Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Adjustable-Rate Mortgages on the Rise: Should You Jump In?

If you’re in the market for a house, you’re probably not encouraged by today’s mortgage rates. Elevated rates and rising home prices have many homebuyers starting to explore other financing options that make more sense. One type of loan gaining popularity is adjustable-rate mortgages (ARMs).

If you remember the 2008 market crash, you may be wary of new types of loans. It’s wise to be cautious, but there’s no need to worry. Today’s ARMs much safer and stricter than the ones you may remember from 2008.

During that time, some buyers held loans they couldn’t afford once their rate adjusted. Today, lenders are more careful, and determine whether you can afford an increased rate before the loan is ever offered. This time, ARMs are returning thanks to creative buyers looking for affordable ways to buy a home..

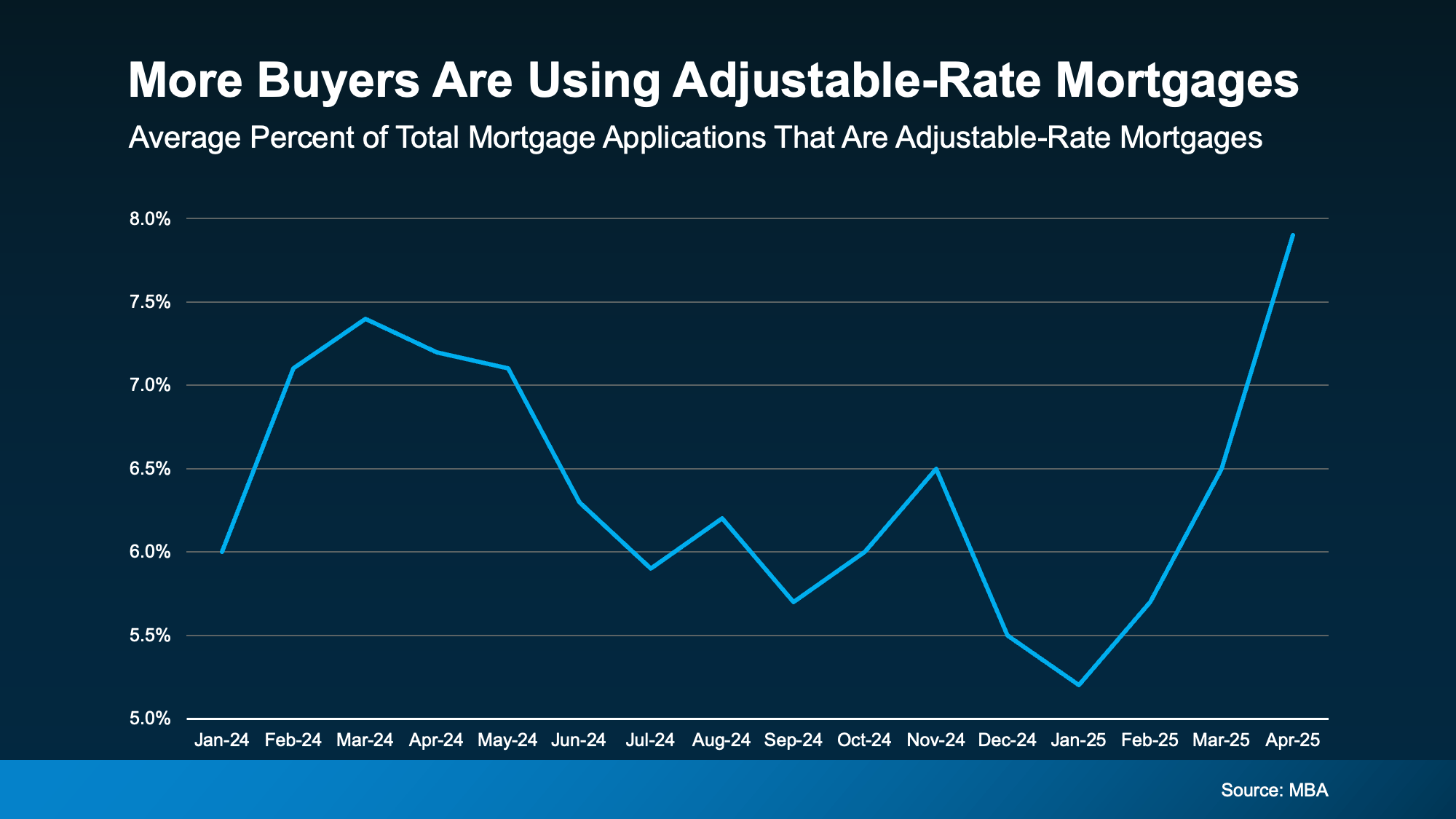

According to recent data from the Mortgage Bankers Association (MBA), more buyers are using ARMs to buy this year.

How Does an Adjustable-Rate Mortgage Work?

If you’ve never heard of ARMs before, you may be wondering what they are, and if they’re right for you. Here’s how Business Insider explains the main difference between a traditional fixed-rate mortgage and an adjustable-rate mortgage:

“With a fixed-rate mortgage, your interest rate remains the same for the entire time you have the loan. This keeps your monthly payment the same for years . . . adjustable-rate mortgages work differently. You’ll start off with the same rate for a few years, but after that, your rate can change periodically. This means that if average rates have gone up, your mortgage payment will increase. If they’ve gone down, your payment will decrease.”

Taxes or homeowner’s insurance can still influence a fixed-rate loan, but your baseline mortgage payment typically changes very little. Meanwhile, adjustable-rate mortgages can potentially change drastically in either direction after your initial payment period ends. Depending on your situation and anticipated market trends, this could either work for you, or be far too risky.

Pros and Cons of Adjustable-Rate Mortgages

With ARMs on the rise in 2025, it’s clear that more buyers are finding them appealing. Under the right conditions, they may offer attractive upsides, like a lower initial rate. According to Business Insider again:

“Because ARM rates are typically lower than fixed mortgage rates, they can help buyers find affordability when rates are high. With a lower ARM rate, you can get a smaller monthly payment or afford more house than you could with a fixed-rate loan.”

Remember that if you have an ARM, your rate will change over time. As Barron’s explains, they can potentially cost you more in the long run:

“Adjustable-rate loans offer a lower initial rate, but recalculate after a period. That is a plus for borrowers if rates come down in the future, or if a borrower sells before the fixed period ends, but can lead to higher costs if they hold on to their home and rates go up.”

