3 Questions About Selling Your House You May Be Asking

Selling a house is one of the most significant financial and emotional decisions a homeowner can make, and unanswered questions about the market make this decision even harder. Sometimes, sellers’ concerns are based on misconceptions or outdated info, but can be quickly alleviated with a trustworthy agent’s help.

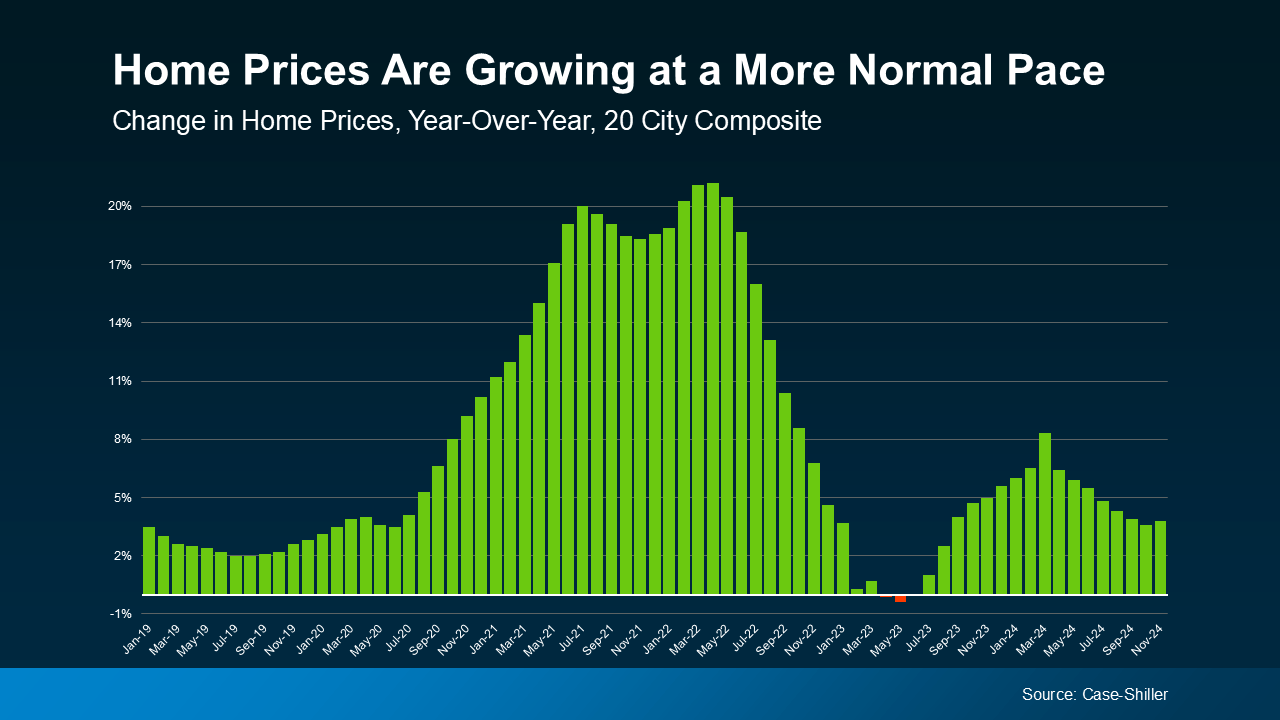

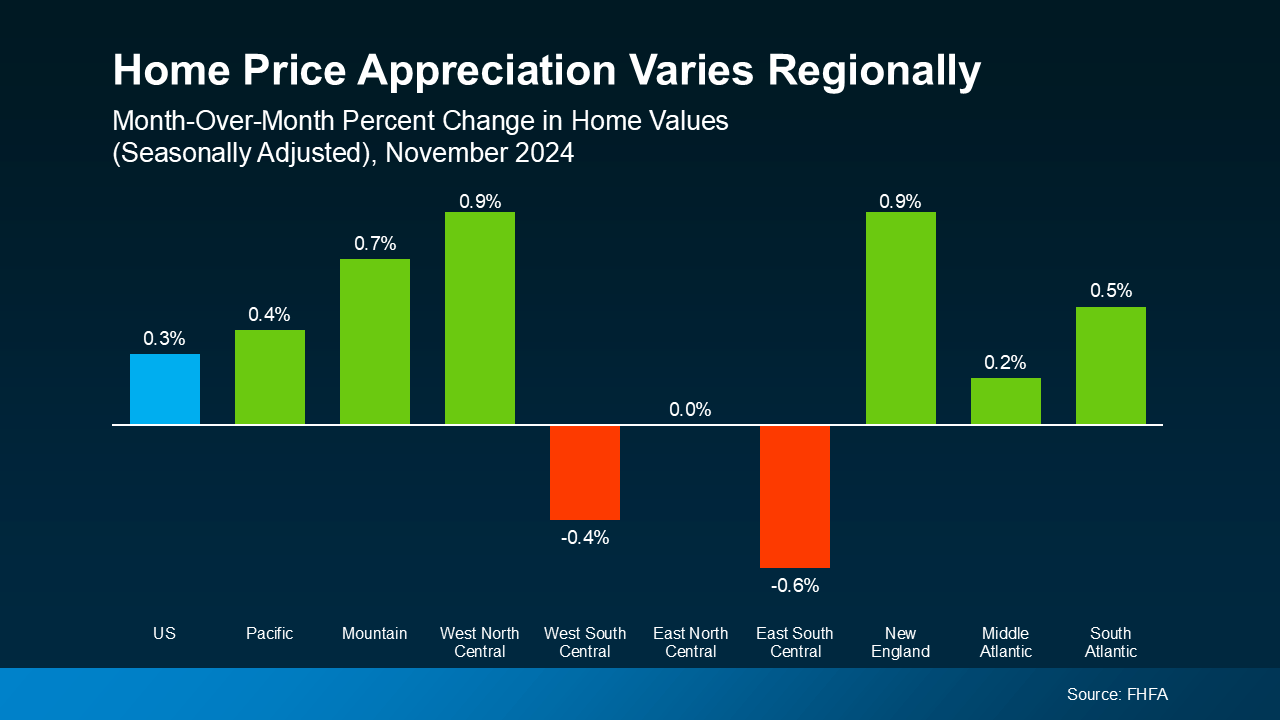

If your own uncertainty about the market is keeping you from selling your house, don’t wait to get the answers you need. Despite rising home prices and stiff demand, the 2025 real estate market is active, and recent reports prove it. If you’re uncertain about selling your house, here are the answers to three you may be asking.

1. Is It a Good Idea To Move Right Now?

If you’re a homeowner itching to make a move, you might be waiting to sell because you don’t to take on a higher mortgage rate on your next house. Between interest rates, inflation, and the job market, it’s both wise and responsible to consider your own finances and the greater state of the economy. The good news is that moving may be a lot more feasible than you think, mainly thanks to how much your house has likely grown in value.

