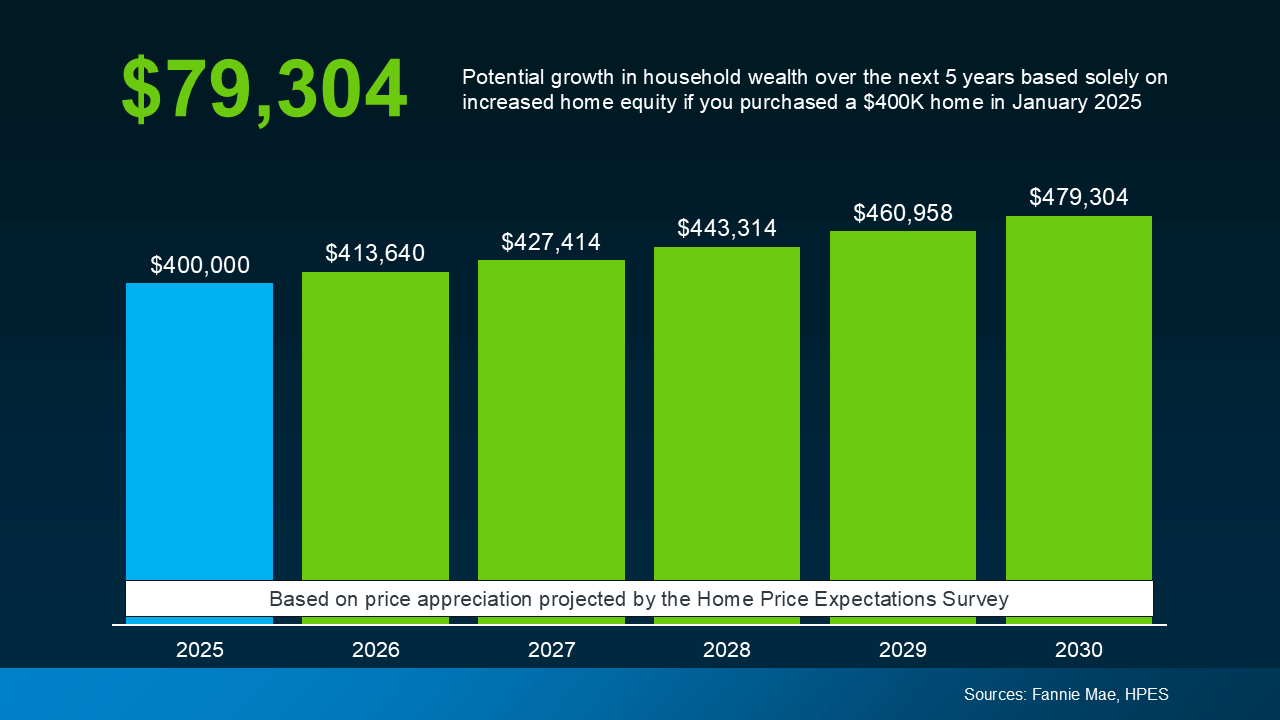

What’s Your Real Home Value in the 2025 Market?