While the upfront savings can be helpful now, consider what could happen if your initial rate ends before you move. Even though rates are projected to ease a bit over the next couple years, nothing is ever guaranteed. Before you choose an ARM, talk with your lender and financial advisor about all your options, and the potential risks.

Conclusion

For certain buyers, adjustable-rate mortgages can offer some big advantages, but this won’t be true for everyone. Understand how they work and whether their pros and cons make sense for you financially. Always talk to a trusted lender and a financial advisor before making entering into a new mortgage.

Need help connecting with a trustworthy lender in your area? Reach out to us for help today.

Foreclosures Rose in Q1 2025 – Is It a Warning Sign?

With everyday costs seemingly rising across the board, the state of the housing market is a natural concern. When basic living expenses rise, even critical financial responsibilities like mortgage payments start to slip, leading to increased foreclosures. Unsurprisingly, new data shows filings for foreclosures rose in Q1 2025, stirring worries about another housing crash like in 2008.

But as it turns out, there’s less cause for worry than you might think. When contextualized correctly, it’s clear these new number don’t point to a repeat of the last big housing crash.

The 2008 Market Versus 2025

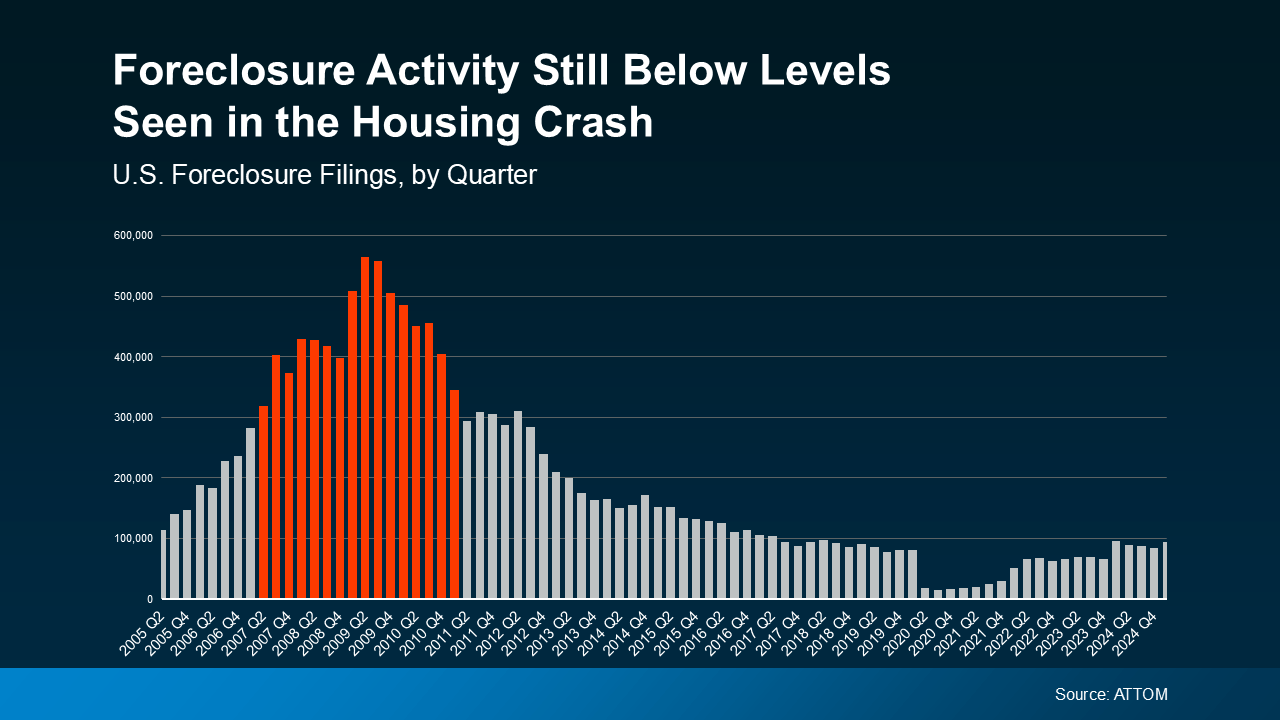

The latest quarterly report from ATTOM shows that foreclosures did rise in Q1 2025, which is concerning at first glance. However, foreclosure filings were still lower than the normal historical average, and far below the levels seen in 2008. When plotted visually, it’s easy to see the huge difference between 2008 and 2025.

Compare the foreclosure filings in Q1 2025 to the years surrounding the 2008 crash on the graph below. Even in the years preceding and following the 2008 crash, foreclosures were dramatically higher than what we’re seeing now.

Back in 2008, lenders were approving loans using much riskier practices, saddling many homeowners with mortgages they couldn’t afford. This flooded the market with distressed properties, surplus housing inventory, and free-falling home prices that collectively caused the crash.

In the years that followed, lending standards became much stricter and stronger to prevent such a crash from happening again. Today, most homeowners are in a much better financial position, and foreclosures have stabilized as a result.

The graph may appear to show foreclosures ramping up since the lows of 2020 and 2021, but this is deceiving. Foreclosures during those years were unusually low thanks to a moratorium designed to help millions of homeowners through the pandemic. That moratorium has since ended, which has caused foreclosure filings to return to the more normal levels we see now.

Compared to pre-pandemic years like 2017-2019, foreclosures overall are actually relatively down from what’s considered normal. So while foreclosures rose in Q1 2025, this doesn’t point to a troubling surge in the market.

Why Foreclosures Haven’t Surged in 2025

Another reassuring difference in today’s real estate market is the power of increased homeowner equity. As home prices have exploded over these past few years, homeowners have enjoyed a welcome boost to their wealth. According to Rob Barber, CEO at ATTOM:

“While levels remain below historical averages, the quarterly growth suggests that some homeowners may be starting to feel the pressure of ongoing economic challenges. However, strong home equity positions in many markets continue to help buffer against a more significant spike . . .”

In short, if a homeowner can’t make their mortgage payments, they may be able to sell their home to avoid foreclosure. During 2008, many people owed more than their homes were worth and had no choice but to foreclose. Today, most homeowners have much stronger equity that protects them from being forced into foreclosing. As Rick Sharga, Founder and CEO of CJ Patrick Company, recently explained in a Forbes article:

“ . . . a significant factor contributing to today’s comparatively low levels of foreclosure activity is that homeowners—including those in foreclosure—possess an unprecedented amount of home equity.”

