Selling Your Home? Avoid This Mistake When Setting Your Asking Price

When selling your house, the typical goal is to sell quickly at the best price possible. Naturally, ever since home prices took off around 5 years ago, most sellers have been aiming high. But housing inventory is making a comeback, and some sellers haven’t considered what this shift means for their asking price. As a result, buyers are becoming choosier, and price cuts on overpriced listings are increasing alongside home supply.

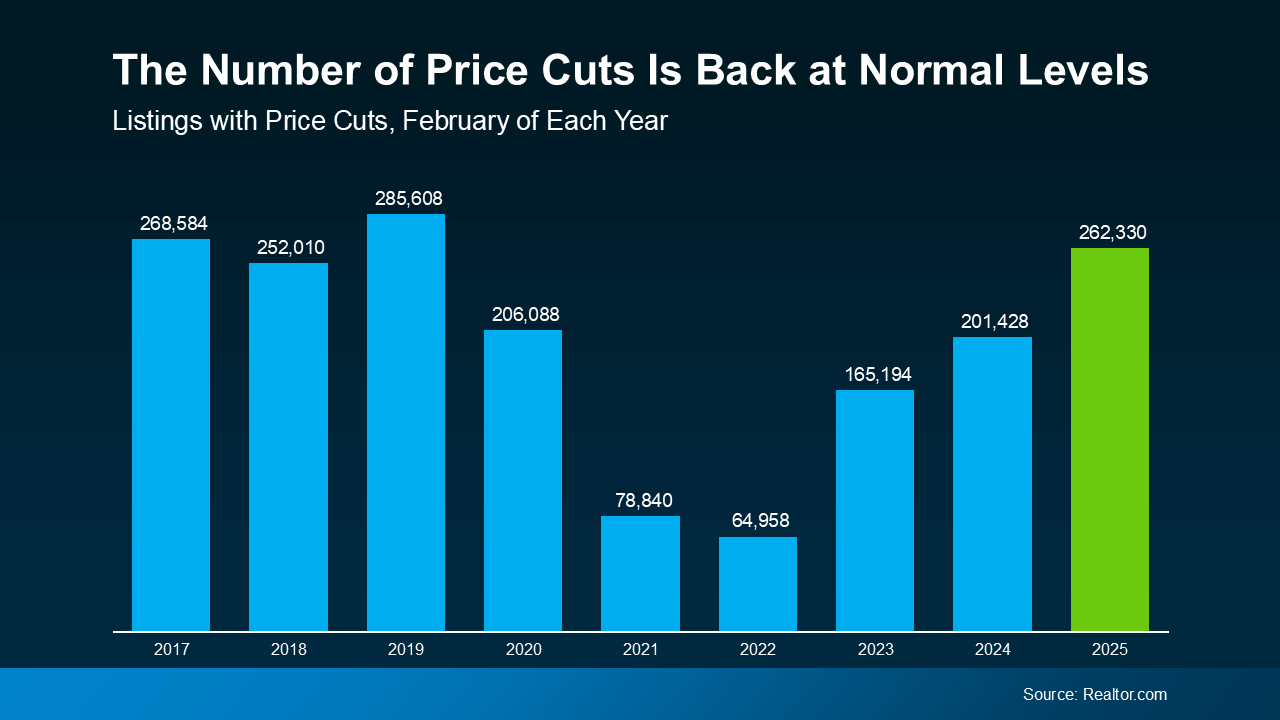

According to February 2025 data from Realtor.com, home price cuts this February reached their highest number since 2019. That’s the highest number of price cuts in 6 years, and a real return to pre-pandemic market levels.

Given that 2019 is considered the housing market’s last normal year, this demonstrates a major, substantial shift. The market is finally starting to normalize, and may quickly break out of the post-pandemic slump it’s been stuck in.

However, this is a distinctly different trend from the hot seller’s market of 2021 and should be treated differently. You may not sell your house for top dollar like you would have at the pandemic’s peak, but that’s okay. By setting a smart asking price and tempering your expectations, you can still sell quickly, and at a great price.

