Here’s the Next Best Time To Sell Your Home This Spring

Back in March, Realtor.com reported that the best time to list your house in 2025 was April 13–19. With that week now behind us, you may be wondering if you missed your chance this year. Fortunately, you still have plenty of time, if another source’s prediction holds true this spring.

Realtor.com may be one of the biggest property search sites, but others have their own data, studies, and methodologies. This means that they sometimes receive different results and reach different conclusions. This means that they sometimes receive different results and reach different conclusions, which may be good news for you. Because according to Zillow, the ideal spring house selling window hasn’t passed yet.

Reports on the Best Spring Selling Period

New research from Zillow has found that sellers who list their homes in late May tend to see higher sale prices. Based on home sales from 2024, homes listed in May had the highest sale premium of about $5,600. According to Zillow‘s study:

“Search activity typically peaks before Memorial Day, as shoppers get serious about house hunting before their summer vacation and the new school year in the fall. By targeting late spring, sellers can get their home listed when the most shoppers are looking. When more buyers are competing for homes, sellers can command a higher price.”

But Zillow isn’t the only one declaring May as the best time for home sellers to list. Using data from 59 million home sales over the past 13 years, ATTOM Data completed a similar study. In this case, it was found that sellers who list in May net an 11.1% higher closing price on average.

“Freshly compiled sales statistics from ATTOM demonstrate that home sellers continue to reap significant benefits from listing their properties during the month of May. Examination of home sales trends spanning thirteen years reveals that, on average, sellers are commanding 11.1 percent premium above the estimated market value.”

Meanwhile, a report from Bankrate states that listing at any time in April or May is ideal. In fact, it found that homes listed in May on average sell for about 13.1% above market value:

“Some patterns and trends usually do hold true throughout the year, and one is that spring continues to be the best time to sell. Sellers can net thousands of dollars more if they sell during the peak months of April and May. . .”

If these reports are accurate, then there’s still time to list during peak home selling season. Closing your home sale in May could get you a sizable increase in your final sale price.

Of course, the best week to list your house ultimately depends on your own local real estate market. Prices are driven by buyer demand and home supply, and these can vary wildly from market to market. This is why working with an experienced local agent can be so helpful, especially in uncertain markets.

Conclusion

Even though Realtor.com‘s recommended spring selling window has passed, other sources say there’s still plenty of time this year. Spring is always a busy time in real estate, and you can take advantage without listing during a specific week.

The true best time to sell your house will be determined by your own unique local market this spring. Working with an agent can help remove some of the guesswork, and get you the best closing price possible.

Many Fear a Housing Market Crash in 2025 – Will It Happen?

Between every economic uncertainty underpinning this year so far, Americans are understandably trepid about the future. Amid market lows and rising prices, many are asking if we’re heading for a housing market crash in 2025.

If talk of tariffs and mercurial markets are giving you pause about your plans, you’re not alone. In fact, new data from Clever Real Estate has found that 70% of Americans are worried about a housing crash in 2025. But how likely is this, and what does the latest data say?

Low Inventory Prevents a Crash in Prices

Before you put your plans to buy or a sell a home on hold, let’s look at the facts. The reality is that the trends in the housing market we’re seeing aren’t signs of crashing, only of shifting. As Chief Economist at First American Mark Fleming explains:

