Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Home Price Growth Is Slowing in 2025 – What Does That Mean for You?

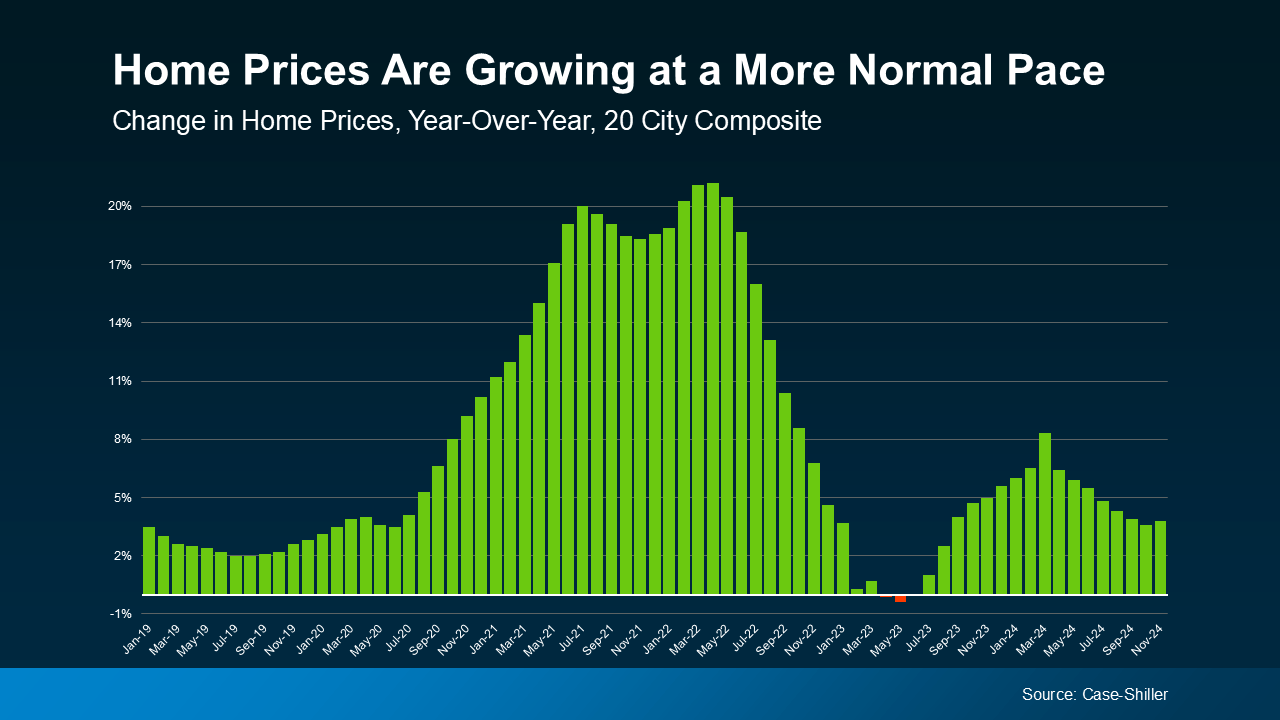

Over the past few years, home prices have skyrocketed as demand has increased and supply has stiffened. It’s been a frustrating market for buyers, leaving many to doubt their chances of ever owning their own home. But the early weeks of 2025 have brought welcome news: the pace of home price growth is finally slowing down, and that’s a positive shift for anyone looking to buy a home.

Home Price Growth Drops to a Healthy Pace

At the national level, home prices are still rising, but at a much more normal, manageable rate compared to the double-digit spikes we saw in 2021 and 2022. Recent data from Case-Shiller show that in November 2024, the year-over-year increase in home prices was just 3.8% nationally, a clear drop from Pandemic rates:

What does this mean for you? For one thing, you’re less likely to experience the sticker shock that was common just a few years ago. The days of rapid price jumps that made it difficult to plan or pursue your purchase are behind us, and projected drops in mortgage rates this year paint an even more positive picture. More stable price growth also means that the home you buy today is still likely to appreciate in value over time, helping you build equity and secure your financial future.