You may be planning to price your listing high and cut it later if necessary, but this has its drawbacks. Pricing too high and lowering later means you may actually end up with lower offers in the end. Pricing right the first time is the best way to avoid this, and a local agent can make the difference.

How a Local Agent Can Find Your Perfect Asking Price

A true expert real estate agent doesn’t set an asking price without good reason. These agents consider real data and trends unique to your market, setting a price specific to your home. This way, you set a realistic price based on your home’s true value to attract as many buyers as possible.

Depending on your local market and your agent’s analysis, they may even recommend strategically pricing slightly below market value. While this may sound counterintuitive, it can be a strategic move to attract more attention to your listing, earning you more competitive offers. Here are a few ways a local agent will determine the best price for your listing:

- Researching recent home sales. What price did homes similar to yours finally sell for? Were these homes initially listed higher before dropping in price to sell?

- Analyzing local market trends. The true value of your home isn’t based on the price you’d like to sell it at. It’s the price that potential buyers are willing to pay. A local agent will have a strong idea of this number based on experience.

- Strategizing to sell. A great agent will price your home to attract attention, creating a sense of urgency among buyers and increasing demand.

How Overpricing Your Home Can Backfire

Unfortunately, some sellers still ignore their agent’s advice and prefer to start high just to see what happens. The hope being maybe they get their full asking price, or they at least have more wiggle room for negotiation. But pricing high usually ends up costing you, and here’s why:

- Buyers may ignore it. The market’s past few years – and the direction it’s headed – have made buyers more budget-conscious than ever. If a home listing looks overpriced, buyers are more likely to ignore it and move on than consider negotiating.

- It could stay on the market too long. The longer your home sits on the market without selling, the more buyers will assume something is wrong with it. This can make it harder and harder to sell as time goes on, and makes a price cut almost inevitable.

- You may sell for less in the end. Price cuts often lower a listing’s final selling price below its best, most realistic market value. Listing at the right price to begin with gives sellers the best chance of selling quickly at a great price.

