What’s Your Real Home Value in the 2025 Market?

If you’ve checked home prices in the past few years, you know too well that they’re always rising. But if you’re a current homeowner, have you considered what this might mean for your own home value? It may be that your home is worth far more than you think in 2025.

While rising prices are expected, the home value increases of the post-Pandemic housing market have been dramatic. And if you’re a seller waiting to list, this could mean a huge payoff when you finally close. If you’re eager to know much your own house could sell for, finding out is easier than you think.

The Post-Pandemic Home Value Launch

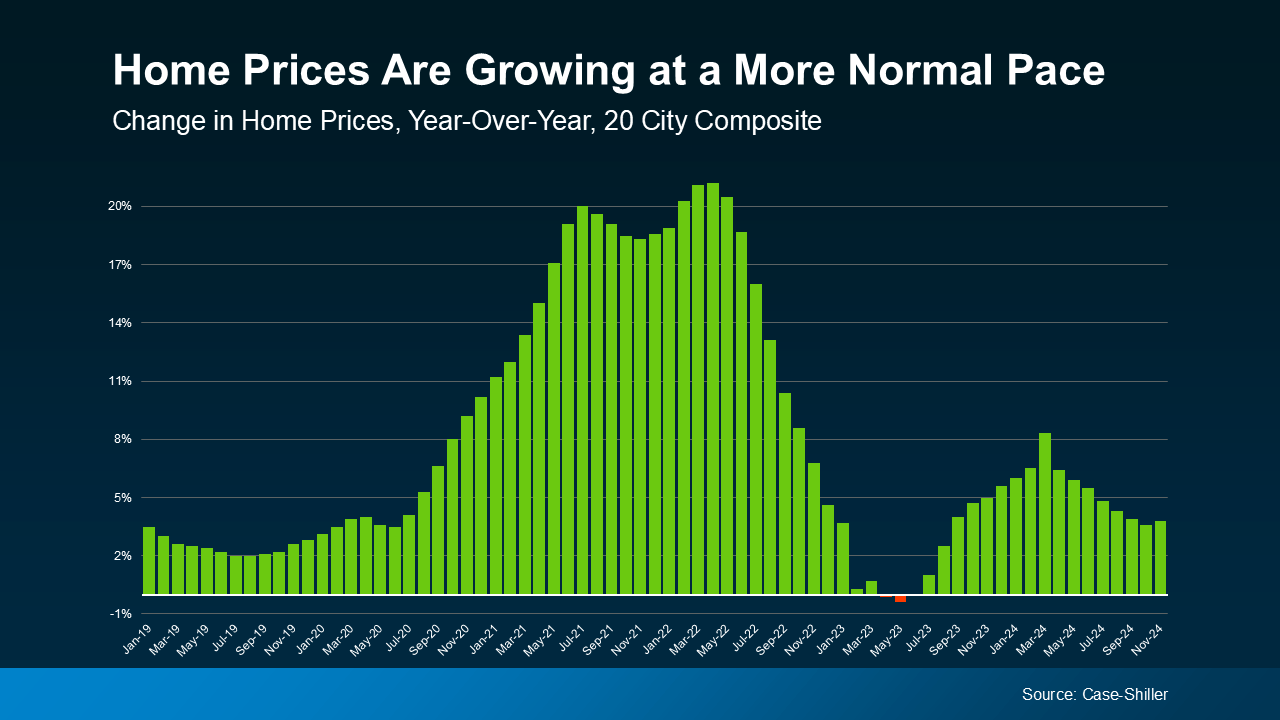

Home prices typically rise around 2-5% per year, but in 2021-2022 that number rose to double-digit levels. In the spring of 2022, year-over-year percentage growth finally peaked at over 20% nationally. The sheer number of buyers in the market during this time sent home prices soaring as housing supply lagged. And though price growth has settled since then, the home value accrued by homeowners in that time remains.

The lingering effects of that volatile period have caused difficulties for buyers, but they’ve also produced great opportunities for sellers. There’s a good chance your house has gained tremendous value since then, and that means more wealth for you.