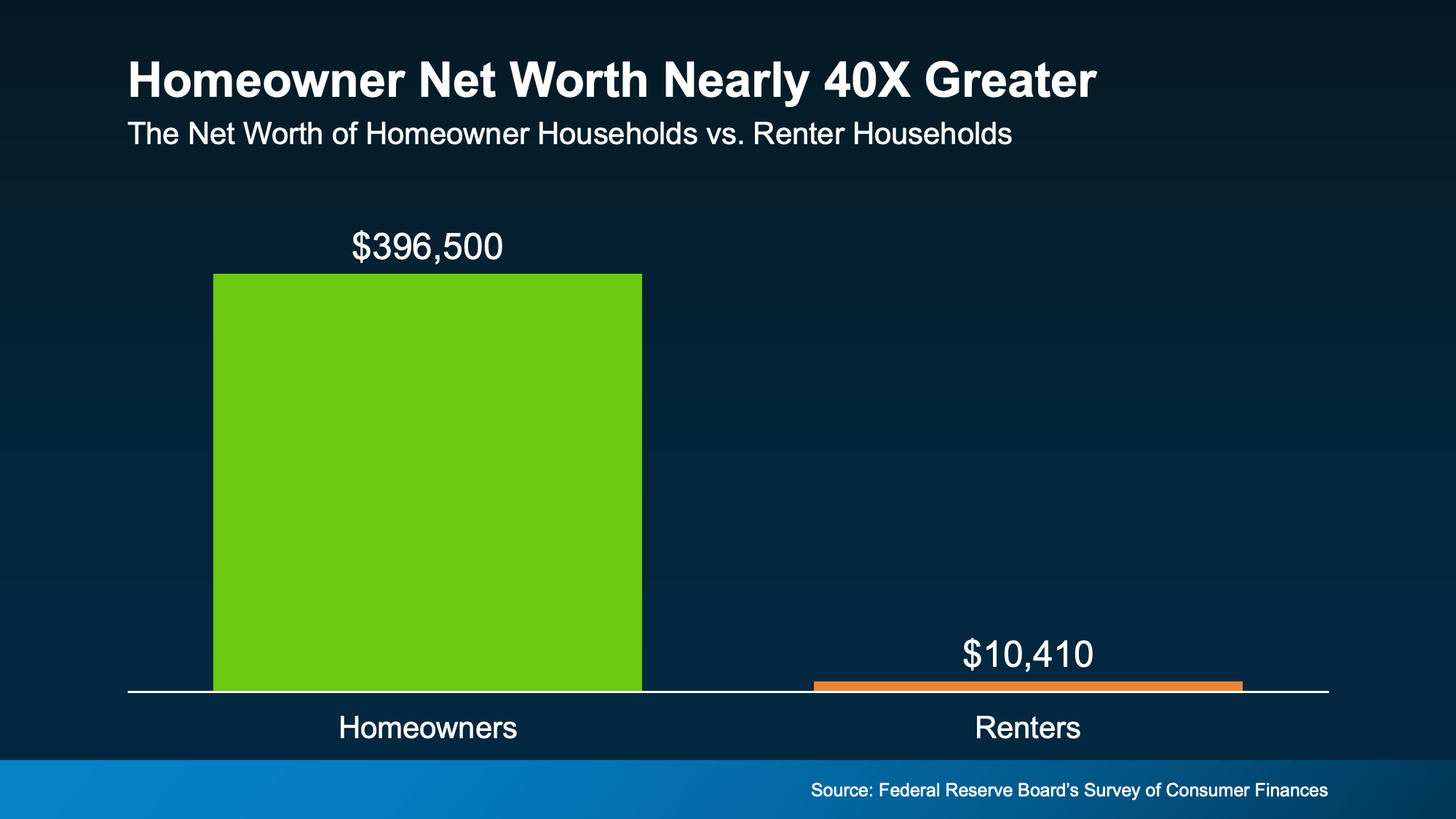

If you’ve checked home prices in the past few years, you know too well that they’re always rising. But if you’re a current homeowner, have you considered what this might mean for your own home value? It may be that your home is worth far more than you think in 2025.

While rising prices are expected, the home value increases of the post-Pandemic housing market have been dramatic. And if you’re a seller waiting to list, this could mean a huge payoff when you finally close. If you’re eager to know much your own house could sell for, finding out is easier than you think.

The Post-Pandemic Home Value Launch

Home prices typically rise around 2-5% per year, but in 2021-2022 that number rose to double-digit levels. In the spring of 2022, year-over-year percentage growth finally peaked at over 20% nationally. The sheer number of buyers in the market during this time sent home prices soaring as housing supply lagged. And though price growth has settled since then, the home value accrued by homeowners in that time remains.

The lingering effects of that volatile period have caused difficulties for buyers, but they’ve also produced great opportunities for sellers. There’s a good chance your house has gained tremendous value since then, and that means more wealth for you.

