Mortgage Rates Just Hit a 3-Year Low. Does It Matter in 2026?

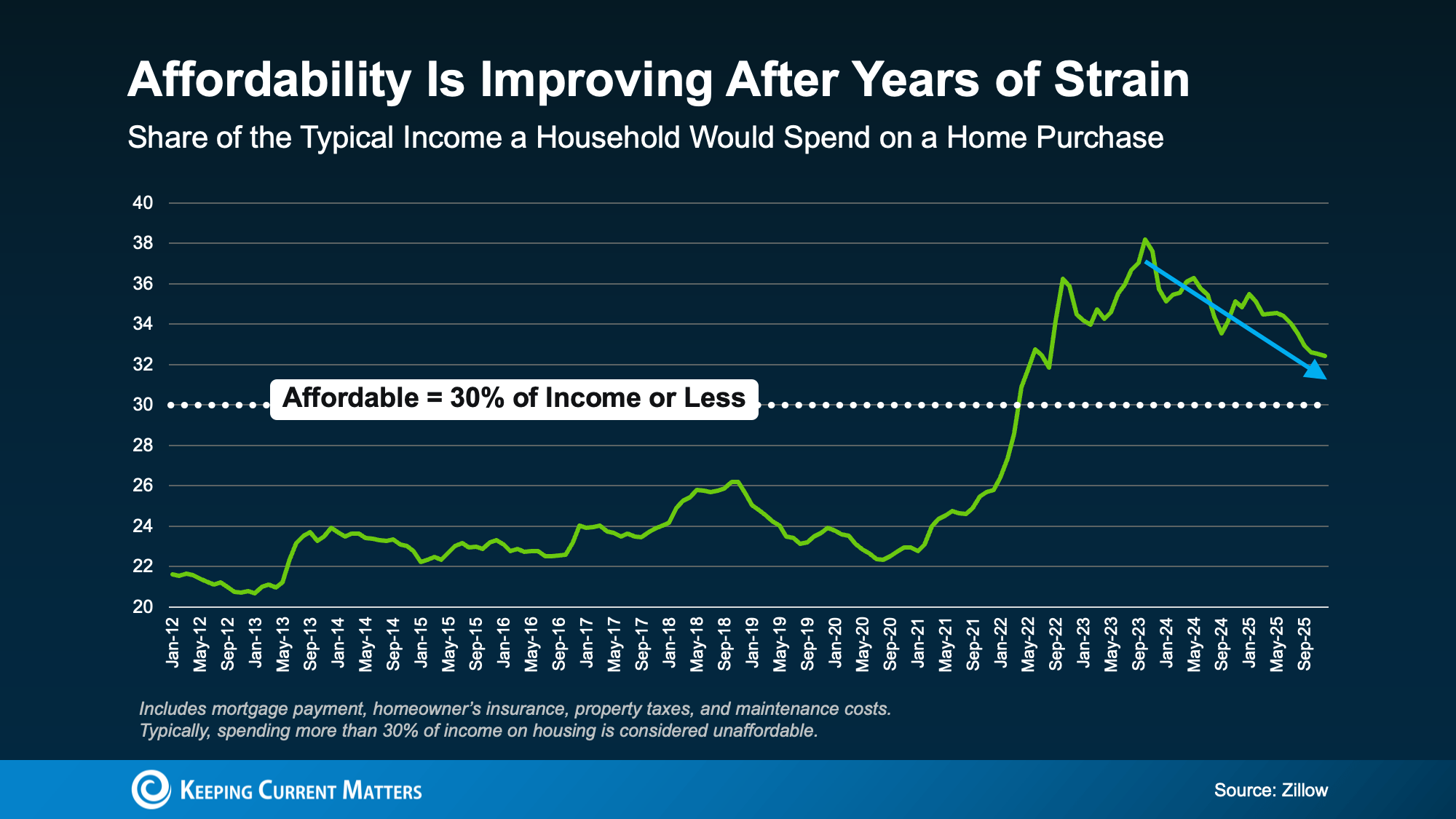

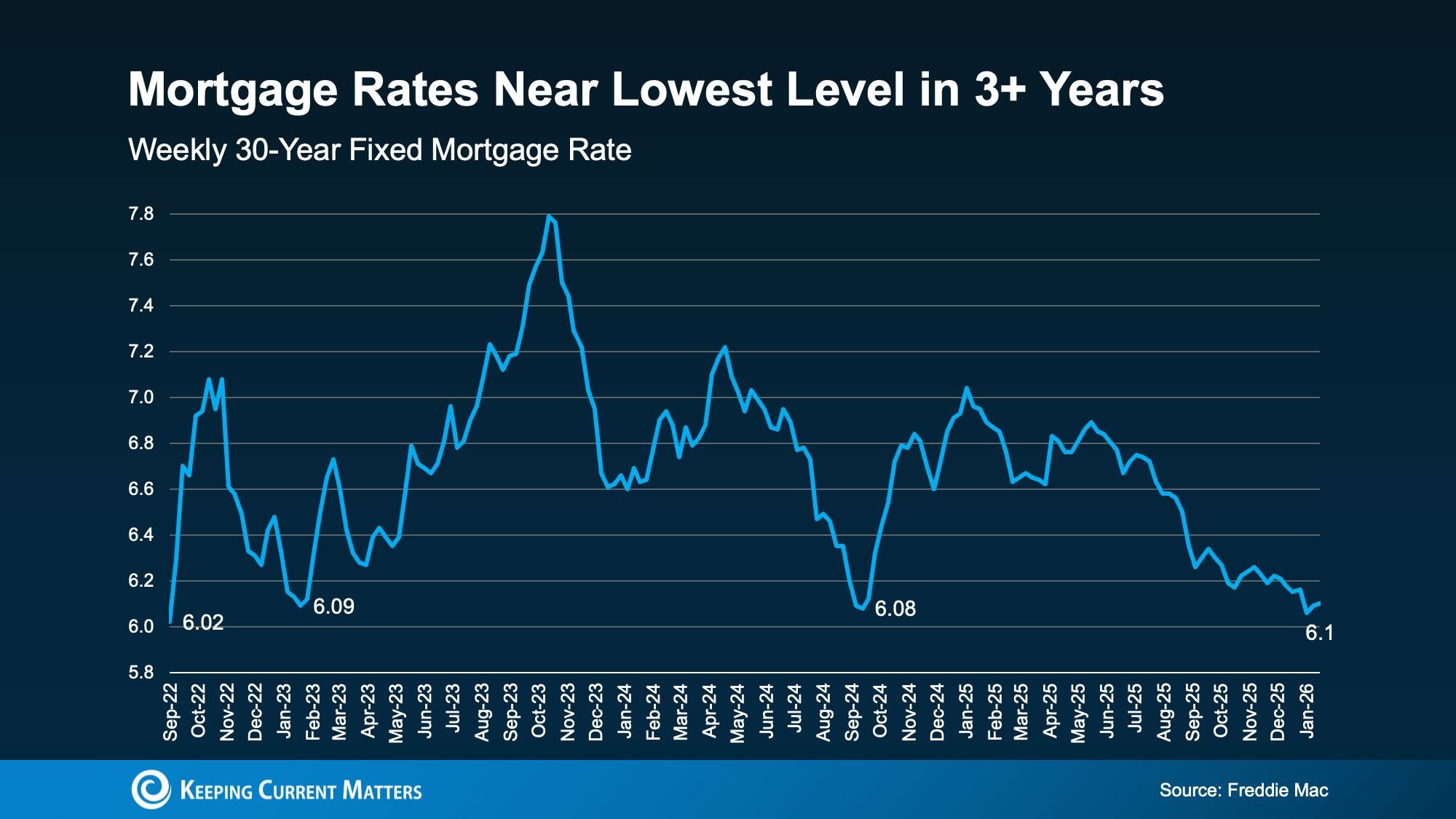

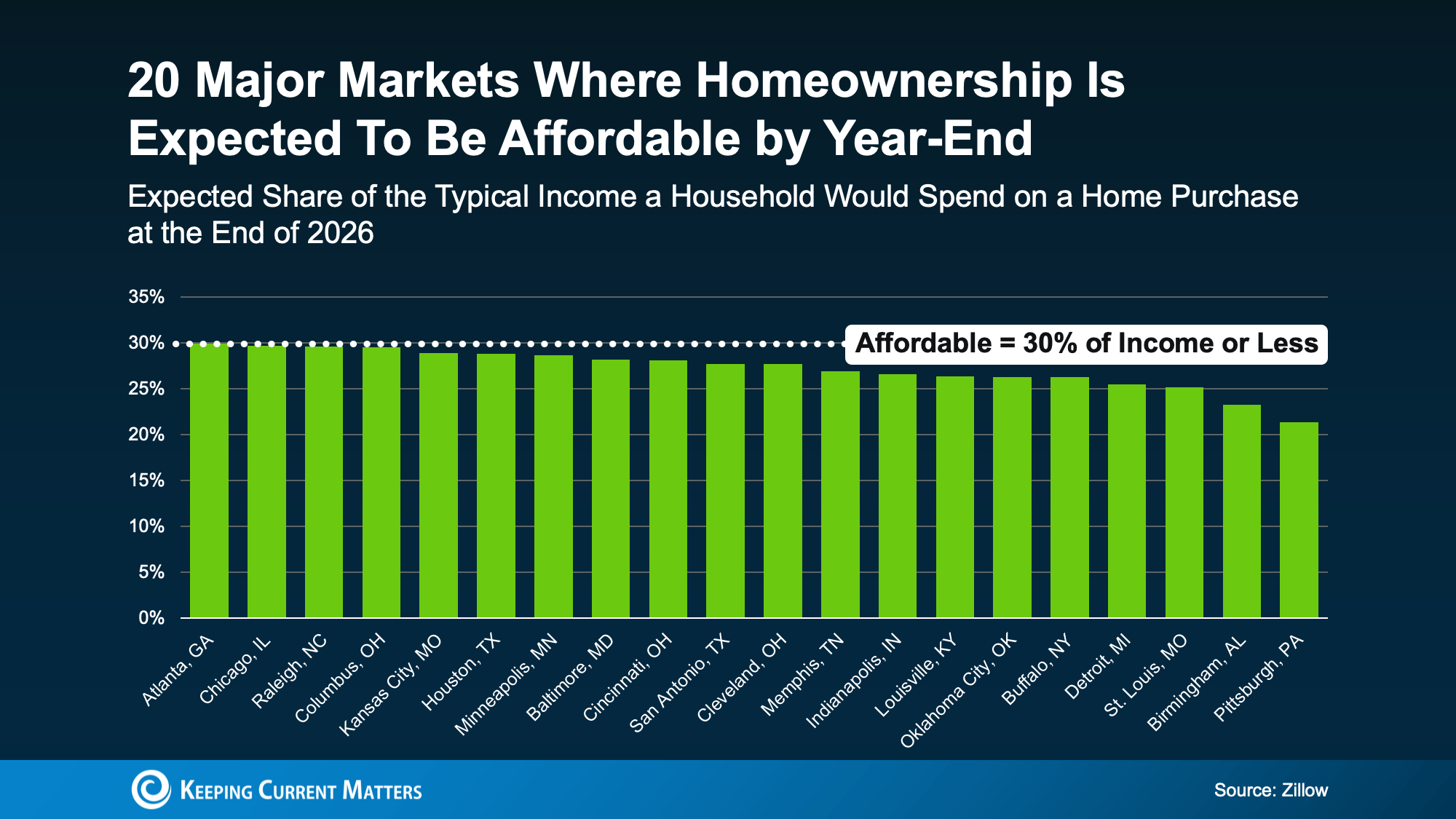

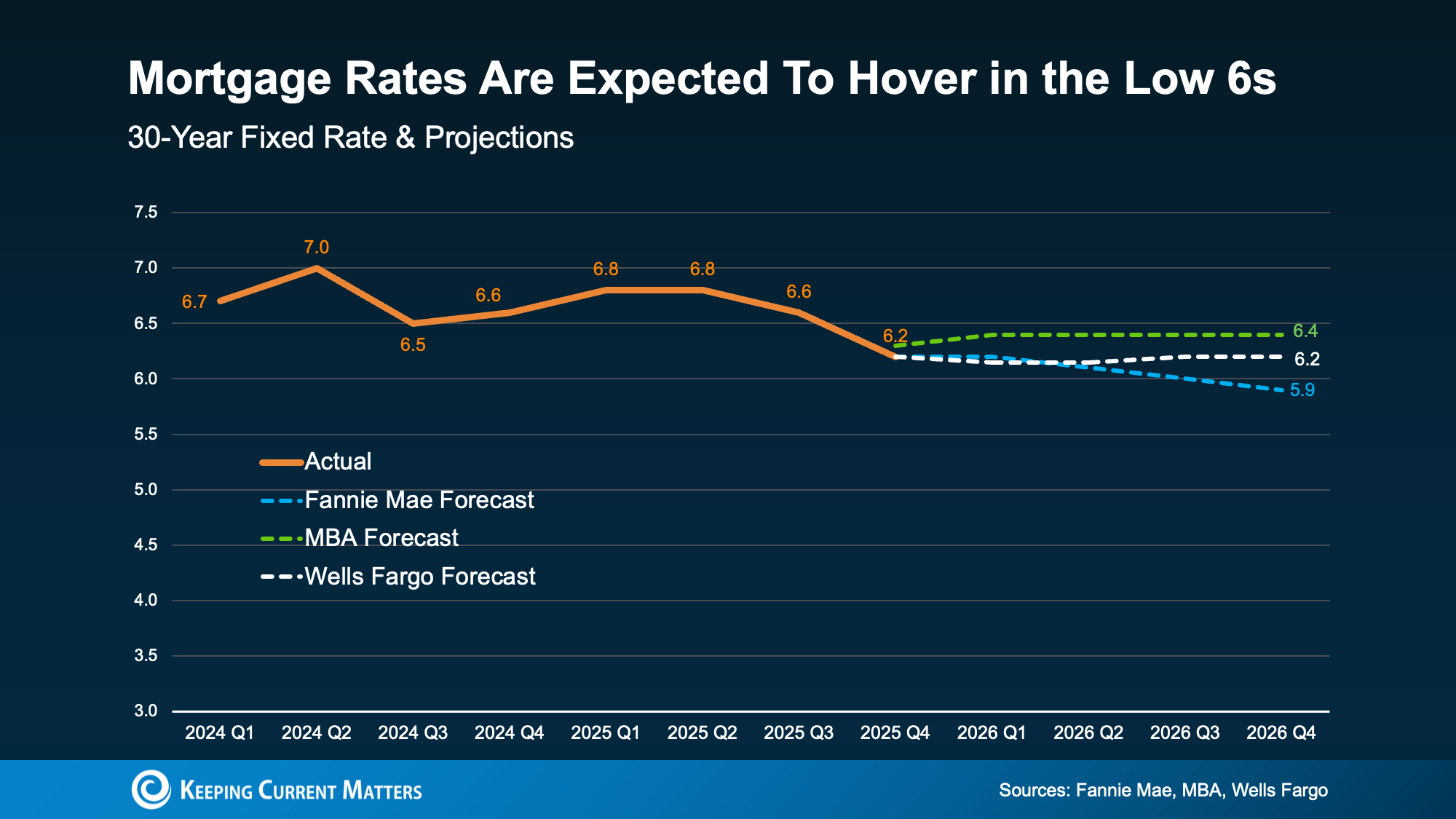

If you’ve been watching mortgage rates and waiting for a “better time” to buy, here’s your chance. Rates just dipped below 6% for the first time in more than three years. Even modest rate movement can change what you can afford, how competitive you can be, and whether buying feels realistic again, especially if last year’s higher rates pushed you to the sidelines.

With rates finally easing up into 2026, here’s a fresh take on why lower mortgage rates are still a big deal, plus what to do next if you’re thinking about making a move.

Why Mortgage Rates Impact More Than Just Interest

A mortgage rate isn’t just a number on a lender’s website. It shapes the entire homebuying experience because it affects:

- Your monthly payment

- How much home you can qualify for

- Your comfort level with your budget

- How competitive your offer can be

When rates jump, affordability tightens fast. That’s why many buyers (especially first-time homebuyers) feel the pinch first. When rates ease, the reverse happens: budgets get a little more breathing room, and choices open up.

The “One-Point” Difference That Changes the Math

One of the easiest ways to understand why rate declines matter is to look at a simple example.