Conclusion

It’s true that foreclosures rose in Q1 2025, but they’re nowhere near the levels seen during the 2008 crash. Even as home prices continue rising, strong equity is protecting existing homeowners and bolstering their wealth. This doesn’t discount the struggles some homeowners are facing, but it’s a reassuring fact for the market at large.

If you’re a homeowner facing foreclosure, ask your mortgage provider about what options are available to you. Are you a first time buyer eager to build your equity? Contact us today for the info you need to get started.

Mortgage Rates Drop to the Lowest Point in 2025 So Far

If you’ve been holding off on buying a home for a lower mortgage rate, take another look at the market. Mortgage rates are trending downward, and they just hit their lowest point of the year so far.

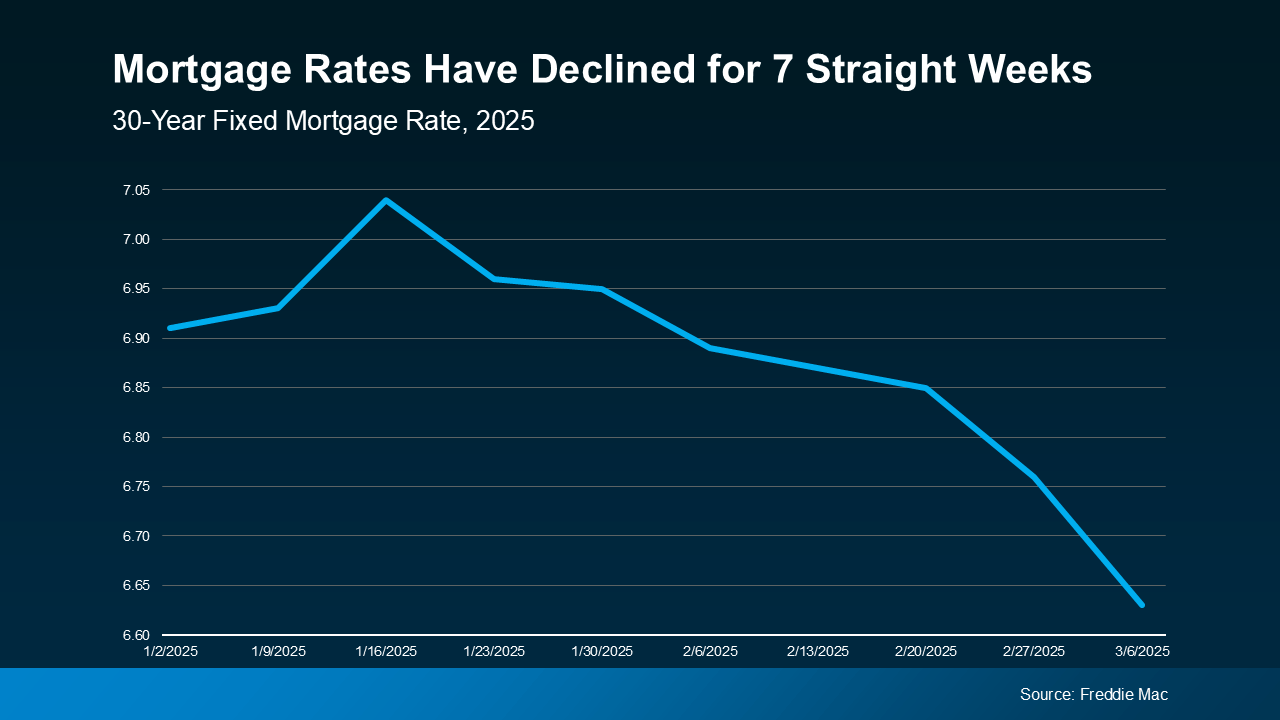

According to a report from Freddie Mac, mortgage rates have been falling for seven straight weeks. The average weekly rate for a 30-year-fixed mortgage is now at the lowest level its been in 2025.

This may not sound significant on its own, but it outlines a remarkable trend. A drop in rates from over 7% to the mid-6’s can make all the difference when buying a home. What’s most significant is that experts previously predicted that rates wouldn’t fall this low until Q3 of this year.

Why Are Mortgage Rates Dropping?

According to Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA), ongoing economic uncertainty is a driving force in pushing rates lower:

“Mortgage rates declined last week on souring consumer sentiment regarding the economy and increasing uncertainty over the impact of new tariffs levied on imported goods into the U.S. Those factors resulted in the largest weekly decline in the 30-year fixed rate since November 2024.”

The timing of this rate drop is great for buyers moving into the Spring 2025 market. But remember that mortgage rates can change quickly, and always expect some volatility in markets driven by uncertainty. With that said, this small window of rates dropping into prime buying season might be exactly wait you’ve waited for.

