Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Renting vs. Buying: Which Home Option Is Right for You?

Between stubborn mortgage rates and rising home prices, you’ve probably mulled over renting vs. buying a home. In market conditions like these, renting and waiting to buy can feel like your only realistic option. This can be the truth in many cases, and buying before you’re ready can be a costly mistake.

But the short-term savings of renting can sometimes trap you in a cycle, preventing you from making wealth-building investments. Over time, this can actually end up costing you more than buying a home early and slowly building equity. Unsurprisingly, a recent survey from Bank of America found that 70% of prospective homebuyers feel renting could hinder their financial future.

Ultimately, the pros and cons of renting and buying come down to your own short-term and long-term financial goals. If you’re feeling torn over whether you should nest or invest, take these major differences into account to decide.

Homeownership Builds Your Wealth Over Time

Apart from giving you your own place to live, homeownership grants the important bonus of building your wealth over time. This is because home prices usually rise as time goes on, meaning waiting longer to buy costs you more. This isn’t always true of every housing market, but the general national trend tends to speak for itself.

The average home sale price has more than tripled in the past 30 years.

Even better, your home equity also grows over time when you’re a homeowner. Equity is the difference between what your home is worth and what you still owe on your mortgage. Your equity grows with each mortgage payment you make, and this builds your net worth over time.

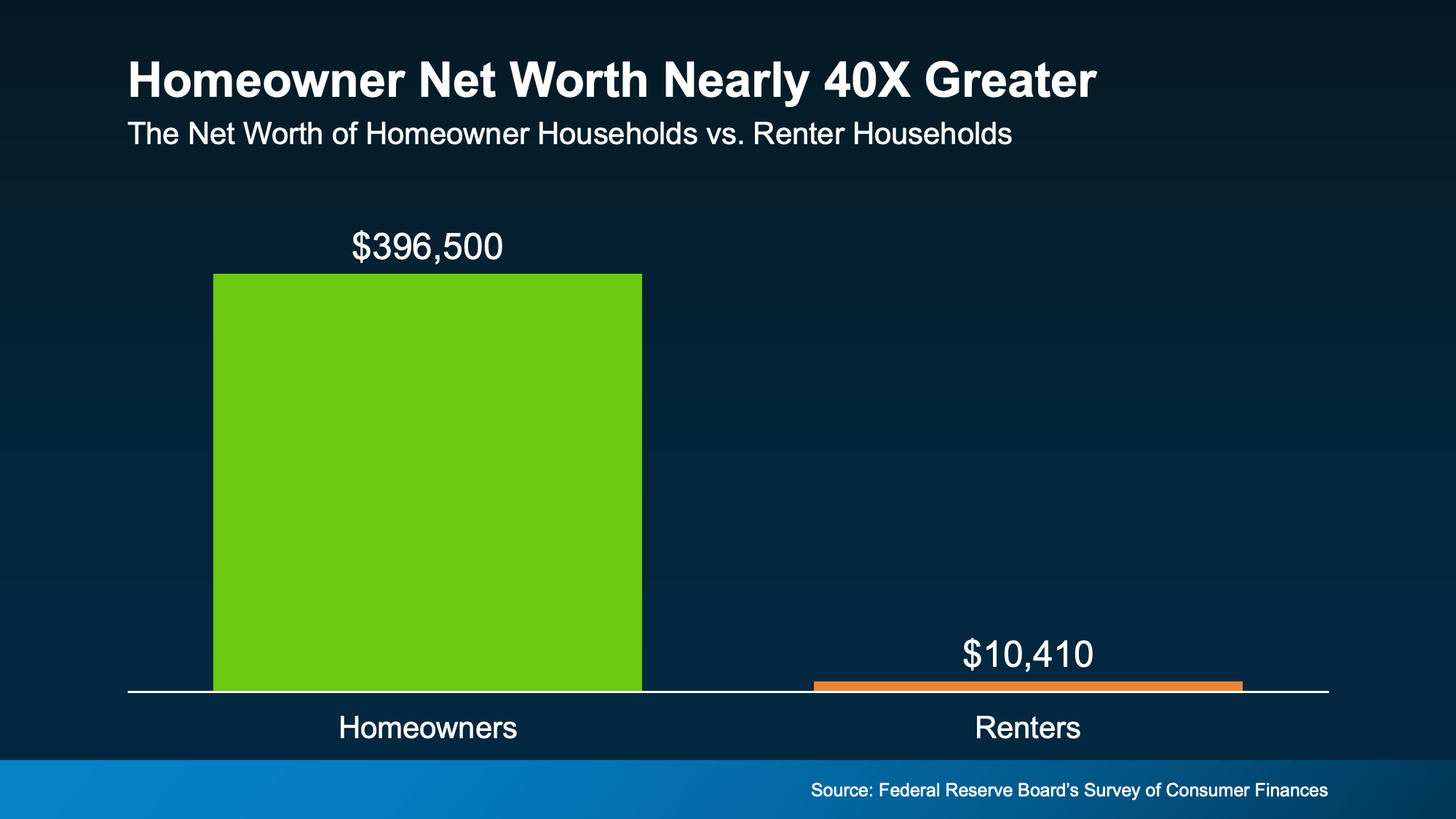

According to the Federal Reserve, the average homeowner’s net worth is nearly 40 times greater than that of a renter. That’s a life-changing difference, and seeing it represented visually really drives the point home.

The average net worth of a homeowner household is almost 40X greater than that of a renter household.

This massive difference in personal wealth is just one of the reasons that Forbes says:

“While renting might seem like [the] less stressful option . . . owning a home is still a cornerstone of the American dream and a proven strategy for building long-term wealth.”

Renting Helps You Save in the Short Term

Compared to homeownership, renting offers lower monthly payments and the freedoms of relatively negligible commitment and responsibility. This often makes renting feel like the safer option, and it usually is, at least in the short term. But in the long term, renting can land you in a trap that prevents you from building real wealth.

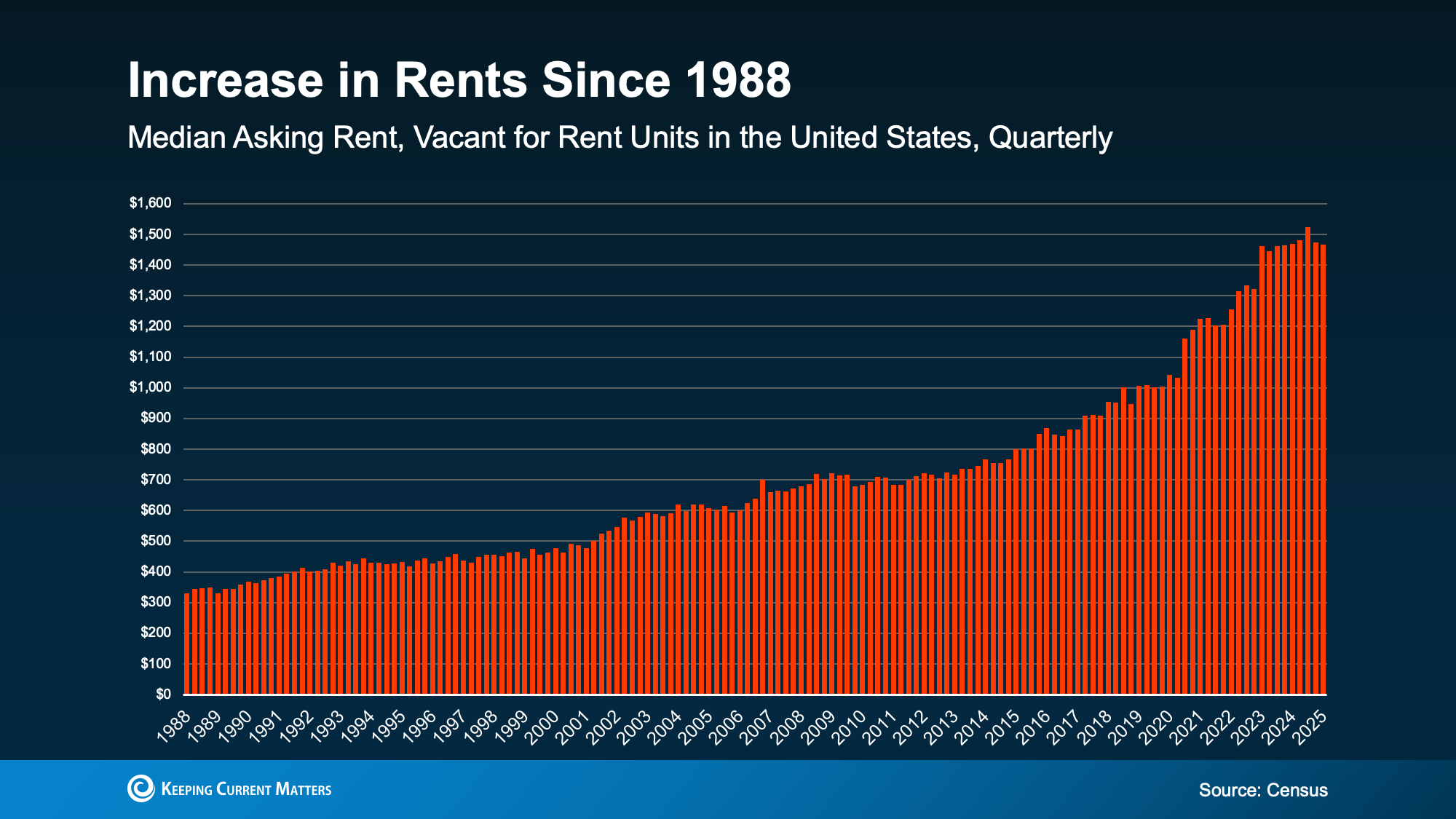

Rent tends to rise along with home prices, and this has been true for decades. Rental costs have been somewhat stable recently, but they almost never trend downward. This trap of paying increasing rent without building wealth can make buying a home feel impossible.