When rates are closer to 7%, monthly payments rise sharply. When rates move closer to 6% (or below), payments can drop meaningfully. On a typical loan amount, that can translate into hundreds of dollars per month in savings compared to the higher-rate environment.

That difference can help you:

-

Stretch your budget without stretching your lifestyle

-

Consider more homes in a neighborhood you actually want

-

Keep cash available for repairs, furnishing, or future goals

In practical terms, the change isn’t just “cheaper interest.” It can be the difference between compromising on your wish list and finding a home that fits.

What Lower Rates Can Unlock for Buyers

When borrowing costs come down, three things usually happen for homebuyers:

1) Lower monthly payments

A lower rate can reduce the monthly principal-and-interest payment, which helps many buyers feel more confident about moving forward.

2) More buying power

When the payment drops, you may qualify for more home at the same monthly budget. That can mean a better location, an extra bedroom, or a property that needs fewer updates.

3) Stronger offers without overextending

More budget flexibility can help you compete without taking on a payment that makes you uncomfortable. That matters in markets where inventory is still tight and desirable homes move quickly.

Why This Can Bring More Buyers Off the Sidelines

Rate changes don’t only affect you. They affect everyone who has been waiting, too.

Industry research suggests that when rates sit around certain thresholds, millions more households can afford a median-priced home. In fact, research from the National Association of Realtors (NAR) points to 5.5 million additional households being able to afford the median-priced home when rates are at 6% or below, and it estimates roughly 550,000 of those households could buy within the next 12 to 18 months.

That matters because it signals something important: pent-up demand can return quickly when affordability improves.

If you’re home-searching now (or preparing to), you may be able to act before competition fully ramps back up.

A Quick Reality Check: Rates Aren’t the Only Factor

Lower rates help, but they don’t magically make every home affordable. Your true monthly cost depends on several moving pieces, including:

-

Home price

-

Local inventory and competition

-

Property taxes

-

Homeowners insurance (which can vary widely by state and ZIP code)

-

HOA dues

-

Your down payment and credit profile

That’s why the smartest next step isn’t guessing. It’s running real numbers to figure out what “affordable” looks like for you.

What To Do Next If You’re Considering Buying

If you’ve been waiting for rates to improve, here’s a simple, practical plan:

-

Get pre-approved (not just pre-qualified).

Pre-approval gives you a clearer budget and shows sellers you’re serious. -

Calculate your comfortable payment range.

Decide what fits your life, not just what a lender says you can qualify for. -

Compare scenarios with your lender.

Ask for payment examples at different price points, down payments, and rate options. -

Watch inventory in your target neighborhoods.

The best “deal” is the home that works for your needs and your budget.

Conclusion

Mortgage rates easing from last year’s highs isn’t just an attractive headline. For many buyers, it can be the shift that turns “maybe someday” into “this could actually work.”

If you paused your search when rates were higher, it’s worth revisiting your numbers now. A quick conversation with a trusted lender can show what today’s rate environment means for your payment, your buying power, and your options.

If you’re thinking of buying, or need help finding a lender, reach out to us today. We can connect you with local agents and lenders to make your journey as simple as possible.

Top 12 Home Improvement Projects That Add the Most Value

Home improvement projects can be productive, fulfilling ways to spend your spare time. But, they can also be costly ventures that end up being more trouble than they’re worth. Your invested time, money, and energy matter, and some upgrades don’t offer the return on investment you expect. U.S. News Real Estate explains it this way:

“. . . not every home renovation project will increase the resale value of a home. Before you invest in a swimming pool or new addition, you should consider whether the project will pay itself off by getting prospective buyers in the door when it’s time to sell.“

Like most projects, home improvement is best tackled when you’ve done all the planning beforehand. That’s why it pays to know the cost of your project, and how much it might increase your home value. Whether you have plans to move or not, strategizing to find the best project will pay off in the long run.

How Preparation Pays Off

If you’re planning to move soon, starting early can make a valuable difference. And if you’re not, you’ll still be glad you planned ahead when life’s surprises get in the way. If your moving timeline changes, you won’t want to shell out extra for rushed projects on short notice.

By doing home updates now, you can work at your own pace, saving yourself headaches and money later on. You’ll also have time to enjoy the updates you make to your home before you decide to move. And when you do move, you’ll rest easier knowing there’s no laundry list of work left before you list.