What Falling Mortgage Rates Mean for Your Buying Power

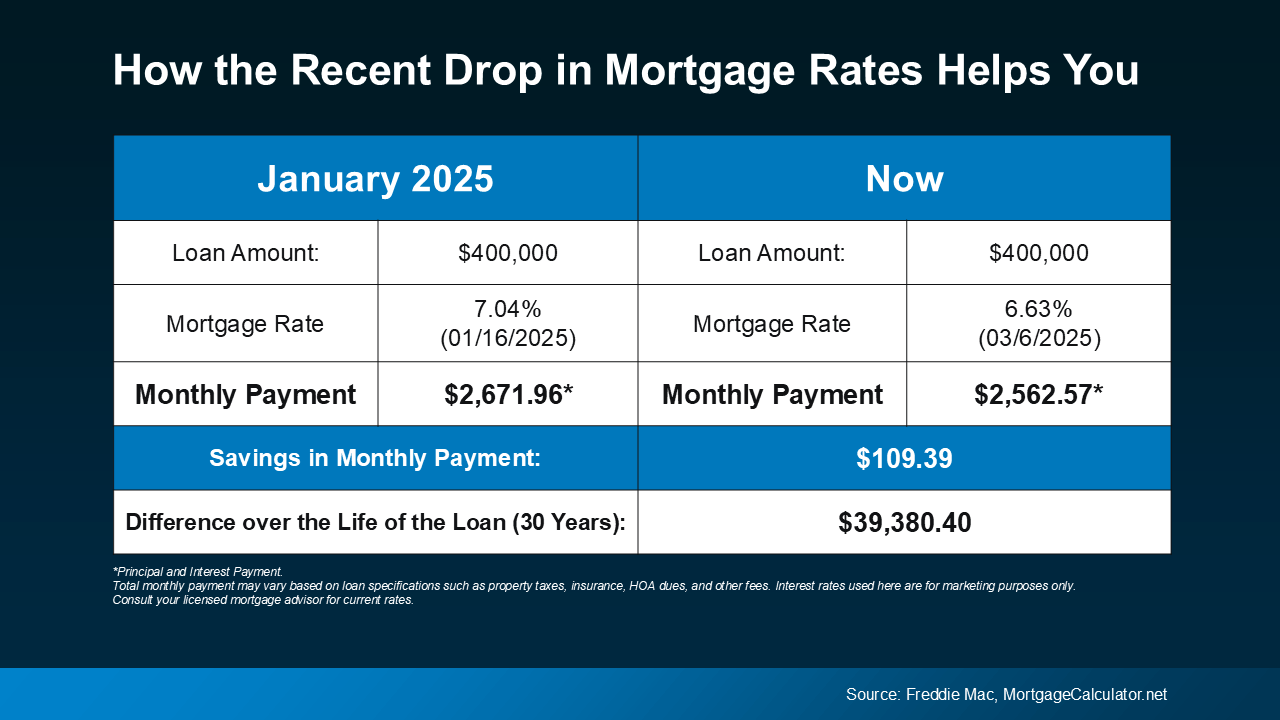

Even a small reduction in your mortgage rate can make a huge difference in your monthly housing payment. The chart below shows what a monthly payment (principal and interest) would look like on a $400K home loan if you purchased a house when rates were 7.04% back in mid-January (this year’s mortgage rate high). The right side shows what it could look like if you buy a home now at current rates.

In just the past few weeks, the expected payment on a $400K loan has come down by over $100 per month. That’s a significant savings that can make a world of difference when deciding to buy a house.

Recent economic shifts have driven rates down faster than expected, and that’s great news. But remember that this could change at any time in the coming days and months for better or worse. So if you’re waiting for rates to fall further before you buy, think hard about the current window of opportunity before making a decision.

Conclusion

Mortgage rates have dipped to their lowest point in 2025 so far. This grants buyers a great position moving into the spring buying season, especially for those who have been waiting. The unpredictability of the market and larger economy mean volatility, so get expert advice and consider before making a decision.

Can You Buy a Home in 2025 Without Waiting for Lower Rates?

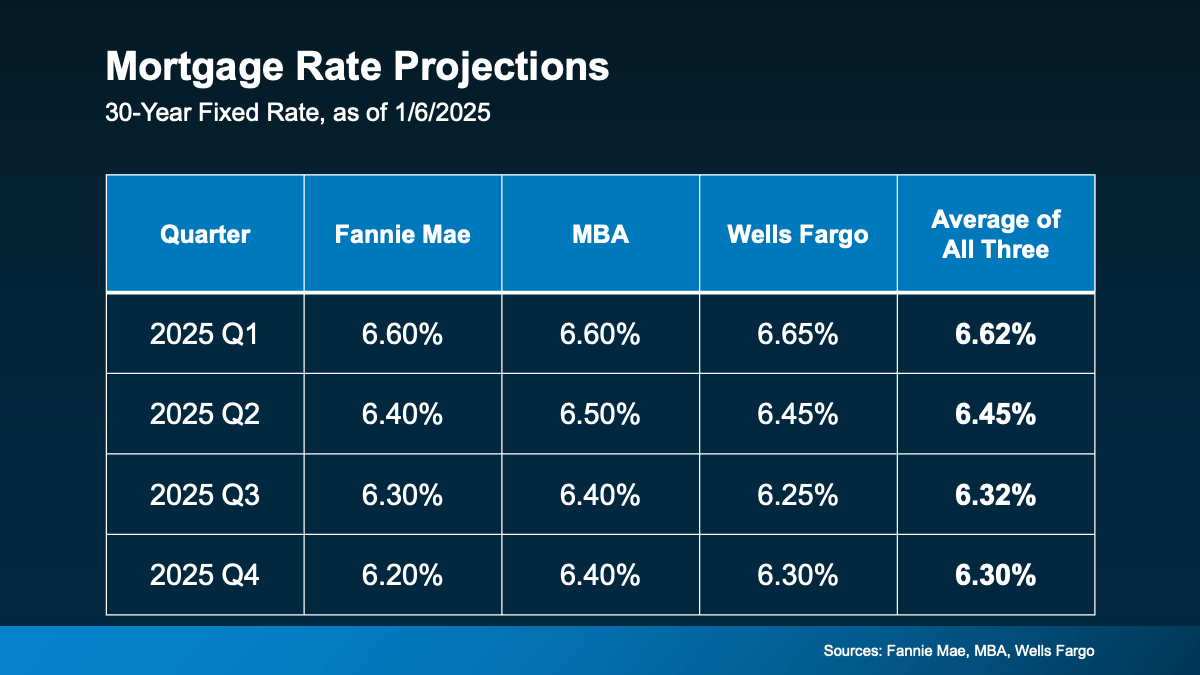

Like many homebuyers, you may be waiting for rates to drop before you finally buy a home this year. The latest expert reports predict that rates will continue to fall, but not as low as many hope. While this may be discouraging, the good news is that there are still ways you can buy a home in 2025 without waiting for lower rates.

Will Rates Keep Dropping?

