Top 12 Home Improvement Projects That Add the Most Value

Home improvement projects can be productive, fulfilling ways to spend your spare time. But, they can also be costly ventures that end up being more trouble than they’re worth. Your invested time, money, and energy matter, and some upgrades don’t offer the return on investment you expect. U.S. News Real Estate explains it this way:

“. . . not every home renovation project will increase the resale value of a home. Before you invest in a swimming pool or new addition, you should consider whether the project will pay itself off by getting prospective buyers in the door when it’s time to sell.“

Like most projects, home improvement is best tackled when you’ve done all the planning beforehand. That’s why it pays to know the cost of your project, and how much it might increase your home value. Whether you have plans to move or not, strategizing to find the best project will pay off in the long run.

How Preparation Pays Off

If you’re planning to move soon, starting early can make a valuable difference. And if you’re not, you’ll still be glad you planned ahead when life’s surprises get in the way. If your moving timeline changes, you won’t want to shell out extra for rushed projects on short notice.

By doing home updates now, you can work at your own pace, saving yourself headaches and money later on. You’ll also have time to enjoy the updates you make to your home before you decide to move. And when you do move, you’ll rest easier knowing there’s no laundry list of work left before you list.

What Buyers Really Want

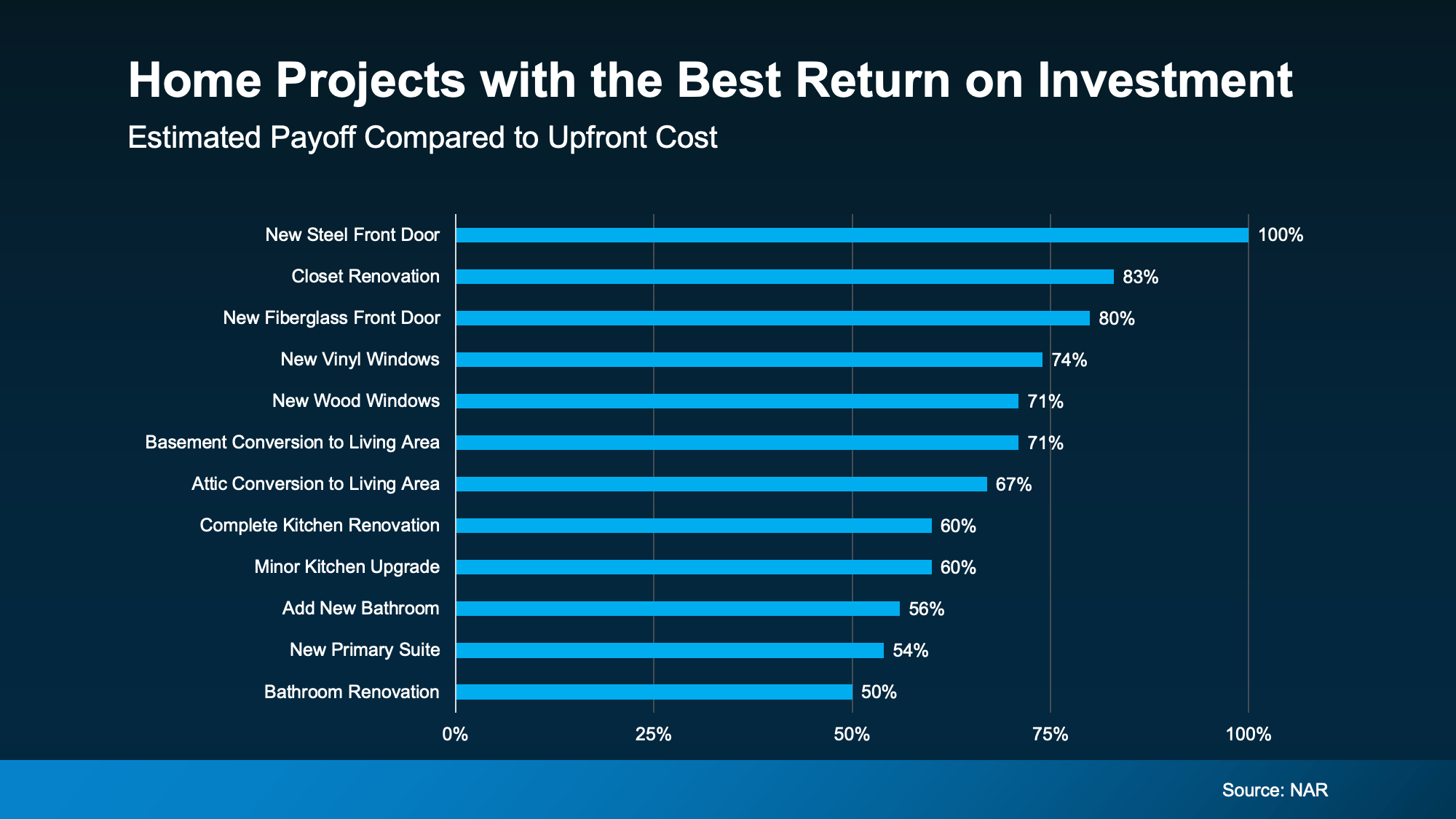

Your first step is choosing a project that will increase your home’s appeal to buyers at selling time. So if you’re not sure what projects are worth your time and money, new industry data can help. A recent study from the National Association of Realtors (NAR) shows the top upgrades offering the best return on investment (ROI).

As the graph above shows, the top home improvement projects that add the highest (estimated) value are as follows:

- New Steel Front Door – 100% return on investment.

- Closet Renovation – 83% return on investment.

- New Fiberglass Front Door – 80% return on investment.

- New Vinyl Windows – 74% return on investment.

- New Wood Windows – 71% return on investment.

- Basement Conversion to Living Area – 71% return on investment.

- Attic Conversion to Living Area – 67% return on investment.

- Complete Kitchen Renovation – 60% return on investment..