Like home prices, rental costs have risen dramatically in the past several years.

Financial uncertainty like this can have a real, lasting impact on any of your financial decisions. In the same Bank of America survey, 72% of potential buyers said they worry rising rent could affect their current and long-term finances.

Rent money doesn’t come back to you, and that means it doesn’t grow your wealth. The only mortgage it’s paying is your landlord’s.

So, whether you’re renting or owning, you’re paying off a mortgage. The question is: whose mortgage do you want to pay?

Renting vs. Buying: What Really Matters

Here’s another way to look at renting vs. buying. Rent money is gone once you pay it. Payments toward your own house build equity, like a savings account you can live in. Obviously, buying comes with higher upfront costs and more long-term responsibility. But the reward is a stable investment that grows over time. And while buying a home often feels out of reach, a solid plan can get you there.

As Realtor.com Senior Economist Joel Berner explains:

“Households working on their budget will find it much easier to continue to rent than to go through the expenses of homeownership. However, they need to consider the equity and generational wealth they can build up by owning a home that they can’t by renting it. In the long run, buying a home may be a better investment even if the short-run costs seem prohibitive.”

Conclusion

Renting may be cheaper in the short term, but it can cost you more over time without building your wealth. If you’re weighing the pros and cons of renting vs. buying, consider your long-term financial goals. Short-term saving can trap you in an endless cycle of renting, but buying without planning can be financially overwhelming.

If you’re ready to make the leap from renting into buying a home, contact us today. We’d be happy to connect you with a local agent who can make your dreams a reality.

Are You Waiting To Buy? This Spring May Be Your Time To Move

Between low inventory, high home prices, and unpredictable mortgage rates, 2024 was a rocky year for real estate. It should come as no surprise then that 70% of buyers stopped their home search last year. If you were one of them and are still waiting to buy in 2025, this spring could be your time.

The Drive of Housing Inventory

Many homeowners who put their move on pause last year are reentering the market this year. This means higher, stronger listing inventory, and with builders finishing more homes, new construction inventory is growing as well. Together, this creates more options for buyers like you, and better chances of finding the home you’ve waited for.

But that’s only part of the story. When you’re selling, you want to feel confident that you’ll find a home you’ll be thrilled to move into. At the same time, you don’t want housing inventory so high that your current house sits on the market. Fortunately, the spring 2025 market is striking a balance between supply and demand that many have waited for.

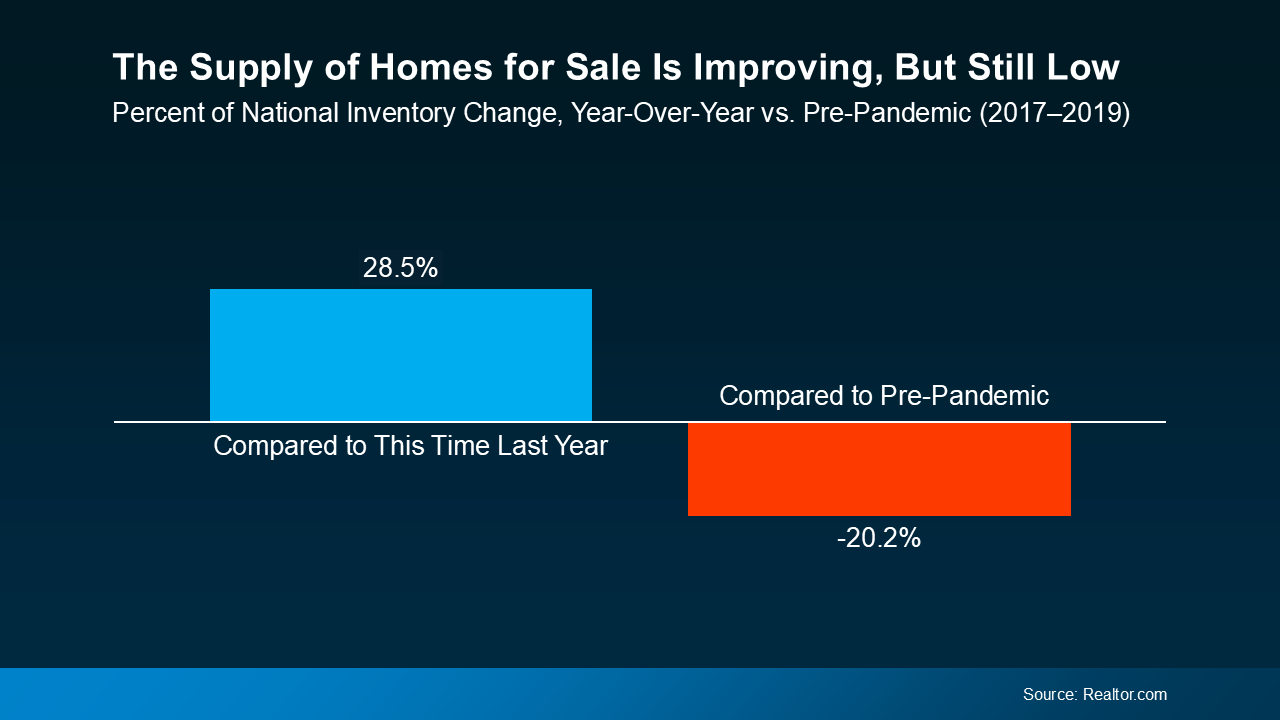

According to research from Realtor.com, housing inventory has jumped 28.5% year-over-year, making March the 17th straight month of inventory growth. This is still below pre-pandemic levels in most markets, but it’s a sweet spot for anyone waiting to buy.

For patient buyers, this means you’ll have more options when moving, but not so many that your current house won’t sell. As long as there’s a healthy demand for homes in your area, your house should still sell relatively quickly. Especially if you work with a local agent to make sure it’s priced right and fixed up to maximize value.

The Sweet Spot: More Options and Steady Demand

Here’s another promising point to think about. As we said, Realtor.com‘s March 2025 data shows that housing inventory has been rising for 17 consecutive months. What’s better, industry experts agree that listing inventory is likely to continue climbing through 2025. According to Lance Lambert, the Co-Founder of ResiClub:

“The fact that inventory is rising year-over-year . . . strongly suggests that national active housing inventory for sale is likely to end the year higher.”

If this prediction proves correct, this spring may be a better time to sell than you think. Listing now could help your house may stand out more than it would later in the year as inventory grows. With more homeowners reentering the market, waiting too long could make it all the more difficult to stand out.

Conclusion

If you’re one of the many who have been waiting to buy a house this past year, here’s your chance. Housing supply is growing but hasn’t caught up to demand yet, meaning new listings are still getting extra buyer attention. Meanwhile, increasing inventory is giving current homeowners more opportunities to scale up, further driving supply and activating buyers.

For both first time buyers and homeowners waiting to sell, this spring’s market is trending toward an ideal sweet spot. If you have questions keeping you from making your move, reach out to us for answers today. We can get you the info you need, or connect you with an agent to navigate your unique local market.

Should You Buy a Home This Spring or Wait for Lower Prices?

You’re probably familiar with the saying “The best time to plant a tree was yesterday, but the next best time is today.” It’s a valuable lesson about future planning and investment that, surprisingly, applies to the decision to buy a home too.

Even though buying a home is a major financial expense, it’s also a major investment that grows over time. As the price of your home increases over time, the value of the equity you’ve built grows with it. And while waiting for prices to drop may be an attractive option, trying to time the market rarely works.

But here’s something to consider: the longer you wait to buy a home, the more your patience could cost you. Let’s explain why.