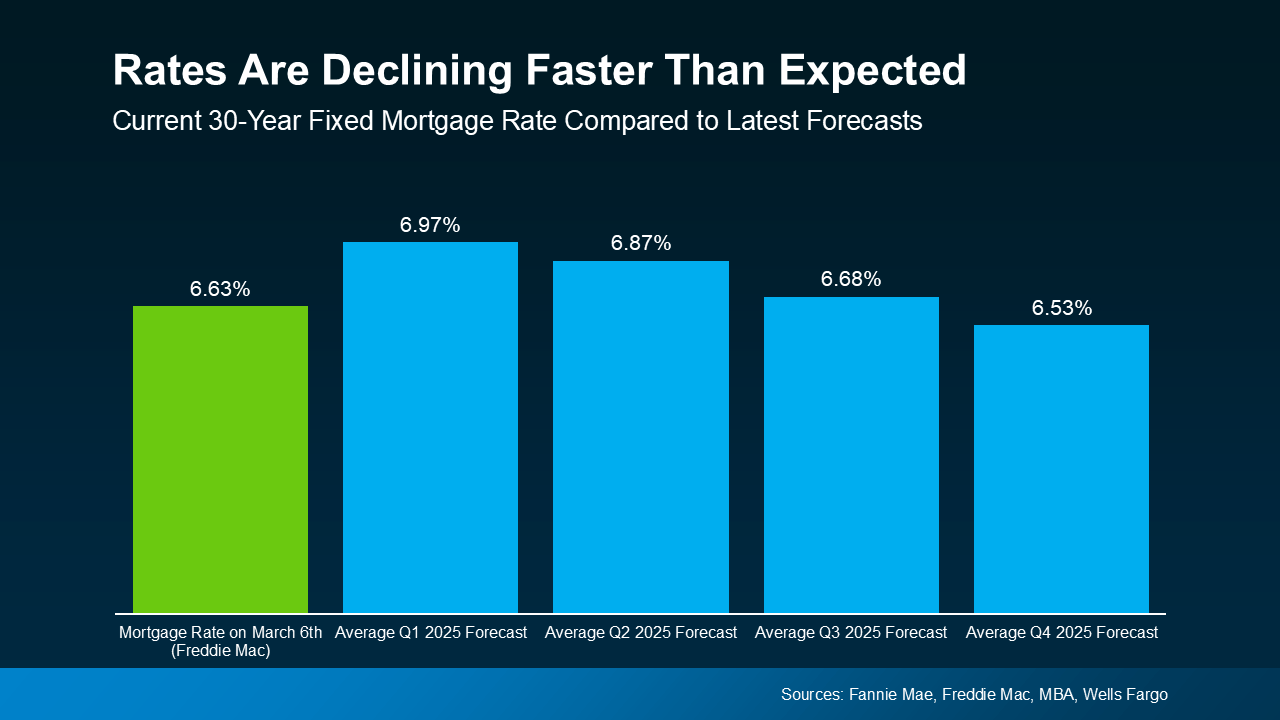

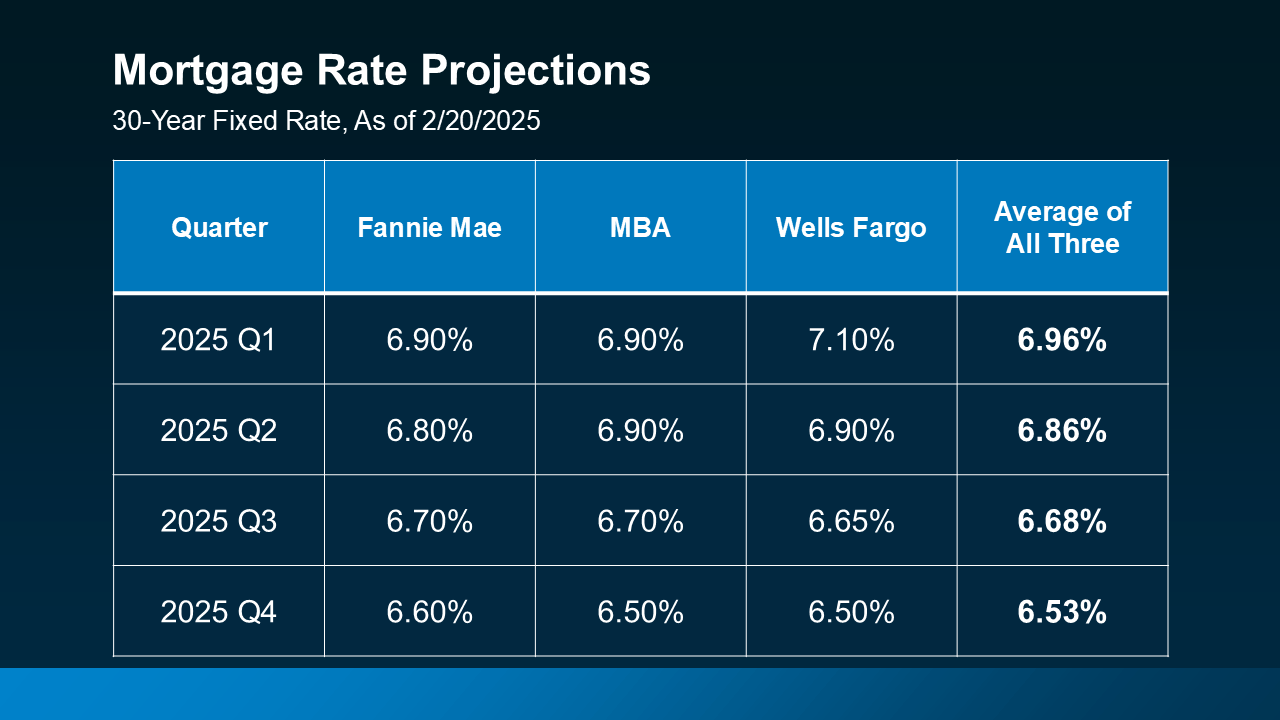

Near the end of 2024, experts were predicting that mortgage rates could dip below 6% by the end of 2025. More recent projections are suggesting that rates will continue to fall but hover somewhere above 6%.

Recent projections from Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo now predict that mortgage rates will stabilize around 6.5% by the end of the year.

If you’re holding out for mortgage rates to drop below 6% before buying, you may need to keep waiting into next year at least. But what if you’re a buyer who can’t wait to move because of a major life event, like a new job, a new baby, or a marriage? Don’t panic—you’ll still be able to move this year, but you may need to take advantage of some alternative financing options.

How to Finance a Home in Today’s Market

With rates predicted to hold more stubbornly than expected this year, it’s worth researching different financing options, especially if your move is a non-negotiable one. Here are three unique financing strategies that may be helpful to you depending on your situation. If you’ve already chosen a lender, discuss each of these options with them to decide if any are a good fit. It may make all the difference you need to buy a house in 2025.

1. Mortgage Buydowns

A mortgage buydown allows you to pay an upfront fee—sometimes called “discount points”— to lower your mortgage rate temporarily or sometimes permanently. This can be an especially helpful option if you want or need a lower monthly mortgage payment early on. Of course, the obvious downside is a higher upfront cost.

A recent survey by HomeLight found that 27% of real estate agents day first-time homebuyers are increasingly requesting mortgage buydowns from sellers. This is a new program called RateReduce Sell that allows sellers to pay an upfront cost to lock in a lower mortgage rate for buyers. However, a real estate agent can help negotiate this with a seller, so be sure to mention it if you’re actively looking to buy a house.

2. Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) are loans that combine a fixed-rate period with an adjustable-rate period. ARMs typically start with a lower rate than a traditional 30-year fixed mortgage then fluctuate with the market once the fixed-rate period ends. This can make them an attractive option if you expect rates to drop in the future, or plan to refinance your home later.