- Minor Kitchen Upgrades – 60% return on investment.

- Bathroom Addition – 56% return on investment.

- New Primary Suite – 54% return on investment.

- Bathroom Renovation – 50% return on investment.

If you’ve already been thinking about a high-ROI project on this list, that’s great news. There’s a good chance it’ll improve your living quality now and increase your home’s value in the long term.

But remember that this list is based on national data using averages from listings sold nationwide. The most in-demand improvements that buyers will pay for depends largely on your local real estate market. That’s where talking to a local agent can help, as an article from Ramsey Solutions explains:

“The best way to gauge what you can expect in terms of resale value on home improvements—especially if you’re planning to sell soon—is to talk to a real estate agent who is an expert in your market. They’re sure to know the local trends, and they can show you how other homes with the features you want to add are selling. That way, you can make an educated decision before you start ordering lumber and knocking down walls.”

At the same time, be careful not to overdo it on home improvements. An excess of upgrades can raise your home’s price right out of the local market. And while that may sound ideal, it can make your listing unattractive to the buyers in your area. This is another area where a local agent can help you choose the best projects for your specific market.

Conclusion

Whether you have moving plans on the horizon or not, making thoughtful, deliberate home improvements can be valuable. Even if you have no intention to move, updates give you more reasons to love and enjoy your house. And, of course, the home value increases that high-ROI projects offer are bound to pay off in the future.

Have you been considering a particular home upgrade but aren’t sure if it’s worth it? Contact us today to connect with an agent who can give you the best advice for your unique area.

Foreclosures Rose in Q1 2025 – Is It a Warning Sign?