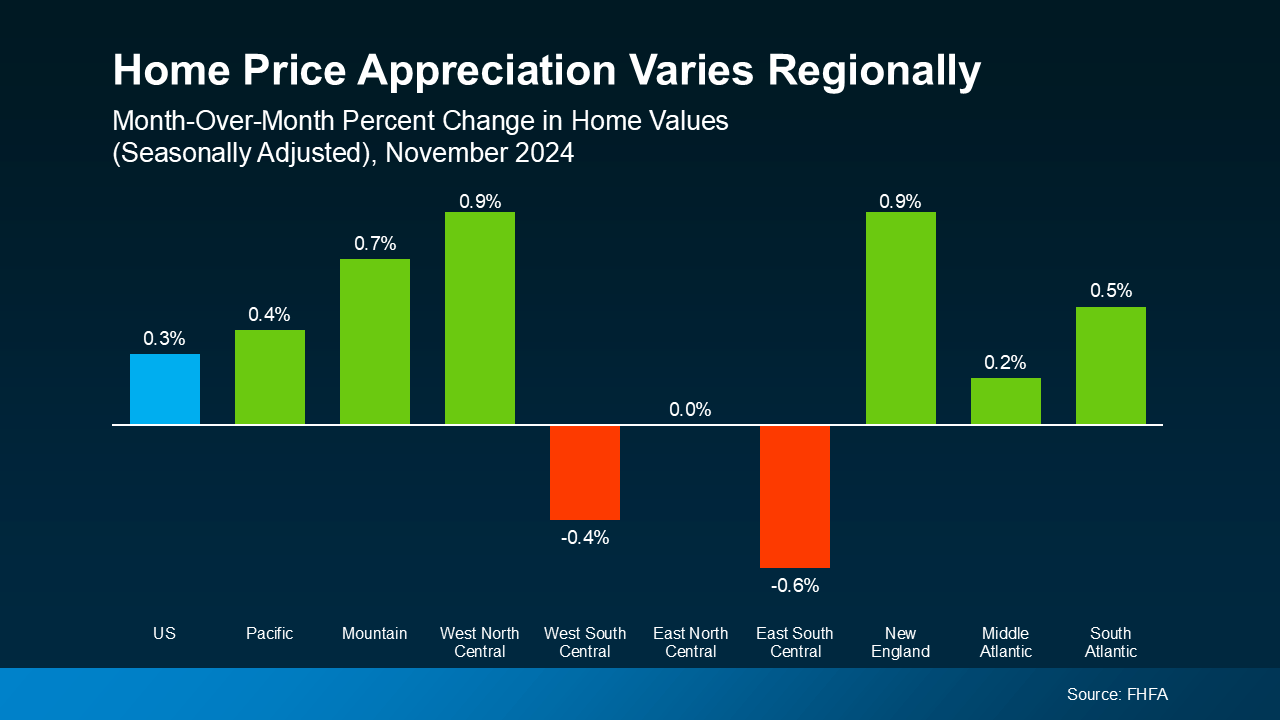

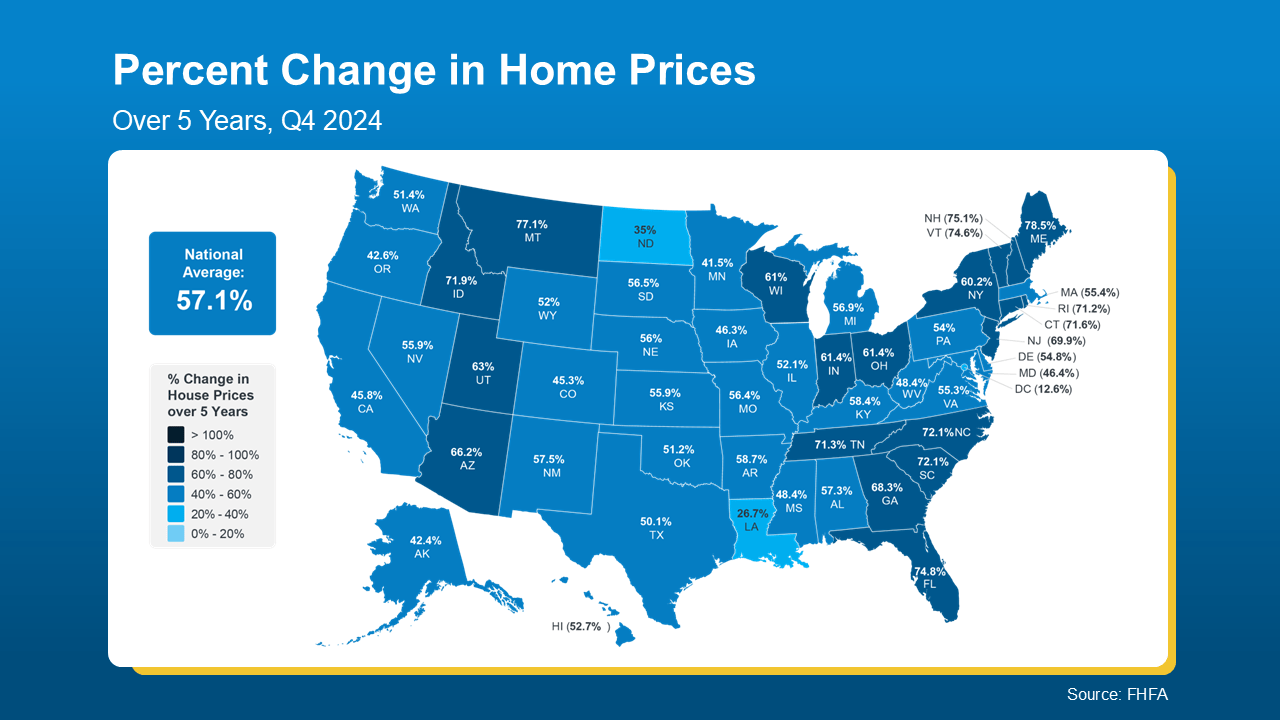

The map below references data from the Federal Housing Finance Agency (FHFA) to illustrate that home prices have risen by nearly 60% in just the past 5 years alone nationally. The most extreme increases have taken place in states marked with a darker blue, like Maine, New Hampshire, and Florida.