Home Prices Are Expected To Continue Climbing

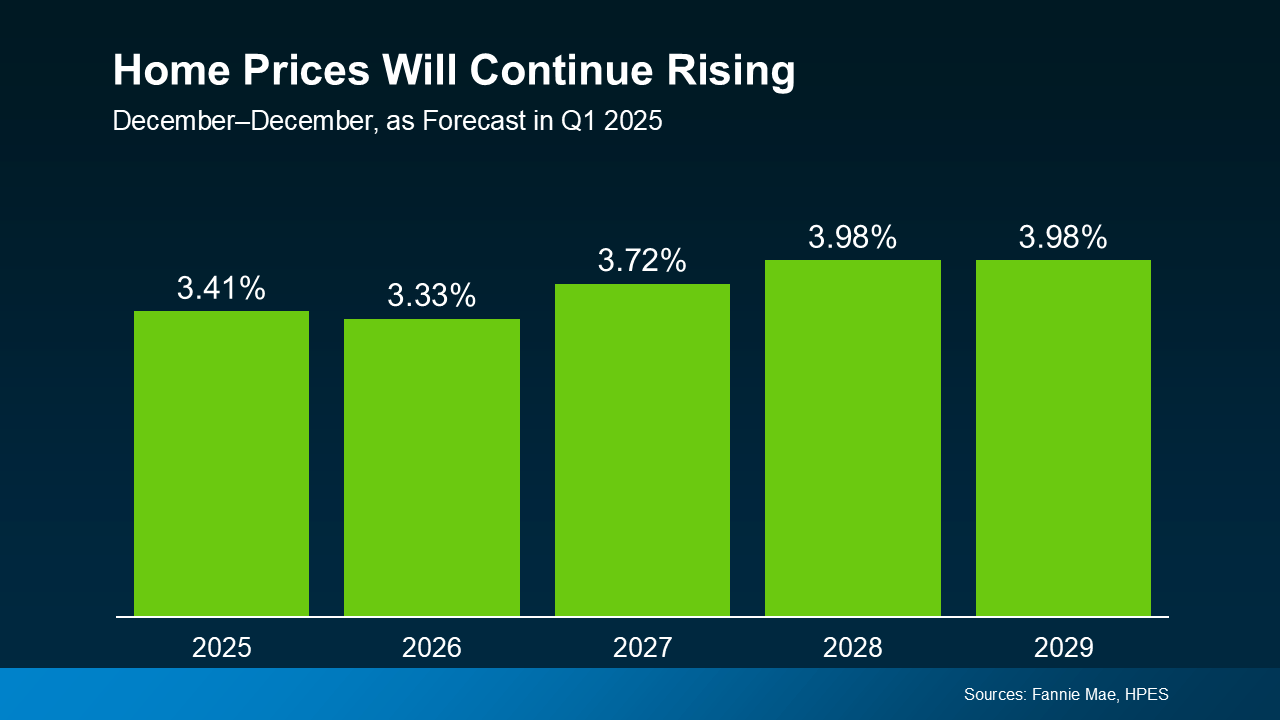

Each quarter, over 100 housing market experts respond to Fannie Mae‘s Home Price Expectations Survey (HPES). Consistently, the survey results show experts agreeing that home prices will continue to rise through 2029 or even longer.

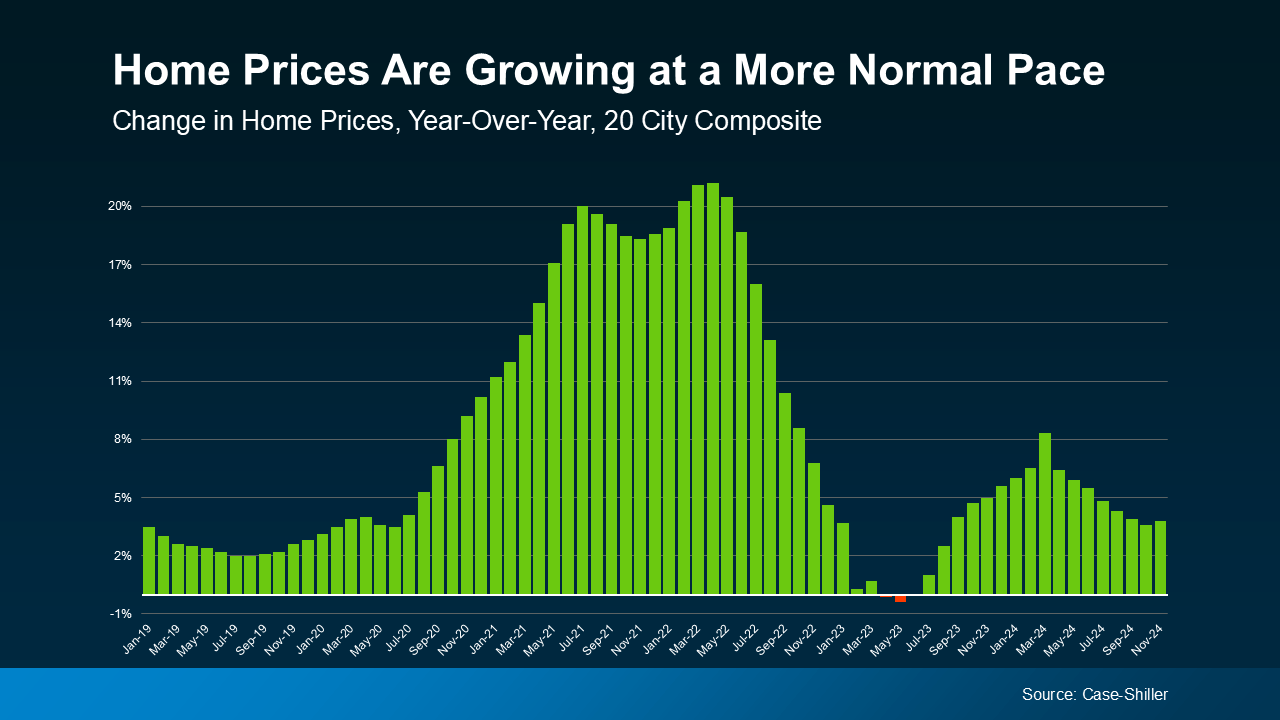

Sharp price increases may be behind us, but experts predict steadier, healthier increases of 3-4% per year moving forward. This rate of increase will vary by market from year to year, but it’s much closer to normal. Reliable growth is a promising sign for hopeful buyers, and the housing market at large, as the graph below demonstrates.

Even in markets experiencing slower price growth or short-term decreases, the steady gains of homeownership eventually win in time. After all, a growing, long-term financial investment will always beat a one-time discount.

Here are the main points to remember:

- Home prices will be higher next year. Experts don’t expect home prices to fall any time soon, at least at the national level.

- Waiting for a perfect mortgage rate or price drops is a gamble. With only slight dips in mortgage rates expected in the near future, price increase could outpace any potential mortgage savings. Unless home price growth is slow or mortgage rates are low in your area, waiting will likely be more expensive.

- Buying early means building more equity. When you invest in homeownership early, your equity and appreciating home value reward you in the long run.

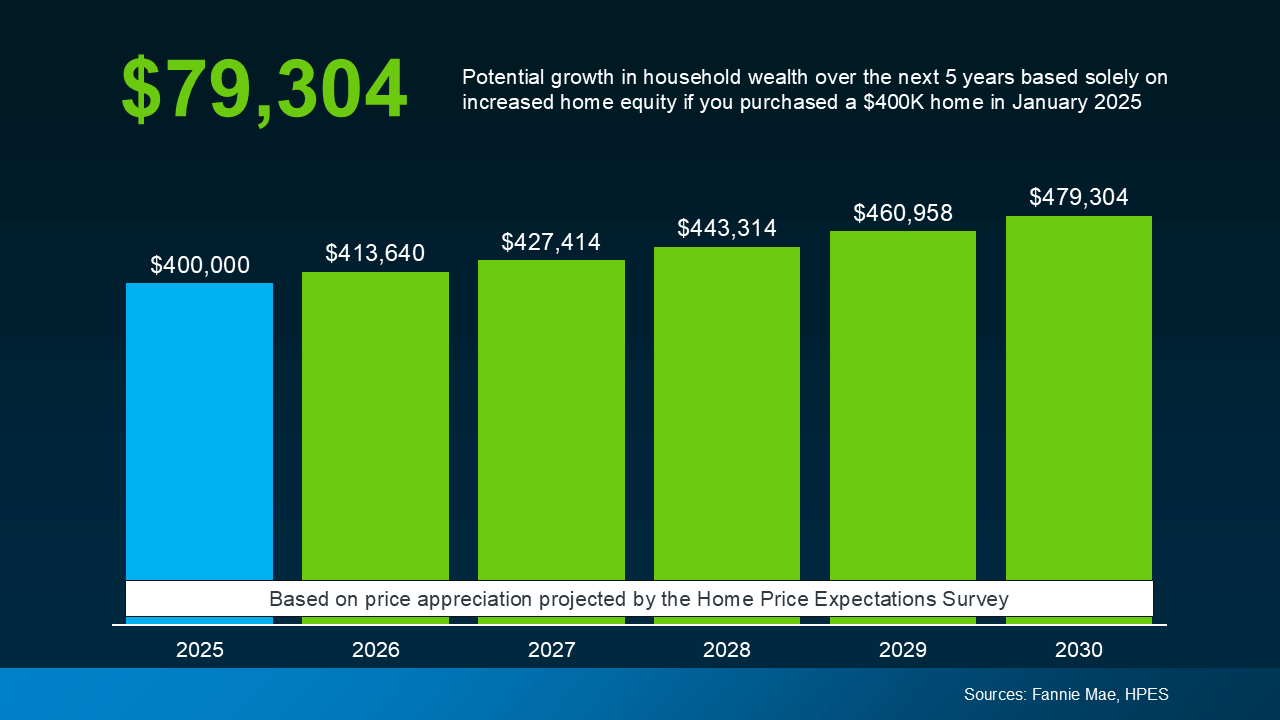

The Costs of Waiting To Buy

To demonstrate how these theories play out in real-world numbers, here’s a typical example. If you were to buy a $400,000 house in 2025, it could gain almost $80,000 in value by 2030. The graph below demonstrates how this value appreciates year by year based on the expert data we mentioned earlier.

This can be a considerable difference in your future wealth and why buyers who invest early are often glad they did. When it comes to building wealth through long-term investment, time in the market matters.

The question to consider isn’t “Should I wait to buy?” It’s really “Can I afford to buy now?” Just like planting a tree, making short-term sacrifices to buy a home will eventually pay off in the long-term.

Between rising prices and stubborn mortgage rates, today’s housing market is challenging, but achieving homeownership is far from impossible. Exploring different neighborhoods, seeking alternative financing options, or applying for down payment assistance programs can all make a critical difference.