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

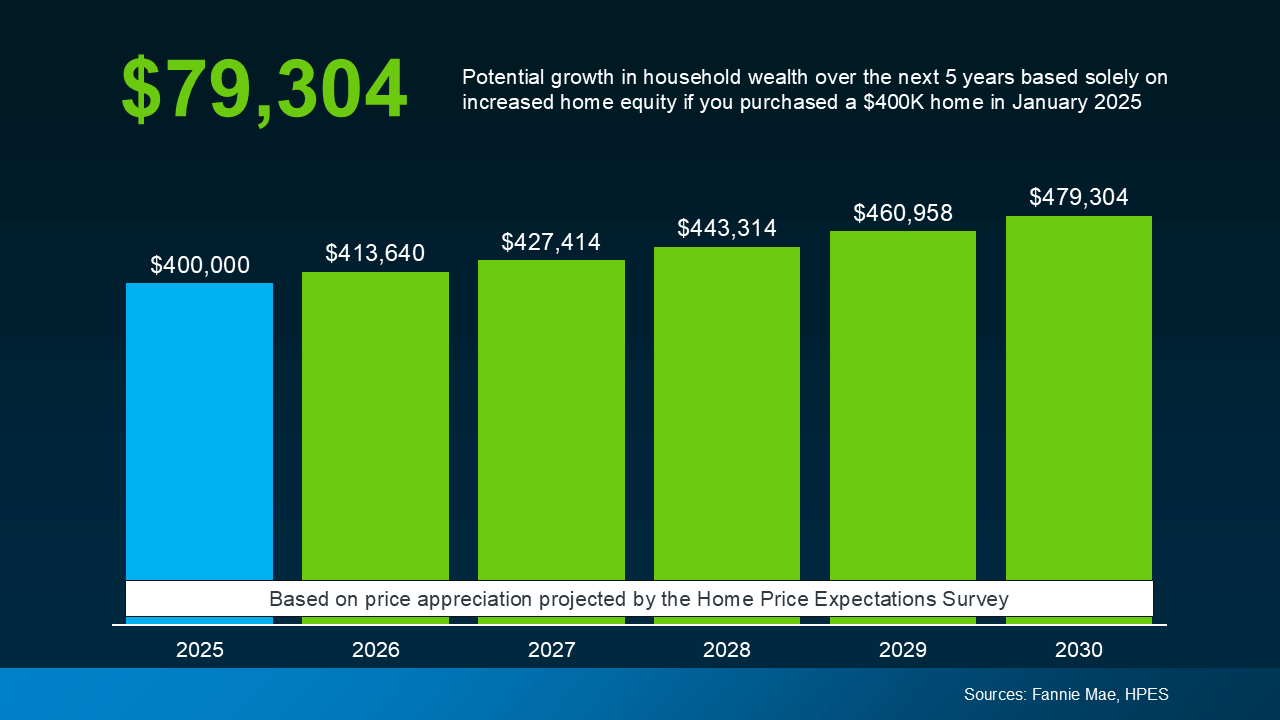

Consider the basic laws of supply and demand. If the supply of something is low, its prices are bound to go up, and homes are no exception. And even though housing inventory is up in 2025, high demand from buyers is still driving home prices higher.

