If the last few years have felt like a constant tug-of-war between home prices, mortgage rates, and “Can we actually afford this?”, you’re not alone. Affordability has been the biggest obstacle for buyers (and a major source of hesitation for sellers), but the outlook for 2026 is more encouraging than what we’ve seen in a while.

In fact, affordability improved meaningfully in 2025, and many industry forecasts expect that progress to continue through 2026. The reason comes down to three forces shaping the market: mortgage rates, housing inventory, and home price growth.

1) Mortgage Rates: Lower Than the Peak, Likely Steadier in 2026

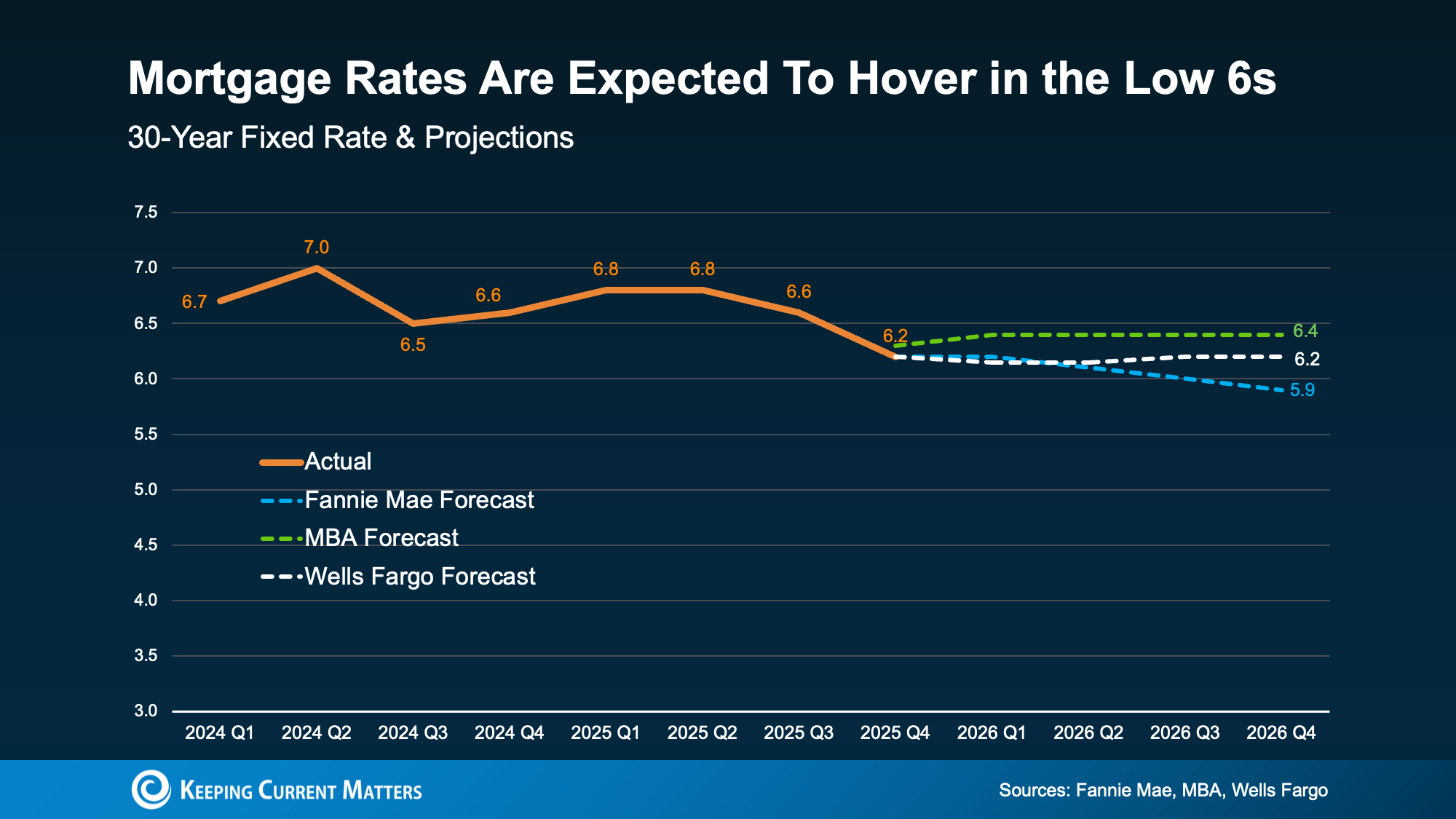

Mortgage rates have already eased from recent highs by nearly a full percentage point over the past year in some measures, and that matters more than most people realize. Even small rate shifts can change monthly payments, buying power, and which homes feel like realistic options.

What experts expect

Forecasts suggest rates may hover in the low 6% range through 2026, though the exact path depends on the broader economy, the job market, and Federal Reserve policy decisions. The key takeaway: rates are already lower than they were a year ago, which helps restore some breathing room for people planning a move in 2026.

What this means for buyers

- Lower rates can reduce monthly payments

- Improved buying power can make more listings qualify as “within reach”

- You may have more flexibility to negotiate when combined with rising inventory

What this means for sellers

- The market is adjusting to the idea that “rates in the 6s” may be the new normal

- If you need to move, it may be more feasible than it looks, especially if you’re sitting on substantial equity

Experts expect mortgage rates to hover in the low 6s or drop even lower as the economy changes in 2026.

2) Housing Inventory: More Homes for Sale, More Leverage for Buyers

One of the biggest changes in 2025 was inventory finally moving in the right direction. With more homes available, buyers got something they haven’t had in years: options—plus more time to compare those options and negotiate.

Inventory is still expected to grow

After a meaningful rise of about 15% in 2025, forecasts call for continued growth in the supply of homes for sale in 2026 (though likely at a slower pace than the last big jump). Realtor.com economists, for example, project additional gains of about 8.9% in active listings this year.

What this means for buyers

- More choices (and fewer “take it or leave it” situations)

- Greater negotiating power—especially on homes that are priced too aggressively or need updates

What this means for sellers

- Pricing strategy becomes critical. In a market with more options, buyers compare everything.

- Strong presentation (clean, staged, repaired) matters more when competition increases