What’s most important is acting decisively when you’re able to, instead of waiting for a perfect opportunity that never comes.

Conclusion

If you’re interested in buying but still undecided, take the time you need to make the right choice. But, remember that realizing an investment takes time, and the sooner you make one, the sooner you’ll be rewarded.

If you’re curious about what’s happening with prices in our local area, then reach out to us. Even if you’re not ready to buy, an expert local agent can fill you in with the info you need.

It’s Tax Day – Here’s How a Refund Can Help You Save For a Home

If you’ve been planning to buy a house, you know how hard it can be to save for a home. What you might not know is that your tax return can be a helpful boost to your savings and budget. According to a recent post by Freddie Mac:

“ . . . your tax refund from the IRS can be a useful supplement to your homebuying budget.”

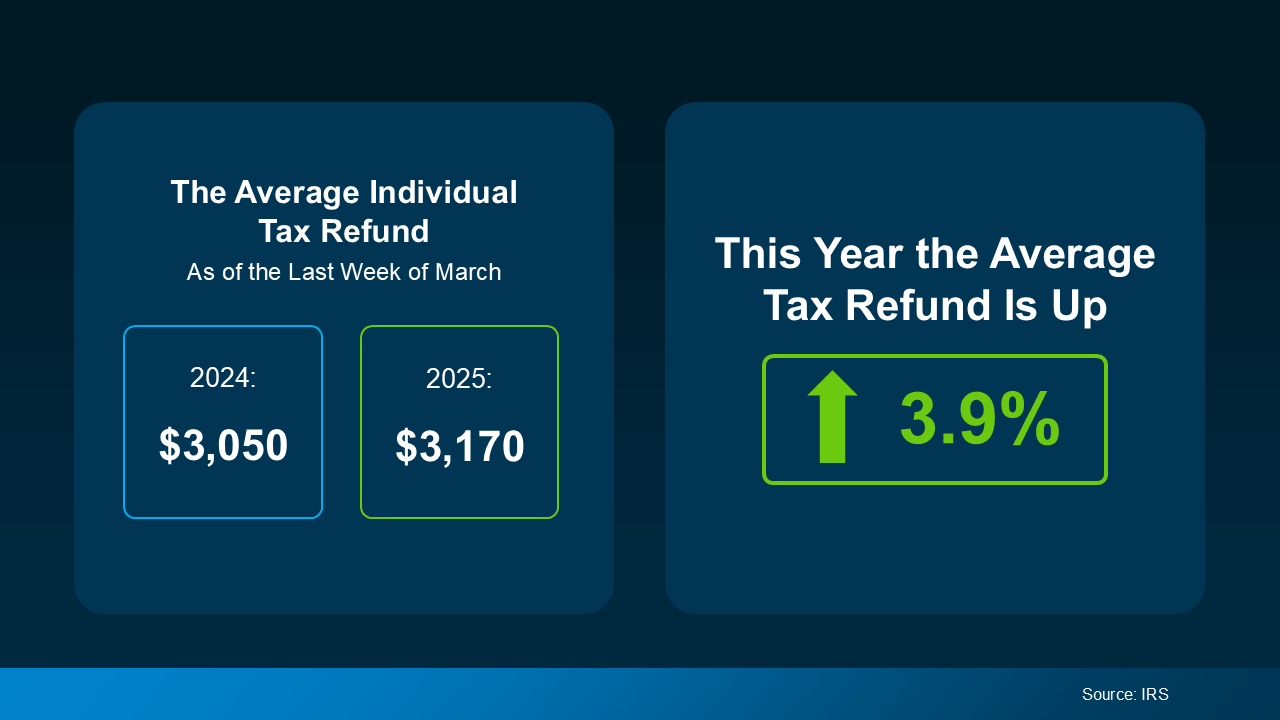

So if you’re planning to get a tax refund this year, consider the difference that extra funding can make. A refund can help you pay for the upfront costs of homebuying, like a down payment or closing costs. And, according to the IRS, your tax refund may even help you out this year more than ever.

How a Tax Return Can Help You Buy a Home in 2025

Recent data from the Internal Revenue Service (IRS) has found that the average individual’s refund is 3.9% higher this year. And while that’s not a huge increase, it can make a big difference if you’ve been struggling to save. The graphic below visualizes the new IRS data, comparing the average tax return in March 2024 to March 2025.

Your own personal tax refund will likely vary, but any financial boost helps when you’re saving for a home. According to Freddie Mac, the following are several ways you can put your tax return to good use when homebuying:

- Saving for a down payment – A down payment on a home is often one of the biggest obstacles to homeownership that buyers face. Saving your tax refund for a down payment can be a smart way to make this major step easier. Keep in mind while a 20% down payment may be common, it’s not typically a hard requirement to buy.

- Paying for closing costs – Usually due at closing, closing costs include fees for services like the appraisal, title insurance, and underwriting of your loan. While these vary by state, they’re often between 2% and 6% of your home’s total final purchase price. As a much lower percentage of your home’s price, closing costs can be a great use of your yearly refund..

- Lowering your mortgage rate – Lenders sometimes give buyers the option to buy down their mortgage rate if they qualify. This allows buyers to pay an upfront fee to lower their initial mortgage rate, reducing monthly payments in the short-term. This option can be particularly helpful if interest rates and mortgage payments are a major homebuying hurdle you’re facing..

Financially speaking, this may be more complicated in practice, but there’s no need to do it all on your own. Working with an experienced, trustworthy real estate professional can simplify your financial planning, helping you reach the best decision possible. An agent who understands the homebuying process, your unique financial needs, and your personal goals can make all the difference.

Conclusion

If you’ve been saving for a home, you already know well that every penny counts. Your tax return probably won’t be the final financial boost you need, but there are ways to use it effectively. Planning and identifying how to best spend that money can give you a real, meaningful step toward buying your home.

Are you eager to buy a home but having trouble making things work? Contact us today. We can connect you with local lenders and agents to help make your dream of homeownership a reality.

Get Ready: The Best Time to List Your House This Year Is Coming Soon

If you’re waiting for the best time to list your house this year, then wait no longer. Experts have looked at the data, and the best week to list your house in 2025 is almost here.

A recent study from Realtor.com analyzed years of housing market trends and found that April 13–19 is expected to be the best week this year to list your house:

“. . . we’ve identified April 13-19 as the best week to list for sellers . . . a seller listing a well-priced, move-in ready home is likely to find success. Because spring is generally the high season for real estate activity and buyers are more plentiful earlier rather than later in the year, listing earlier in the spring raises a seller’s odds of a successful sale.”

Why Is This the Best Time?

Spring is typically a strong season for sellers and when the housing starts to really take off every year. But according to Realtor.com, this window could be particularly advantageous in 2025 thanks to a few key factors. Here are the biggest influences that make April 13-19 the ideal week for new listings:

- More potential buyers are looking at your home since demand is usually highest in the spring and summer every year.

- A faster, easier sale since many serious, committed buyers are eager to move before summer.

- Higher chances of getting the best offer. According to Realtor.com, you could get $4,800 more on average this week, and $27,000 more than earlier in the year.

Want Your House Listed at the Best Time? Start Now

Only a couple weeks are left before the year’s prime listing week, but you can still make the deadline. If you’ve been planning to list for a while, a smart plan and quick action can make it happen. This is where working with a great local real estate agent can make all the difference between selling and not. An expert agent can help you:

- Figure out exactly what you need to do to get your home ready to list and, eventually, sold.

- Prioritize the tasks to make the biggest impact on your listing and chances of selling in the shortest time.

- Identify any quick fixes or easy upgrades to help you attract as many potential buyers as possible.

If your house is already in good repair and condition, your focus should be on quick, value-adding updates. The idea is to eliminate any potential dealbreakers for interested buyers, as Investopedia says:

“You won’t have time for any major renovations, so focus on quick repairs to address things that could deter potential buyers.”

With the April 13-19 window fast approaching, the quicker you can finish these projects, the better. Here are some small projects recommended by Redfin you can do that can make a big difference to interested buyers:

What if You’re Not Ready to List?

If you don’t think you’ll be ready to list before this windows passes, then don’t worry. Even though Realtor.com expects April 13–19 to be the best time to list, it’s not the only good time to sell. What’s most important is getting your home ready to maximize its attractiveness to buyers when you do decide to list. Even if you list a bit late, there’s still plenty of opportunity before prime homebuying season is over.

Conclusion

If you’ve been waiting for just the right moment to sell, April 13-19 could be the perfect time. Realtor.com projects this as the best time to list your house this year, but there’s a bit more to consider. Making sure your home is fully prepped and priced competitively for your local market can make the difference.

Ready to list but need a real estate agent’s advice and expertise first? Reach out today and we’ll connect you with a local expert who can help you list and sell your home fast.

The Spring 2025 Housing Market: 4 Things To Expect

Spring is in full swing, and the spring 2025 housing market is swinging along with it. Wondering whether now is the right time to finally buy a house or sell your home? Here are four trends you can expect in the market this year, and what they mean for you.