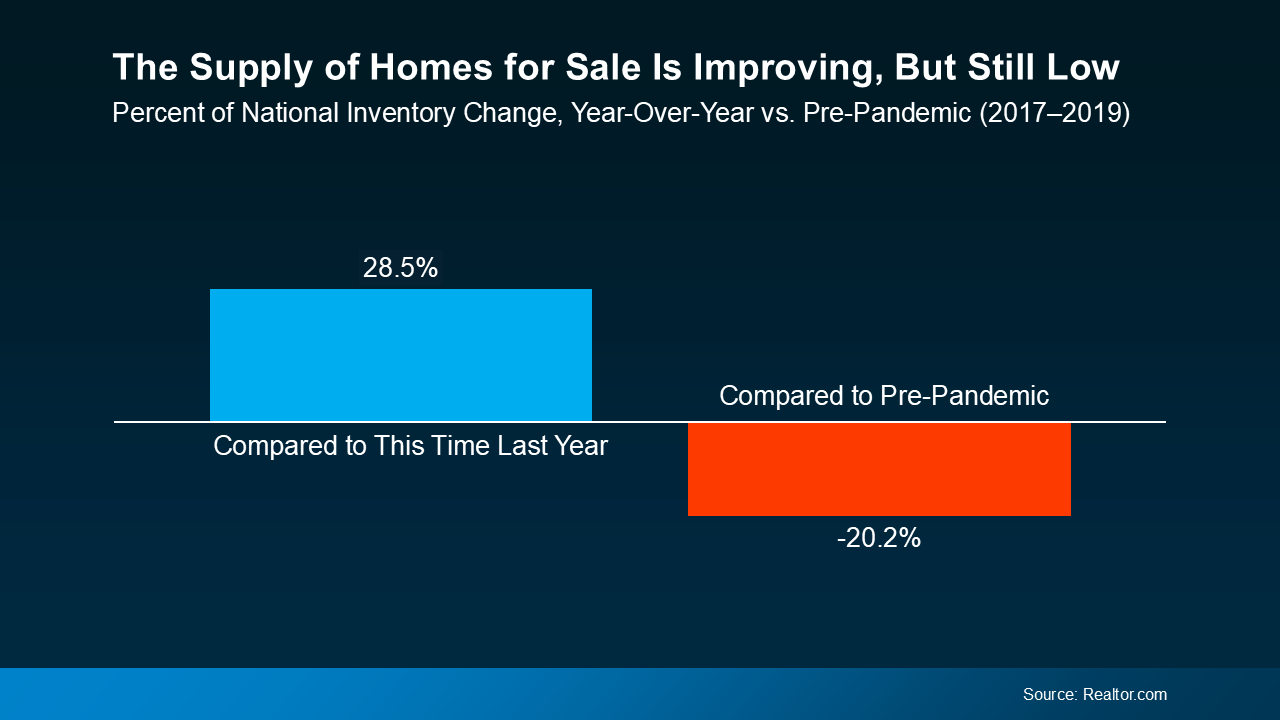

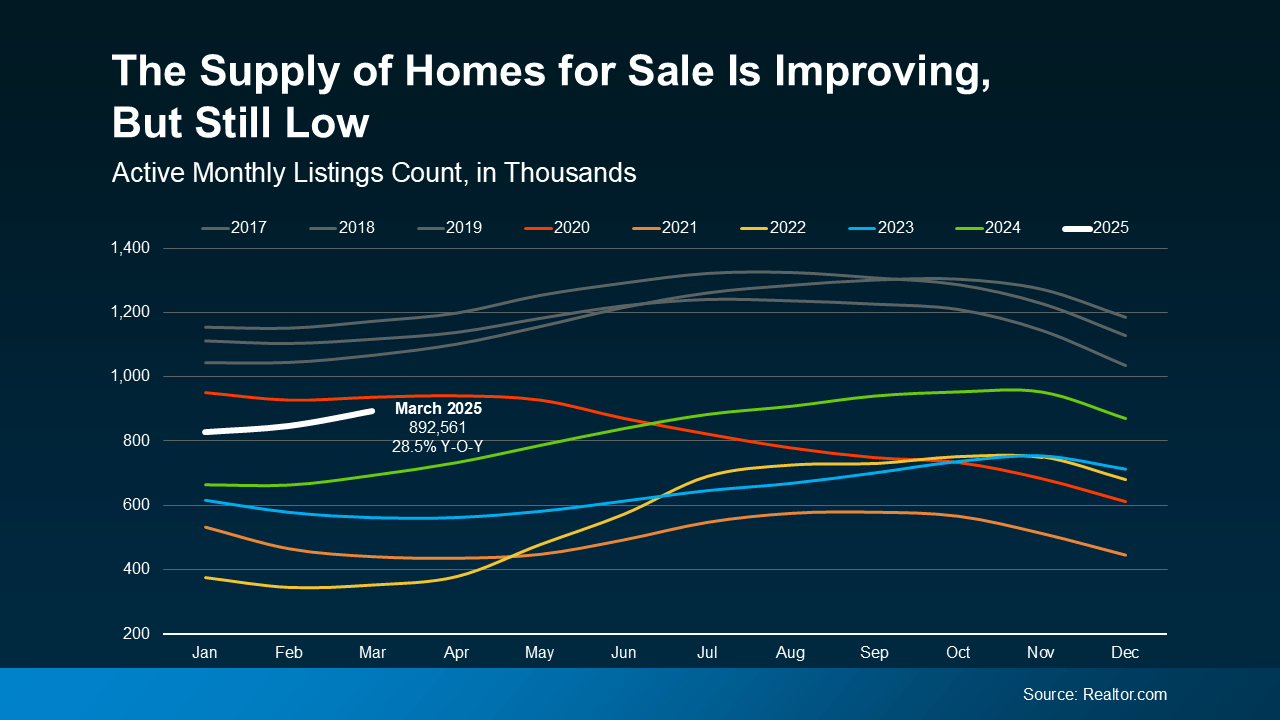

According to recent data from Realtor.com, the number of homes for sale in 2025 is climbing, but still below normal levels. Even still, home supply is at its highest since pre-pandemic levels, showing a positive trend in the right direction.

That ongoing low supply is what’s stopping home prices from dropping at the national level. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“… if there’s a shortage, prices simply cannot crash.”