If worries about today’s rates and prices have stopped you from selling your home, let these numbers reassure you. Your home’s risen value may be exactly what you need to close the affordability gap and purchase your next house.

Even better, if you’ve owned your home for 10 years or more, your value is likely even higher. You can stack the incredible gains of the past five years on top of five years of healthy appreciation too. And an agent can help you figure out what that really looks like.

How To Find Out What Your House Is Really Worth

Percentages will help you ballpark an estimate, but you need specific numbers to make real, actionable decisions. To help, you can get a free home valuation estimate from us right now using the tool below. You can even sign up for a full valuation report.

Home valuations can be great tools, but only a local real estate agent can give you the best, most accurate look at your house’s real market value. An agent will know the state of your local housing market and the factors driving it. They can provide insights about current housing inventory, pricing of comparable homes, and unique contributors to value like renovations.

By knowing what’s happening where you live, an agent can stack their market knowledge against the unique condition and features of your home and give you an accurate estimate of your home’s current value in your area.

Conclusion

Home values have taken off in just the past few years, and that’s great news for current homeowners. Knowing what your house is worth in today’s real estate market will help you plan your next move. A local agent can give you a great idea of how much your home might realistically sell for.

If you’re a homeowner considering a move, get your free home valuation from us at Century 21 Affiliated now. Ready to sell? Reach out now and we’ll connect you with a local expert real estate agent who can get your house sold.

Century 21 Affiliated Ranked #1 in the World for the 11th Year in a Row

MADISON, WI, March 3, 2025 – CENTURY 21 Affiliated is once again the #1 CENTURY 21® franchise in the world, marking an unprecedented 11th consecutive year at #1, and locking in the title of the most successful franchise in the history of CENTURY 21®. This milestone reflects the company’s unwavering commitment to excellence, innovation, and client satisfaction in the real estate industry.

“Our agents and staff continue to set the bar higher every year,” said Dan Kruse, CEO & Owner of CENTURY 21 Affiliated. “Being ranked #1 for 11 years straight is no small feat – it’s a testament to our relentless dedication to providing exceptional service and helping our clients achieve their real estate goals.”

Over the past 11 years, CENTURY 21 Affiliated has continued to expand its footprint, delivering outstanding results across the United States. The company’s success is built on a strong foundation of top-tier training, cutting-edge technology, and a culture of collaboration and growth.

“We are incredibly proud of this achievement,” said Jasen Schrock, President & Owner of CENTURY 21 Affiliated. “It speaks volumes about the talent and dedication of our agents and leadership team. Year after year, they prove why we are the best in the business.”

With a mission to deliver extraordinary experiences, CENTURY 21 Affiliated remains committed to client-focused strategies that drive results.

“We don’t take this ranking lightly,” said Sam Bell, President of Brokerage at CENTURY 21 Affiliated. “It fuels us to keep improving, evolving, and delivering at the highest level. Our success is a direct reflection of the hard work and dedication of our entire team.”

As CENTURY 21 Affiliated looks ahead, the company remains focused on growth, agent success, and maintaining its industry-leading position. With 11 years at the top, the future is brighter than ever.

About CENTURY 21 Affiliated

CENTURY 21 Affiliated is a member of multiple listing services in California, Illinois, Michigan, Minnesota, and Wisconsin, with over 1,500+ sales professionals and 70+ offices. CENTURY 21 Affiliated also specializes in worldwide relocation. At CENTURY 21 Affiliated, the customer comes first. The complete commitment to this philosophy has made CENTURY 21 Affiliated a powerful force in the real estate industry. CENTURY 21 Affiliated has been ranked the No. 1 CENTURY 21® franchise worldwide for over ten years in a row. Visit C21Affiliated.com to learn more.

###

3 Questions About Selling Your House You May Be Asking

Selling a house is one of the most significant financial and emotional decisions a homeowner can make, and unanswered questions about the market make this decision even harder. Sometimes, sellers’ concerns are based on misconceptions or outdated info, but can be quickly alleviated with a trustworthy agent’s help.