1. More Homes on the Market

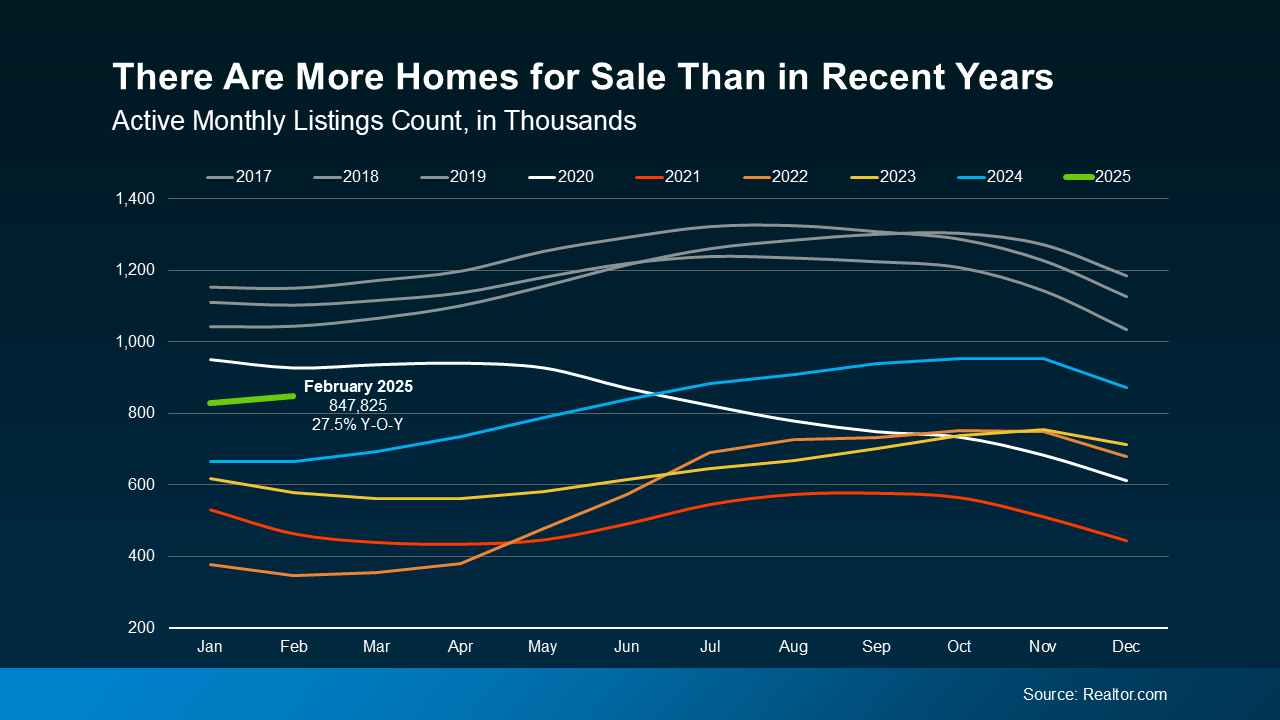

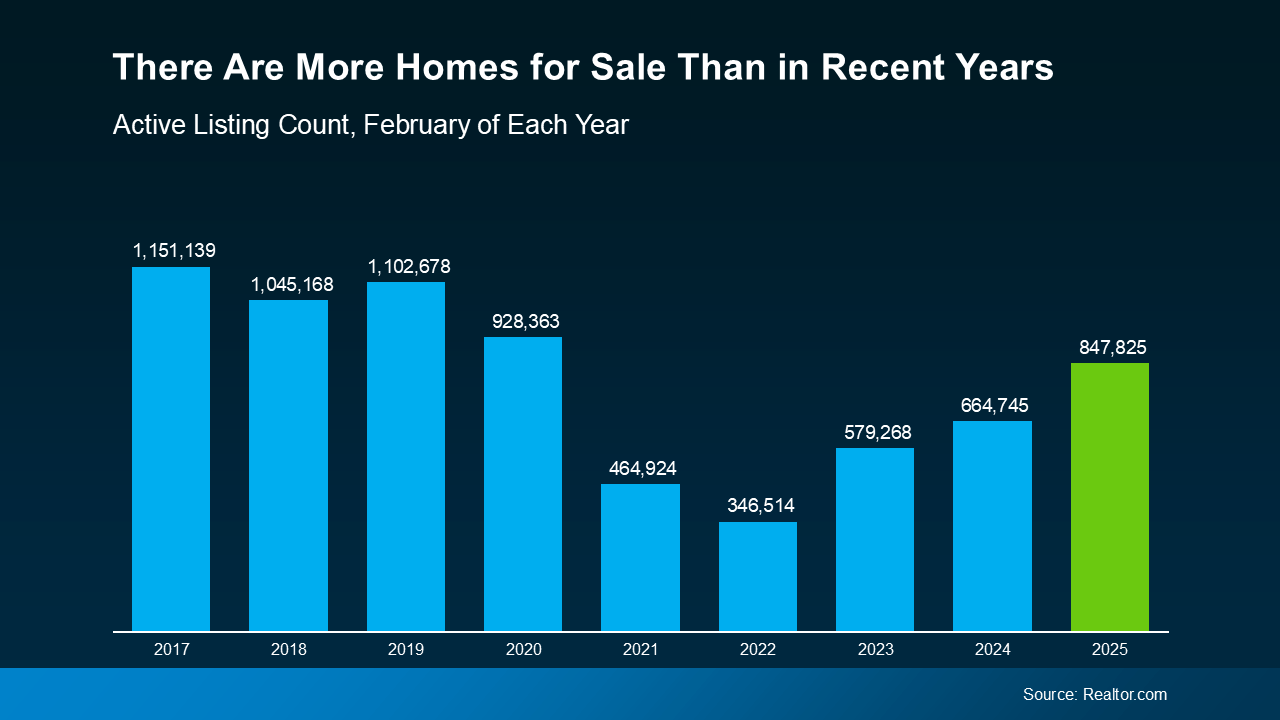

After years of housing shortages nationwide, the number of homes for sale is finally improving. According to recent national data from Realtor.com, active home listings are up 27.5% compared to this time last year. Housing inventory took a tremendous dive in 2020, but at long last, it’s close to reaching pre-pandemic levels this spring.

The graph below shows monthly active listing count for each year dating back to 2017. As you can see, even though inventory levels still haven’t quite returned to pre-pandemic norms, they’ve improved over last year. In fact, they’re almost at 2020 levels, and will likely exceed them this summer if their upward trend continues.

For Buyers: More housing inventory means you have more options and choices. Having options means you can be more selective, and that sellers may be more willing to negotiate with you.

For Sellers: With more homes available, you’re more likely to find the right house to move into. With inventory still below normal levels, your current home will stay in higher demand, at least until home supply normalizes.

2. Home Price Growth Is Slowing

As inventory increases, the rate of home price growth is slowing down as prices respond to buyer demand. This will continue through the spring 2025 housing market and beyond into 2026 if the current trend holds steady. With more homes for sale, eager buyers are less pressured to compete for limited inventory. Price growth will continue to slow as supply rises and buyers enjoy more options, but it will generally remain positive. A recent projection from Freddie Mac says:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

Every housing market is different, so while home prices are rising nationally, this may not be true everywhere. Some markets are actually seeing stronger price growth, while others are slowing or even seeing home prices decline.

For Buyers: Slower home price growth means prices aren’t rising as quickly as before. Still, any home you buy now is likely to appreciate in value over time, helping you build equity.

For Sellers: Home prices are still rising, but you may need to temper your expectations in terms of pricing your home. Pricing too high in a more competitive market could mean your house takes longer to sell. Listing at a price point competitive with your local market is going to become a key factor as prices normalize.

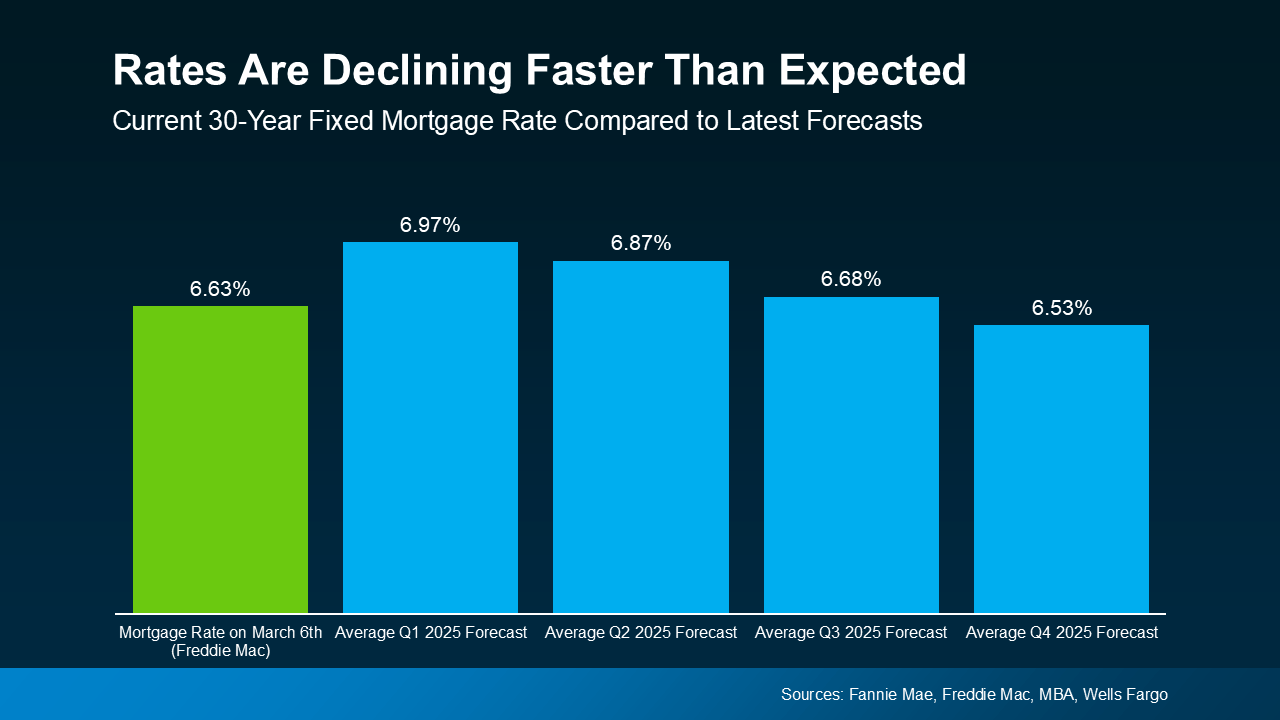

3. Mortgage Rates Are Falling and Stabilizing

One of the biggest obstacles for buyers – especially new ones – since the pandemic has been higher, less predictable mortgage rates. Fortunately, rates have been slowly stabilizing so far in Q1 of 2025, and have even dropped faster than experts anticipated. These aren’t the 3% rates of 2020, but less volatile rates give buyers more reason to buy with confidence. As Chief Economist at CoreLogic Selma Hepp says:

“With the spring homebuying season upon us, the recent improvements in mortgage rates may help invite homebuyers back into the market.”

For Buyers: When mortgage rates are stable, planning ahead is easier because your future payments are likely to be more predictable. But keep in mind that even though mortgage rates are stabilizing, they’re still far from being completely static. When buying, consult your agent and lender to stay current with rates and how they might affect your plans.

For Sellers: Lower rates starting to stabilize means more buyers are becoming active – especially those who have been patiently waiting. This means increases in housing demand and more potential interested buyers for your house.

4. More Buyers Are Entering the Market

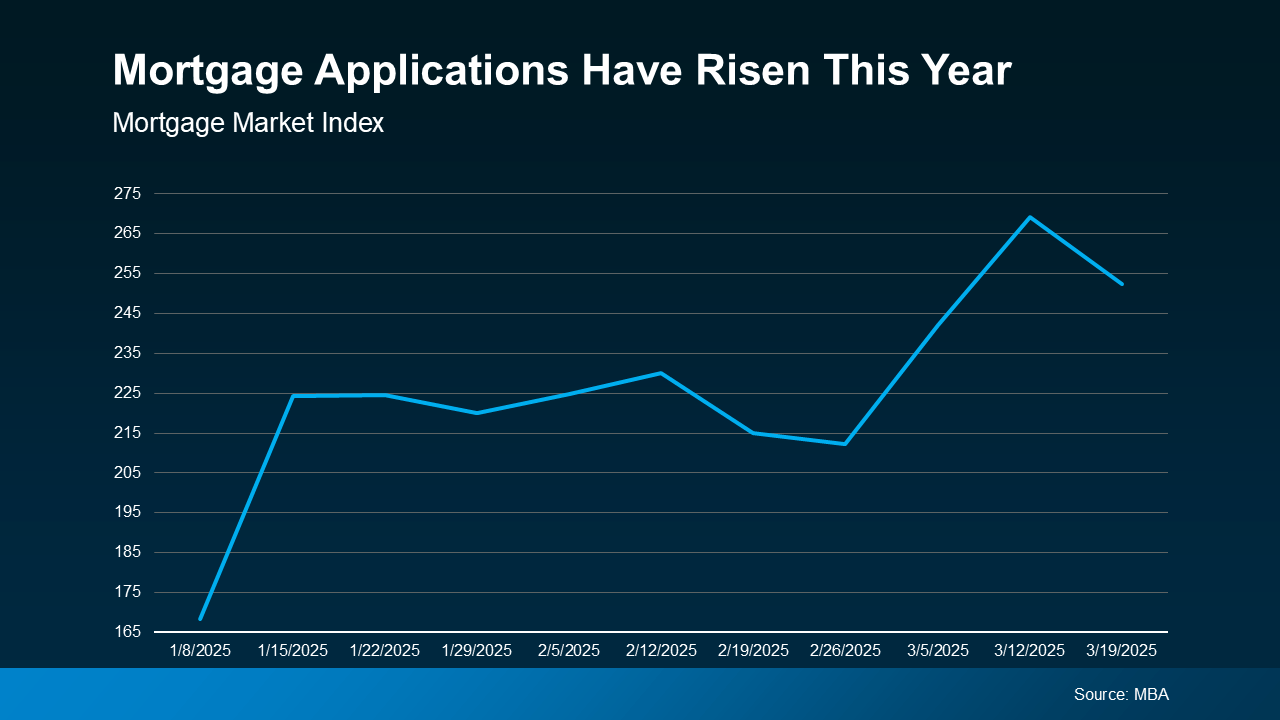

With more inventory, slowing price growth, and stabilizing mortgage rates, buyers are gaining confidence and finally reentering the market. Demand is increasing, and recent data from the Mortgage Bankers Association (MBA) shows an uptick in mortgage applications compared to the start of the year.

For Buyers: The spring 2025 housing market buying season is quickly heating up. Making your move now and getting a leg up on your competition could be a wise strategy this spring.

For Sellers: Eager buyers wanting to buy a home in the spring or summer are entering the market quickly. Naturally, this is great news for you: more buyers means a better chance of selling your home fast.

Conclusion

Between more homes for sale, slowing price growth, and stabilizing mortgage rates, there’s plenty reason to be positive this spring. Buyers can expect higher housing inventory at more reasonable rates, while sellers can count on a busier market with more activated homebuyers. If you’re wondering how this spring’s trends might affect you, contact us today to get started with an expert agent in your area.

Spring Home Inventory Hits Highest Level in Five Years

The spring 2025 housing market is shaping up to be a great time for buyers. Home inventory has risen to the highest level in five years, which puts more pressure on sellers to negotiate. This grants buyers more power and more options to get the home they really want at a fairer price. Here are just a couple promising things that more houses on the market could mean for you as a buyer.

1. More Homes on the Market To Choose From

The number of homes for sale in February this year was higher than it’s been in five years, dating back to February 2020. This is the strongest home supply seen since the COVID-19 pandemic, and it’s great news for any hopeful homebuyer. The following graph shows new data from Realtor.com illustrating a significant 27.5% increase in home inventory since last year.

While inventory hasn’t returned to pre-2020 levels yet, experts say that inventory is expected to continue rising this year. More houses available means more choices, more options, and more chances to find the house you want. And according to Danielle Hale, Chief Economist at Realtor.com, more inventory will bring other welcome changes to the market.

“Buyers will not only have more home options . . . but they are also likely to find somewhat lower asking prices and more time to make decisions – all buyer-friendly factors as we inch closer to the busy homebuying season.”

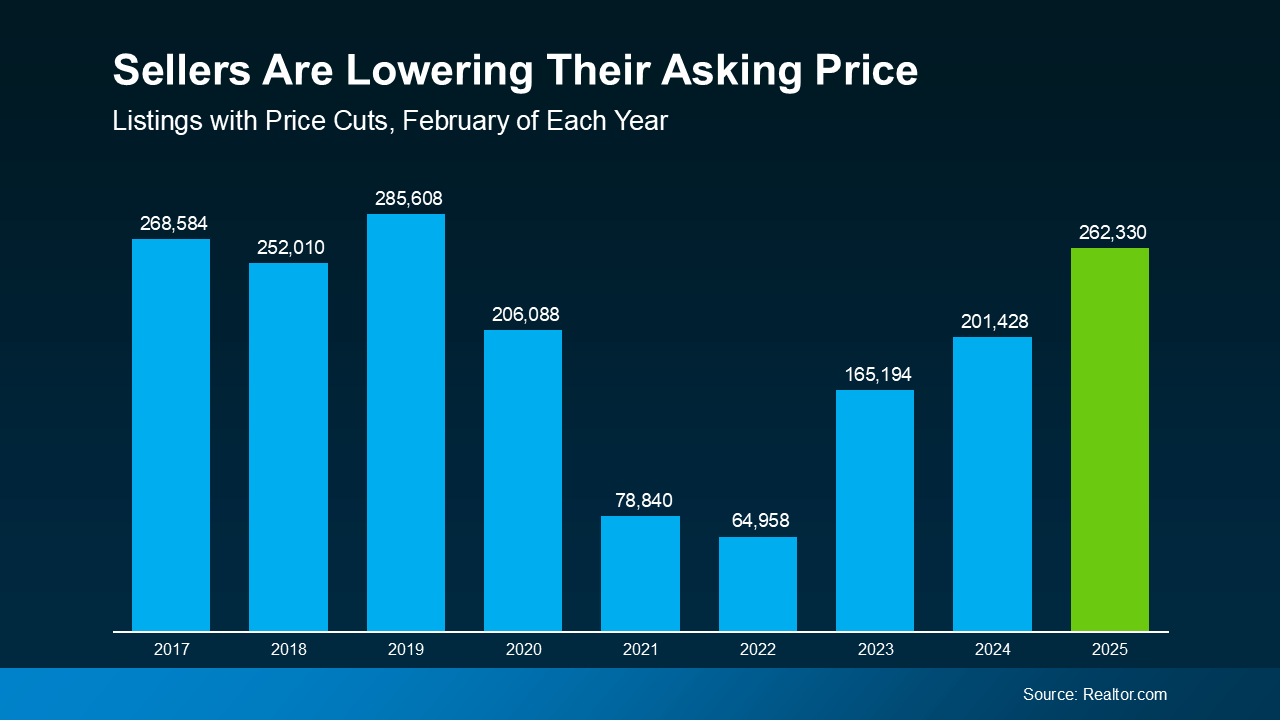

2. Sellers Are More Likely To Accept Price Cuts

When buyers have more options, some homes tend to stay on the market for longer than they otherwise would. This is especially true of homes that are initially priced too high and out of some buyers’ ideal range. When this happens, sellers are forced to drop prices to keep their listing competitive with other houses on the market. And combined with falling mortgage rates, it means a more normalized market and better deals for buyers.