Home Prices Normalize as Inventory Increases

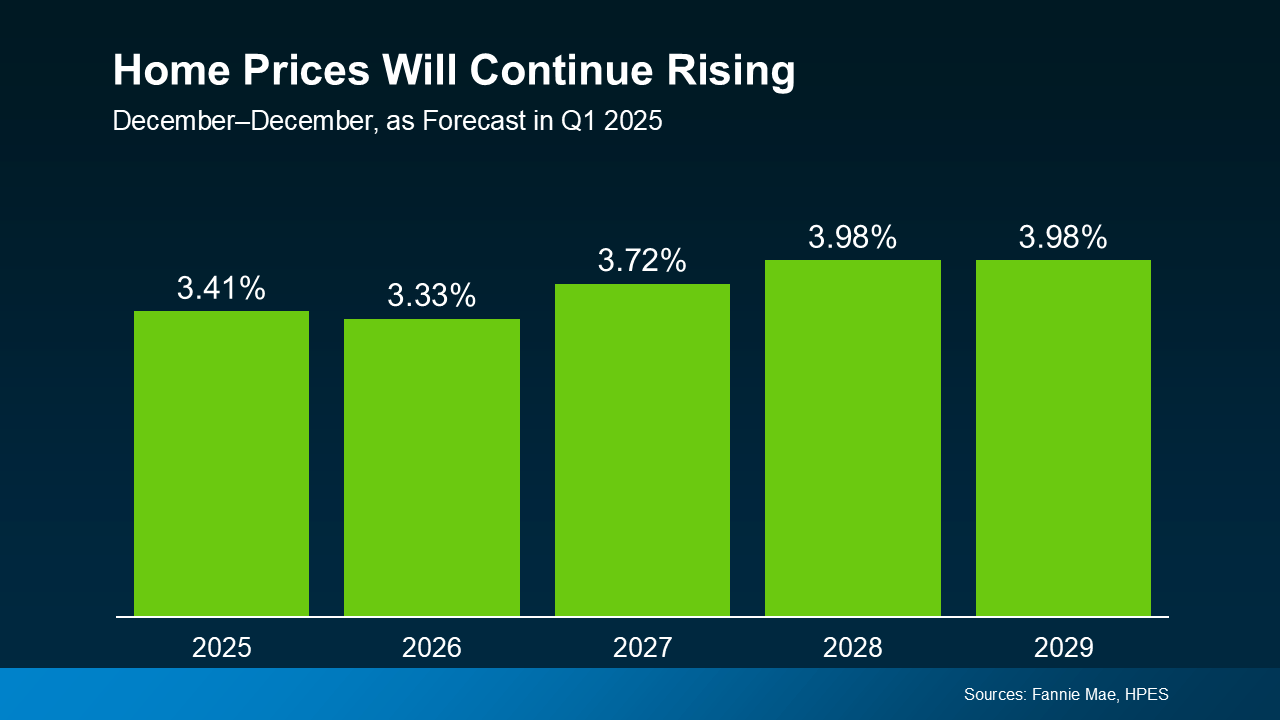

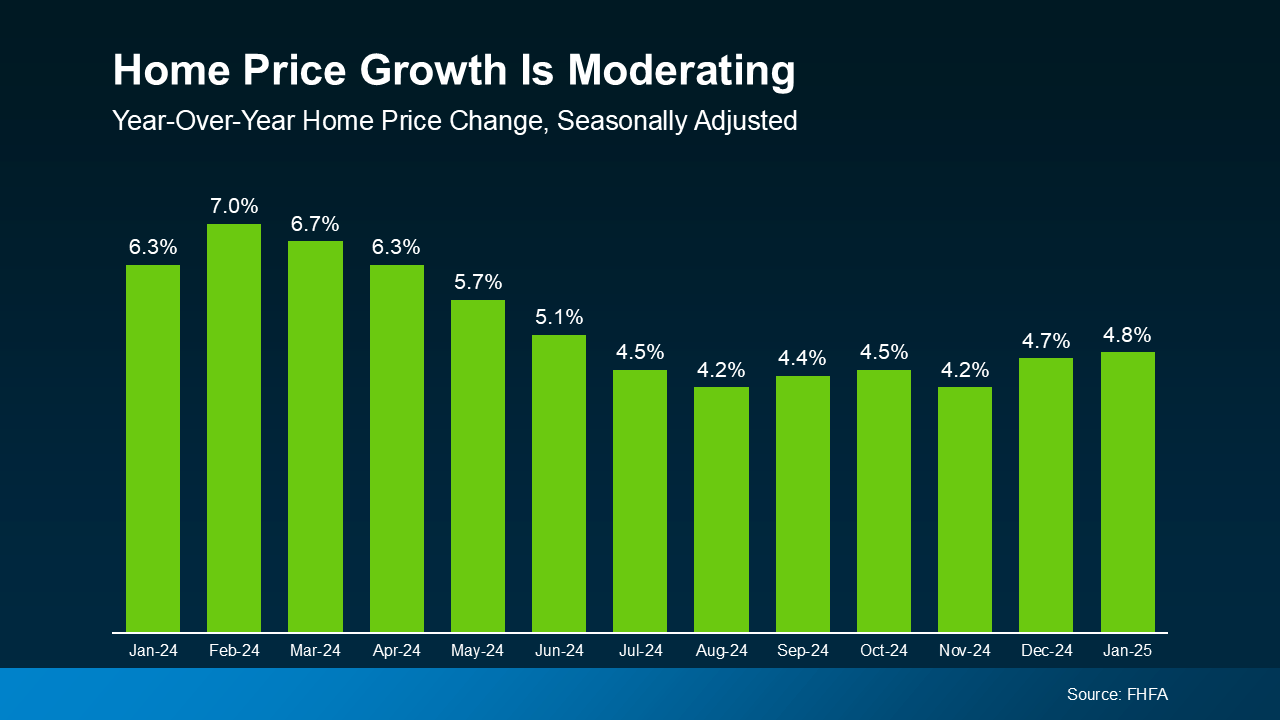

As more homes are listed on the market, upward pressure on home price growth normalizes. Prices may not be falling, but they’re rising at a rate closer to what we’d consider normal for the market.

Even though prices aren’t declining nationally, increased inventory means they’re rising more slowly than they were. The trend we’re currently seeing is what’s considered price moderation.

The good news for buyers is that this price moderation is expected to continue throughout the rest of the year, according to a January report from Freddie Mac:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

This means that home prices will continue rising in most markets, but not as quickly as they did in 2024. This is great news for anyone who’s been priced out of the market thanks to rapid price appreciation these past few years.

These numbers represent national trends, so the true story will vary in individual markets. A local real estate agent can give you the latest details on the market trends in your your own unique area.

Conclusion

Fears of a housing market crash in 2025 abound, but don’t let this worry you. While a little caution is healthy, experts are confident that a housing market crash is unlikely in 2025. As a recent report from Business Insider says:

“. . . economists who study housing market conditions generally do not expect a crash in 2025 or beyond unless the economic outlook changes.”

In reality, this year’s housing market is stabilizing thanks to decreasing price growth and increasing home supply. If you’re curious about the market trends in your local area, contact us today to connect with an agent who can reassure you with the facts.

New Data Points to a Promising 2025 Home Buying Season for Buyers

Many real estate markets have been in a bit of a freeze these past few years thanks to low inventory. But if you’ve been in the market for a home and discouraged by lacking options, good news has finally arrived. Home supply is rising, and the 2025 home buying season is shaping up to be a promising time for buyers. According to March 2025 data, new home listings are up to levels we haven’t seen since 2022.

New Home Listings Are Rising

The number of home listings on the market suffered a slump in 2022 that only worsened in 2023. But finally, after a frustrating few years, total new home listings this March reached a number just below pre-pandemic levels. According to Daryl Fairweather, Chief Economist at Redfin:

“Now is the best time to buy in the last two years. Mortgage rates are comparable to what they were two years ago, and prices remain high. However, there is significantly more inventory . . .”

A higher number of homes for sale on the market means more options for you as a buyer. While this is expected during the busy springtime market, the 2025 home buying season is showing significant, encouraging activity.