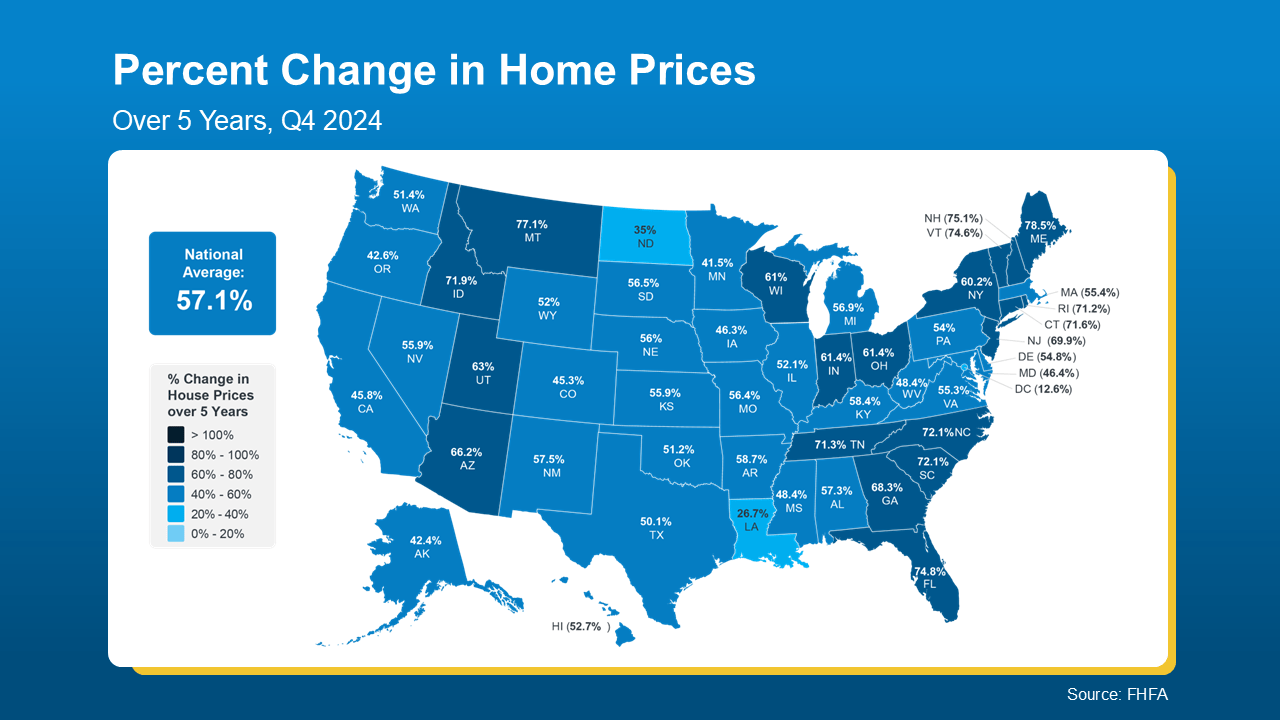

The map below references data from the Federal Housing Finance Agency (FHFA) to illustrate that home prices have risen by nearly 60% in just the past 5 years alone nationally. The most extreme increases have taken place in states marked with a darker blue, like Maine, New Hampshire, and Florida.

If worries about today’s rates and prices have stopped you from selling your home, let these numbers reassure you. Your home’s risen value may be exactly what you need to close the affordability gap and purchase your next house.

Even better, if you’ve owned your home for 10 years or more, your value is likely even higher. You can stack the incredible gains of the past five years on top of five years of healthy appreciation too. And an agent can help you figure out what that really looks like.

How To Find Out What Your House Is Really Worth

Percentages will help you ballpark an estimate, but you need specific numbers to make real, actionable decisions. To help, you can get a free home valuation estimate from us right now using the tool below. You can even sign up for a full valuation report.

Home valuations can be great tools, but only a local real estate agent can give you the best, most accurate look at your house’s real market value. An agent will know the state of your local housing market and the factors driving it. They can provide insights about current housing inventory, pricing of comparable homes, and unique contributors to value like renovations.

By knowing what’s happening where you live, an agent can stack their market knowledge against the unique condition and features of your home and give you an accurate estimate of your home’s current value in your area.

Conclusion

Home values have taken off in just the past few years, and that’s great news for current homeowners. Knowing what your house is worth in today’s real estate market will help you plan your next move. A local agent can give you a great idea of how much your home might realistically sell for.

If you’re a homeowner considering a move, get your free home valuation from us at Century 21 Affiliated now. Ready to sell? Reach out now and we’ll connect you with a local expert real estate agent who can get your house sold.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link