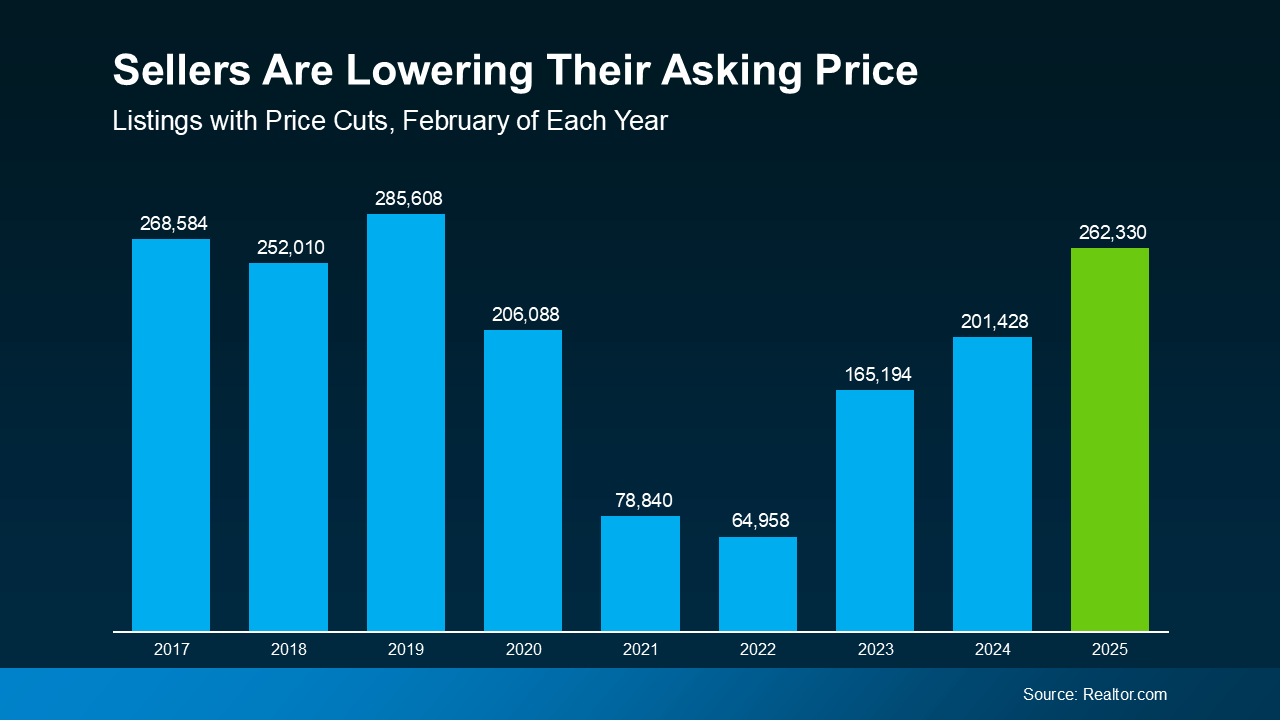

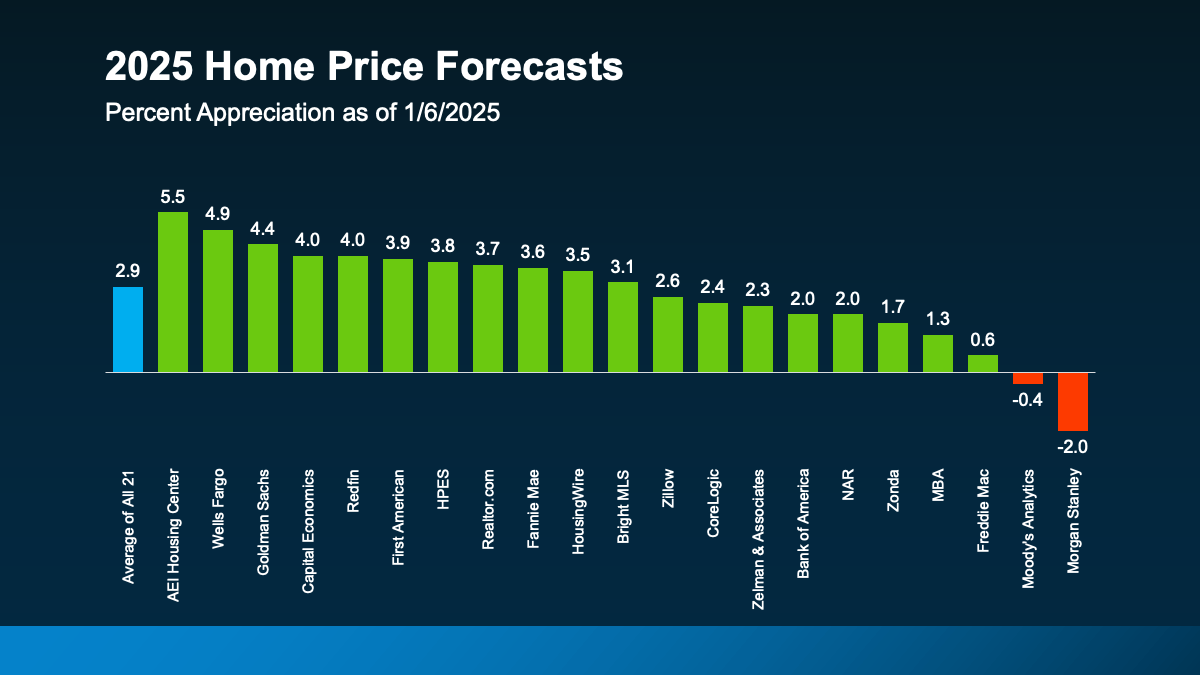

If your own uncertainty about the market is keeping you from selling your house, don’t wait to get the answers you need. Despite rising home prices and stiff demand, the 2025 real estate market is active, and recent reports prove it. If you’re uncertain about selling your house, here are the answers to three you may be asking.