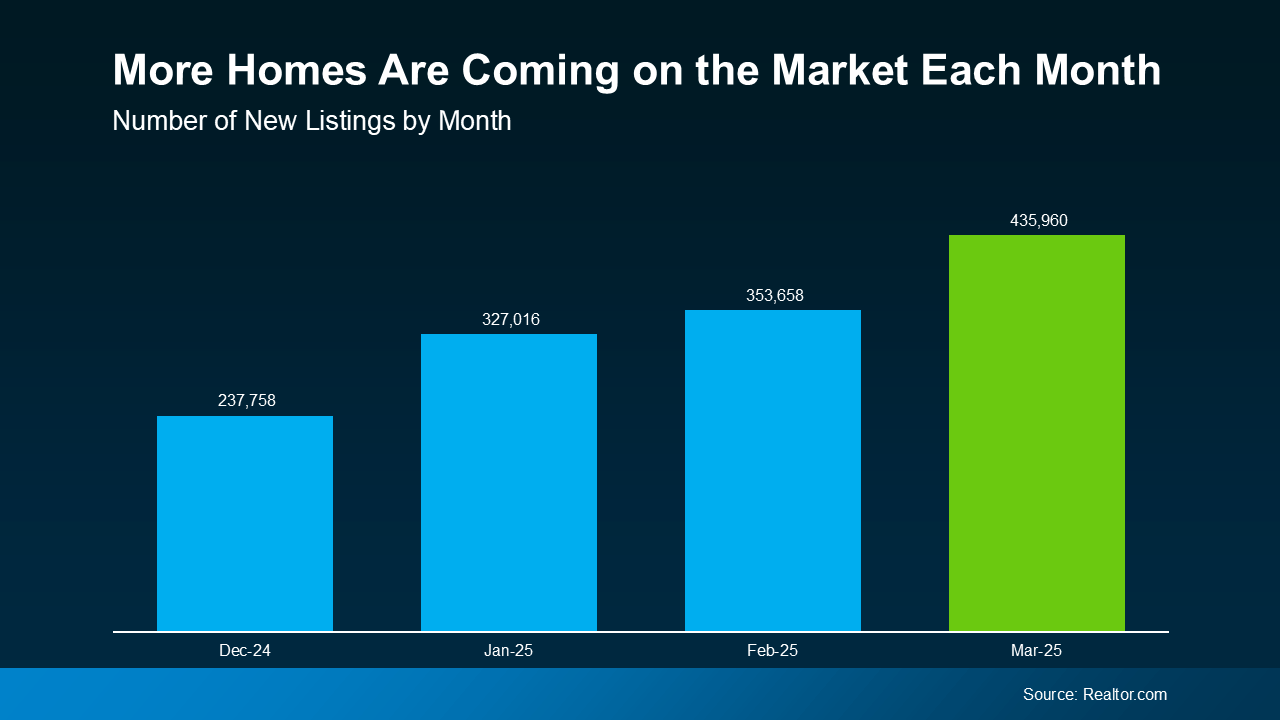

Put simply, existing homeowners are listing their houses at the highest rate in years. According to the latest data from Realtor.com, active home listings on the market have been increasing since the start of 2025.

As the graph shows, more and people are putting their homes on the market each month as 2025 goes on. These sellers may be upgrading, downsizing, or relocating, but they’re all listing, and it’s a healthy trend for the market.

The takeaway is that sellers who may have been patiently waiting these past few years are finally jumping back in. That boost to the market’s inventory means better opportunities for both first time homebuyers and existing move-up sellers. But what’s most significant isn’t the month-over-month inventory increases, it’s the year-over-year gains over last year’s spring market.