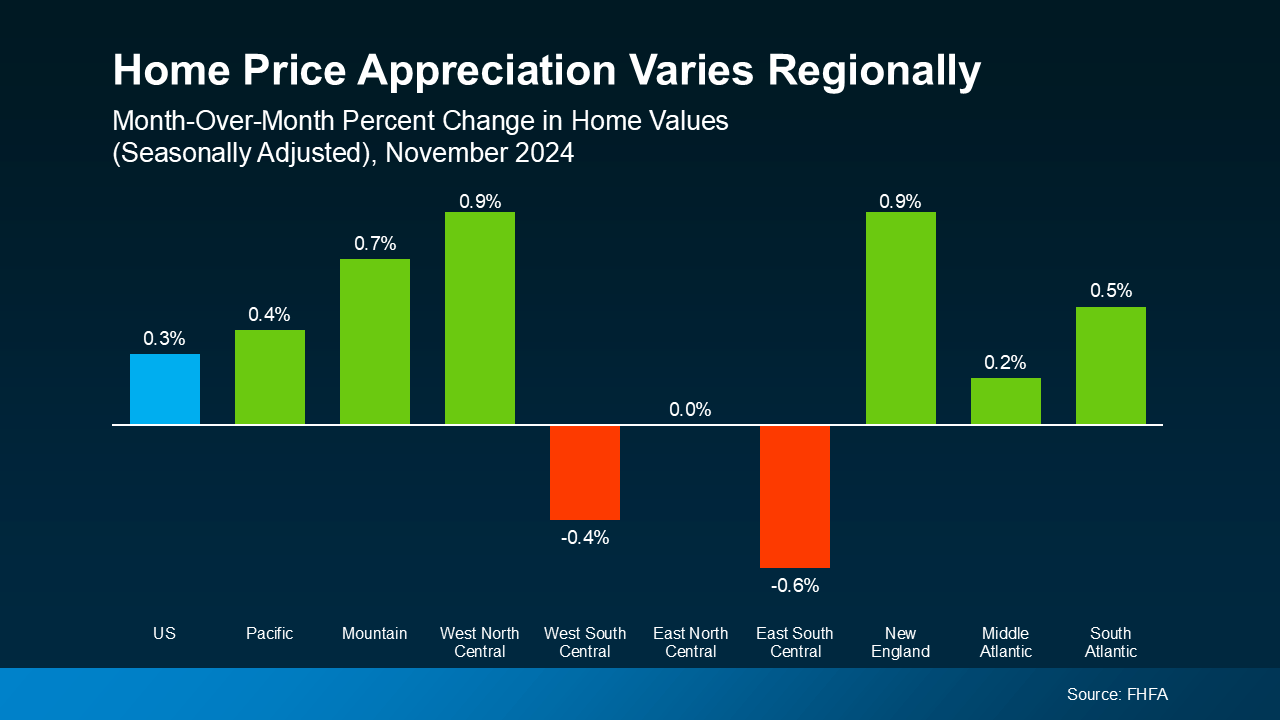

Real Estate Is Local: Prices Vary by Market

While the national trend is pointing to more moderate price growth, keep in mind that all real estate is local. Some markets are still experiencing strong demand and upward price pressures, while others are cooling off or even seeing declines. For example, smaller, more affordable metro areas are still seeing significant demand and price increases. As CoreLogic Chief Economist Selma Hepp explains:

“Regionally, variations persist, as some affordable areas – including smaller metros in the Midwest — remain in high demand and continue to see upward home price pressures.”

Meanwhile, other regions, particularly those in southern markets, experienced slight month-over-month declines in November, according to Federal Housing Finance Agency (FHFA) data:

Differences like these highlight the importance of understanding what’s happening in your specific market. National averages can provide a general idea, but they rarely give you the whole picture. That’s where the knowledge and expertise of a local real estate agent can really help. They can help you understand local trends, identify opportunities, and create a buying strategy tailored to your needs and budget. Whether you’re buying in a high-demand market or one that’s cooling off, having a local expert on your side ensures you’re making more informed and confident decisions.

Conclusion

Home prices in early 2025 are growing at a more manageable pace, giving you the opportunity to plan your purchase without fearing the rapid price hikes of recent years. Connecting with a local real estate agent can help you navigate your area’s local home market, and make the best decision possible.

If you’re thinking about buying a home, 2025 is shaping up to be a great time to explore your options. Reach out to us today to connect with a local expert who can help you buy with confidence and find the perfect home for you.

FHA Home Loans in Wisconsin

If you’re in the market for a home in Wisconsin, you may have heard of FHA loans, or Federal Housing Administration loans, as a financing option. These government-backed loans are a popular choice for first-time homebuyers and those with less-than-perfect credit. In this guide, we’ll break down everything you need to know about FHA loans in Wisconsin, along with benefits and requirements of state-specific programs that can help you achieve your dream of homeownership.

What are FHA Home Loans?

FHA loans are mortgages insured by the Federal Housing Administration (FHA) and are designed to make homeownership more accessible, especially for Americans who may not qualify for a traditional mortgage or other loans. This reduces the risk for lenders and allows them to offer lower down payments and more lenient credit requirements. This also makes FHA loans particularly appealing to first-time buyers or those with limited savings.