Consider if there’s anyone in your neighborhood who sold their house recently. If so, do you know what it sold for? Considering how much home values have increased since 2021, the final closing price may surprise you. According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), the typical homeowner has gained almost $150,000 in housing wealth in the last five years alone.

That’s a significant gain depending on your house’s initial value when you bought. When you decide to sell, the increased value of your home along with the equity you’ve built can make all the difference you need to lock down your new home.

2. Will I Be Able To Find a Home I Like?

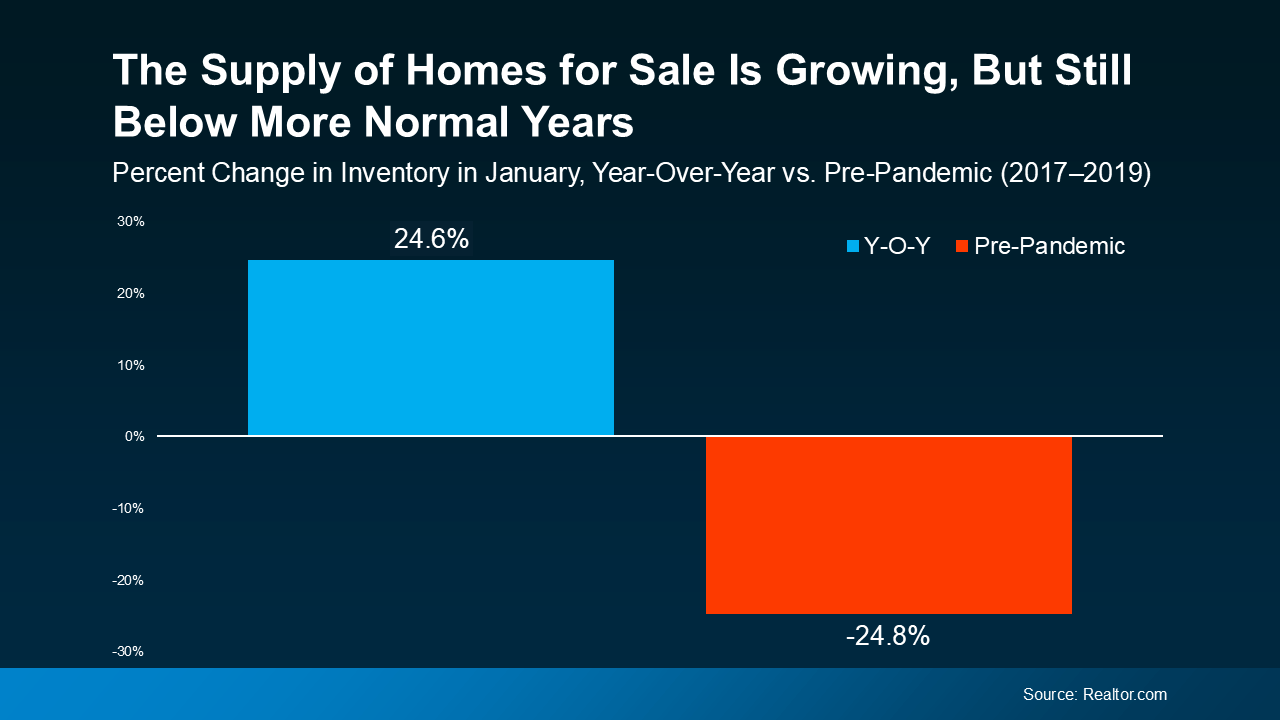

If finding the right house is stopping you from selling your house, it’s probably because you remember how hard it’s been to find a home these past few years due to low housing inventory. But thanks to positive inventory trends in today’s market, finding a good home is becoming easier.