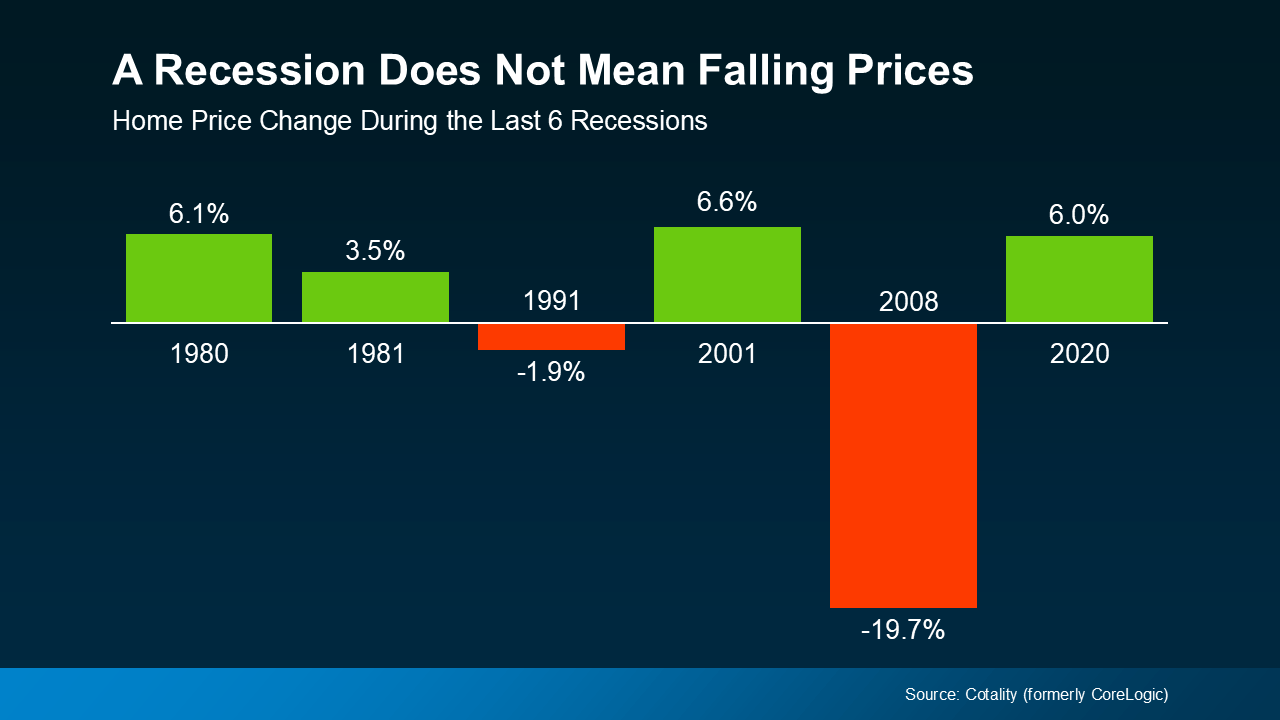

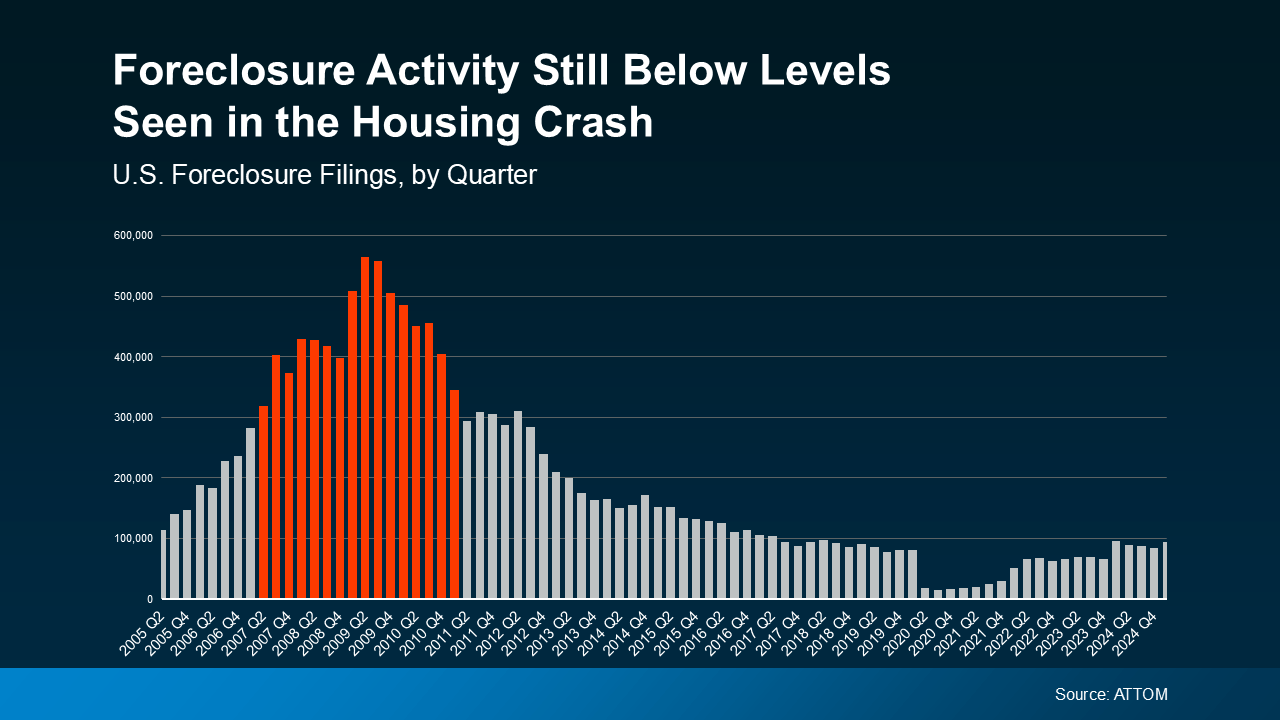

With everyday costs seemingly rising across the board, the state of the housing market is a natural concern. When basic living expenses rise, even critical financial responsibilities like mortgage payments start to slip, leading to increased foreclosures. Unsurprisingly, new data shows filings for foreclosures rose in Q1 2025, stirring worries about another housing crash like in 2008.

But as it turns out, there’s less cause for worry than you might think. When contextualized correctly, it’s clear these new number don’t point to a repeat of the last big housing crash.

The 2008 Market Versus 2025

The latest quarterly report from ATTOM shows that foreclosures did rise in Q1 2025, which is concerning at first glance. However, foreclosure filings were still lower than the normal historical average, and far below the levels seen in 2008. When plotted visually, it’s easy to see the huge difference between 2008 and 2025.

Compare the foreclosure filings in Q1 2025 to the years surrounding the 2008 crash on the graph below. Even in the years preceding and following the 2008 crash, foreclosures were dramatically higher than what we’re seeing now.

Back in 2008, lenders were approving loans using much riskier practices, saddling many homeowners with mortgages they couldn’t afford. This flooded the market with distressed properties, surplus housing inventory, and free-falling home prices that collectively caused the crash.

In the years that followed, lending standards became much stricter and stronger to prevent such a crash from happening again. Today, most homeowners are in a much better financial position, and foreclosures have stabilized as a result.

The graph may appear to show foreclosures ramping up since the lows of 2020 and 2021, but this is deceiving. Foreclosures during those years were unusually low thanks to a moratorium designed to help millions of homeowners through the pandemic. That moratorium has since ended, which has caused foreclosure filings to return to the more normal levels we see now.

Compared to pre-pandemic years like 2017-2019, foreclosures overall are actually relatively down from what’s considered normal. So while foreclosures rose in Q1 2025, this doesn’t point to a troubling surge in the market.

Why Foreclosures Haven’t Surged in 2025

Another reassuring difference in today’s real estate market is the power of increased homeowner equity. As home prices have exploded over these past few years, homeowners have enjoyed a welcome boost to their wealth. According to Rob Barber, CEO at ATTOM:

“While levels remain below historical averages, the quarterly growth suggests that some homeowners may be starting to feel the pressure of ongoing economic challenges. However, strong home equity positions in many markets continue to help buffer against a more significant spike . . .”

In short, if a homeowner can’t make their mortgage payments, they may be able to sell their home to avoid foreclosure. During 2008, many people owed more than their homes were worth and had no choice but to foreclose. Today, most homeowners have much stronger equity that protects them from being forced into foreclosing. As Rick Sharga, Founder and CEO of CJ Patrick Company, recently explained in a Forbes article:

“ . . . a significant factor contributing to today’s comparatively low levels of foreclosure activity is that homeowners—including those in foreclosure—possess an unprecedented amount of home equity.”

Conclusion

It’s true that foreclosures rose in Q1 2025, but they’re nowhere near the levels seen during the 2008 crash. Even as home prices continue rising, strong equity is protecting existing homeowners and bolstering their wealth. This doesn’t discount the struggles some homeowners are facing, but it’s a reassuring fact for the market at large.

If you’re a homeowner facing foreclosure, ask your mortgage provider about what options are available to you. Are you a first time buyer eager to build your equity? Contact us today for the info you need to get started.

Here’s the Next Best Time To Sell Your Home This Spring

Back in March, Realtor.com reported that the best time to list your house in 2025 was April 13–19. With that week now behind us, you may be wondering if you missed your chance this year. Fortunately, you still have plenty of time, if another source’s prediction holds true this spring.

Realtor.com may be one of the biggest property search sites, but others have their own data, studies, and methodologies. This means that they sometimes receive different results and reach different conclusions. This means that they sometimes receive different results and reach different conclusions, which may be good news for you. Because according to Zillow, the ideal spring house selling window hasn’t passed yet.

Reports on the Best Spring Selling Period

New research from Zillow has found that sellers who list their homes in late May tend to see higher sale prices. Based on home sales from 2024, homes listed in May had the highest sale premium of about $5,600. According to Zillow‘s study:

“Search activity typically peaks before Memorial Day, as shoppers get serious about house hunting before their summer vacation and the new school year in the fall. By targeting late spring, sellers can get their home listed when the most shoppers are looking. When more buyers are competing for homes, sellers can command a higher price.”