Here are a few ways that FHA loans stand out from other options:

- Low Down Payment: You can qualify with as little as 3.5% down if your credit score is 580 or higher, meaning that up to 96.5% of a home’s value can be borrowed through an FHA loan.

- Flexible Credit Requirements: FHA loans are more forgiving of lower credit scores compared to conventional loans. Borrowers with scores as low as 500 may still qualify with a 10% down payment.

- Competitive Interest Rates: Being backed by the federal government, FHA loans often have lower interest rates than conventional loans, making monthly payments more affordable.

- Mandatory Mortgage Insurance: FHA loans require both an upfront mortgage insurance premium (UFMIP) and an annual mortgage insurance premium (MIP), which is paid monthly.

These are just a few ways FHA loans can help homebuyers overcome financial barriers and make homeownership a reality for more Americans. With lower credit score requirements and lower down payments, it’s an easier pathway to securing a loan and finally owning a house.

Current FHA Loan Interest Rates in Wisconsin

As of February 2025, the average interest rate for a 30-year fixed FHA loan in Wisconsin is 6.24%, with an APR of 6.92%. These rates are slightly lower than conventional loan rates, making FHA loans a more cost-effective option. However, rates vary depending on your credit score, the lender, and the loan type and length, so always explore your options and compare offers when possible.

FHA Loan Requirements in Wisconsin

To qualify for a FHA home loans in Wisconsin, several key criteria must be met to ensure that potential borrowers are financially stable and capable of repaying their loan. Most notably, applicants need to demonstrate a reliable employment history and income.

Here’s a summary of the main eligibility criteria:

- Credit Score: As of 2023, a minimum score of 580 is required for a 3.5% down payment. Scores between 500 and 579 require a 10% down payment.

- Debt-to-Income Ratio (DTI): Your total monthly debt, including the mortgage, should not exceed 43% of your income, though some lenders may allow up to 57% in certain cases.

- Employment and Income: You’ll need a steady employment history of at least two years and verifiable income.

- Primary Residence: The home must be your primary residence.

- Property Standards: The property must meet FHA’s minimum standards for safety and livability, as determined by an FHA-approved appraiser.

- Loan Limits: For 2025, the FHA loan limit for a single-family home in most Wisconsin counties is $524,225. In higher-cost areas like Pierce and St. Croix counties, the limit is $529,000.

By meeting these requirements, you better position yourself for loan approval. It can also simplify the loan process, making it smoother and preventing potential setbacks or delays.

Applying for an FHA Loan in Wisconsin

Applying for FHA home loans in Wisconsin is straightforward but involves several basic steps. Borrowers should start by researching and comparing various FHA-approved lenders to find the best loan terms and secure the best deal.

After selecting a lender, borrowers complete the FHA loan application process. This process may vary between lenders, but should follow the same general steps. Here’s an overview of the major stages involved:

- Find an FHA-Approved Lender: Choose a lender approved by the FHA. Most banks, credit unions, and mortgage companies offer FHA loans.

- Pre-Approval: Get pre-approved to determine your budget and show sellers you’re a serious buyer.

- Submit Your Application: Provide details about your income, employment, and the property you want to buy .

- Provide Documentation: Submit tax returns, pay stubs, bank statements, and other financial documents.

- Property Appraisal: The lender will order an appraisal to ensure the home meets FHA standards and is worth the loan amount.

- Underwriting: The lender reviews your application to ensure you meet all FHA requirements.

- Closing: Sign the final paperwork, pay closing costs, and officially become a homeowner.

Wisconsin-Specific Programs to Pair with FHA Loans

Certain areas in Wisconsin may offer programs that can make FHA loans even more affordable. These programs are most common in larger metropolitan areas like Madison and Milwaukee, but some are available statewide through the Wisconsin Housing and Economic Development Authority (WHEDA). Here are a few options to explore if you’re planning to buy a home in Wisconsin:

- WHEDA Down Payment Assistance: The Wisconsin Housing and Economic Development Authority (WHEDA) offers programs like the Easy Close DPA, which provides up to 6% of the home’s purchase price as a second mortgage. Another option is the Capital Access DPA, offering $7,500 with no interest or monthly payments

- City of Madison’s Home-Buy the American Dream Program: Provides up to $35,000 in down payment and closing cost assistance, deferred until the home is sold or refinanced.

- Milwaukee Down Payment Assistance: Offers forgivable grants of up to $7,000 for homes in designated areas, provided the buyer contributes at least $1,000 and lives in the home for five years.

