As talk about economic slowdowns runs wild, worries about a potential recession in 2025 are on the rise. Naturally, many homeowners are wondering what a recession could do to the value of their home, and their buying power.

Using historical data from recessions of decades past, let’s see how a recession might affect the housing market in 2025.

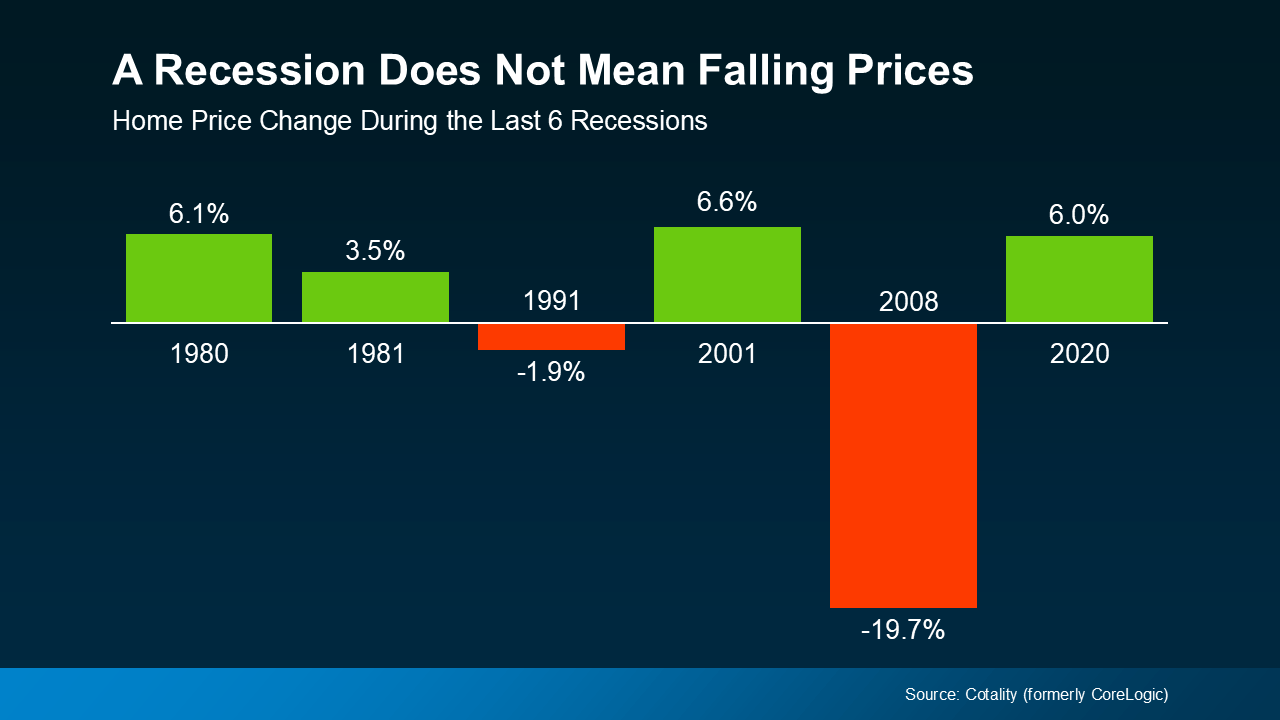

A Recession Won’t Lower Home Prices

It’s a common misconception that a recession will cause home prices to crash, like they did in 2008. In reality, 2008 was the only time the housing market saw such an extreme, dramatic drop in prices. Overflowing home inventory caused that price crash, and conversely, low inventory has prevented a similar crash in the years since.

Even in markets where housing inventory is up, it’s still far below the listing oversupply that caused the 2008 crash. Indeed, according to data from Cotality, home prices actually increased during four of the last six major recessions.

As the graph shows, a recession doesn’t necessarily mean that home prices will crash, or even drop. In reality, historical data shows that home prices usually continue along their current trajectory when a recession hits. And at the moment, home prices are still rising nationally, but at a more normalized rate. So, as the market stands now, a recession in 2025 would most likely drive prices even higher.