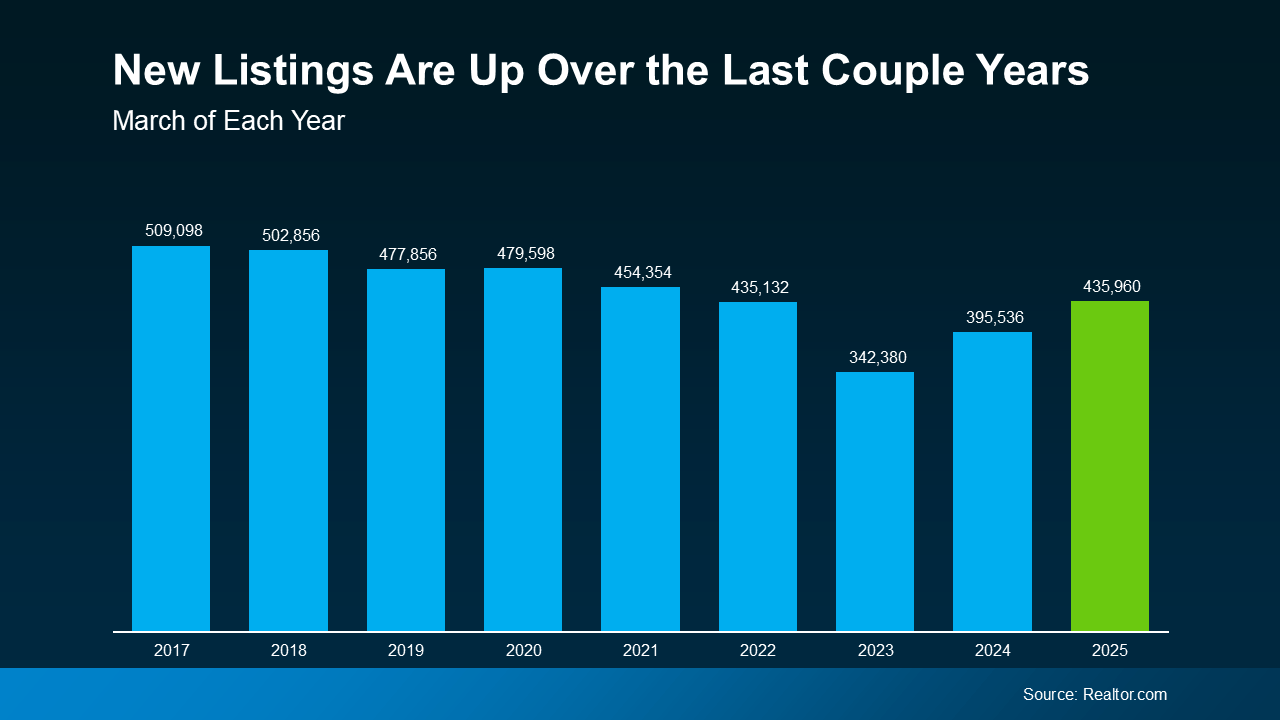

The Realtor.com data showed that new listings this March were 10.2% higher than last year. That increase made last month the biggest March for new home listings since 2021, as you can see below.

If you’ve been patiently watching for more house options before moving, this is the market shift you’ve been waiting for. With more home listings entering the market, you have a much better chance of finding the perfect fit. Even better, having more options means sellers may be more willing to negotiate, giving you more power as buyer.

Conclusion

If you’ve been waiting to make a move, this is spring is promising to be filled with options and opportunities. More listings are on the market, and the 2025 home buying season is looking like the healthiest one in years. For buyers, this means more homes to choose from, and possibly even a better deal on the house you want.

If you’re in the market and don’t want to miss the perfect listing, reach out to us today. We’ll connect you with a local agent who can keep you current with your area’s latest listings.

Selling Your Home? Avoid This Mistake When Setting Your Asking Price

When selling your house, the typical goal is to sell quickly at the best price possible. Naturally, ever since home prices took off around 5 years ago, most sellers have been aiming high. But housing inventory is making a comeback, and some sellers haven’t considered what this shift means for their asking price. As a result, buyers are becoming choosier, and price cuts on overpriced listings are increasing alongside home supply.

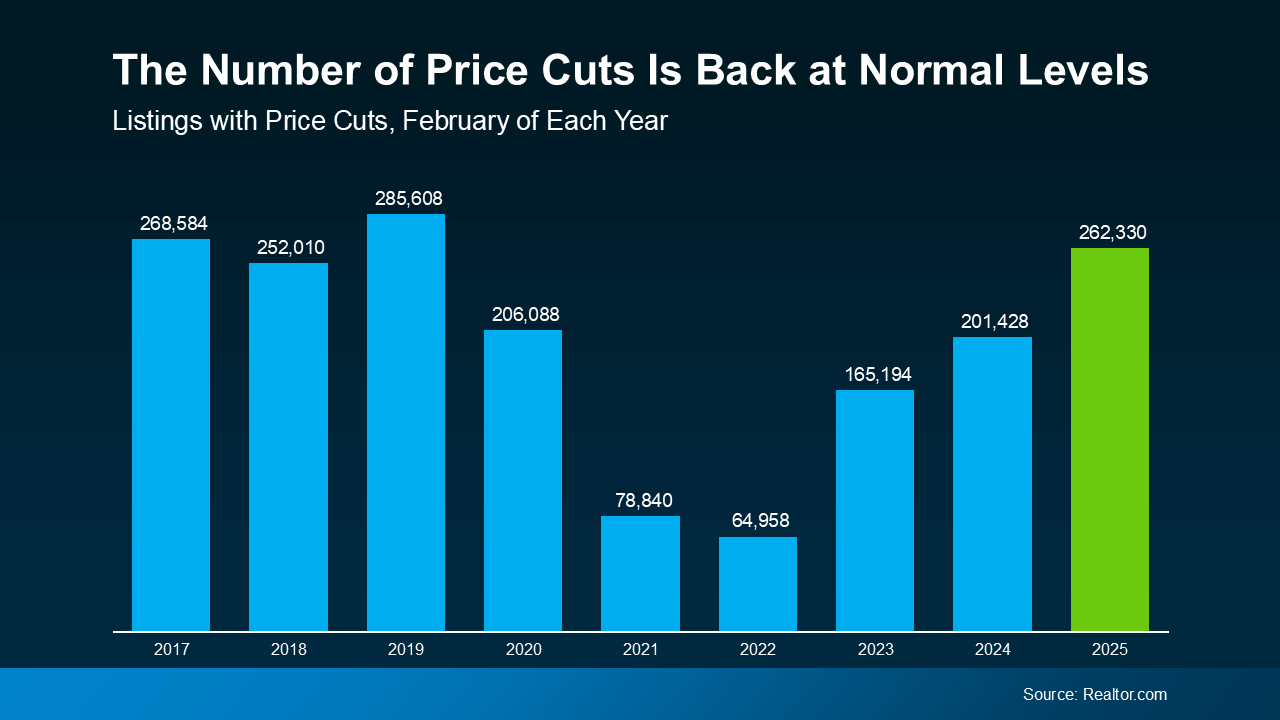

According to February 2025 data from Realtor.com, home price cuts this February reached their highest number since 2019. That’s the highest number of price cuts in 6 years, and a real return to pre-pandemic market levels.

Given that 2019 is considered the housing market’s last normal year, this demonstrates a major, substantial shift. The market is finally starting to normalize, and may quickly break out of the post-pandemic slump it’s been stuck in.