- Local Assistance Programs: Many cities and counties in Wisconsin offer grants or zero-interest loans for first-time buyers. Check with your local housing authority for details.

Conclusion

FHA loans are an excellent choice for hopeful homebuyers, especially first-time buyers or those with limited savings. By combining the benefits of FHA loans with Wisconsin-specific programs like WHEDA’s down payment assistance, you can make your dream of homeownership a reality. Whether you’re buying in Milwaukee, Madison, or a smaller town, understanding the FHA loan process and available resources will help you make informed decisions and secure the best deal for your new home.

If you’re ready to take the next step, start by finding an FHA-approved lender and exploring the down payment assistance programs available in your area. With the right preparation, you’ll be well on your way to owning a home in the beautiful state of Wisconsin!

Ready to buy but not sure how to secure a loan? Reach out to us today for help finding a qualified lender that works for you.

3 Reasons To Buy a Home Before Spring

Buying a home before spring

Let’s face it — buying a home can feel like a challenge with today’s mortgage rates. You might even be thinking, “Should I just wait until spring when more homes hit the market and rates might be lower?”

But here’s the thing, no one knows for sure where mortgage rates will go from here, and waiting could mean facing more competition, higher prices, and a lot more stress.

What if Buying a home before spring might actually give you the upper hand? Here are three reasons why that just might be the case.

1. Less Competition from Other Buyers

The winter months tend to be quieter in the real estate market. Fewer people are actively looking for homes, which means you’ll likely face less competition when you make an offer. This makes the process feel less rushed and less stressful.

According to the National Association of Realtors (NAR), homes sit on the market longer in winter compared to spring and summer (see graph below):

Fewer buyers in the market means you’ll likely have more time to make thoughtful decisions. It also means you may have more negotiating power. According to the Alabama Association of Realtors:

“A significant benefit of buying a home in winter is the reduced competition. Because of the perceived benefits of spring, many buyers delay the start of their house hunt. As a result, you will find fewer people competing for the same properties during winter. Less demand can translate into more negotiating power as sellers may be more willing to entertain offers or agree to concessions to get a deal closed quickly.”

2. More Negotiating Power

With homes staying on the market longer, sellers may be more willing to negotiate. This can lead to better deals for you as a buyer, whether that means a lower price or added incentives, like sellers covering closing costs or making repairs. As Chen Zhao, an Economist at Redfin, points out:

“. . . buying during the off season means less competition from other buyers. That means potentially negotiating a better deal.”

Plus, when demand is lower, sellers often feel more pressure to work with serious buyers. This could give you an edge to negotiate terms that work best for your situation.

3. Lock in Today’s Prices Before They Rise

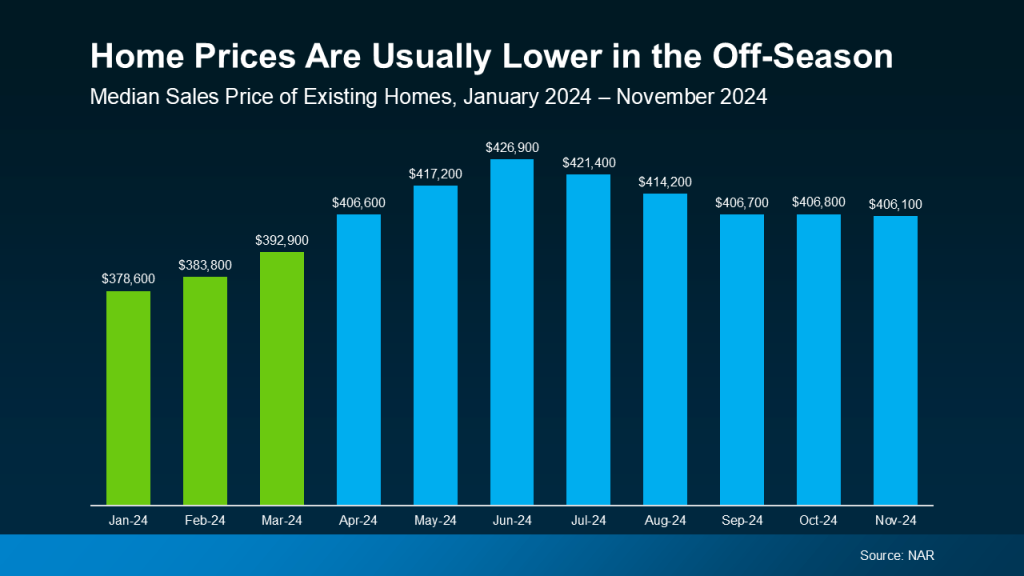

Historically, home prices tend to be at their lowest point in the winter months, too. According to data from NAR, home prices last year were at their lowest in January, February, and March — right before the spring buying season kicked in (see graph below):

This trend isn’t new — Bright MLS shows between 2010 and 2024, home prices in January and February were, on average, 15% lower than during the month of peak home prices (typically June). Buying in the off-season means you’re more likely to avoid paying the premium prices that come with the high demand of spring.