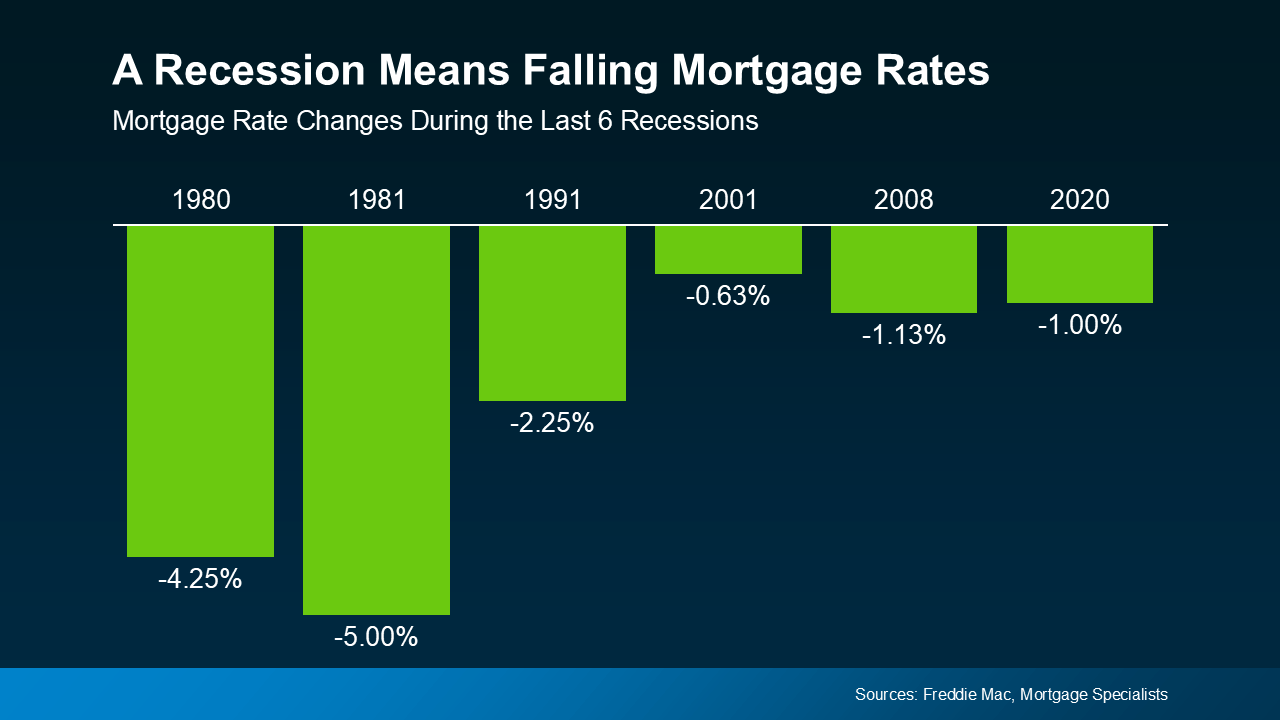

Mortgage Rates Typically Decline During Recessions

Home prices may stay their path during economic slowdowns, but mortgage rates actually tend to drop. Looking again at historical data from the last six recessions, this time from Freddie Mac, mortgage rates fell each time.

Historically speaking, a recession could mean that mortgage rates may even decline this year. However, the last time a recession dramatically lowered mortgage rates was over three decades ago in 1991. So with that said, even if a recession does happen, don’t expect a game-changing drop in mortgage rates.

Conclusion

Nobody ever truly knows what the economy will do, but the odds of a recession in 2025 have increased. Still, a recession doesn’t mean you need to worry about the housing market or the value of your home. The historical data tells us that a recession may even drive home prices higher and mortgage rates lower.

Wondering how an economic slowdown could impact your local market? Connect with us to get the info you need to plan ahead.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link