Based on data from Realtor.com, the number of listings with price reductions has increased over the last few years. In fact, price reductions have even risen above the levels seen in 2020, as the graph below illustrates.

Price reductions are a great sign that sellers are more willing to negotiate and compromise today. Compared to the market’s more normal years of 2017–2019, today’s number of price cuts is much closer to what’s typical. For most buyers, this is a welcome relief, and a promising sign of where the market is headed.

For you, this could mean fewer compromises and a better chance to negotiate on price, closing costs, or even repairs. Not every seller is willing to adjust their price, but a higher home inventory means many more will. Either way, healthier inventory levels mean you have more leverage in the market than buyers have had in years.

Conclusion

If you’ve been watching the market and waiting for the right moment to buy, this spring could be the perfect time. Home supply is up, mortgage rates are down, and more sellers are cutting prices to attract eager buyers. Best of all, these trends are expected to continue into the spring, making for a stronger, healthier market for everyone.

For help navigating your unique local housing market, consider connecting with an expert real estate agent. They can talk to you about what’s happening in your area and get you started on your home search. Reach out today and we’ll connect you with a local expert who can find the home you’re looking for.

Mortgage Rates Drop to the Lowest Point in 2025 So Far

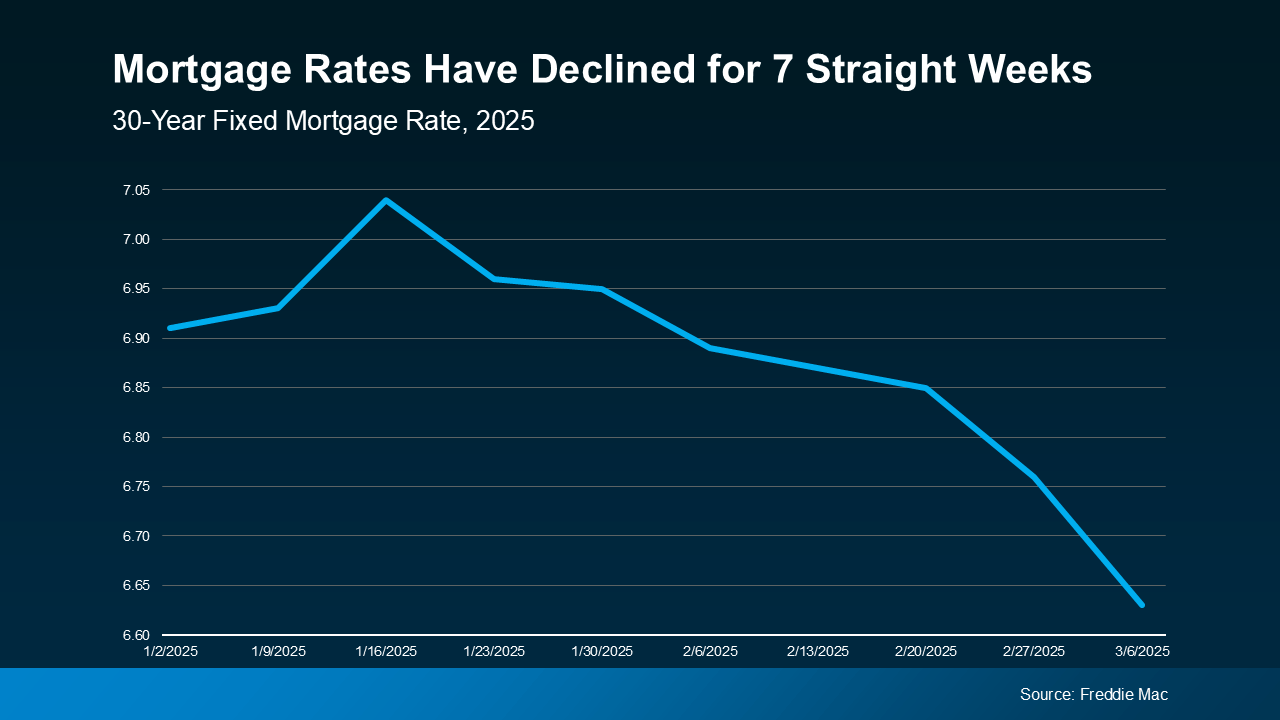

If you’ve been holding off on buying a home for a lower mortgage rate, take another look at the market. Mortgage rates are trending downward, and they just hit their lowest point of the year so far.

According to a report from Freddie Mac, mortgage rates have been falling for seven straight weeks. The average weekly rate for a 30-year-fixed mortgage is now at the lowest level its been in 2025.

This may not sound significant on its own, but it outlines a remarkable trend. A drop in rates from over 7% to the mid-6’s can make all the difference when buying a home. What’s most significant is that experts previously predicted that rates wouldn’t fall this low until Q3 of this year.

Why Are Mortgage Rates Dropping?

According to Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA), ongoing economic uncertainty is a driving force in pushing rates lower:

“Mortgage rates declined last week on souring consumer sentiment regarding the economy and increasing uncertainty over the impact of new tariffs levied on imported goods into the U.S. Those factors resulted in the largest weekly decline in the 30-year fixed rate since November 2024.”

The timing of this rate drop is great for buyers moving into the Spring 2025 market. But remember that mortgage rates can change quickly, and always expect some volatility in markets driven by uncertainty. With that said, this small window of rates dropping into prime buying season might be exactly wait you’ve waited for.

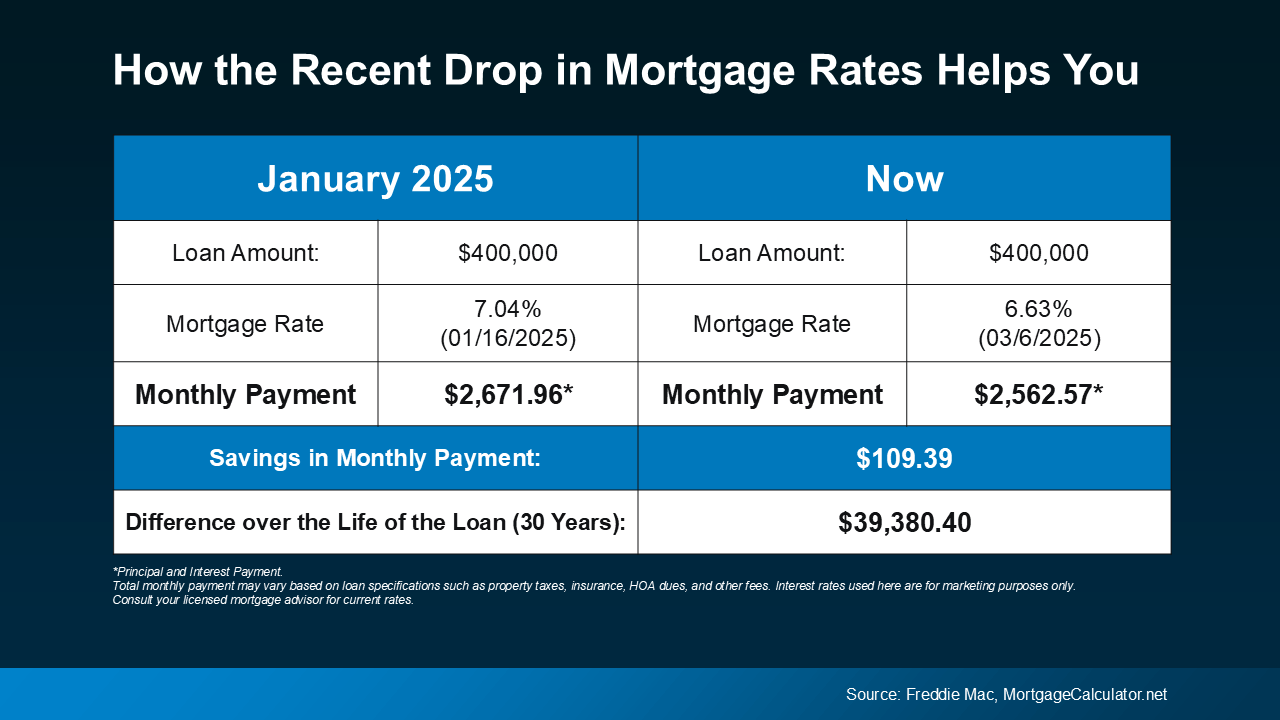

What Falling Mortgage Rates Mean for Your Buying Power

Even a small reduction in your mortgage rate can make a huge difference in your monthly housing payment. The chart below shows what a monthly payment (principal and interest) would look like on a $400K home loan if you purchased a house when rates were 7.04% back in mid-January (this year’s mortgage rate high). The right side shows what it could look like if you buy a home now at current rates.