But Zillow isn’t the only one declaring May as the best time for home sellers to list. Using data from 59 million home sales over the past 13 years, ATTOM Data completed a similar study. In this case, it was found that sellers who list in May net an 11.1% higher closing price on average.

“Freshly compiled sales statistics from ATTOM demonstrate that home sellers continue to reap significant benefits from listing their properties during the month of May. Examination of home sales trends spanning thirteen years reveals that, on average, sellers are commanding 11.1 percent premium above the estimated market value.”

Meanwhile, a report from Bankrate states that listing at any time in April or May is ideal. In fact, it found that homes listed in May on average sell for about 13.1% above market value:

“Some patterns and trends usually do hold true throughout the year, and one is that spring continues to be the best time to sell. Sellers can net thousands of dollars more if they sell during the peak months of April and May. . .”

If these reports are accurate, then there’s still time to list during peak home selling season. Closing your home sale in May could get you a sizable increase in your final sale price.

Of course, the best week to list your house ultimately depends on your own local real estate market. Prices are driven by buyer demand and home supply, and these can vary wildly from market to market. This is why working with an experienced local agent can be so helpful, especially in uncertain markets.

Conclusion

Even though Realtor.com‘s recommended spring selling window has passed, other sources say there’s still plenty of time this year. Spring is always a busy time in real estate, and you can take advantage without listing during a specific week.

The true best time to sell your house will be determined by your own unique local market this spring. Working with an agent can help remove some of the guesswork, and get you the best closing price possible.

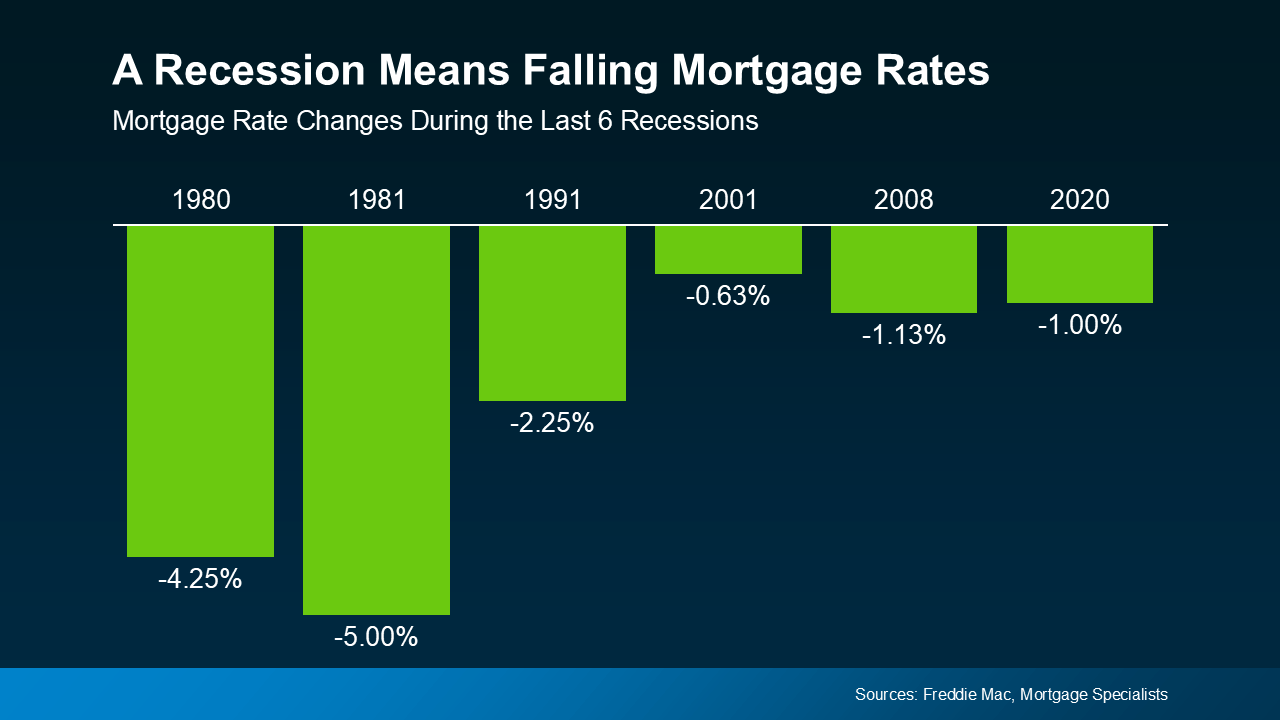

Many Fear a Housing Market Crash in 2025 – Will It Happen?

Between every economic uncertainty underpinning this year so far, Americans are understandably trepid about the future. Amid market lows and rising prices, many are asking if we’re heading for a housing market crash in 2025.

If talk of tariffs and mercurial markets are giving you pause about your plans, you’re not alone. In fact, new data from Clever Real Estate has found that 70% of Americans are worried about a housing crash in 2025. But how likely is this, and what does the latest data say?