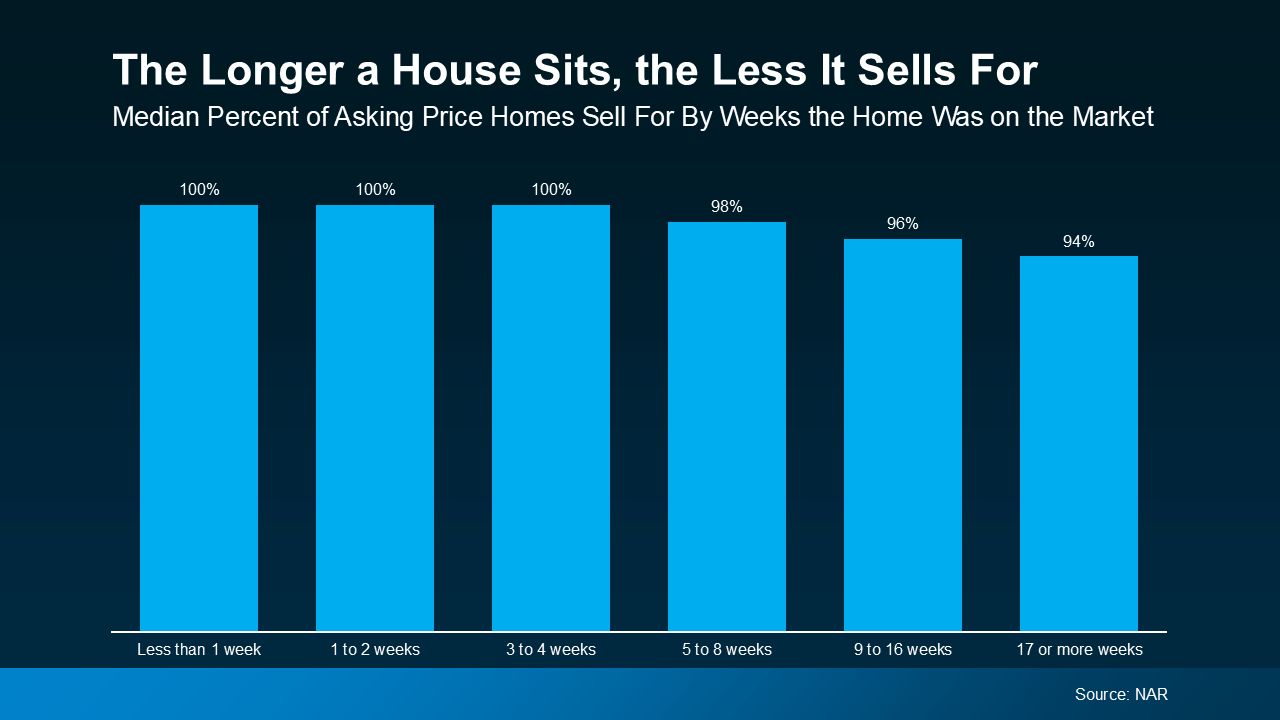

The graph below demonstrates how these factors play out in the market. Using data from the National Association of Realtors (NAR), it shows how time on the market lowers final selling price.

According to the data, if a house sells within its first 4 weeks after listing, it usually sells for full price. Homes that are priced at or just below current market value typically sell quickly in this same window. When a home is priced right, it attracts truly interested buyers who are willing to buy at your asking price. In a hot market, buyers may even compete with other buyers, or even make an offer above your listing price.

On the other hand, a home that’s overpriced will take longer to sell, if it sells at all. As the graph demonstrates, after that first 4 weeks on the market, final selling price starts to drop. And as buyer interest declines over time, the more likely a seller will accept a low offer, or cut their price.

Conclusion

The housing market is normalizing thanks to increasing housing inventory, causing price cuts to rise with increasing buyer power. For sellers, setting the right asking price is more important than ever, and overpricing could make your listing sit on the market. Advice from a local agent can help you avoid this mistake and sell quickly without having to lower your price.

Interested in selling but need help pricing your home for your local market? Get in touch with us today. We can connect you with a local agent who can sell your home at the best price possible.

What’s Your Real Home Value in the 2025 Market?

If you’ve checked home prices in the past few years, you know too well that they’re always rising. But if you’re a current homeowner, have you considered what this might mean for your own home value? It may be that your home is worth far more than you think in 2025.

While rising prices are expected, the home value increases of the post-Pandemic housing market have been dramatic. And if you’re a seller waiting to list, this could mean a huge payoff when you finally close. If you’re eager to know much your own house could sell for, finding out is easier than you think.

The Post-Pandemic Home Value Launch

Home prices typically rise around 2-5% per year, but in 2021-2022 that number rose to double-digit levels. In the spring of 2022, year-over-year percentage growth finally peaked at over 20% nationally. The sheer number of buyers in the market during this time sent home prices soaring as housing supply lagged. And though price growth has settled since then, the home value accrued by homeowners in that time remains.

The lingering effects of that volatile period have caused difficulties for buyers, but they’ve also produced great opportunities for sellers. There’s a good chance your house has gained tremendous value since then, and that means more wealth for you.