3) Home Prices: Still Rising Nationally, But at a More Sustainable Pace

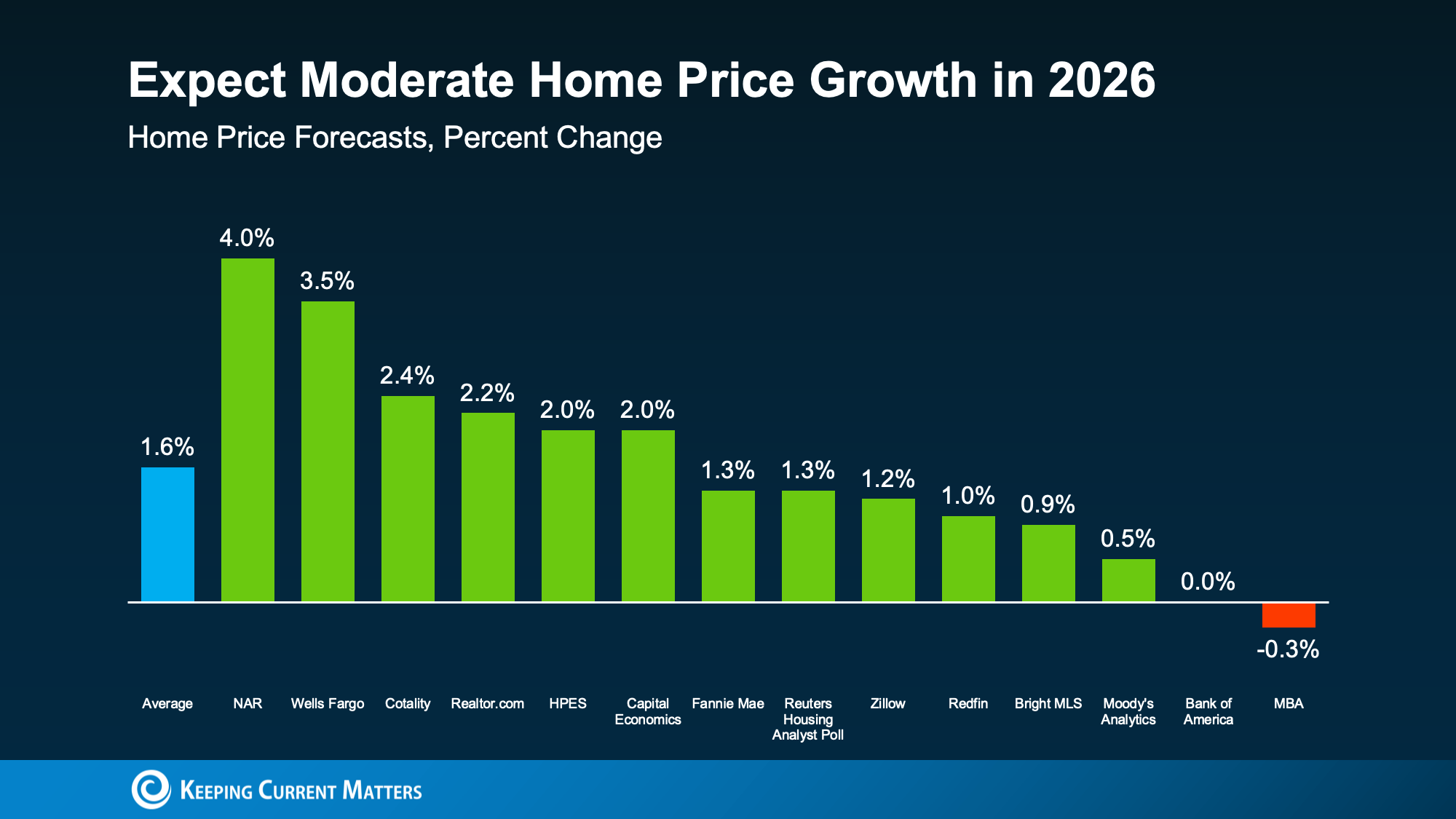

Here’s what many headlines miss: increasing inventory tends to reduce upward pressure on prices, but it doesn’t automatically mean prices crash. Most national forecasts expect home prices to keep rising in 2026, just more slowly than the rapid spikes of the recent past. On average, experts predict home price growth of about 1.6% in 2026.

Why slower growth can be good news

More moderate appreciation helps buyers plan and budget with fewer surprises, while still supporting overall market stability.

But location is everything. Some areas may outperform the national average, while others could see flat or slightly declining prices depending on local supply, demand, and employment conditions. If you’re serious about a move, a local real estate agent can help you interpret what’s happening in your neighborhood, not just what’s happening nationally.

Home prices are expected to continue rising in 2026, though at a more moderate rate.

Will More Homes Sell in 2026?