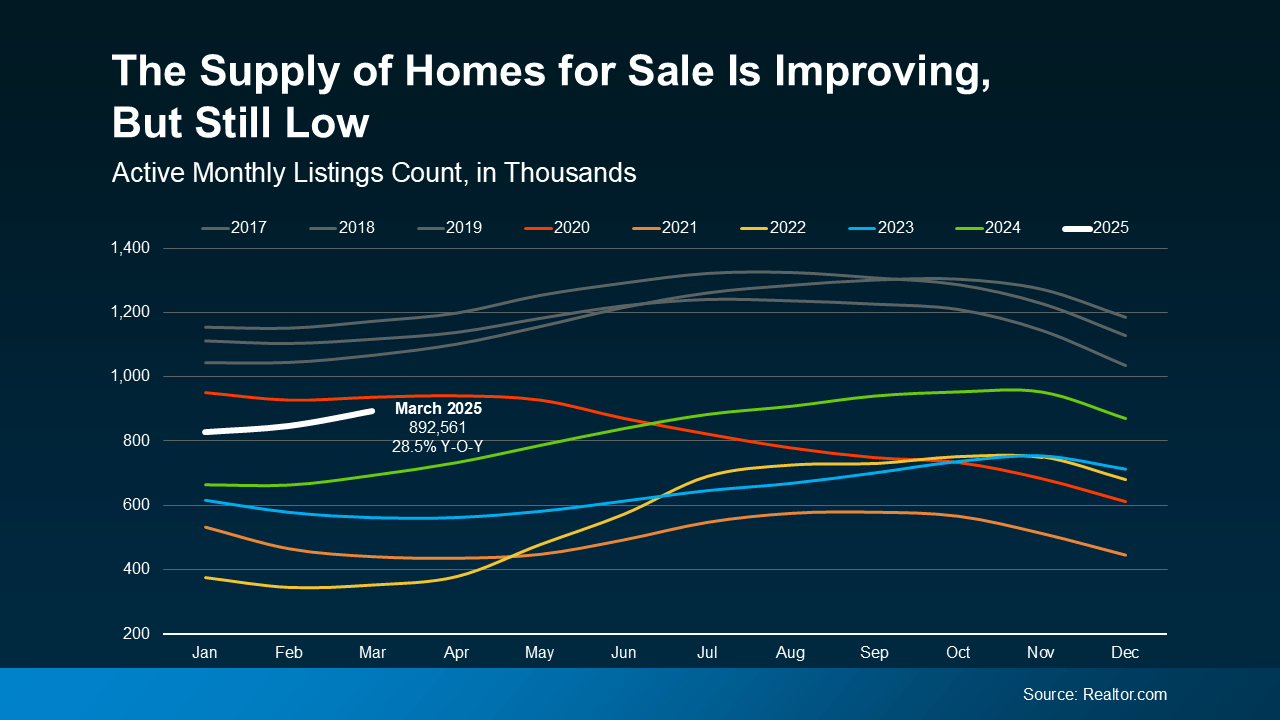

Low Inventory Prevents a Crash in Prices

Before you put your plans to buy or a sell a home on hold, let’s look at the facts. The reality is that the trends in the housing market we’re seeing aren’t signs of crashing, only of shifting. As Chief Economist at First American Mark Fleming explains:

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

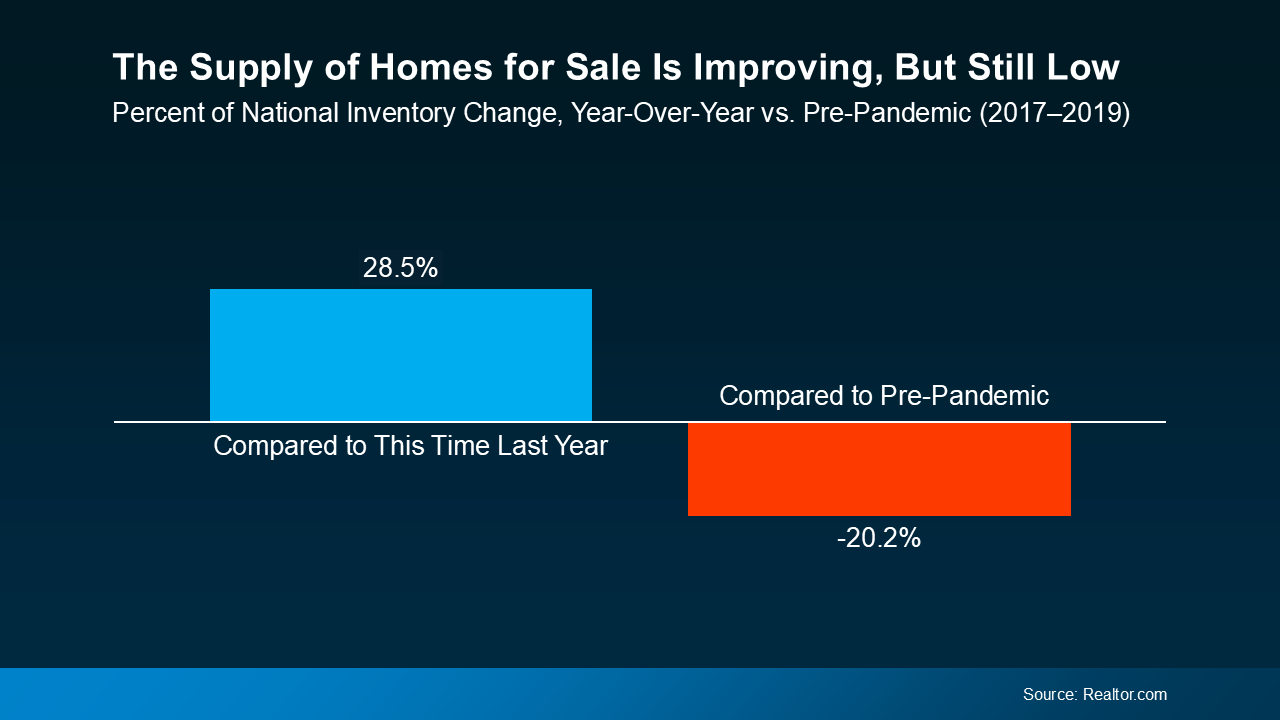

Consider the basic laws of supply and demand. If the supply of something is low, its prices are bound to go up, and homes are no exception. And even though housing inventory is up in 2025, high demand from buyers is still driving home prices higher.