1. Is It a Good Idea To Move Right Now?

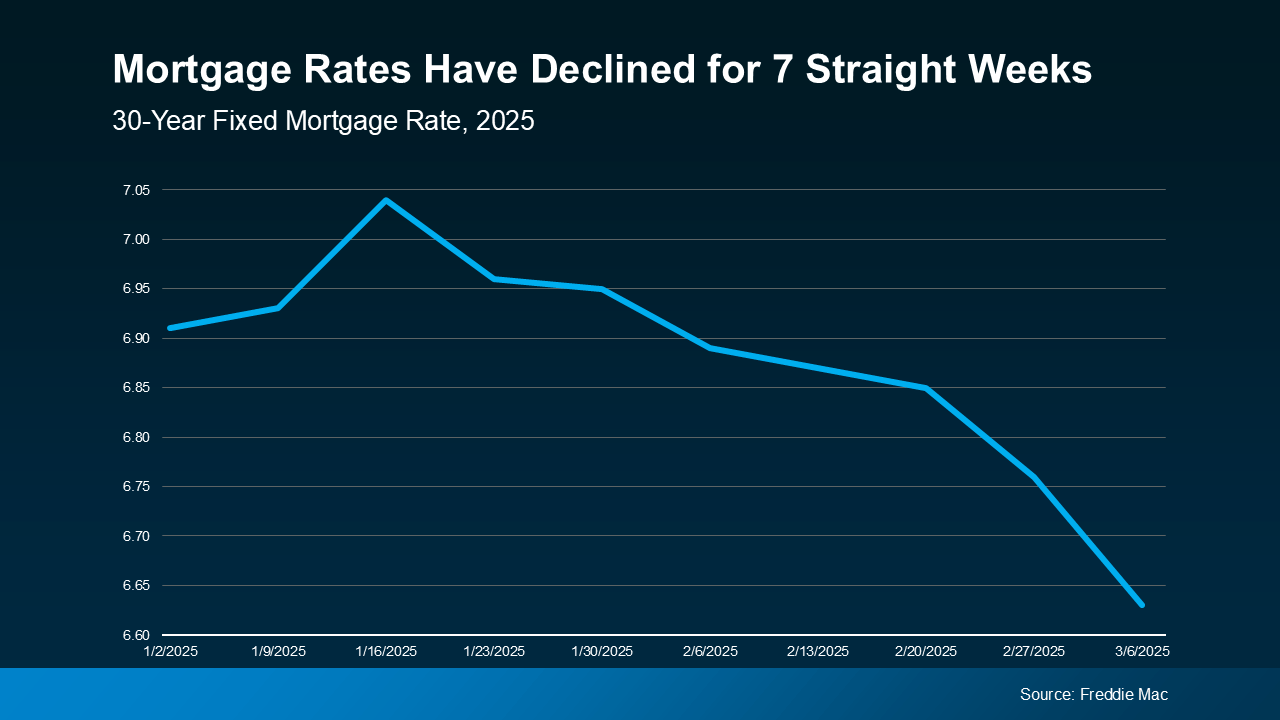

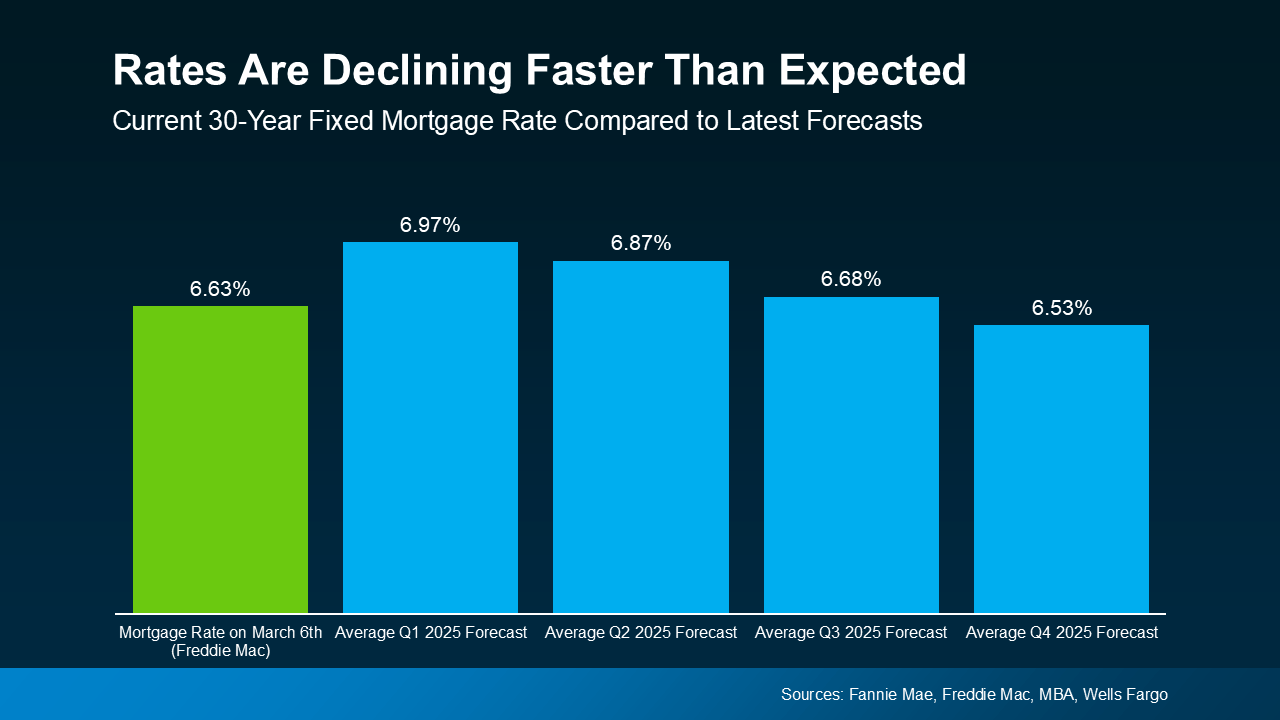

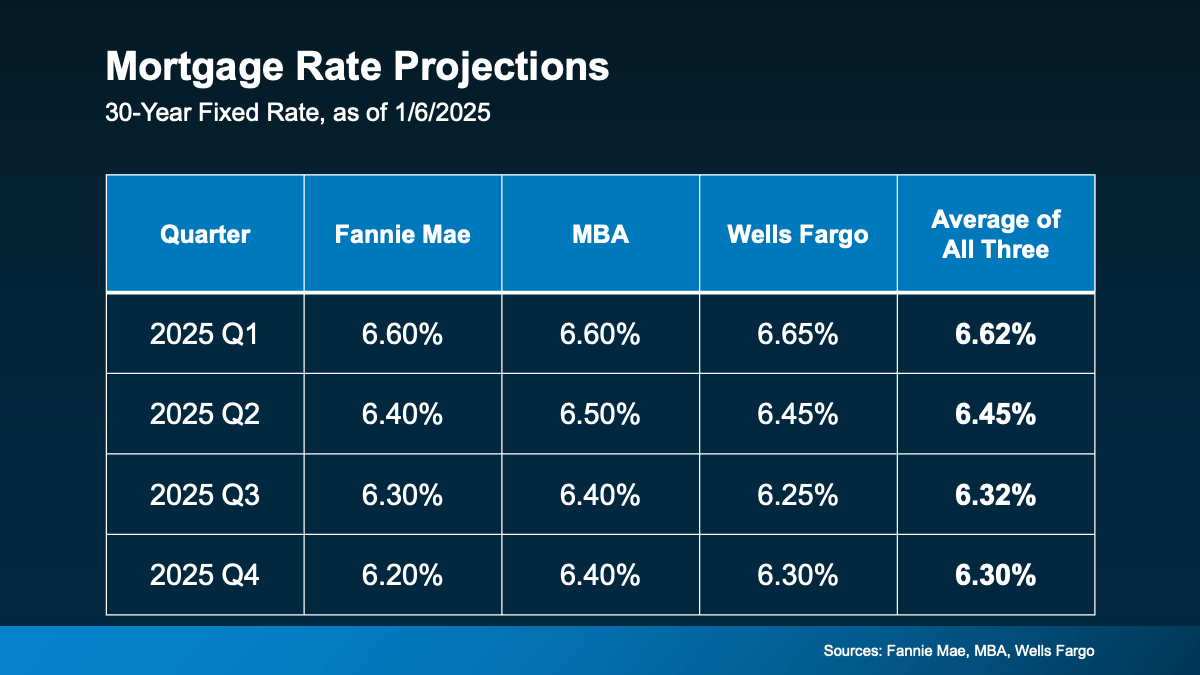

If you’re a homeowner itching to make a move, you might be waiting to sell because you don’t to take on a higher mortgage rate on your next house. Between interest rates, inflation, and the job market, it’s both wise and responsible to consider your own finances and the greater state of the economy. The good news is that moving may be a lot more feasible than you think, mainly thanks to how much your house has likely grown in value.

Consider if there’s anyone in your neighborhood who sold their house recently. If so, do you know what it sold for? Considering how much home values have increased since 2021, the final closing price may surprise you. According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), the typical homeowner has gained almost $150,000 in housing wealth in the last five years alone.

That’s a significant gain depending on your house’s initial value when you bought. When you decide to sell, the increased value of your home along with the equity you’ve built can make all the difference you need to lock down your new home.