In just the past few weeks, the expected payment on a $400K loan has come down by over $100 per month. That’s a significant savings that can make a world of difference when deciding to buy a house.

Recent economic shifts have driven rates down faster than expected, and that’s great news. But remember that this could change at any time in the coming days and months for better or worse. So if you’re waiting for rates to fall further before you buy, think hard about the current window of opportunity before making a decision.

Conclusion

Mortgage rates have dipped to their lowest point in 2025 so far. This grants buyers a great position moving into the spring buying season, especially for those who have been waiting. The unpredictability of the market and larger economy mean volatility, so get expert advice and consider before making a decision.

Home Price Growth Is Slowing in 2025 – What Does That Mean for You?

Over the past few years, home prices have skyrocketed as demand has increased and supply has stiffened. It’s been a frustrating market for buyers, leaving many to doubt their chances of ever owning their own home. But the early weeks of 2025 have brought welcome news: the pace of home price growth is finally slowing down, and that’s a positive shift for anyone looking to buy a home.

Home Price Growth Drops to a Healthy Pace

At the national level, home prices are still rising, but at a much more normal, manageable rate compared to the double-digit spikes we saw in 2021 and 2022. Recent data from Case-Shiller show that in November 2024, the year-over-year increase in home prices was just 3.8% nationally, a clear drop from Pandemic rates:

What does this mean for you? For one thing, you’re less likely to experience the sticker shock that was common just a few years ago. The days of rapid price jumps that made it difficult to plan or pursue your purchase are behind us, and projected drops in mortgage rates this year paint an even more positive picture. More stable price growth also means that the home you buy today is still likely to appreciate in value over time, helping you build equity and secure your financial future.

Real Estate Is Local: Prices Vary by Market

While the national trend is pointing to more moderate price growth, keep in mind that all real estate is local. Some markets are still experiencing strong demand and upward price pressures, while others are cooling off or even seeing declines. For example, smaller, more affordable metro areas are still seeing significant demand and price increases. As CoreLogic Chief Economist Selma Hepp explains:

“Regionally, variations persist, as some affordable areas – including smaller metros in the Midwest — remain in high demand and continue to see upward home price pressures.”

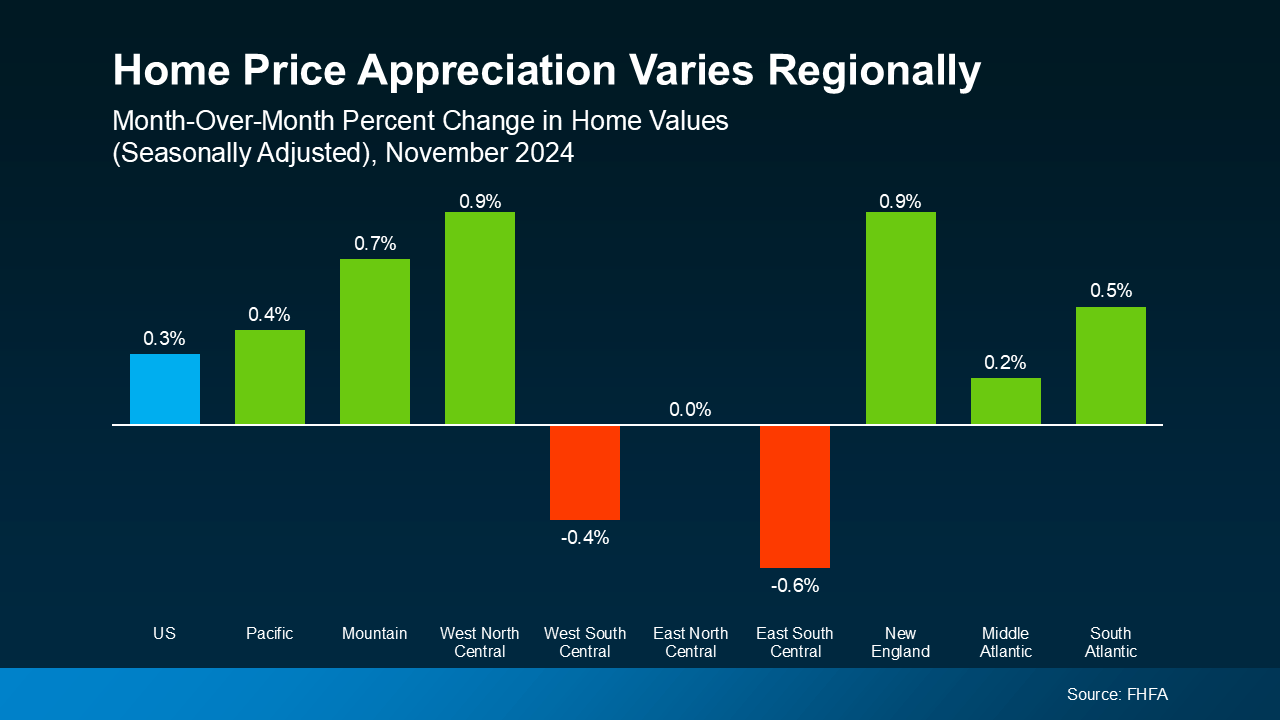

Meanwhile, other regions, particularly those in southern markets, experienced slight month-over-month declines in November, according to Federal Housing Finance Agency (FHFA) data:

Differences like these highlight the importance of understanding what’s happening in your specific market. National averages can provide a general idea, but they rarely give you the whole picture. That’s where the knowledge and expertise of a local real estate agent can really help. They can help you understand local trends, identify opportunities, and create a buying strategy tailored to your needs and budget. Whether you’re buying in a high-demand market or one that’s cooling off, having a local expert on your side ensures you’re making more informed and confident decisions.

Conclusion

Home prices in early 2025 are growing at a more manageable pace, giving you the opportunity to plan your purchase without fearing the rapid price hikes of recent years. Connecting with a local real estate agent can help you navigate your area’s local home market, and make the best decision possible.

If you’re thinking about buying a home, 2025 is shaping up to be a great time to explore your options. Reach out to us today to connect with a local expert who can help you buy with confidence and find the perfect home for you.

Closing on a House: A Step-By-Step Buyer’s Guide

The process of closing on a house is the final stretch before home ownership is transferred and the property becomes legally yours. If you’re a new homebuyer, the closing process and its various steps can be confusing and intimidating. This short guide will outline the home closing process and help simplify your final steps to home ownership.

10 Steps to Closing on a House

The closing process can vary from transaction to transaction but generally tends to follow the same basic milestones. Here are 10 major steps of the closing process you’ll need to follow to complete your home purchase.

1. Offer and Acceptance

The closing process typically begins when the seller accepts your offer to purchase the home. This agreement sets the terms, including the purchase price and any contingencies.

2. Open an Escrow Account

Escrow plays a pivotal role in the real estate closing process. An escrow account is established to hold funds and documents until the transaction is finalized. This account is managed by a neutral third party, such as an escrow agent or title company, which also manages the transfer of the property title.

3. Conduct a Title Search and Obtain Title Insurance

A title search ensures the property is free of liens or ownership disputes so you can be sure you’re buying a home with a clear title. Meanwhile, title insurance protects you from future claims against the property and covers legal costs if past owners have unresolved claims. Together, a title search and insurance provide a buyer with legal safeguards and extra peace of mind during the closing process.

4. Schedule a Home Inspection

Hire a professional inspector to evaluate the property’s condition. Address any issues identified during the inspection by negotiating repairs or price adjustments with the seller. While costly, this will save you from any unexpected repairs and expenses after closing.

5. Negotiate Closing Costs

Work with the seller to determine who will cover specific closing costs, which may include loan fees, appraisal fees, and title insurance. Always review your settlement statement thoroughly to understand what costs you’re responsible for and if any are negotiable.

6. Secure Financing

Finalize your mortgage by submitting required documents, locking in your interest rate, and obtaining loan approval. Ensure you receive a Loan Estimate and Closing Disclosure from your lender. Timelines for a mortgage approval can vary, so stay in constant communication with your lender to monitor progress and respond promptly to any additional requests they make.

7. Review All Documents

Carefully review the Closing Disclosure (or settlement statement), which outlines the final loan terms and closing costs. Pay special attention to any discrepancies in loan terms or fees to avoid unexpected expenses in the future. Verify all details are accurate and address any remaining issues immediately.

8. Conduct a Final Walk-Through

Perform a final inspection of the property within 24-48 hours before closing. Confirm the property is in the agreed-upon condition and that all negotiated repairs have been completed. Following a walk-through checklist can be a convenient way to personally check each area of the home ands its condition.

9. Attend the Closing Meeting

At the closing meeting, sign all necessary documents, including the deed, mortgage, and promissory note. Pay the remaining closing costs and down payment. Address any potential closing delays, such as remaining problems from the title search or home inspection.

10. Transfer of Ownership

Once all documents are signed and funds are transferred, the title is recorded, and ownership officially transfers to you. You’ll receive the keys to your new home and will finally be ready to begin moving in. Congratulations!

Conclusion: From Buyer to Homeowner

With the closing transaction complete, it’s time to enjoy your new home! Before putting your closing behind you, take care of any post-closing responsibilities you may still have to a third party other than your lender. Next, you’re ready to begin your transition into the next step of your journey as an official new homeowner.

Interested in closing on a house or making that first leap into home ownership but unsure where to start? Contact us today to connect with an expert real estate agent for help on your homebuying journey, or start a property search in your local area now.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link