According to recent data from Realtor.com, the number of homes for sale in 2025 is climbing, but still below normal levels. Even still, home supply is at its highest since pre-pandemic levels, showing a positive trend in the right direction.

That ongoing low supply is what’s stopping home prices from dropping at the national level. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“… if there’s a shortage, prices simply cannot crash.”

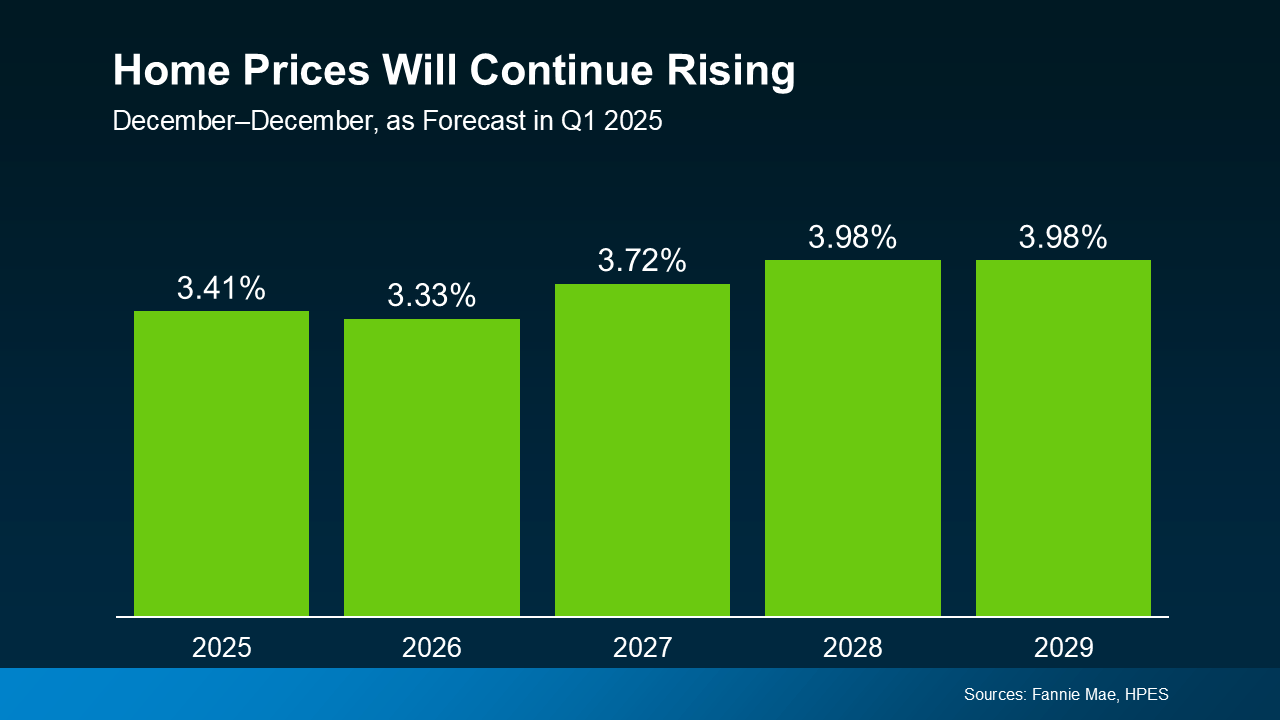

Home Prices Normalize as Inventory Increases

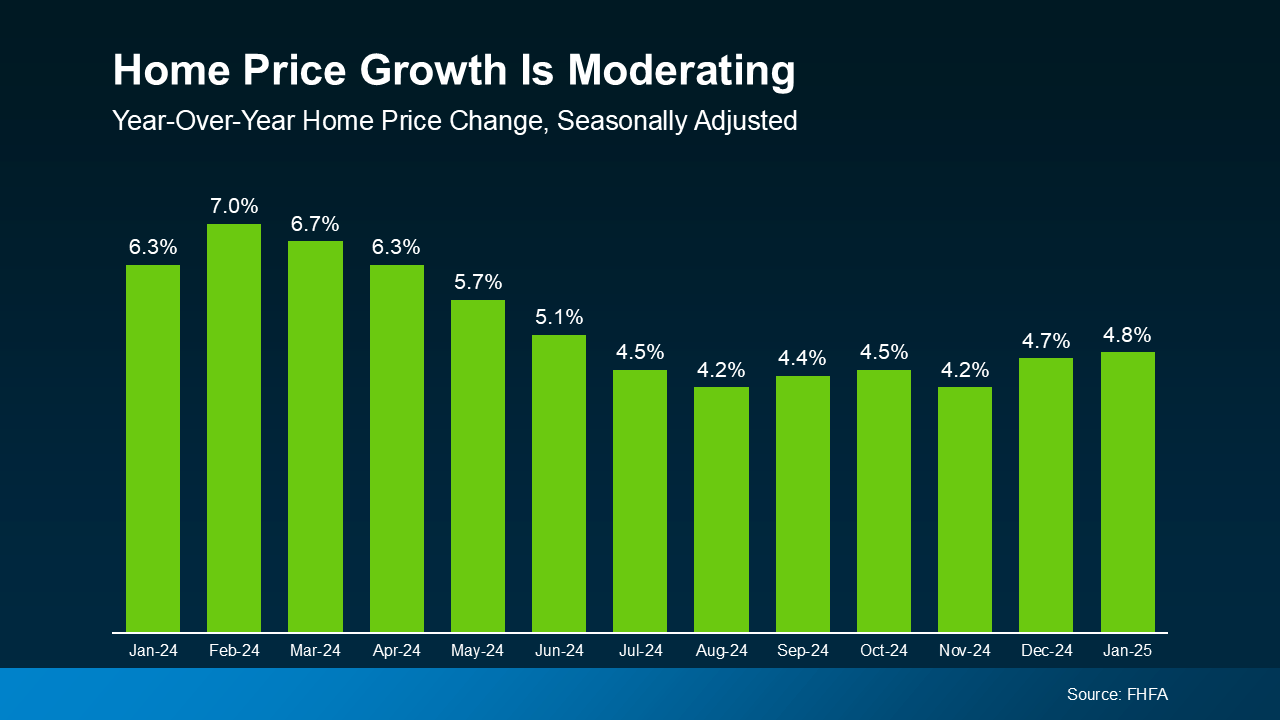

As more homes are listed on the market, upward pressure on home price growth normalizes. Prices may not be falling, but they’re rising at a rate closer to what we’d consider normal for the market.