2. Will I Be Able To Find a Home I Like?

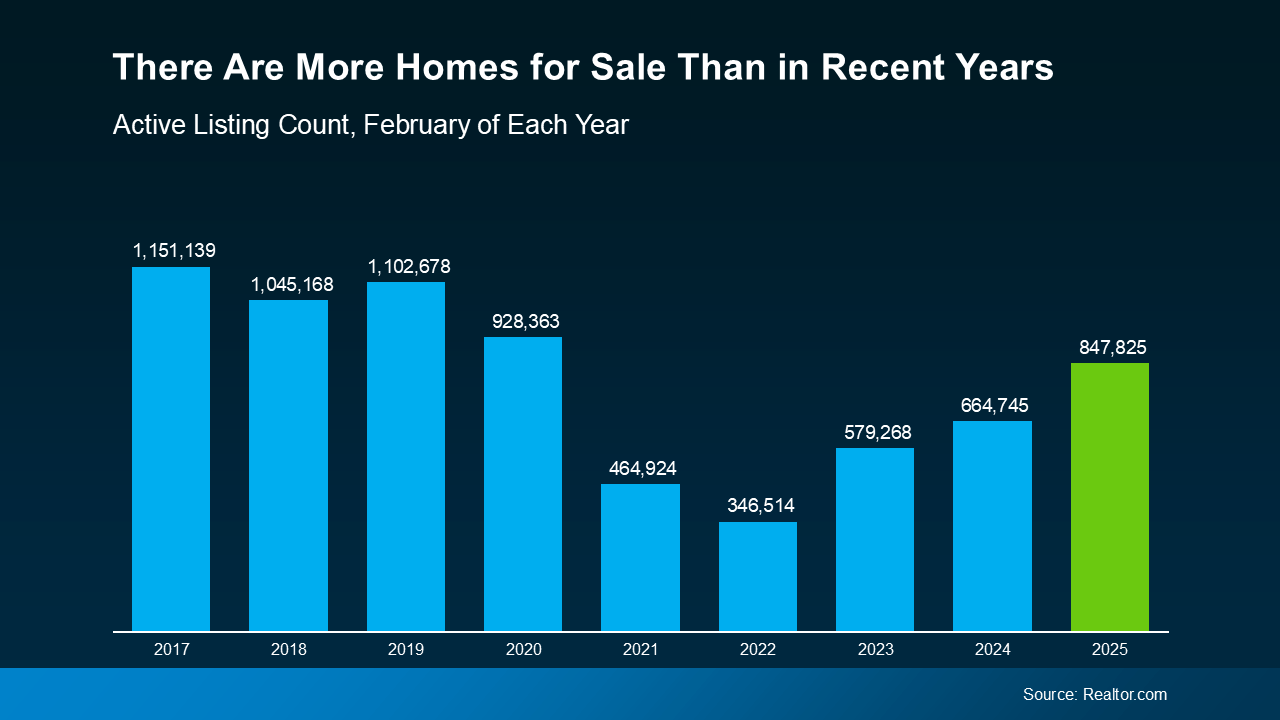

If finding the right house is stopping you from selling your house, it’s probably because you remember how hard it’s been to find a home these past few years due to low housing inventory. But thanks to positive inventory trends in today’s market, finding a good home is becoming easier.