What Buyers Really Want

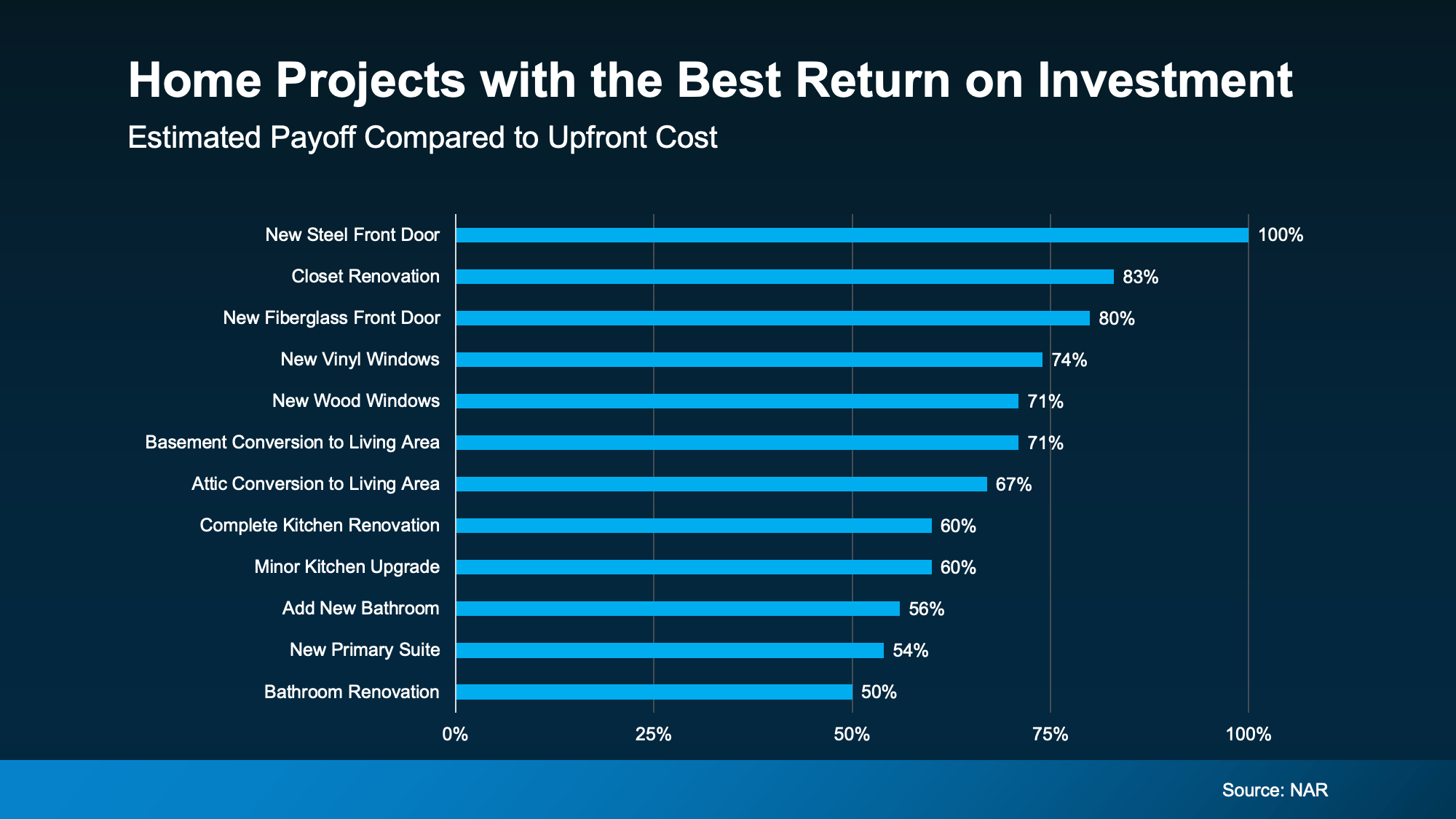

Your first step is choosing a project that will increase your home’s appeal to buyers at selling time. So if you’re not sure what projects are worth your time and money, new industry data can help. A recent study from the National Association of Realtors (NAR) shows the top upgrades offering the best return on investment (ROI).