However, this is a distinctly different trend from the hot seller’s market of 2021 and should be treated differently. You may not sell your house for top dollar like you would have at the pandemic’s peak, but that’s okay. By setting a smart asking price and tempering your expectations, you can still sell quickly, and at a great price.

You may be planning to price your listing high and cut it later if necessary, but this has its drawbacks. Pricing too high and lowering later means you may actually end up with lower offers in the end. Pricing right the first time is the best way to avoid this, and a local agent can make the difference.

How a Local Agent Can Find Your Perfect Asking Price

A true expert real estate agent doesn’t set an asking price without good reason. These agents consider real data and trends unique to your market, setting a price specific to your home. This way, you set a realistic price based on your home’s true value to attract as many buyers as possible.

Depending on your local market and your agent’s analysis, they may even recommend strategically pricing slightly below market value. While this may sound counterintuitive, it can be a strategic move to attract more attention to your listing, earning you more competitive offers. Here are a few ways a local agent will determine the best price for your listing:

- Researching recent home sales. What price did homes similar to yours finally sell for? Were these homes initially listed higher before dropping in price to sell?

- Analyzing local market trends. The true value of your home isn’t based on the price you’d like to sell it at. It’s the price that potential buyers are willing to pay. A local agent will have a strong idea of this number based on experience.

- Strategizing to sell. A great agent will price your home to attract attention, creating a sense of urgency among buyers and increasing demand.

How Overpricing Your Home Can Backfire

Unfortunately, some sellers still ignore their agent’s advice and prefer to start high just to see what happens. The hope being maybe they get their full asking price, or they at least have more wiggle room for negotiation. But pricing high usually ends up costing you, and here’s why:

- Buyers may ignore it. The market’s past few years – and the direction it’s headed – have made buyers more budget-conscious than ever. If a home listing looks overpriced, buyers are more likely to ignore it and move on than consider negotiating.

- It could stay on the market too long. The longer your home sits on the market without selling, the more buyers will assume something is wrong with it. This can make it harder and harder to sell as time goes on, and makes a price cut almost inevitable.

- You may sell for less in the end. Price cuts often lower a listing’s final selling price below its best, most realistic market value. Listing at the right price to begin with gives sellers the best chance of selling quickly at a great price.

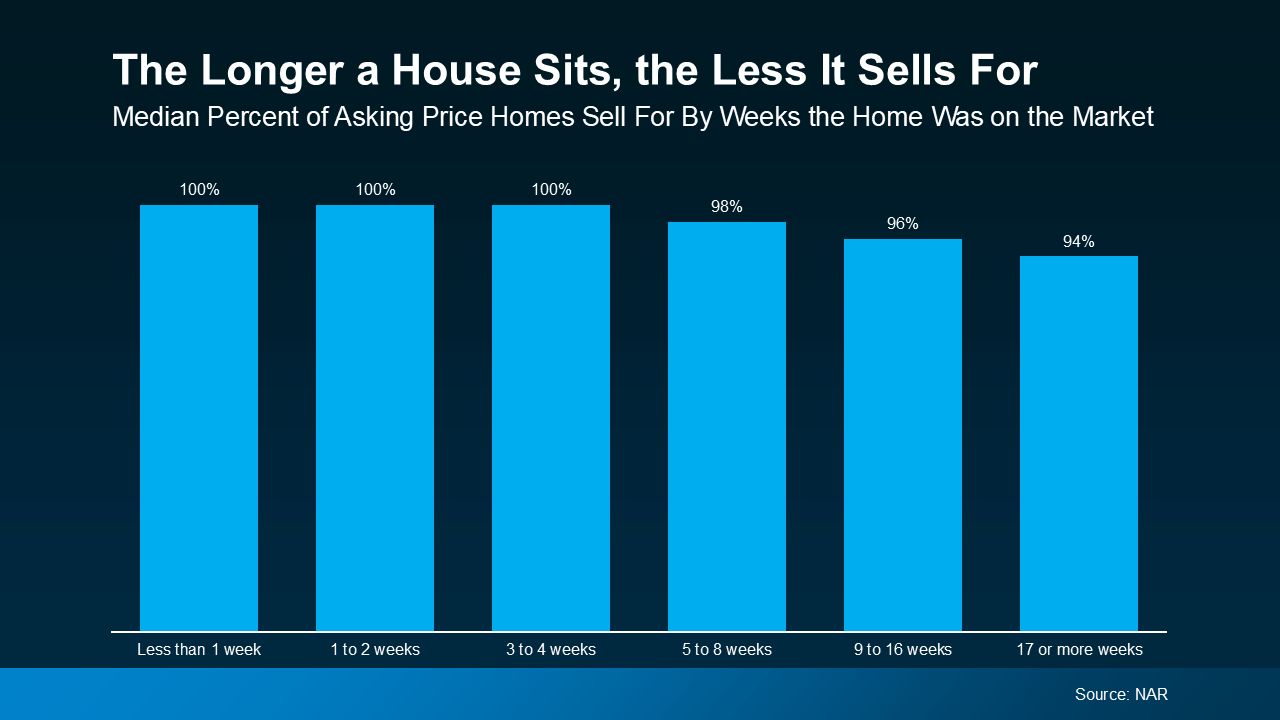

The graph below demonstrates how these factors play out in the market. Using data from the National Association of Realtors (NAR), it shows how time on the market lowers final selling price.