Even though prices aren’t declining nationally, increased inventory means they’re rising more slowly than they were. The trend we’re currently seeing is what’s considered price moderation.

The good news for buyers is that this price moderation is expected to continue throughout the rest of the year, according to a January report from Freddie Mac:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

This means that home prices will continue rising in most markets, but not as quickly as they did in 2024. This is great news for anyone who’s been priced out of the market thanks to rapid price appreciation these past few years.

These numbers represent national trends, so the true story will vary in individual markets. A local real estate agent can give you the latest details on the market trends in your your own unique area.

Conclusion

Fears of a housing market crash in 2025 abound, but don’t let this worry you. While a little caution is healthy, experts are confident that a housing market crash is unlikely in 2025. As a recent report from Business Insider says:

“. . . economists who study housing market conditions generally do not expect a crash in 2025 or beyond unless the economic outlook changes.”

In reality, this year’s housing market is stabilizing thanks to decreasing price growth and increasing home supply. If you’re curious about the market trends in your local area, contact us today to connect with an agent who can reassure you with the facts.

Selling Your Home? Avoid This Mistake When Setting Your Asking Price

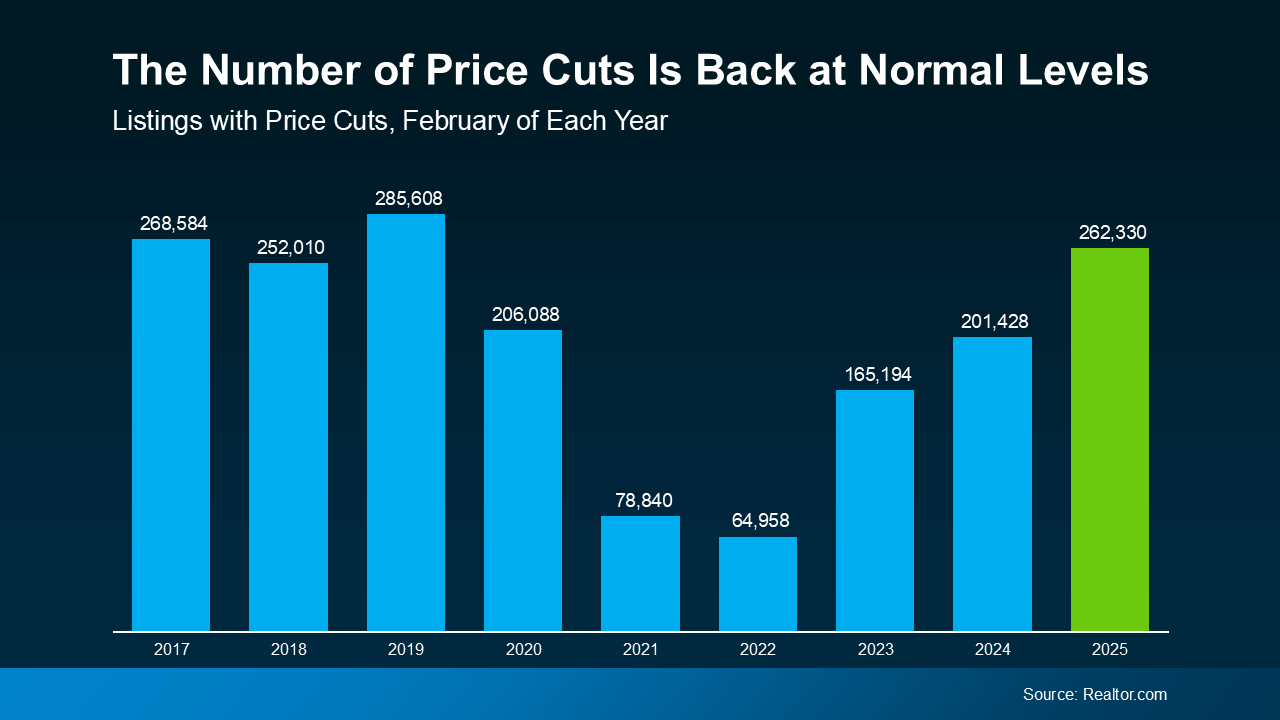

When selling your house, the typical goal is to sell quickly at the best price possible. Naturally, ever since home prices took off around 5 years ago, most sellers have been aiming high. But housing inventory is making a comeback, and some sellers haven’t considered what this shift means for their asking price. As a result, buyers are becoming choosier, and price cuts on overpriced listings are increasing alongside home supply.

According to February 2025 data from Realtor.com, home price cuts this February reached their highest number since 2019. That’s the highest number of price cuts in 6 years, and a real return to pre-pandemic market levels.

Given that 2019 is considered the housing market’s last normal year, this demonstrates a major, substantial shift. The market is finally starting to normalize, and may quickly break out of the post-pandemic slump it’s been stuck in.

However, this is a distinctly different trend from the hot seller’s market of 2021 and should be treated differently. You may not sell your house for top dollar like you would have at the pandemic’s peak, but that’s okay. By setting a smart asking price and tempering your expectations, you can still sell quickly, and at a great price.

You may be planning to price your listing high and cut it later if necessary, but this has its drawbacks. Pricing too high and lowering later means you may actually end up with lower offers in the end. Pricing right the first time is the best way to avoid this, and a local agent can make the difference.