As the graph above shows, the top home improvement projects that add the highest (estimated) value are as follows:

- New Steel Front Door – 100% return on investment.

- Closet Renovation – 83% return on investment.

- New Fiberglass Front Door – 80% return on investment.

- New Vinyl Windows – 74% return on investment.

- New Wood Windows – 71% return on investment.

- Basement Conversion to Living Area – 71% return on investment.

- Attic Conversion to Living Area – 67% return on investment.

- Complete Kitchen Renovation – 60% return on investment..

- Minor Kitchen Upgrades – 60% return on investment.

- Bathroom Addition – 56% return on investment.

- New Primary Suite – 54% return on investment.

- Bathroom Renovation – 50% return on investment.

If you’ve already been thinking about a high-ROI project on this list, that’s great news. There’s a good chance it’ll improve your living quality now and increase your home’s value in the long term.

But remember that this list is based on national data using averages from listings sold nationwide. The most in-demand improvements that buyers will pay for depends largely on your local real estate market. That’s where talking to a local agent can help, as an article from Ramsey Solutions explains:

“The best way to gauge what you can expect in terms of resale value on home improvements—especially if you’re planning to sell soon—is to talk to a real estate agent who is an expert in your market. They’re sure to know the local trends, and they can show you how other homes with the features you want to add are selling. That way, you can make an educated decision before you start ordering lumber and knocking down walls.”

At the same time, be careful not to overdo it on home improvements. An excess of upgrades can raise your home’s price right out of the local market. And while that may sound ideal, it can make your listing unattractive to the buyers in your area. This is another area where a local agent can help you choose the best projects for your specific market.

Conclusion

Whether you have moving plans on the horizon or not, making thoughtful, deliberate home improvements can be valuable. Even if you have no intention to move, updates give you more reasons to love and enjoy your house. And, of course, the home value increases that high-ROI projects offer are bound to pay off in the future.

Have you been considering a particular home upgrade but aren’t sure if it’s worth it? Contact us today to connect with an agent who can give you the best advice for your unique area.

Foreclosures Rose in Q1 2025 – Is It a Warning Sign?

With everyday costs seemingly rising across the board, the state of the housing market is a natural concern. When basic living expenses rise, even critical financial responsibilities like mortgage payments start to slip, leading to increased foreclosures. Unsurprisingly, new data shows filings for foreclosures rose in Q1 2025, stirring worries about another housing crash like in 2008.

But as it turns out, there’s less cause for worry than you might think. When contextualized correctly, it’s clear these new number don’t point to a repeat of the last big housing crash.