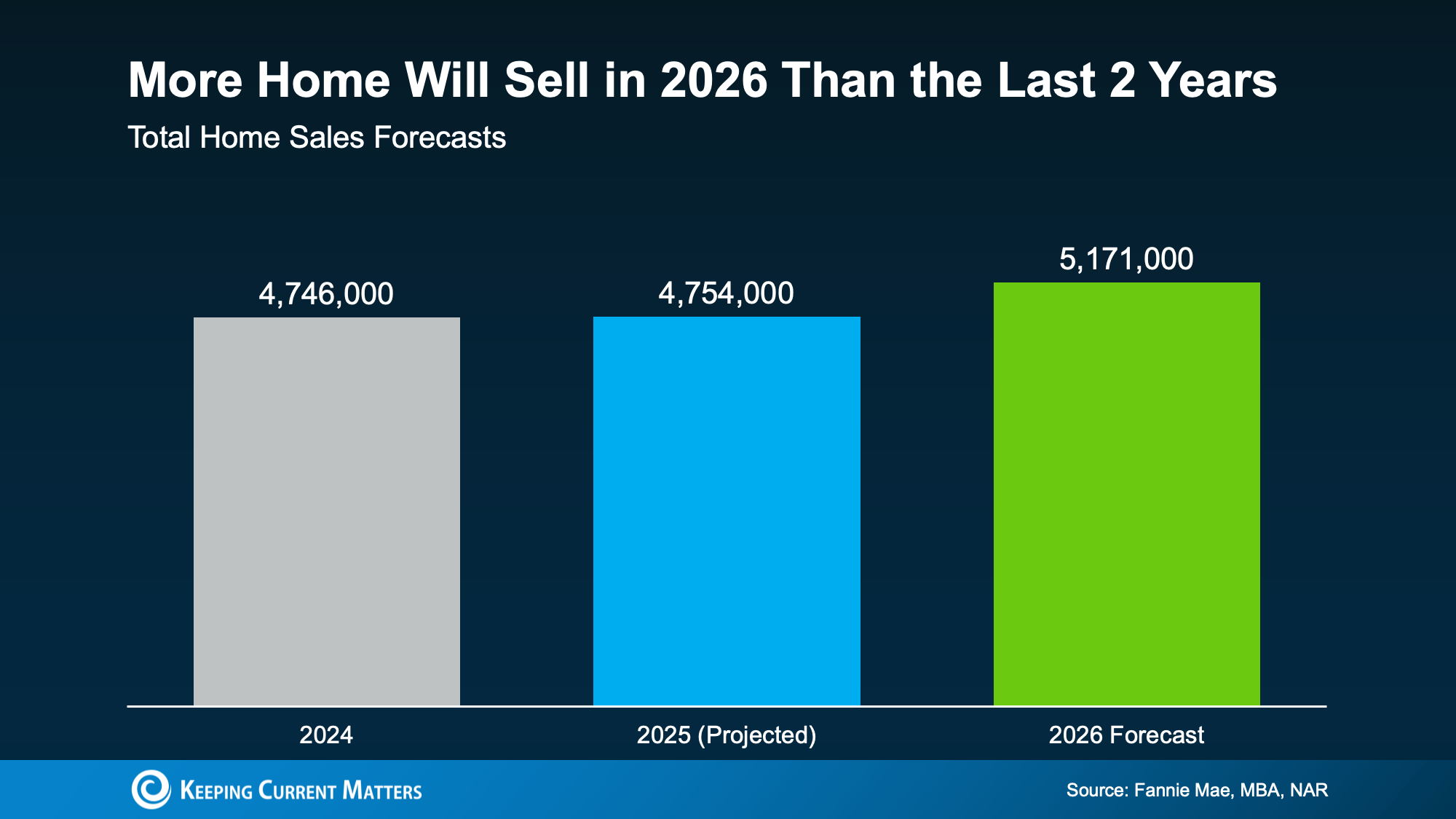

When rates are lower than recent peaks, inventory is improving, and price growth is calmer, you get a healthier affordability equation. That’s why many experts expect more home sales in 2026, as both buyers and sellers find conditions easier to navigate.

As Zillow’s Chief Economist Mischa Fisher notes:

“Buyers are benefiting from more inventory and improved affordability, while sellers are seeing price stability and more consistent demand. Each group should have a bit more breathing room in 2026.”

Increased affordability in 2026 has experts predicting higher home sales over the past two years.

2026 Could Feel More Balanced Than You’ve Seen in Years

Affordability won’t change overnight. But if current forecasts hold, 2026 is shaping up to be a year with:

- More balance between buyers and sellers

- More predictability in pricing

- More flexibility in negotiations

- More opportunity for people who’ve been waiting on the sidelines

If you’re thinking about buying or selling in 2026, the smartest next step is to get hyper-local: understand neighborhood pricing trends, inventory levels, and what buyers are actually paying (and negotiating) right now.

Ready to start but aren’t sure how? Reach out to us today to connect with an expert agent for all the latest info on your local market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link