If you remember the 2008 housing crash, it may be reassuring to know that today’s ARMs aren’t like the volatile loans from back then. Lance Lambert, Co-Founder of ResiClub, describes modern ARMs this way:

“. . . ARM products today are different from many of the products issued in the mid-2000s. Before 2008, lenders often approved ARMs based on borrowers ability to pay the initial lower interest rates. And sometimes they didn’t even check that (remember Ninja loans). Today, adjustable-rate borrowers qualify based on their ability to cover a higher monthly payment, not just the initial lower payment.”

Before 2008, banks used to give loans without checking to see if buyers could realistically afford them. These days, lenders verify income, assets, and employment, reducing the risks previously associated with loans like ARMs.

3. Assumable Mortgages

An assumable mortgage allows you to take over a seller’s existing loan, usually including its lower mortgage rate, repayment period, and remaining balance. This can be a great option if the seller was locked into a low mortgage rate, but few are willing to offer it by default. According to U.S. News, more than 11 million homes qualify for an assumable mortgage, so it’s always worth bringing up with your agent or seller.

Conclusion

With mortgage rates looking unlikely to fall below 6% in this year, waiting for a drop may not work out if you’re eager to buy a house in 2025. Consider options like mortgage buydowns, ARMs, or assumable mortgages depending on what makes the most sense for you. Connect with a local lender or expert agent today to explore your options and get the help you need.

FHA Home Loans in Wisconsin

If you’re in the market for a home in Wisconsin, you may have heard of FHA loans, or Federal Housing Administration loans, as a financing option. These government-backed loans are a popular choice for first-time homebuyers and those with less-than-perfect credit. In this guide, we’ll break down everything you need to know about FHA loans in Wisconsin, along with benefits and requirements of state-specific programs that can help you achieve your dream of homeownership.

What are FHA Home Loans?

FHA loans are mortgages insured by the Federal Housing Administration (FHA) and are designed to make homeownership more accessible, especially for Americans who may not qualify for a traditional mortgage or other loans. This reduces the risk for lenders and allows them to offer lower down payments and more lenient credit requirements. This also makes FHA loans particularly appealing to first-time buyers or those with limited savings.

Here are a few ways that FHA loans stand out from other options:

- Low Down Payment: You can qualify with as little as 3.5% down if your credit score is 580 or higher, meaning that up to 96.5% of a home’s value can be borrowed through an FHA loan.

- Flexible Credit Requirements: FHA loans are more forgiving of lower credit scores compared to conventional loans. Borrowers with scores as low as 500 may still qualify with a 10% down payment.

- Competitive Interest Rates: Being backed by the federal government, FHA loans often have lower interest rates than conventional loans, making monthly payments more affordable.

- Mandatory Mortgage Insurance: FHA loans require both an upfront mortgage insurance premium (UFMIP) and an annual mortgage insurance premium (MIP), which is paid monthly.

These are just a few ways FHA loans can help homebuyers overcome financial barriers and make homeownership a reality for more Americans. With lower credit score requirements and lower down payments, it’s an easier pathway to securing a loan and finally owning a house.

Current FHA Loan Interest Rates in Wisconsin

As of February 2025, the average interest rate for a 30-year fixed FHA loan in Wisconsin is 6.24%, with an APR of 6.92%. These rates are slightly lower than conventional loan rates, making FHA loans a more cost-effective option. However, rates vary depending on your credit score, the lender, and the loan type and length, so always explore your options and compare offers when possible.

FHA Loan Requirements in Wisconsin

To qualify for a FHA home loans in Wisconsin, several key criteria must be met to ensure that potential borrowers are financially stable and capable of repaying their loan. Most notably, applicants need to demonstrate a reliable employment history and income.

Here’s a summary of the main eligibility criteria:

- Credit Score: As of 2023, a minimum score of 580 is required for a 3.5% down payment. Scores between 500 and 579 require a 10% down payment.

- Debt-to-Income Ratio (DTI): Your total monthly debt, including the mortgage, should not exceed 43% of your income, though some lenders may allow up to 57% in certain cases.

- Employment and Income: You’ll need a steady employment history of at least two years and verifiable income.

- Primary Residence: The home must be your primary residence.

- Property Standards: The property must meet FHA’s minimum standards for safety and livability, as determined by an FHA-approved appraiser.

- Loan Limits: For 2025, the FHA loan limit for a single-family home in most Wisconsin counties is $524,225. In higher-cost areas like Pierce and St. Croix counties, the limit is $529,000.

By meeting these requirements, you better position yourself for loan approval. It can also simplify the loan process, making it smoother and preventing potential setbacks or delays.

Applying for an FHA Loan in Wisconsin

Applying for FHA home loans in Wisconsin is straightforward but involves several basic steps. Borrowers should start by researching and comparing various FHA-approved lenders to find the best loan terms and secure the best deal.

After selecting a lender, borrowers complete the FHA loan application process. This process may vary between lenders, but should follow the same general steps. Here’s an overview of the major stages involved:

- Find an FHA-Approved Lender: Choose a lender approved by the FHA. Most banks, credit unions, and mortgage companies offer FHA loans.

- Pre-Approval: Get pre-approved to determine your budget and show sellers you’re a serious buyer.

- Submit Your Application: Provide details about your income, employment, and the property you want to buy .

- Provide Documentation: Submit tax returns, pay stubs, bank statements, and other financial documents.

- Property Appraisal: The lender will order an appraisal to ensure the home meets FHA standards and is worth the loan amount.

- Underwriting: The lender reviews your application to ensure you meet all FHA requirements.

- Closing: Sign the final paperwork, pay closing costs, and officially become a homeowner.

Wisconsin-Specific Programs to Pair with FHA Loans

Certain areas in Wisconsin may offer programs that can make FHA loans even more affordable. These programs are most common in larger metropolitan areas like Madison and Milwaukee, but some are available statewide through the Wisconsin Housing and Economic Development Authority (WHEDA). Here are a few options to explore if you’re planning to buy a home in Wisconsin:

- WHEDA Down Payment Assistance: The Wisconsin Housing and Economic Development Authority (WHEDA) offers programs like the Easy Close DPA, which provides up to 6% of the home’s purchase price as a second mortgage. Another option is the Capital Access DPA, offering $7,500 with no interest or monthly payments

- City of Madison’s Home-Buy the American Dream Program: Provides up to $35,000 in down payment and closing cost assistance, deferred until the home is sold or refinanced.