The 2008 Market Versus 2025

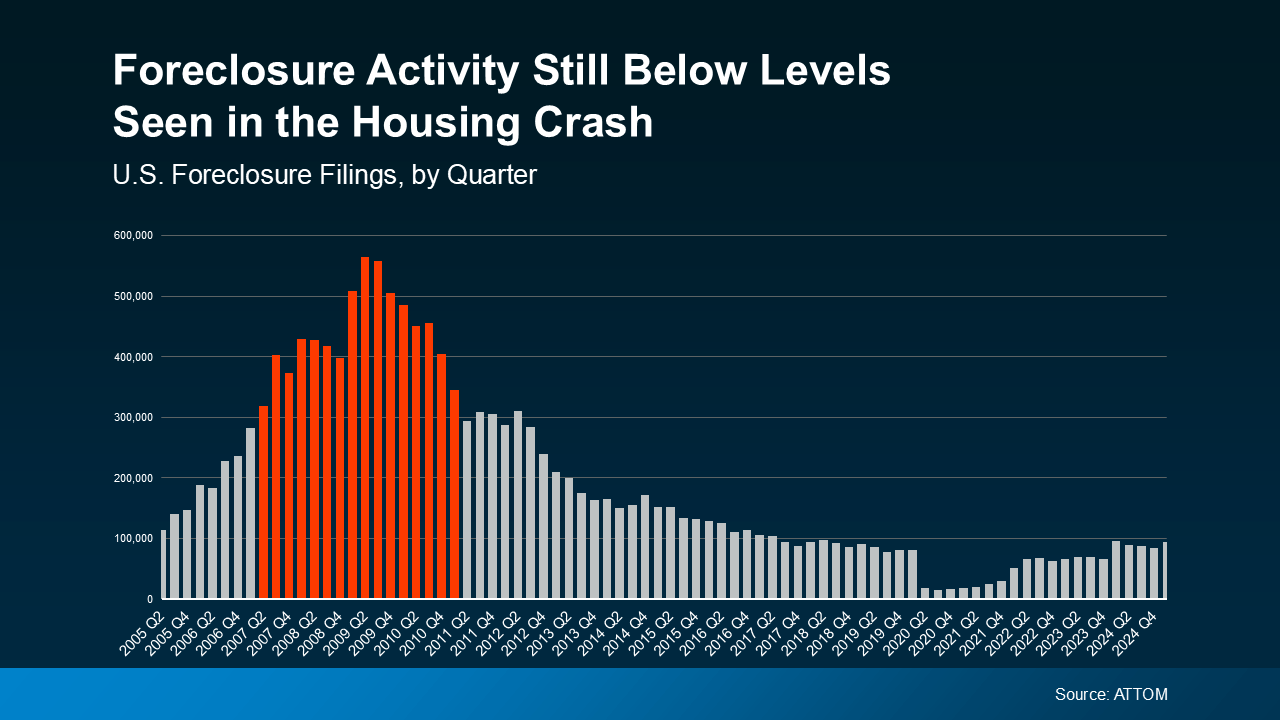

The latest quarterly report from ATTOM shows that foreclosures did rise in Q1 2025, which is concerning at first glance. However, foreclosure filings were still lower than the normal historical average, and far below the levels seen in 2008. When plotted visually, it’s easy to see the huge difference between 2008 and 2025.

Compare the foreclosure filings in Q1 2025 to the years surrounding the 2008 crash on the graph below. Even in the years preceding and following the 2008 crash, foreclosures were dramatically higher than what we’re seeing now.

Back in 2008, lenders were approving loans using much riskier practices, saddling many homeowners with mortgages they couldn’t afford. This flooded the market with distressed properties, surplus housing inventory, and free-falling home prices that collectively caused the crash.

In the years that followed, lending standards became much stricter and stronger to prevent such a crash from happening again. Today, most homeowners are in a much better financial position, and foreclosures have stabilized as a result.

The graph may appear to show foreclosures ramping up since the lows of 2020 and 2021, but this is deceiving. Foreclosures during those years were unusually low thanks to a moratorium designed to help millions of homeowners through the pandemic. That moratorium has since ended, which has caused foreclosure filings to return to the more normal levels we see now.

Compared to pre-pandemic years like 2017-2019, foreclosures overall are actually relatively down from what’s considered normal. So while foreclosures rose in Q1 2025, this doesn’t point to a troubling surge in the market.

Why Foreclosures Haven’t Surged in 2025

Another reassuring difference in today’s real estate market is the power of increased homeowner equity. As home prices have exploded over these past few years, homeowners have enjoyed a welcome boost to their wealth. According to Rob Barber, CEO at ATTOM:

“While levels remain below historical averages, the quarterly growth suggests that some homeowners may be starting to feel the pressure of ongoing economic challenges. However, strong home equity positions in many markets continue to help buffer against a more significant spike . . .”

In short, if a homeowner can’t make their mortgage payments, they may be able to sell their home to avoid foreclosure. During 2008, many people owed more than their homes were worth and had no choice but to foreclose. Today, most homeowners have much stronger equity that protects them from being forced into foreclosing. As Rick Sharga, Founder and CEO of CJ Patrick Company, recently explained in a Forbes article:

“ . . . a significant factor contributing to today’s comparatively low levels of foreclosure activity is that homeowners—including those in foreclosure—possess an unprecedented amount of home equity.”

Conclusion

It’s true that foreclosures rose in Q1 2025, but they’re nowhere near the levels seen during the 2008 crash. Even as home prices continue rising, strong equity is protecting existing homeowners and bolstering their wealth. This doesn’t discount the struggles some homeowners are facing, but it’s a reassuring fact for the market at large.

If you’re a homeowner facing foreclosure, ask your mortgage provider about what options are available to you. Are you a first time buyer eager to build your equity? Contact us today for the info you need to get started.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link