According to the data, if a house sells within its first 4 weeks after listing, it usually sells for full price. Homes that are priced at or just below current market value typically sell quickly in this same window. When a home is priced right, it attracts truly interested buyers who are willing to buy at your asking price. In a hot market, buyers may even compete with other buyers, or even make an offer above your listing price.

On the other hand, a home that’s overpriced will take longer to sell, if it sells at all. As the graph demonstrates, after that first 4 weeks on the market, final selling price starts to drop. And as buyer interest declines over time, the more likely a seller will accept a low offer, or cut their price.

Conclusion

The housing market is normalizing thanks to increasing housing inventory, causing price cuts to rise with increasing buyer power. For sellers, setting the right asking price is more important than ever, and overpricing could make your listing sit on the market. Advice from a local agent can help you avoid this mistake and sell quickly without having to lower your price.

Interested in selling but need help pricing your home for your local market? Get in touch with us today. We can connect you with a local agent who can sell your home at the best price possible.

REAL Trends Recognizes CENTURY 21 Affiliated Among Leading Realty Firms in 2025

REAL Trends has once again recognized CENTURY 21 Affiliated as a top real estate firm in the United States. Ranked 58 in brokerage sales nationwide, the REAL Trends 500 places CENTURY 21 Affiliated as the top-producing CENTURY 21 franchise.

CENTURY 21 Affiliated ranked #1 in both state volume and sides, and received the prestigious “Billionaires’ Club” Award for surpassing $3.76B in closed sales over the past year.

See the Report Here.

The REAL Trends 500 list highlights CENTURY 21 Affiliated’s continued success across its five-state footprint, further solidifying its reputation as a leader in the real estate industry.

“CENTURY 21 Affiliated sales professionals approach everything they do with passion and professionalism, which has made our company a fixture across the United States,” said Dan Kruse, CEO of CENTURY 21 Affiliated. “We couldn’t be more proud of our Affiliated Family and the dedication they bring to their clients and communities.”

For over three decades, REAL Trends has been the industry standard in ranking the performance of residential real estate service firms. The organization remains a trusted source for news, analysis, and insight into the real estate market since 1988.

2024 was another milestone year for CENTURY 21 Affiliated, as the franchise continued to expand its offices and strengthen its market presence. Once again, CENTURY 21 Affiliated was named the #1 CENTURY 21 franchise in the world for units sold and AGC (Average Gross Commission) – marking its eleventh consecutive year at the top.

About CENTURY 21 Affiliated Real Estate LLC

CENTURY 21 Affiliated is a member of multiple listings services in California, Illinois, Michigan, Minnesota, and Wisconsin with over 1,400 sales professionals and 70+ offices.

CENTURY 21 Affiliated also specializes in worldwide relocation. At CENTURY 21 Affiliated, the customer comes first. The complete commitment to this philosophy is what has made CENTURY 21 Affiliated such a powerful force in the real estate industry. CENTURY 21 Affiliated has been ranked the number one CENTURY 21® franchise in the world for eleven years in a row. Visit C21Affiliated.com to learn more.

©2025 CENTURY 21 All Rights Reserved. CENTURY 21® and the CENTURY 21 Logo are registered service marks owned by Century 21 Real Estate LLC. Each office is independently owned and operated.

###

CENTURY 21 Affiliated Named Among Top 100 Real Estate Firms in RISMedia’s 2025 Power Broker Report

CENTURY 21 Affiliated, the #1 Century 21 franchise in the world, proudly announces its ranking in RISMedia’s 2025 Power Broker Report, which recognizes the nation’s top-performing real estate firms based on transactions.

CENTURY 21 Affiliated has been ranked #40 based on transactions, and #57 based on sales volume, reinforcing its standing as a dominant force in the real estate industry.

Published annually, RISMedia’s Power Broker Report is based on responses to its Power Broker Survey, distributed each January. The report celebrates the remarkable achievements of real estate leaders and brokerage firms that continue to drive the industry forward.

See Dan Kruse’s Feature in the 2025 Power Broker Report Here.

“Our real estate professionals consistently deliver exceptional service in an evolving market,” said Dan Kruse, CEO & Owner of CENTURY 21 Affiliated. “We’re honored to be recognized among the top brokerages in the country, a testament to our agents’ dedication and commitment to excellence.”

With 1,400 sales associates and 70+ offices spanning California, Illinois, Michigan, Minnesota, and Wisconsin, CENTURY 21 Affiliated remains a leading full-service real estate brokerage. Since joining the CENTURY 21® system in 1978, the company has upheld a legacy of innovation and customer-focused service.

View the Full 2025 Power Broker Report Here.

About CENTURY 21 Affiliated Real Estate LLC

CENTURY 21 Affiliated is a member of multiple listings services in California, Illinois, Michigan, Minnesota, and Wisconsin with over 1,400 sales professionals and 70+ offices.

CENTURY 21 Affiliated also specializes in worldwide relocation. At CENTURY 21 Affiliated, the customer comes first. The complete commitment to this philosophy is what has made CENTURY 21 Affiliated such a powerful force in the real estate industry. CENTURY 21 Affiliated has been ranked the number one CENTURY 21® franchise in the world for eleven years in a row. Visit C21Affiliated.com to learn more.

©2025 CENTURY 21 All Rights Reserved. CENTURY 21® and the CENTURY 21 Logo are registered service marks owned by Century 21 Real Estate LLC. Each office is independently owned and operated.

###

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link