- Milwaukee Down Payment Assistance: Offers forgivable grants of up to $7,000 for homes in designated areas, provided the buyer contributes at least $1,000 and lives in the home for five years.

- Local Assistance Programs: Many cities and counties in Wisconsin offer grants or zero-interest loans for first-time buyers. Check with your local housing authority for details.

Conclusion

FHA loans are an excellent choice for hopeful homebuyers, especially first-time buyers or those with limited savings. By combining the benefits of FHA loans with Wisconsin-specific programs like WHEDA’s down payment assistance, you can make your dream of homeownership a reality. Whether you’re buying in Milwaukee, Madison, or a smaller town, understanding the FHA loan process and available resources will help you make informed decisions and secure the best deal for your new home.

If you’re ready to take the next step, start by finding an FHA-approved lender and exploring the down payment assistance programs available in your area. With the right preparation, you’ll be well on your way to owning a home in the beautiful state of Wisconsin!

Ready to buy but not sure how to secure a loan? Reach out to us today for help finding a qualified lender that works for you.

2025 Housing Market Predictions: What Do the Experts Say?

Wondering how the housing market is expected to change in 2025? And more specifically, what it all means for you if you plan to buy or sell a home? As always, the best way to get that information is to consult the pros.

Experts are constantly refining their predictions in response to changes in the market and overall economy. Here’s the latest information on two key factors sure to influence the housing market in 2025: mortgage rates and home prices.

Will Mortgage Rates Come Down?

Mortgage rates remain one of the strongest factors influencing the market, and everyone is waiting for them to come down. The real question is: will they drop, and how quickly?

The good news is that mortgage rates are indeed projected to ease a bit in 2025, falling into the mid-6% range on average. But experts say not to expect a return to 3-4% mortgage rates, at least not this year. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Are we going to go back to 4%? Per my forecast, unfortunately, we will not. It’s more likely that we’ll go back to 6%.”

Other experts agree with Yun’s 6% prediction. They’re forecasting rates could settle in the mid-to-low 6% range by the end of 2025 (see chart below):

But remember that the market can change quickly, and experts will revise their predictions as the new year continues. Market forecasts are based on what experts know right now. And since everything from inflation to economic drivers have an impact on where rates go from here, some ups and downs are still very likely. So, don’t get caught up in the most exact numbers and try to time the market. Instead, focus on the overall industry trend and on what you can actually control.

A trusted lender and a local agent partner will make sure you’ve always got the latest data and the context on what it really means for you and your financial goals. With their help, you’ll see that even a small decline in mortgage rates can help bring down your future mortgage payment when you decide to buy.

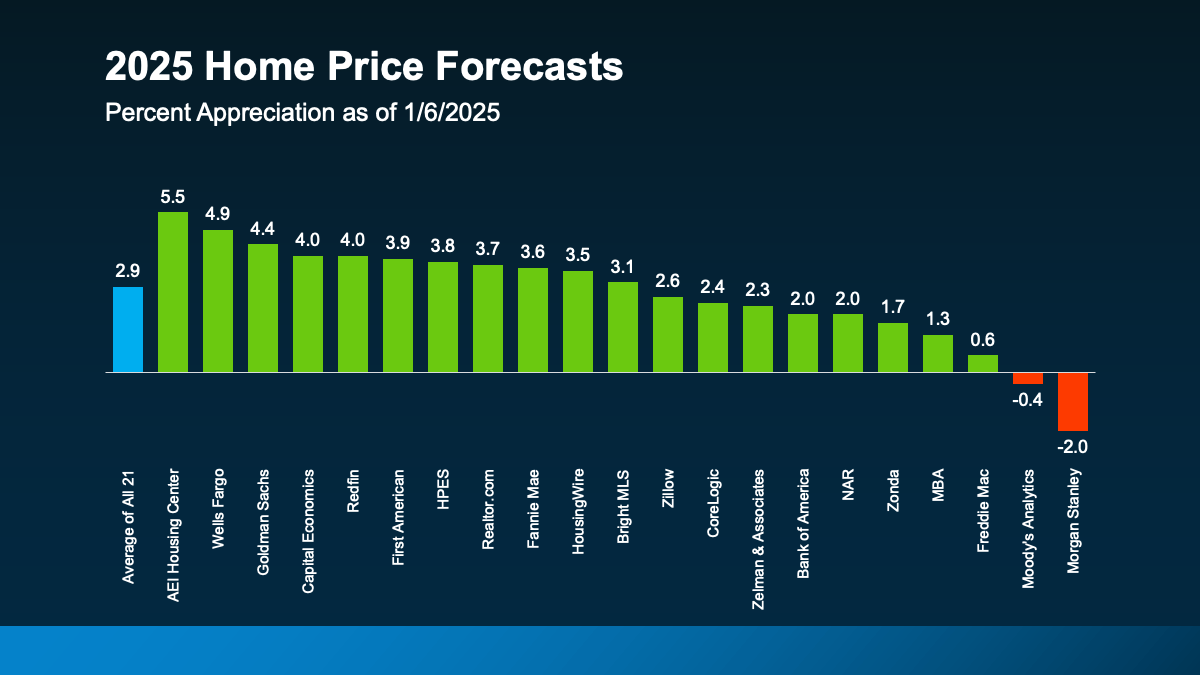

Will Home Prices Fall?

The short answer? Not likely. While mortgage rates are expected to ease, home prices are projected to keep climbing in most areas – but at a slower, more normal pace. If you average the expert forecasts together, you’ll see prices are expected to go up roughly 3% next year, with most of them hitting somewhere in the 3 to 4% range. But this is a much more typical and sustainable rise in prices compared to (see graph below):

If you’re thinking of buying in 2025, don’t expect a sudden drop to score you a big deal. That may sound disappointing if you’re hoping for home prices to come down, but this means you won’t have to deal with the steep increases we saw in recent years. You’ll also likely see any home you do buy go up in value after you get the keys in hand, and this can turn into a great investment over time.

Like many buyers, you might be wondering how it’s even possible that home prices are still rising. The answer all comes down to supply and demand. Even though there are more homes for sale now than there were in 2024, it’s still not enough to keep up with all the active home buyers on the market. As Redfin explains:

“Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand.”

Keep in mind that the housing market is hyper-local, so this will vary by area. Some markets will see even higher prices, and some may see prices level off or even dip if inventory is up in that area. In most places though, prices will continue to rise as they usually do.