How a Local Agent Can Find Your Perfect Asking Price

A true expert real estate agent doesn’t set an asking price without good reason. These agents consider real data and trends unique to your market, setting a price specific to your home. This way, you set a realistic price based on your home’s true value to attract as many buyers as possible.

Depending on your local market and your agent’s analysis, they may even recommend strategically pricing slightly below market value. While this may sound counterintuitive, it can be a strategic move to attract more attention to your listing, earning you more competitive offers. Here are a few ways a local agent will determine the best price for your listing:

- Researching recent home sales. What price did homes similar to yours finally sell for? Were these homes initially listed higher before dropping in price to sell?

- Analyzing local market trends. The true value of your home isn’t based on the price you’d like to sell it at. It’s the price that potential buyers are willing to pay. A local agent will have a strong idea of this number based on experience.

- Strategizing to sell. A great agent will price your home to attract attention, creating a sense of urgency among buyers and increasing demand.

How Overpricing Your Home Can Backfire

Unfortunately, some sellers still ignore their agent’s advice and prefer to start high just to see what happens. The hope being maybe they get their full asking price, or they at least have more wiggle room for negotiation. But pricing high usually ends up costing you, and here’s why:

- Buyers may ignore it. The market’s past few years – and the direction it’s headed – have made buyers more budget-conscious than ever. If a home listing looks overpriced, buyers are more likely to ignore it and move on than consider negotiating.

- It could stay on the market too long. The longer your home sits on the market without selling, the more buyers will assume something is wrong with it. This can make it harder and harder to sell as time goes on, and makes a price cut almost inevitable.

- You may sell for less in the end. Price cuts often lower a listing’s final selling price below its best, most realistic market value. Listing at the right price to begin with gives sellers the best chance of selling quickly at a great price.

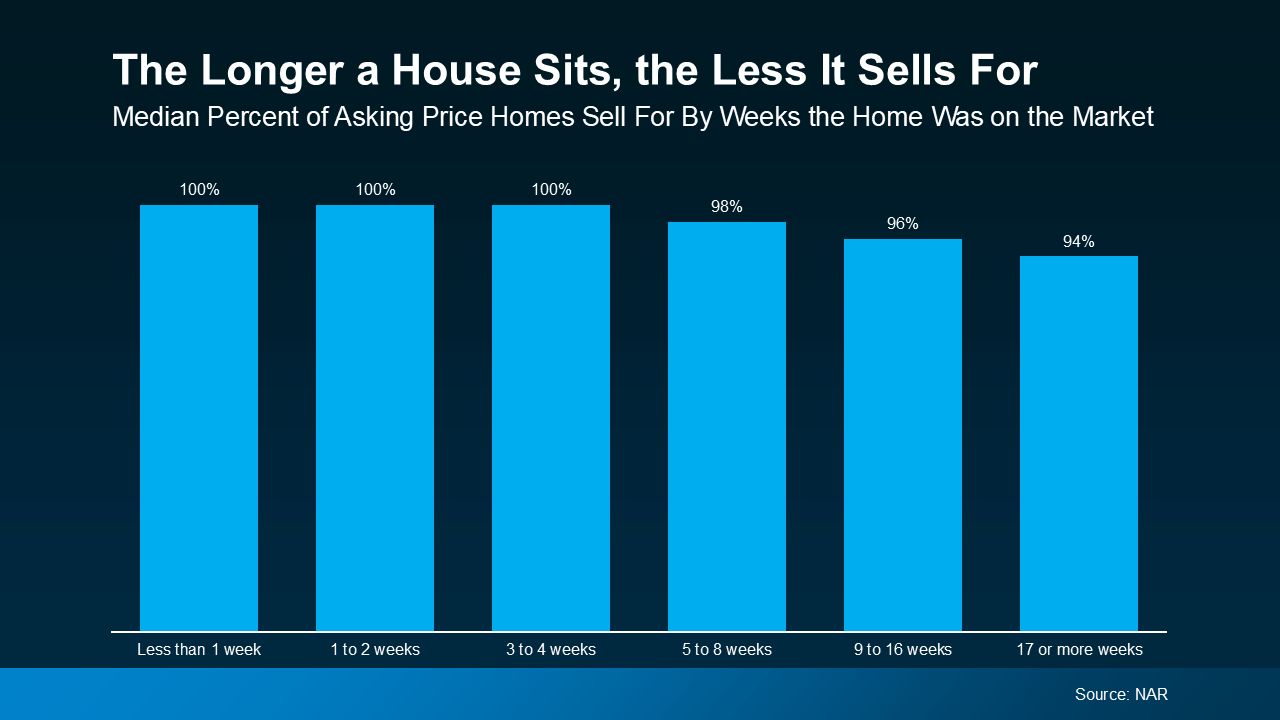

The graph below demonstrates how these factors play out in the market. Using data from the National Association of Realtors (NAR), it shows how time on the market lowers final selling price.

According to the data, if a house sells within its first 4 weeks after listing, it usually sells for full price. Homes that are priced at or just below current market value typically sell quickly in this same window. When a home is priced right, it attracts truly interested buyers who are willing to buy at your asking price. In a hot market, buyers may even compete with other buyers, or even make an offer above your listing price.

On the other hand, a home that’s overpriced will take longer to sell, if it sells at all. As the graph demonstrates, after that first 4 weeks on the market, final selling price starts to drop. And as buyer interest declines over time, the more likely a seller will accept a low offer, or cut their price.

Conclusion

The housing market is normalizing thanks to increasing housing inventory, causing price cuts to rise with increasing buyer power. For sellers, setting the right asking price is more important than ever, and overpricing could make your listing sit on the market. Advice from a local agent can help you avoid this mistake and sell quickly without having to lower your price.

Interested in selling but need help pricing your home for your local market? Get in touch with us today. We can connect you with a local agent who can sell your home at the best price possible.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link