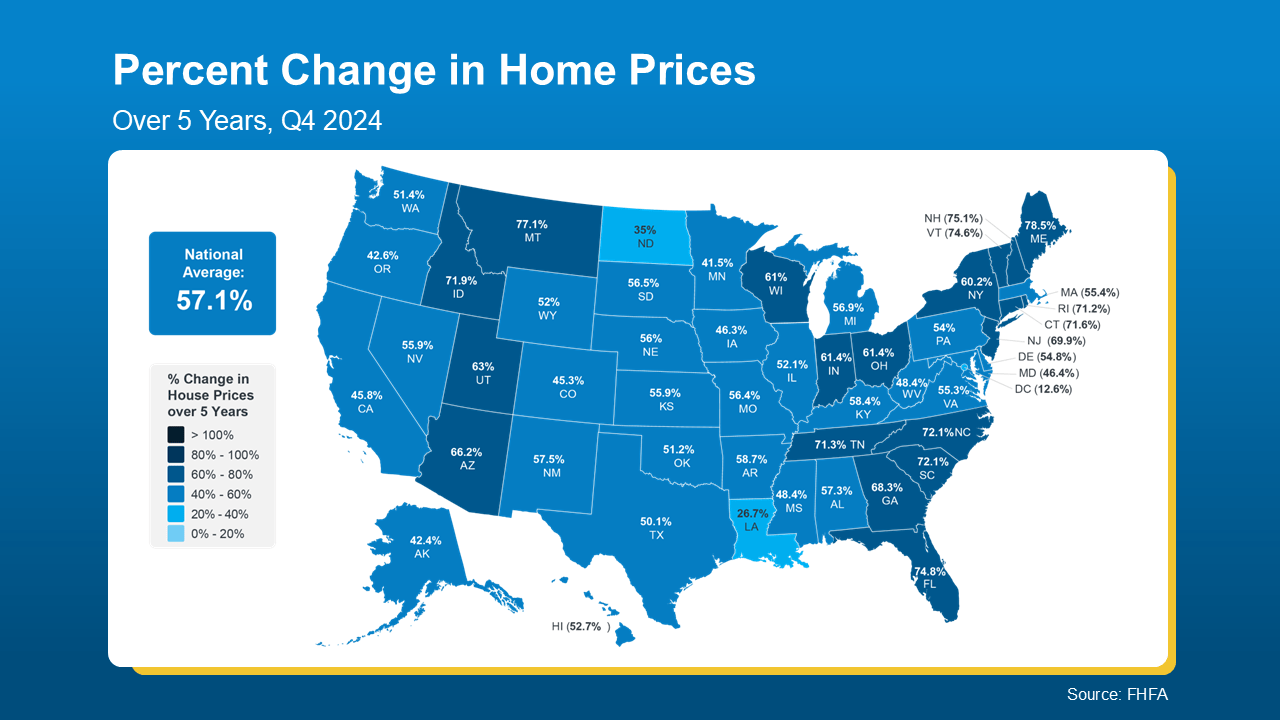

The map below references data from the Federal Housing Finance Agency (FHFA) to illustrate that home prices have risen by nearly 60% in just the past 5 years alone nationally. The most extreme increases have taken place in states marked with a darker blue, like Maine, New Hampshire, and Florida.

If worries about today’s rates and prices have stopped you from selling your home, let these numbers reassure you. Your home’s risen value may be exactly what you need to close the affordability gap and purchase your next house.

Even better, if you’ve owned your home for 10 years or more, your value is likely even higher. You can stack the incredible gains of the past five years on top of five years of healthy appreciation too. And an agent can help you figure out what that really looks like.

How To Find Out What Your House Is Really Worth

Percentages will help you ballpark an estimate, but you need specific numbers to make real, actionable decisions. To help, you can get a free home valuation estimate from us right now using the tool below. You can even sign up for a full valuation report.

Home valuations can be great tools, but only a local real estate agent can give you the best, most accurate look at your house’s real market value. An agent will know the state of your local housing market and the factors driving it. They can provide insights about current housing inventory, pricing of comparable homes, and unique contributors to value like renovations.

By knowing what’s happening where you live, an agent can stack their market knowledge against the unique condition and features of your home and give you an accurate estimate of your home’s current value in your area.

Conclusion

Home values have taken off in just the past few years, and that’s great news for current homeowners. Knowing what your house is worth in today’s real estate market will help you plan your next move. A local agent can give you a great idea of how much your home might realistically sell for.

If you’re a homeowner considering a move, get your free home valuation from us at Century 21 Affiliated now. Ready to sell? Reach out now and we’ll connect you with a local expert real estate agent who can get your house sold.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link