If you want to find out what’s happening in your local housing market, it always helps to lean on an agent who can explain the latest trends and what they mean for your homeownership plans.

Conclusion

The housing market is always changing, and 2025 will be no different. With mortgage rates likely to ease down to the 6% range and prices rising at a slower, more sustainable pace, it could be a great time to finally buy or sell. As always, it’s all about staying informed and making a plan that works for you.

If you’re in the market to buy or sell a home in 2025, let’s connect you with a local agent who can give expert advice on what’s happening in your area and make sure your next move is a smart one.

What Credit Score Do You Need To Buy a House?

Buying a house is a major milestone for many people, but it can also be a daunting process. One of the biggest concerns for potential homebuyers is their credit score. So what credit score do you need to buy a house in Wisconsin? Let’s explore this question and how it relates to the housing market.

Understanding Credit Scores

Before we dive into the specific credit score needed to buy a house, it’s important to understand what a credit score is and how it is calculated. A credit score is a three-digit number that represents your creditworthiness and is used by lenders to determine your risk as a borrower. The most commonly used credit score is the FICO (Fair Isaac Corporation) model, which ranges from 300 to 850 and prioritizes payment history. The other credit score type is the VantageScore model, which prioritizes total credit usage and is typically referred to less often.

Your FICO score is calculated based on several factors, including your payment history, amounts owed, length of credit history, new credit, and types of credit used. Credit payment history and amounts owed are typically the most significant factors in determining your FICO score. Keeping your credit balances low and making regular on-time payments are the best ways to maintain a good FICO score. The higher your credit score, the better your chances of getting approved for a loan and receiving favorable mortgage rates.

The Housing Market and Credit Scores

The housing market is constantly changing, and this can have an impact on the credit score needed to buy a house. In a strong housing market, lenders may be more lenient with credit score requirements as they are more confident in the market’s stability. On the other hand, in a weaker housing market, lenders may tighten their requirements and look for higher credit scores to mitigate their risk.

Credit Score Requirements for Different Types of Loans

Different types of loans have different credit score requirements. For example, a conventional loan typically requires a credit score of at least 620, while an FHA loan may accept a credit score as low as 500 with a 10% down payment. While a higher credit score will usually result in better mortgage rates and loan terms, it’s always advisable to compare the repayment terms of different loan offers before accepting one. While a loan with a lower down payment may be enticing in the short term, a lower interest rate will results in a lower monthly payment, saving you more in the long term.

Good Credit Score for Buying a House

While the minimum credit score required for a mortgage loan may vary, a good credit score for buying a house is generally considered to be 700 or above. In particular, Wisconsin has one of the highest average credit scores in the country at 732, which falls in the upper end of the “Good” score range. Having an average credit score or better shows lenders that you are a responsible borrower and can handle the financial responsibility of a mortgage. With a good credit score, you are more likely to be approved for a loan and receive favorable mortgage rates.

Improving Your Credit Score

If your credit score isn’t where you want it to be, don’t worry. There are steps you can take to improve your credit score before applying for a mortgage. These include paying off outstanding debts, making all payments on time, and keeping credit card balances low. It’s also a great practice to regularly check your credit report for any errors and dispute them if necessary. Generally, the best way to build your credit score over time is to make regular monthly payments that slowly lower your total credit usage.

Final Thoughts

The credit score needed to buy a house can vary depending on the local housing market and the type of loan you are applying for. With that said, a good credit score for buying a house is generally considered to be 700 or above. If your credit score is not where you want it to be, take steps to improve it before applying for a mortgage. Keep in mind that the average credit score in Wisconsin is relatively high at 732, and that meeting or exceeding this score will grant you a valuable advantage. With a good credit score, you can increase your chances of loan approval and receive better mortgage rates that will save you a considerable amount of money in the long run.

Why Pre-Approval Is Your Homebuying Game Changer

If you’re thinking about buying a home, pre-approval is a crucial part of the process you definitely don’t want to skip. So, before you start picturing yourself in your new living room or dining on your future all-season patio, be sure you’re working with a trusted lender to prioritize this essential step. Here’s why.

While home price growth is moderating and mortgage rates have been coming down in recent weeks, affordability is still tight. At the same time, there’s a limited number of homes for sale right now, and that means ongoing competition among hopeful buyers. But, if you’re strategic, there are ways to navigate these waters – and pre-approval is the game changer.

What Pre-Approval Does for You

To understand why it’s such an important step, you need to know more about pre-approval. As part of the homebuying process, a lender looks at your finances to determine what they’re willing to loan you. From there, your lender will give you a pre-approval letter to help you understand how much money you can borrow. Freddie Mac explains it like this:

“A pre-approval is an indication from your lender that they are willing to lend you a certain amount of money to buy your future home. . . . Keep in mind that the loan amount in the pre-approval letter is the lender’s maximum offer. Ultimately, you should only borrow an amount you are comfortable repaying.”

Getting pre-approved starts to put you in the mindset of seeing the bigger financial picture, one step at a time. And the key is actually more than just getting a pre-approval letter from your lender. The combination of pre-approval and strategic budgeting is your golden ticket to understanding what you can actually afford. It saves you from painful heartaches down the road so you don’t fall in love with a house that might be out of reach.

Pre-Approval Helps Show Sellers You’re a Serious Buyer

But that’s just the beginning. Let’s face it, there are more people looking to buy than there are homes available for sale , and that creates competition among homebuyers. That means you could see yourself in a multiple-offer scenario when you get ready to make your move. But getting pre-approved for a mortgage can help you stand out from other buyers.

In today’s fast-moving housing market, having that pre-approval in your back pocket can be your secret weapon. When sellers see you’re pre-approved, it tells them you’re a strategic and serious buyer. In a world of multiple offers, that’s a big deal. As an article from the Wall Street Journal (WSJ) says :

“If you plan to use a mortgage for your home purchase, preapproval should be among the first steps in your search process. Not only can getting preapproved help you zero in on the right price range, but it can give you a leg up on other buyers, too.”

Pre-approval shows sellers you’re more than just a window shopper. You’re a buyer who’s already undergone a credit and financial check, making it more likely that the sale will move forward without unexpected delays or issues. Sellers love that because they see your offer as a reliable one. A win-win, right?

Bottom Line

So, before you start mentally arranging furniture in your dream home, work with a trusted lender to get your pre-approval set. It’ll save you time, stress, and a lot of headaches that could come up along the way without it. The reality is, the more prepared you are, the more likely you are to land the home you’re longing for.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link