If you’ve been planning to buy a house, you know how hard it can be to save for a home. What you might not know is that your tax return can be a helpful boost to your savings and budget. According to a recent post by Freddie Mac:

“ . . . your tax refund from the IRS can be a useful supplement to your homebuying budget.”

So if you’re planning to get a tax refund this year, consider the difference that extra funding can make. A refund can help you pay for the upfront costs of homebuying, like a down payment or closing costs. And, according to the IRS, your tax refund may even help you out this year more than ever.

How a Tax Return Can Help You Buy a Home in 2025

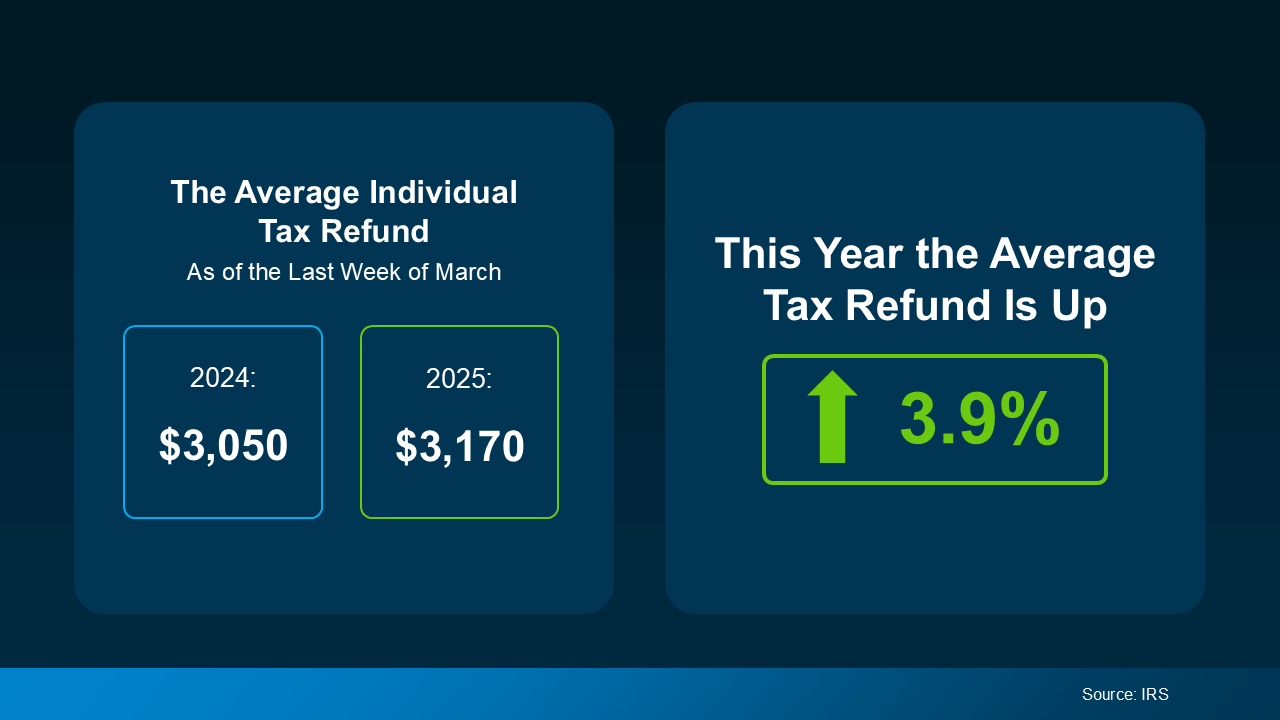

Recent data from the Internal Revenue Service (IRS) has found that the average individual’s refund is 3.9% higher this year. And while that’s not a huge increase, it can make a big difference if you’ve been struggling to save. The graphic below visualizes the new IRS data, comparing the average tax return in March 2024 to March 2025.

Your own personal tax refund will likely vary, but any financial boost helps when you’re saving for a home. According to Freddie Mac, the following are several ways you can put your tax return to good use when homebuying:

- Saving for a down payment – A down payment on a home is often one of the biggest obstacles to homeownership that buyers face. Saving your tax refund for a down payment can be a smart way to make this major step easier. Keep in mind while a 20% down payment may be common, it’s not typically a hard requirement to buy.

- Paying for closing costs – Usually due at closing, closing costs include fees for services like the appraisal, title insurance, and underwriting of your loan. While these vary by state, they’re often between 2% and 6% of your home’s total final purchase price. As a much lower percentage of your home’s price, closing costs can be a great use of your yearly refund..

- Lowering your mortgage rate – Lenders sometimes give buyers the option to buy down their mortgage rate if they qualify. This allows buyers to pay an upfront fee to lower their initial mortgage rate, reducing monthly payments in the short-term. This option can be particularly helpful if interest rates and mortgage payments are a major homebuying hurdle you’re facing..

Financially speaking, this may be more complicated in practice, but there’s no need to do it all on your own. Working with an experienced, trustworthy real estate professional can simplify your financial planning, helping you reach the best decision possible. An agent who understands the homebuying process, your unique financial needs, and your personal goals can make all the difference.

Conclusion

If you’ve been saving for a home, you already know well that every penny counts. Your tax return probably won’t be the final financial boost you need, but there are ways to use it effectively. Planning and identifying how to best spend that money can give you a real, meaningful step toward buying your home.

Are you eager to buy a home but having trouble making things work? Contact us today. We can connect you with local lenders and agents to help make your dream of homeownership a reality.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link