According to a January 2025 report from from Realtor.com, home supply has increased nearly 25% since this time last year.

Housing inventory still hasn’t risen to pre-pandemic levels, but it’s improved significantly in the past year since January 2024. Even better, real estate experts say the supply of homes will continue to grow another 10 to 15% in 2025. More houses on the market means more options for you as a buyer, and a better chance of finding the perfect home.

3. Will My House Sell?

Lastly, if you’re worried that buyers aren’t buying thanks to home prices and mortgage rates, here’s some encouraging info. While last year’s home sales were still below normal, about 4.24 million homes sold according to data from the National Association of Realtors (NAR). Experts expect that number to rise in 2025, but here’s how 2024’s break down over time:

- 4.24 million homes ÷ 365 days in a year = 11,616 homes sold each day.

- 11,616 homes ÷ 24 hours in a day = 484 homes sold per hour.

- 484 homes ÷ 60 minutes = 8 homes sold every minute.

To apply some perspective: in the minute it took you to read this paragraph, 8 homes sold last year. And homes are expected to sell even faster in 2025, so rest assured that buyers are still buying. The market may not be back to pre-pandemic levels, but there are thousands of active buyers looking for homes like yours.

Conclusion

Selling your house is a major decision just like buying, but there are plenty of reasons for optimism in 2025. Home inventory is increasing, buyers are becoming more active, and your current home is likely worth more than you think.

Are you thinking of selling but have unanswered questions holding you back? Reach out today and we’ll connect you with an expert local real estate agent who can help.

The Top 5 Fastest-Growing Cities in Wisconsin

Like many areas throughout the country, Wisconsin has seen varied population growth across its cities in recent years following the COVID-19 pandemic. This growth is often driven by homebuyers seeking affordable homes or stronger local economies, and there are several areas enjoying particularly strong influxes of new residents. In this post, we’ll explore the five fastest-growing cities in the state of Wisconsin, based on recent data and trends.

1. Madison

Madison, the ever-popular capital city of Wisconsin, has experienced significant population growth in recent years. Between 2020 and 2023, Madison’s population increased by 4.4%, from 274,686 to 286,785 residents. This growth continues a trend observed over the past decade, where the city saw a 17.7% increase in population from 2010 to 2020. Madison’s robust growth can be attributed to its strong economy, education opportunities, and consistently high livability and quality of life rankings.

2. Fitchburg

Fitchburg, a suburb south of Madison and part of the Madison metropolitan area, has also seen substantial post-pandemic growth. From 2020 to 2023, the city’s population grew by 9.74%, from 30,999 to 34,019 residents. Fitchburg’s recent growth rate is one of the highest in the state, reflecting the town’s appeal as a suburban community with convenient access to the nearby amenities of Madison.

3. Sun Prairie

Sun Prairie, yet another city in Dane County, has experienced a 6.73% population increase from 2020 to 2023, growing from 35,967 to 38,387 residents. Over the past decade, Sun Prairie’s population has surged by 29.3%, making it one of the fastest-growing cities in Wisconsin. Sun Prairie’s growth is strongly driven by its proximity to Madison, family-friendly suburban environment, and considerably strong economic development.

4. Oak Creek

Oak Creek, located on the southwestern shores of Lake Michigan in Milwaukee County, saw a 4.59% increase in population from 2020 to 2023, growing from 36,497 to 38,174 residents. This growth is significant given the overall population decline in Milwaukee County during that same period. Oak Creek’s rising population and development is supported by its strategic location between Milwaukee and Chicago and expanding residential and commercial sectors.

5. Eau Claire

On the opposite side of the state, the city of Eau Claire has enjoyed a 2.71% population increase from 2020 to 2023, growing from 69,421 to 71,304 residents. This growth has positioned Eau Claire as the seventh-largest city in Wisconsin, surpassing Waukesha since the last U.S. census in 2020. Eau Claire has long stood as an attractive destination thanks to its reputation as a cultural hub and close proximity to Minnesota’s Twin Cities. Other notable attractions driving Eau Claire’s growth include its vivacious arts scene and ongoing municipal investments such as the expansion of its downtown area.

The cities of Madison, Fitchburg, Sun Prairie, Oak Creek, and Eau Claire are leading the way in population growth in Wisconsin. These destinations offer a compelling combination of economic opportunities, quality of life, and strategic locations that are driving new residents into their welcoming arms. If you’re interested in making a move to one of Wisconsin’s most popular cities, start a search for a new home today or contact us to get in touch with a local real estate expert.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link