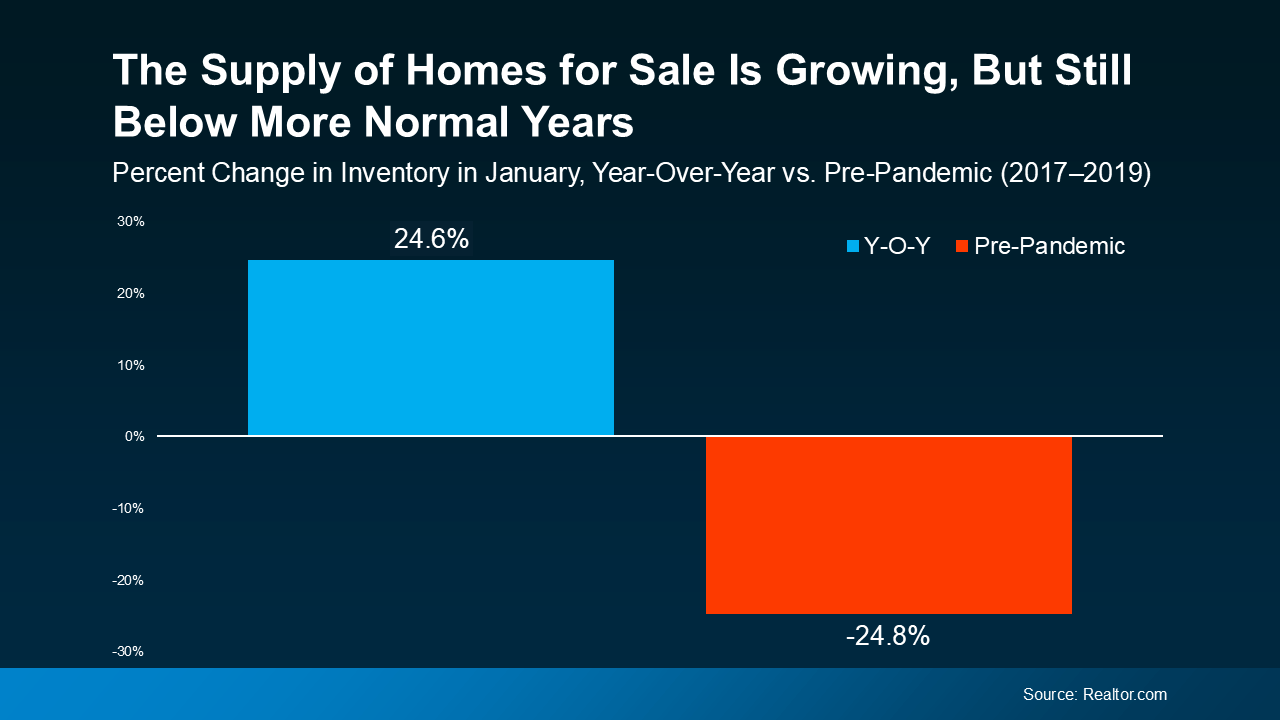

According to a January 2025 report from from Realtor.com, home supply has increased nearly 25% since this time last year.

Housing inventory still hasn’t risen to pre-pandemic levels, but it’s improved significantly in the past year since January 2024. Even better, real estate experts say the supply of homes will continue to grow another 10 to 15% in 2025. More houses on the market means more options for you as a buyer, and a better chance of finding the perfect home.

3. Will My House Sell?

Lastly, if you’re worried that buyers aren’t buying thanks to home prices and mortgage rates, here’s some encouraging info. While last year’s home sales were still below normal, about 4.24 million homes sold according to data from the National Association of Realtors (NAR). Experts expect that number to rise in 2025, but here’s how 2024’s break down over time:

- 4.24 million homes ÷ 365 days in a year = 11,616 homes sold each day.

- 11,616 homes ÷ 24 hours in a day = 484 homes sold per hour.

- 484 homes ÷ 60 minutes = 8 homes sold every minute.

To apply some perspective: in the minute it took you to read this paragraph, 8 homes sold last year. And homes are expected to sell even faster in 2025, so rest assured that buyers are still buying. The market may not be back to pre-pandemic levels, but there are thousands of active buyers looking for homes like yours.

Conclusion

Selling your house is a major decision just like buying, but there are plenty of reasons for optimism in 2025. Home inventory is increasing, buyers are becoming more active, and your current home is likely worth more than you think.

Are you thinking of selling but have unanswered questions holding you back? Reach out today and we’ll connect you with an expert local real estate agent who can help.

Dan Kruse of CENTURY 21 Affiliated Recognized Among the Industry’s Most Influential Leaders

[Madison, WI] – January 13, 2025 – CENTURY 21 Affiliated is proud to announce that its President and CEO, Dan Kruse, has been ranked #109 on the prestigious 2025 Swanepoel Power 200 (SP 200), a definitive ranking of the most powerful and influential leaders in the residential real estate industry.

The Swanepoel Power 200, published annually by T3 Sixty, evaluates leaders based on their achievements, influence, and contributions to the real estate industry. The ranking underscores Kruse’s dedication to innovation, leadership, and commitment to providing unparalleled value to CENTURY 21 Affiliated agents, clients, and communities.

Dan Kruse – CEO and President of CENTURY 21 Affiliated

“I am incredibly honored to be recognized among so many trailblazers in our industry,” said Dan Kruse. “This acknowledgment is a reflection of the extraordinary efforts of all our CENTURY 21 Affiliated real estate professionals. Together, we are setting a standard of excellence for agents and clients alike.”

Under Kruse’s leadership, CENTURY 21 Affiliated has solidified its position as one of the largest and most successful CENTURY 21 franchises in the world, with a steadfast focus on agent support, cutting-edge technology, and community engagement. His forward-thinking strategies have led to record-breaking achievements for the company, including expanding its footprint across multiple states, fostering a culture of growth and innovation, and holding the record for most transactions by a single CENTURY 21 franchise.

Kruse’s inclusion on the SP 200 highlights his role as a visionary leader driving success not only for CENTURY 21 Affiliated but also for the real estate industry as a whole.

For more information about CENTURY 21 Affiliated and its innovative approach to real estate, please visit C21Affiliated.com.

About CENTURY 21 Affiliated

CENTURY 21 Affiliated is a member of multiple listings services in California, Illinois, Michigan, Minnesota and Wisconsin with more than 1,400 sales professionals and 60+ offices. CENTURY 21 Affiliated also specializes in worldwide relocation. At CENTURY 21 Affiliated, the customer comes first. The complete commitment to this philosophy is what has made CENTURY 21 Affiliated such a powerful force in the real estate industry. CENTURY 21 Affiliated has been ranked the No. 1 CENTURY 21® franchise in the world for eleven years.

###

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link