On top of that, home prices generally appreciate over time, meaning they tend to go up year after year. That means if you’re ready to buy and you can make it happen, you’re not only taking advantage of what might be the lowest prices of the year, but you’re also locking in today’s price before it increases in the future.

Bottom Line

While spring may seem like the obvious time to buy, moving before the peak season can give you significant advantages, like less competition, more negotiation power, and lower prices.

Start your home buying journey by visiting our Property Search page.

Are You Waiting To Buy? This Spring May Be Your Time To Move

April 29, 2025

Should You Buy a Home This Spring or Wait for Lower Prices?

April 24, 2025

Here’s the Next Best Time To Sell Your Home This Spring

April 23, 2025

Many Fear a Housing Market Crash in 2025 – Will It Happen?

April 18, 2025

It’s Tax Day – Here’s How a Refund Can Help You Save For a Home

April 15, 2025

Closing on a House: A Step-By-Step Buyer’s Guide

The process of closing on a house is the final stretch before home ownership is transferred and the property becomes legally yours. If you’re a new homebuyer, the closing process and its various steps can be confusing and intimidating. This short guide will outline the home closing process and help simplify your final steps to home ownership.

10 Steps to Closing on a House

The closing process can vary from transaction to transaction but generally tends to follow the same basic milestones. Here are 10 major steps of the closing process you’ll need to follow to complete your home purchase.

1. Offer and Acceptance

The closing process typically begins when the seller accepts your offer to purchase the home. This agreement sets the terms, including the purchase price and any contingencies.

2. Open an Escrow Account

Escrow plays a pivotal role in the real estate closing process. An escrow account is established to hold funds and documents until the transaction is finalized. This account is managed by a neutral third party, such as an escrow agent or title company, which also manages the transfer of the property title.

3. Conduct a Title Search and Obtain Title Insurance

A title search ensures the property is free of liens or ownership disputes so you can be sure you’re buying a home with a clear title. Meanwhile, title insurance protects you from future claims against the property and covers legal costs if past owners have unresolved claims. Together, a title search and insurance provide a buyer with legal safeguards and extra peace of mind during the closing process.

4. Schedule a Home Inspection

Hire a professional inspector to evaluate the property’s condition. Address any issues identified during the inspection by negotiating repairs or price adjustments with the seller. While costly, this will save you from any unexpected repairs and expenses after closing.

5. Negotiate Closing Costs

Work with the seller to determine who will cover specific closing costs, which may include loan fees, appraisal fees, and title insurance. Always review your settlement statement thoroughly to understand what costs you’re responsible for and if any are negotiable.

6. Secure Financing

Finalize your mortgage by submitting required documents, locking in your interest rate, and obtaining loan approval. Ensure you receive a Loan Estimate and Closing Disclosure from your lender. Timelines for a mortgage approval can vary, so stay in constant communication with your lender to monitor progress and respond promptly to any additional requests they make.

7. Review All Documents

Carefully review the Closing Disclosure (or settlement statement), which outlines the final loan terms and closing costs. Pay special attention to any discrepancies in loan terms or fees to avoid unexpected expenses in the future. Verify all details are accurate and address any remaining issues immediately.

8. Conduct a Final Walk-Through

Perform a final inspection of the property within 24-48 hours before closing. Confirm the property is in the agreed-upon condition and that all negotiated repairs have been completed. Following a walk-through checklist can be a convenient way to personally check each area of the home ands its condition.

9. Attend the Closing Meeting

At the closing meeting, sign all necessary documents, including the deed, mortgage, and promissory note. Pay the remaining closing costs and down payment. Address any potential closing delays, such as remaining problems from the title search or home inspection.

10. Transfer of Ownership

Once all documents are signed and funds are transferred, the title is recorded, and ownership officially transfers to you. You’ll receive the keys to your new home and will finally be ready to begin moving in. Congratulations!

Conclusion: From Buyer to Homeowner

With the closing transaction complete, it’s time to enjoy your new home! Before putting your closing behind you, take care of any post-closing responsibilities you may still have to a third party other than your lender. Next, you’re ready to begin your transition into the next step of your journey as an official new homeowner.

Interested in closing on a house or making that first leap into home ownership but unsure where to start? Contact us today to connect with an expert real estate agent for help on your homebuying journey, or start a property search in your local area now.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link